- Foreign exchange market. Asian session: the euro climbed

Noticias del mercado

Foreign exchange market. Asian session: the euro climbed

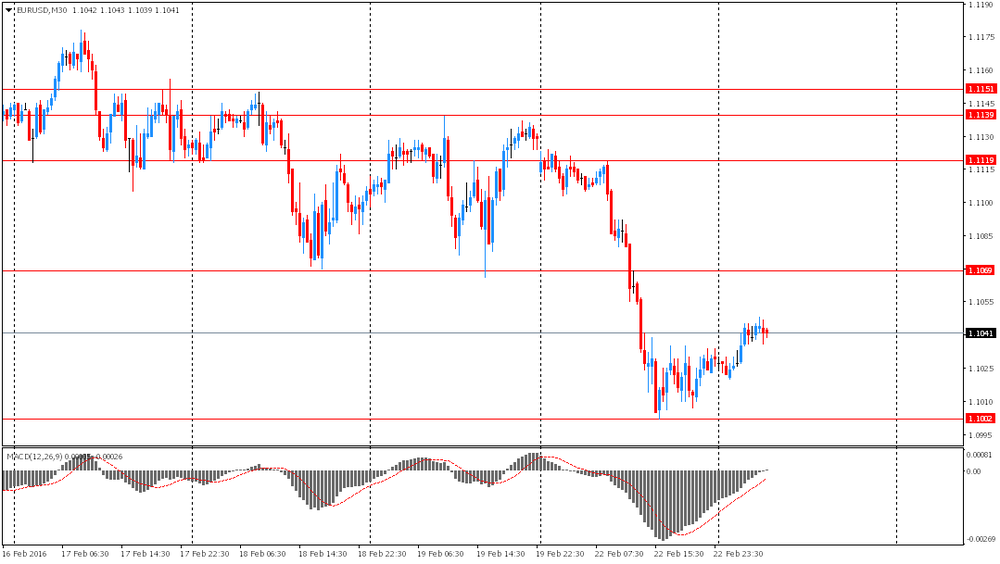

The euro climbed after falling on weak economic data yesterday. The single currency is also supported by optimistic expectations for today's publication of final German GDP for the fourth quarter. The German economy is expected to have grown by 0.3% q/q and by 2.1% y/y.

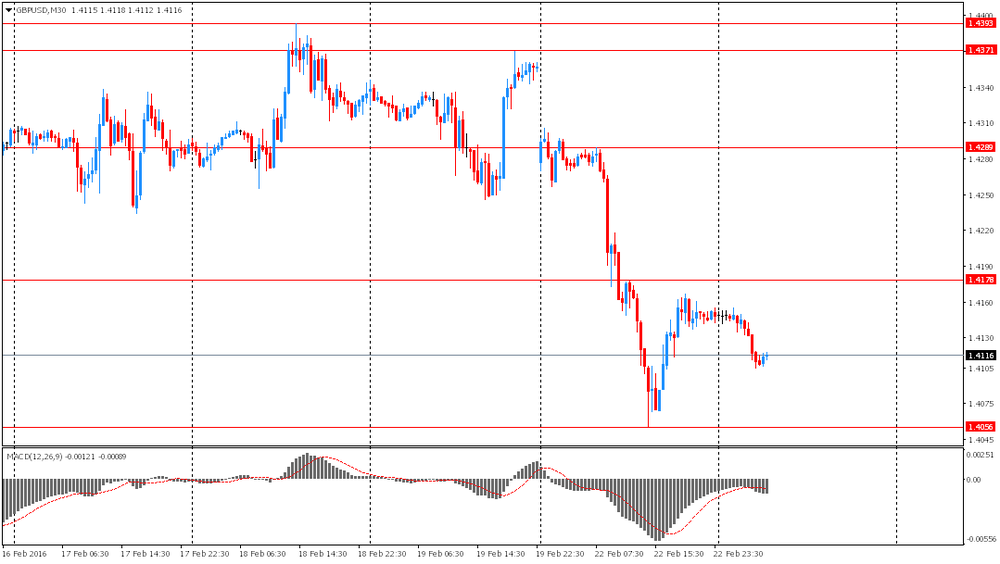

The pound continued declining amid growing fears of the U.K.'s exit from the European Union. Moody's warned that the country's rating could be revised in case it leaves the union. Some economists believe that U.K. exit would result in capital outflows and weaker economic growth.

The Australian dollar is supported by weekly consumer confidence data from ANZ Roy Morgan.The corresponding index rose by 0.6% to 114.3 in the week ending February 21 from 113.6 reported previously. Analysts explain this increase by weaker influence from financial markets instability.

EUR/USD: the pair rose to $1.1045 in Asian trade

USD/JPY: the pair fell to Y111.95

GBP/USD: the pair fell to $1.4105

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany GDP (YoY) (Finally) Quarter IV 1.8% 2.1%

07:00 Germany GDP (QoQ) (Finally) Quarter IV 0.3% 0.3%

09:00 Germany IFO - Expectations February 102.4 101.6

09:00 Germany IFO - Business Climate February 107.3 106.7

09:00 Germany IFO - Current Assessment February 112.5 112.0

11:15 Switzerland SNB Chairman Jordan Speaks

14:00 Belgium Business Climate February -3.0 -3.6

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December 5.8% 5.8%

15:00 U.S. Richmond Fed Manufacturing Index February 2 2

15:00 U.S. Existing Home Sales January 5.46 5.32

15:00 U.S. Consumer confidence February 98.1 97.0

17:00 United Kingdom MPC Member Andy Haldane Speaks