- WSE: Session Results

Noticias del mercado

WSE: Session Results

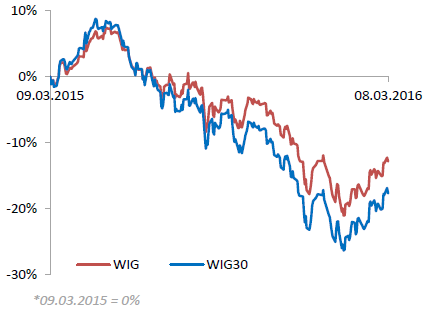

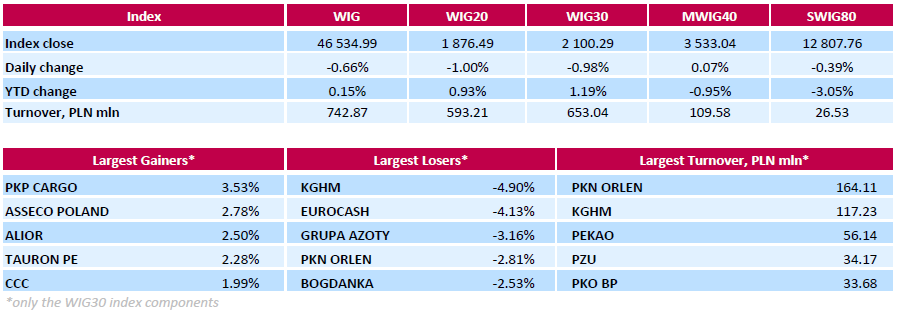

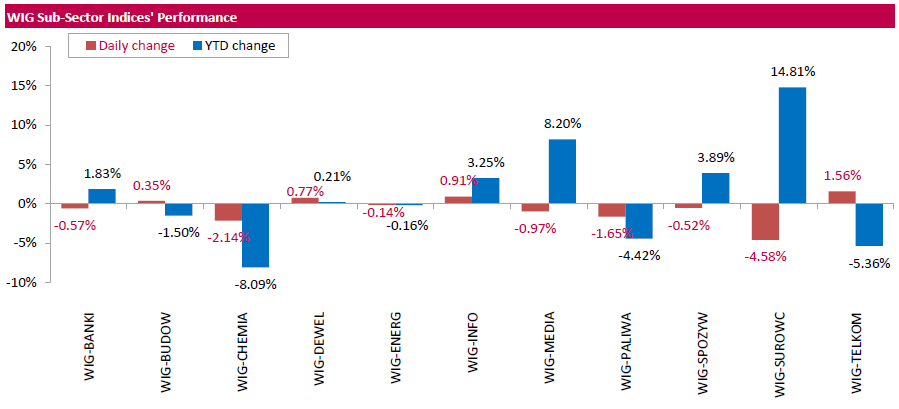

Polish equity market closed lower on Tuesday amid commodities slump and ahead of ECB meeting. The broad market benchmark, the WIG Index, declined by 0.66%. Sector-wise, materials (-4.58%) fared the worst, while telecommunication services sector (+1.56%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, fell by 0.98%. Copper producer KGHM (WSE: KGH) and oil refiner PKN ORLEN (WSE: PKN) were among the biggest laggards in the index, losing a respective 4.9% and 2.81% due to deterioration in sentiment towards commodities. Crude lost nearly 3% after reaching the resistance level at local maximum at the end of December. Contracts for copper with a fall of 2.4% also suggest that the market is entering a stronger correction of recent increases. Aside from that, FMCG-wholesaler EUROCASH (WSE: EUR), chemical producer GRUPA AZOTY (WSE: ATT) and thermal coal miner BOGDANKA (WSE: LWB) also recorded significant losses of 4.13%, 3.16% and 2.53% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and IT-company ASSECO POLAND (WSE: ACP) managed to record the biggest daily gains, climbing by 3.53% and 2.78% respectively. Elsewhere, banking sector name ALIOR (WSE: ALR) added 2.5% on news the bank is in talks to buy its rival Bank BPH from General Electric.