- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone

Noticias del mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance January -3.52 Revised From -3.535 -3.1 -2.94

01:45 China Markit/Caixin Services PMI February 52.4 52.6 51.2

07:00 United Kingdom Nationwide house price index February 0.3% 0.5% 0.3%

07:00 United Kingdom Nationwide house price index, y/y February 4.4% 5% 4.8%

08:30 United Kingdom Halifax house price index February 1.7% 0% -1.4%

08:30 United Kingdom Halifax house price index 3m Y/Y February 9.7% 10.4% 9.7%

08:50 France Services PMI (Finally) February 50.3 49.8 49.2

08:55 Germany Services PMI (Finally) February 55 55.1 55.3

09:00 Eurozone Services PMI (Finally) February 53.6 53 53.3

09:30 United Kingdom Purchasing Manager Index Services February 55.6 55.1 52.7

10:00 Eurozone Retail Sales (YoY) January 2.1% Revised From 1.4% 1.3% 2.0%

10:00 Eurozone Retail Sales (MoM) January 0.6% Revised From 0.3% 0.1% 0.4%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic data. The ISM non-manufacturing purchasing managers' index is expected to fall to 53.2 in February from 53.5 in January.

The number of initial jobless claims in the U.S. is expected to decrease by 1,000 to 271,000 last week.

Final productivity in the U.S. non-farm businesses is expected to decline at a 3.2% annual rate in the fourth quarter, after a 2.1% rise in the third quarter.

Final unit labour costs are expected to increase 4.7% in the fourth quarter, after a 1.9 gain in the third quarter.

The U.S. factory orders are expected to rise 2.0% in January, after a 2.9% drop in December.

The euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone increased 0.4% in January, beating expectations for a 0.1% rise, after a 0.6% gain in December. December's figure was revised up from a 0.3% increase.

Non-food sales increased 0.7% in January, food, drinks and tobacco sales rose 0.5%, while automotive fuel sales were up 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.0% in January, beating forecasts of a 1.3% gain, after a 2.1% increase in December. December's figure was revised up from a 1.4% gain.

Non-food sales gained 3.0% year-on-year in January, gasoline sales increased 0.3%, while food, drinks and tobacco sales rose 1.4%.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services PMI declined to 53.3 in February from 53.6 in January, up from the preliminary reading of 53.0. It was the lowest level since January 2015.

The index was mainly driven by a weaker rate of improvement in new business, while job creation also slowed.

Eurozone's final composite output index fell to 53.0 in February from 53.6 in January, up from the preliminary reading of 52.7.

"The survey data raise the prospect of economic growth deteriorating further from the already meagre pace seen late last year, when GDP rose only 0.3%," Chief Economist at Markit Chris Williamson said.

Germany's final services PMI rose to 55.3 in February from 55.0 in January, up from the preliminary reading of 55.1. The index was mainly driven by a faster growth in new orders.

France's final services PMI slid to 49.2 in February from 50.3 in January, down from the preliminary reading of 49.8. It was the lowest level since November 2014. The index was driven by declines in new business and backlogs of work.

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected U.K. services PMI data. Markit's and the Chartered Institute of Purchasing & Supply's services PMI for the U.K. dropped to 52.7 in February from 55.6 in January, missing expectations for a fall to 55.1. It was the lowest level since March 2013.

The decrease was driven by a slower growth in new business and employment.

"The slowdown in February leaves the PMI surveys suggesting that economic growth could weaken to 0.3% in the first quarter, but there are downside risks to even this modest expansion," the Chief Economist at Markit Chris Williamson said.

