- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the U.K. economic data

Noticias del mercado

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the U.K. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany CPI, m/m (Finally) February -0.8% 0.4% 0.4%

07:00 Germany CPI, y/y (Finally) February 0.5% 0% 0.0%

09:30 United Kingdom Total Trade Balance January -3.69 Revised From -2.71 -3.0 -3.46

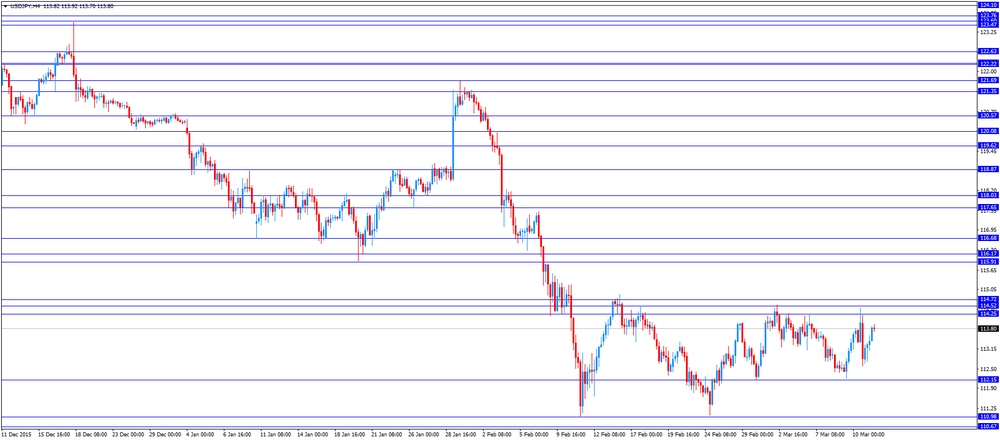

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. import price index data. The U.S. import price index is expected to decline 0.6% in February, after a 1.1% fall in January.

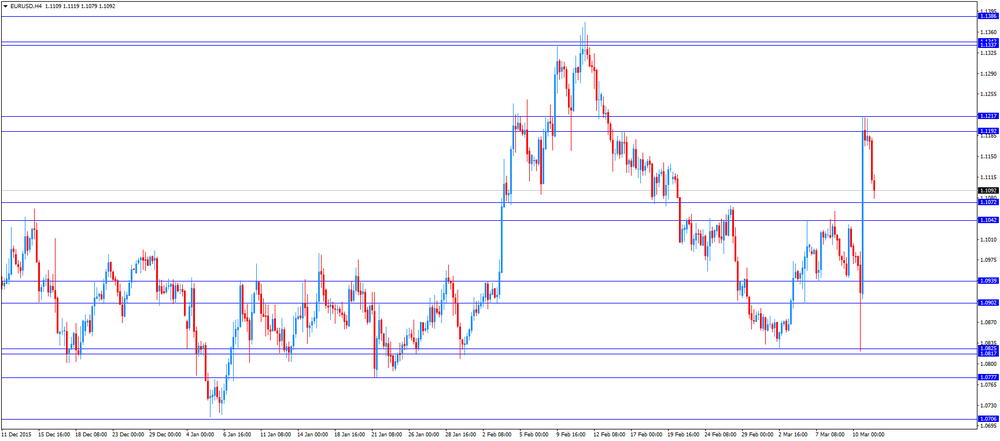

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Yesterday's interest rate decision by the European Central Bank (ECB) weighed on the euro. The central bank cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

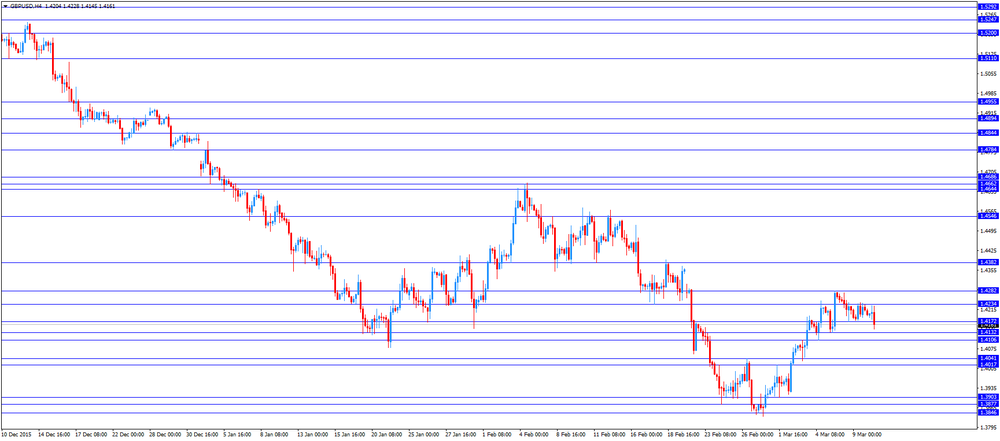

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £10.29 billion in January from £10.45 billion in December. December's figure was revised down from a deficit of £9.92 billion.

The decline in deficit was driven by a smaller gap with non-EU countries.

The total trade deficit, including services, narrowed to £3.46 billion in January from £3.70 billion in December. December's figure was revised down from a deficit of £2.71 billion.

Construction output in the U.K. declined 0.2% in January, after a 2.1% rise in December. The decline was mainly driven by a drop in all new work, which plunged 0.8% in January.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 7.2% in February.

Canada's economy is expected to add 9,000 jobs in February.

EUR/USD: the currency pair declined to $1.1079

GBP/USD: the currency pair rose to $1.4308

USD/JPY: the currency pair increased to Y113.92

The most important news that are expected (GMT0):

13:30 Canada Employment February -5.7 9

13:30 Canada Unemployment rate February 7.2% 7.2%

13:30 U.S. Import Price Index February -1.1% -0.6%