- WSE: Session Results

Noticias del mercado

WSE: Session Results

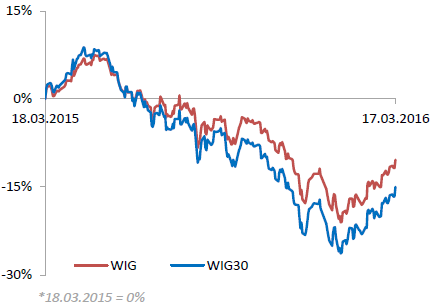

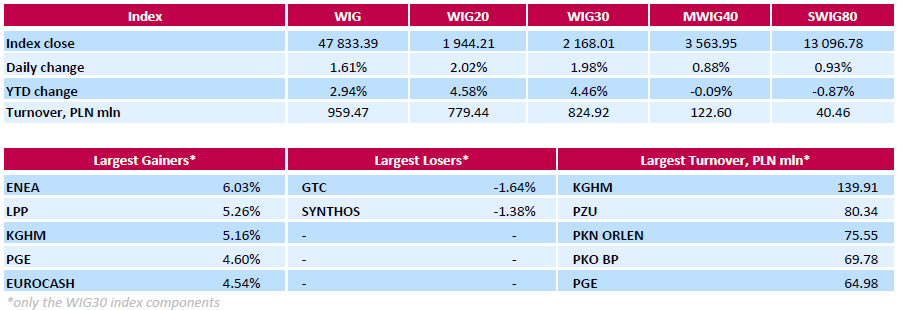

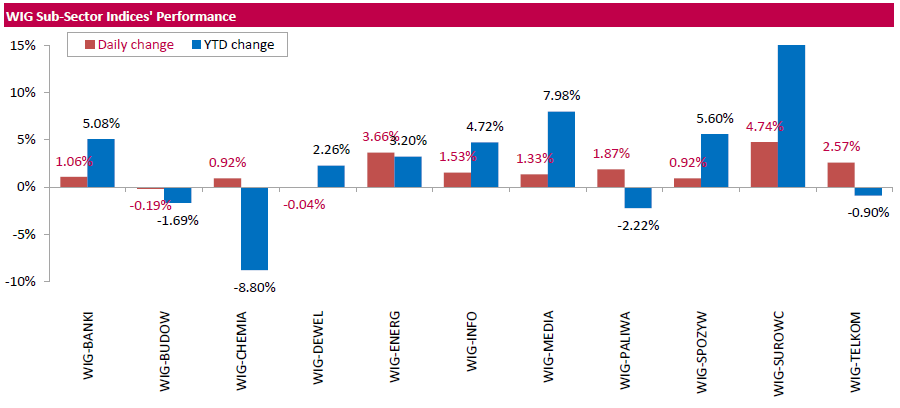

Polish equity market enjoyed a strong run on Thursday. The broad market measure, the WIG Index, surged by 1.61%. Except for developers (-0.04%) and construction sector (-0.19%), every sector in the WIG Index gained, with materials (+4.74%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.98%. Almost all Index components returned gains, with the way up led by genco ENEA (WSE: ENA), jumping by 6.03%. It was followed by clothing retailer LPP (WSE: LPP), copper producer KGHM (WSE: KGH), genco PGE (WSE: PGE) and FMCG-wholesaler EUROCASH (WSE: EUR), climbing by 4.54%-5.26%. At the same time, property developer GTC (WSE: GTC) and chemical producer SYNTHOS (WSE: SNS) were the only decliners, falling by 1.64% and 1.38% respectively.

Beyond the WIG30 Index, the main event of the day was the information about a conditional deal to take over a majority stake in KOPEX (WSE: KPX) by the chief shareholder of mining machinery group FAMUR (WSE: FMF). KOPEX has recently fallen into financial difficulties in the wake of coal sector problems. The firm posted PLN 0.5 bln attributable net loss in Q4 2015 on the back of over PLN 430 mln in non-cash impairments. KOPEX soared by over 32% on the end of the session, while FAMUR jumped 22%.