- Foreign exchange market. European session: the Canadian dollar traded higher against the U.S. dollar after the release of the mixed Canadian economic data

Noticias del mercado

Foreign exchange market. European session: the Canadian dollar traded higher against the U.S. dollar after the release of the mixed Canadian economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Producer Price Index (MoM) February -0.7% -0.2% -0.5%

07:00 Germany Producer Price Index (YoY) February -2.4% -2.6% -3.0%

12:30 Canada Retail Sales, m/m January -2.1% Revised From -2.2% 0.6% 2.1%

12:30 Canada Retail Sales YoY January 2.6% 6.4%

12:30 Canada Retail Sales ex Autos, m/m January -1.6% 0.4% 1.2%

12:30 Canada Consumer Price Index m / m February 0.2% 0.4% 0.2%

12:30 Canada Consumer price index, y/y February 2% 1.5% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February 2.0% 2% 1.9%

13:00 U.S. FOMC Member Dudley Speak

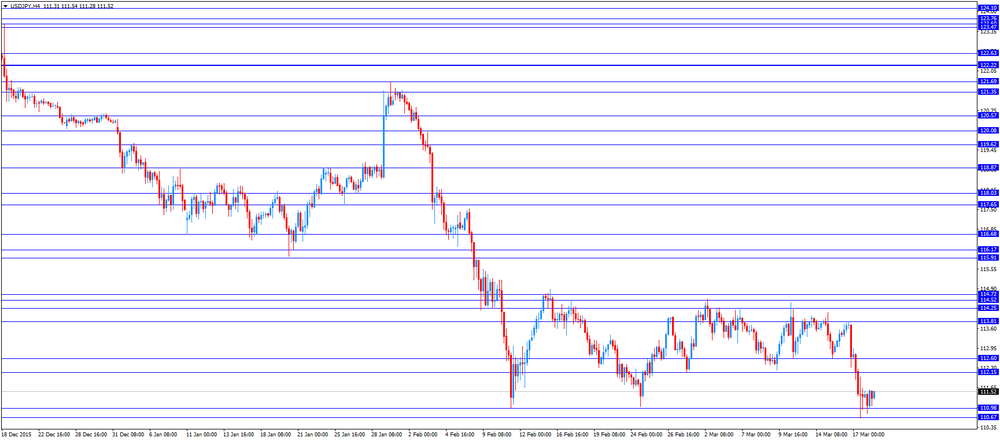

The U.S. dollar traded mixed against the most major currencies ahead the release of the preliminary Thomson Reuters/University of Michigan consumer sentiment index. The index is expected to increase to 92.2 in March from 91.7 in February.

The Fed's interest rate decision continued to weigh on the greenback. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

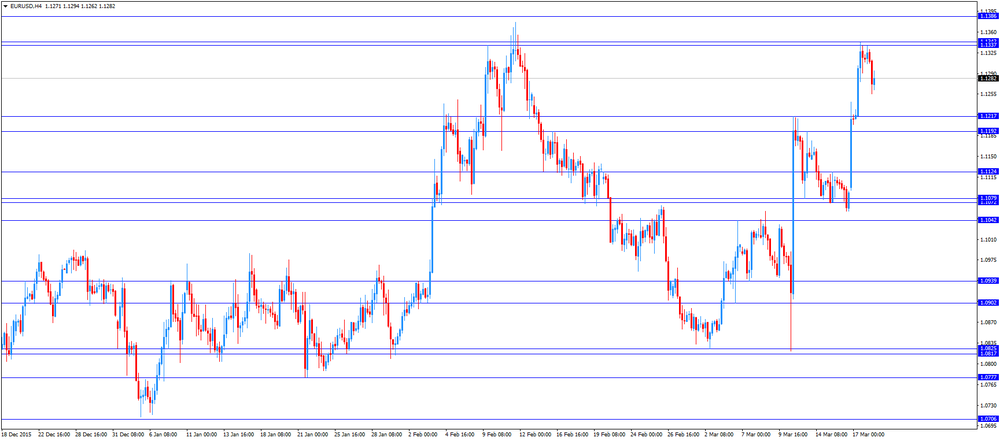

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

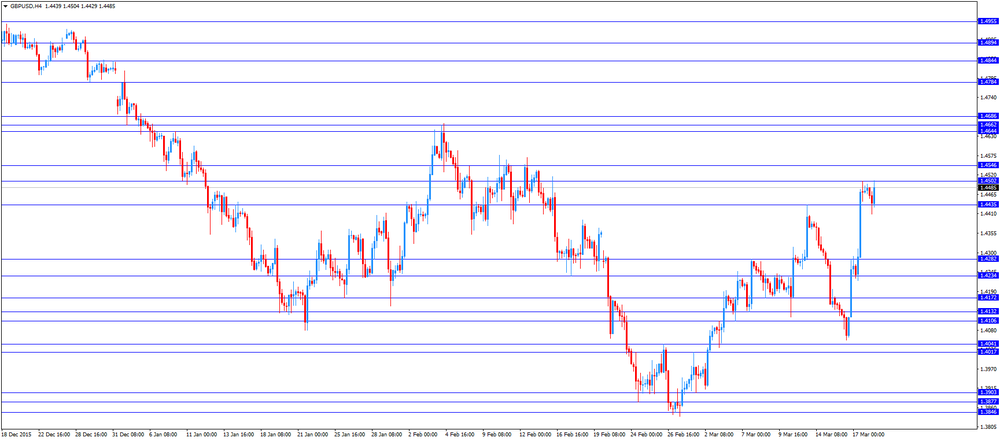

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar after the release of the mixed Canadian economic data. Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in February, missing expectations for a 0.4% rise, after a 0.2% gain in January.

The monthly rise was mainly driven by an increase in prices for recreation, education and reading, and clothing and footwear. Prices for recreation, education and reading were up 1.6% in February, while prices clothing and footwear increased 1.4%.

On a yearly basis, the consumer price index slid to 1.4% in February from 2.0% in January, missing expectations for a decline to 1.5%.

The consumer price index was mainly driven by lower gasoline prices, which plunged 13.1% year-on-year in February.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.5% in February, after a 0.3% increase in January.

On a yearly basis, core consumer price index in Canada fell to 1.9% in February from 2.0% in January. Analysts had expected the index to remain unchanged at 2.0%.

Canadian retail sales climbed by 2.1% in January, exceeding expectations for a 0.6% gain, after a 2.1% decrease in December. December's figure was revised up from a 2.2% drop. The increase was mainly driven by higher sales at motor vehicle and parts dealers, and at general merchandise stores. Sales at motor vehicle and parts dealers rose by 4.8% in January, while sales at general merchandise stores increased by 4.9%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.4504

USD/JPY: the currency pair increased to Y111.54

The most important news that are expected (GMT0):

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 91.7 92.2

15:00 U.S. FOMC Member Rosengren Speaks

19:00 U.S. FOMC Member James Bullard Speaks