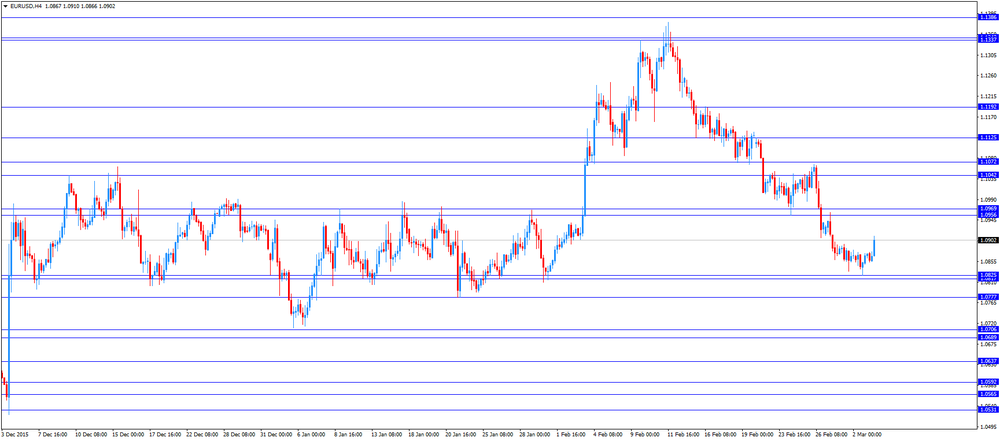

EUR/USD: the currency pair rose to $1.0910

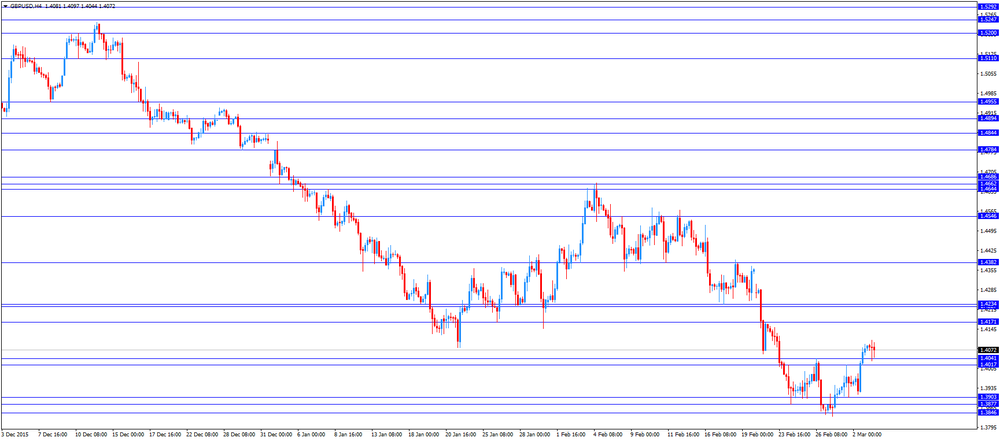

GBP/USD: the currency pair traded mixed

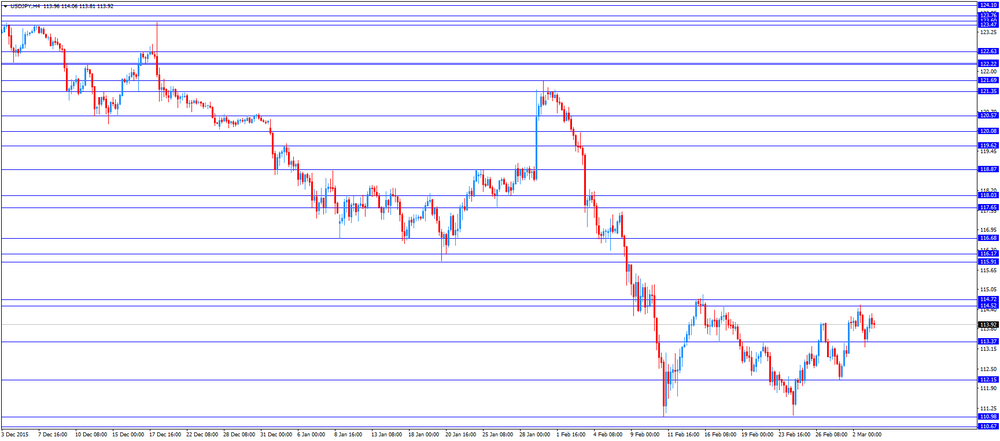

USD/JPY: the currency pair fell to Y113.80

The most important news that are expected (GMT0):

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter IV 1.9% 4.7%

13:30 U.S. Initial Jobless Claims February 272 271

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter IV 2.1% -3.2%

14:45 U.S. Services PMI (Finally) February 53.2 49.8

15:00 U.S. ISM Non-Manufacturing February 53.5 53.2

15:00 U.S. Factory Orders January -2.9% 2%