- Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies after the release of the mostly positive U.S. economic data

Noticias del mercado

Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies after the release of the mostly positive U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Bulletin

00:30 Australia Changing the number of employed February -7.4 Revised From -7.9 10 0.3

00:30 Australia Unemployment rate February 6.0% 6% 5.8%

06:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:15 Switzerland Producer & Import Prices, m/m February -0.4% 0.2% -0.6%

08:15 Switzerland Producer & Import Prices, y/y February -5.3% -5.1% -4.6%

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

10:00 Eurozone Trade balance unadjusted January 25.4 Revised From 24.3 9.0 6.2

10:00 Eurozone Harmonized CPI February -1.4% 0.1% 0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February 0.3% -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) February 1% 0.7% 0.8%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:30 Canada Wholesale Sales, m/m January 1.8% Revised From 2.0% 0.2% 0.0%

12:30 U.S. Current account, bln Quarter IV -129.9 Revised From -124.1 -118.9 -125.3

12:30 U.S. Continuing Jobless Claims March 2227 Revised From 2225 2228 2235

12:30 U.S. Philadelphia Fed Manufacturing Survey March -2.8 -1.7 12.4

12:30 U.S. Initial Jobless Claims March 258 Revised From 259 268 265

The U.S. dollar traded mixed to lower against the most major currencies after the release of the mostly positive U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 12 in the U.S. increased by 7,000 to 265,000 from 258,000 in the previous week. The previous week's figure was revised down from 259,000. Analysts had expected jobless claims to rise to 268,000.

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 12.4 in March from -2.8 in February, exceeding expectations for an increase to -1.7.

Yesterday's interest rate decision by the Fed weighed on the greenback. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

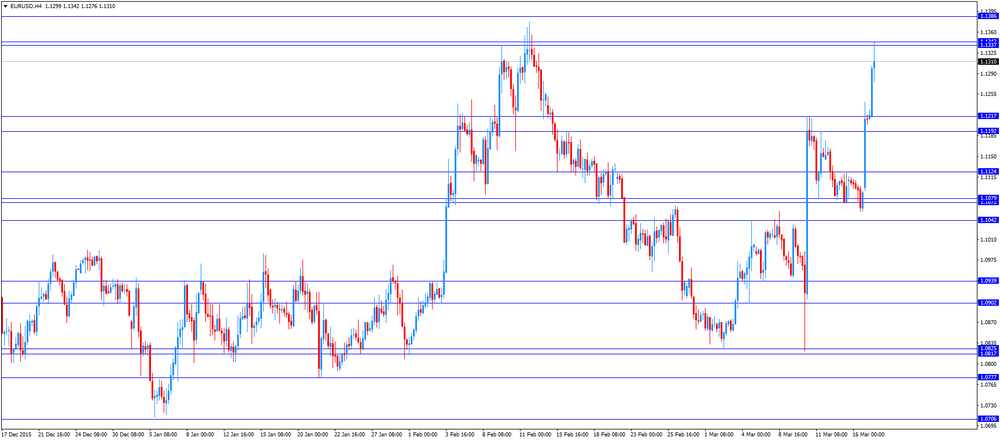

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

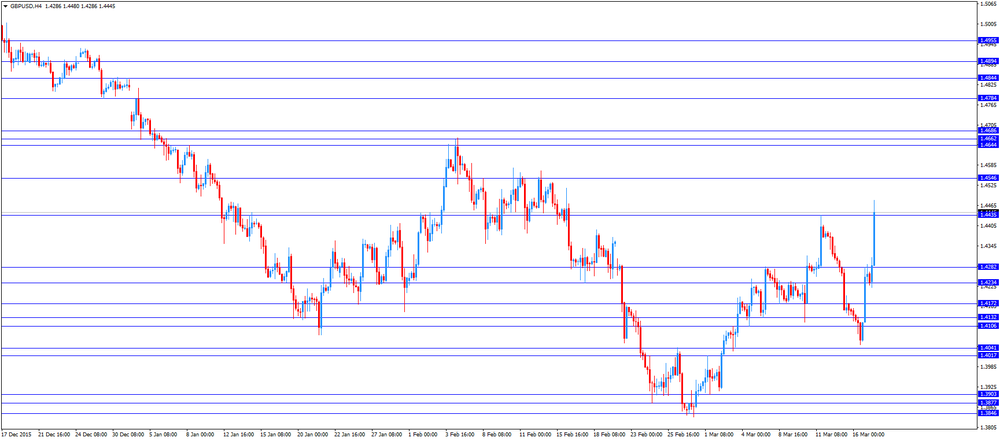

The British pound traded higher against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged. The BoE noted that the private domestic demand remained solid, while the labour market strengthened.

The Canadian dollar traded mixed against the U.S. dollar after the release of the negative Canadian economic data. Statistics Canada released wholesale sales figures on Thursday. Wholesale sales were flat in January, missing expectations for a 0.2% gain, after a 1.8% rise in December. December's figure was revised up from a 2.0% increase. A rise in the machinery, equipment and supplies subsector was offset by a drop in the motor vehicle and parts subsector.

The Swiss Franc traded higher against the U.S. dollar. The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed. The SNB noted that the Swiss franc was still significantly overvalued.

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency downgraded its 2016 growth forecast to 1.4% from 1.5%. GDP for 2017 was downgraded to 1.8% from 1.9%. "The strong appreciation of the Swiss franc was a main factor slowing down economic growth," the SECO said in its Spring report.

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices fell 0.6% in February, missing expectations for a 0.2% gain, after a 0.4% decrease in January. The decrease was mainly driven by lower prices for chemical and pharmaceutical, and petroleum products.

EUR/USD: the currency pair rose to $1.1342

GBP/USD: the currency pair declined to $1.4480

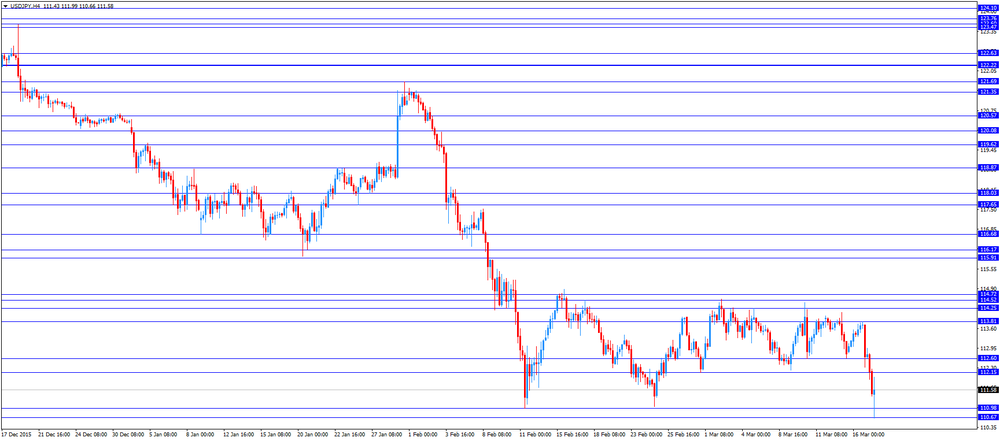

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Leading Indicators February -0.2% 0.2%

14:00 U.S. JOLTs Job Openings January 5.607 5.5

23:50 Japan Monetary Policy Meeting Minutes