- Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report

Noticias del mercado

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Switzerland UBS Consumption Indicator February 1.45 Revised From 1.66 1.53

07:00 Switzerland KOF Leading Indicator March 102.6 Revised From 102.4 101.9 102.5

09:00 Eurozone Economic sentiment index March 103.9 Revised From 103.8 103.8 103

09:00 Eurozone Industrial confidence March -4.1 Revised From -4 -4.2 -4.2

09:00 Eurozone Consumer Confidence (Finally) March -8.8 -9.7 -9.7

09:00 Eurozone Business climate indicator March 0.09 Revised From 0.07 0.08 0.11

11:00 U.S. MBA Mortgage Applications March -3.3% -1%

12:00 Germany CPI, m/m (Preliminary) March 0.4% 0.6% 0.8%

12:00 Germany CPI, y/y (Preliminary) March 0.0% 0.1% 0.3%

12:15 U.S. ADP Employment Report March 205 Revised From 214 194 200

The U.S. dollar traded mixed against the most major currencies after the release of the U.S. ADP Employment Report. Private sector in the U.S. added 200,000 jobs in March, according the ADP report on Wednesday. February's figure was revised down to 205,000 jobs from a previous reading of 214,000 jobs.

Analysts expected the private sector to add 194,000 jobs.

The greenback remained under pressure on comments by Fed Chairwoman Janet Yellen. She said in a speech to the Economic Club of New York on Tuesday that the Fed would hike its interest rate gradually. Yellen noted that the Fed should be cautious in hiking rates as risks from global economic and financial developments rose since December.

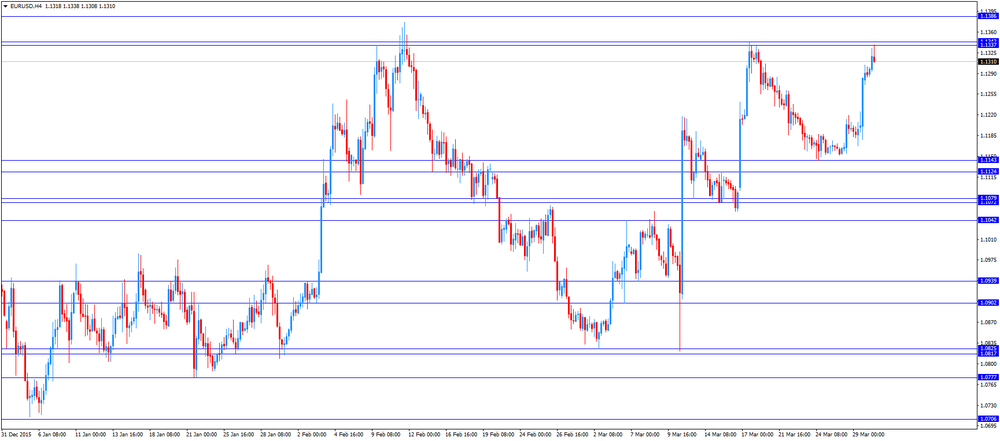

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Wednesday. German preliminary consumer price index increased 0.8% in March, exceeding expectations for a 0.6% rise, after a 0.4% gain in February.

On a yearly basis, German preliminary consumer price index climbed to 0.3% in March from 0.0% in February, beating expectations for a rise to 0.1%.

The European Commission released its economic sentiment index for the Eurozone on Wednesday. The index slid to 103.0 in March from 103.9 in February. February's figure was revised up from 103.8. Analysts had expected the index to decline to 103.8.

The drop was driven by lower confidence among consumers and managers in the services and construction sectors.

The industrial confidence index declined to -4.2 in March from -4.1 in February, in line with expectations. February's figure was revised down from -4.0.

The final consumer confidence index was down to -10.0 in March from -8.8 in February, missing expectations for a decline to -9.7.

The business climate index increased to 0.11 in March from 0.09 in February. February's figure was revised up from 0.07. Analysts had expected the index to decline to 0.08.

The rise in business climate index was driven by a more favourable managers' assessment of past production.

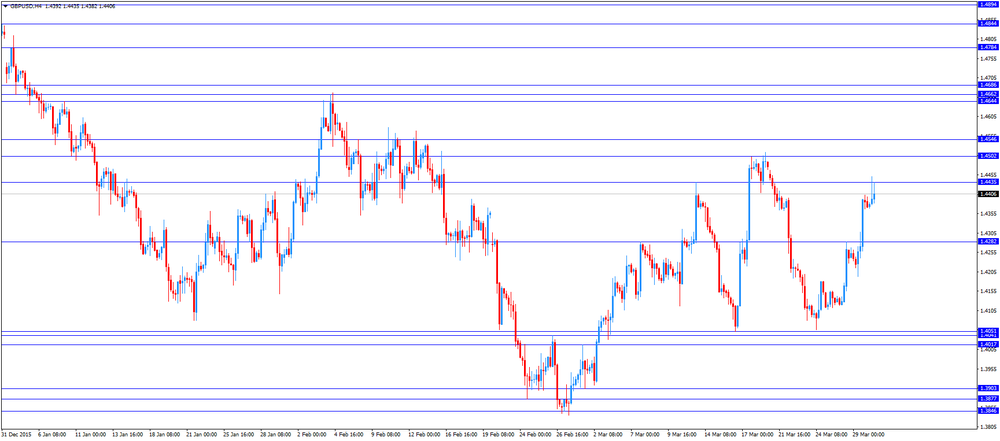

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.53 in February from 1.45 in January. The increase was driven by higher demand for automobiles, which climbed 1.2% year-on-year in February.

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Wednesday. The KOF leading indicator fell to 102.5 in March from 102.6 in February, beating expectations for a decline to 101.9. The decline was mainly driven by negative indicators for the manufacturing sector and the export.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.4377

USD/JPY: the currency pair rose Y112.67

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories March 9.357 3.0

23:05 United Kingdom Gfk Consumer Confidence March 0 -1