- Asian session

Noticias del mercado

Asian session

The dollar was on the defensive on Monday, after Friday's firm U.S. jobs report failed to shift the broadly held view that the Federal Reserve will remain cautious on interest rate hikes this year.

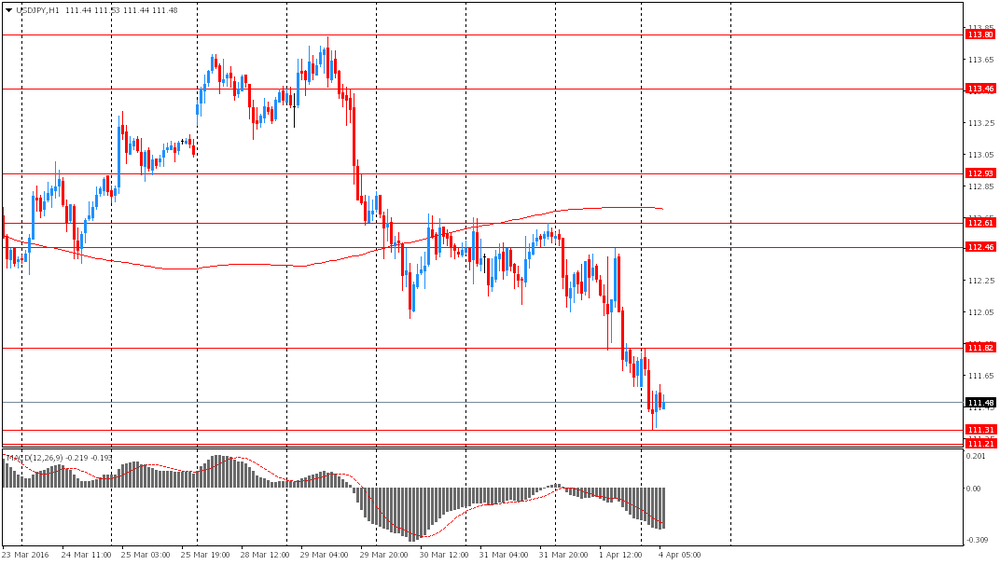

"I don't see any reason that many people would want to buy the yen against the dollar," he said, in light of the mostly positive U.S. employment report as well as the likelihood of more monetary stimulus from Japan.

According to Friday's data, U.S. non-farm payrolls rose by 215,000 last month, slightly above expectations, and average hourly earnings rose after slipping in February. But the unemployment rate edged up to 5.0 percent from an eight-year low of 4.9 percent.

Japanese companies' long-term inflation expectations weakened in March from three months ago, a Bank of Japan survey showed on Monday, a sign that the central bank's January decision to adopt negative interest rates has so far failed to convince firms price rises will accelerate over time.

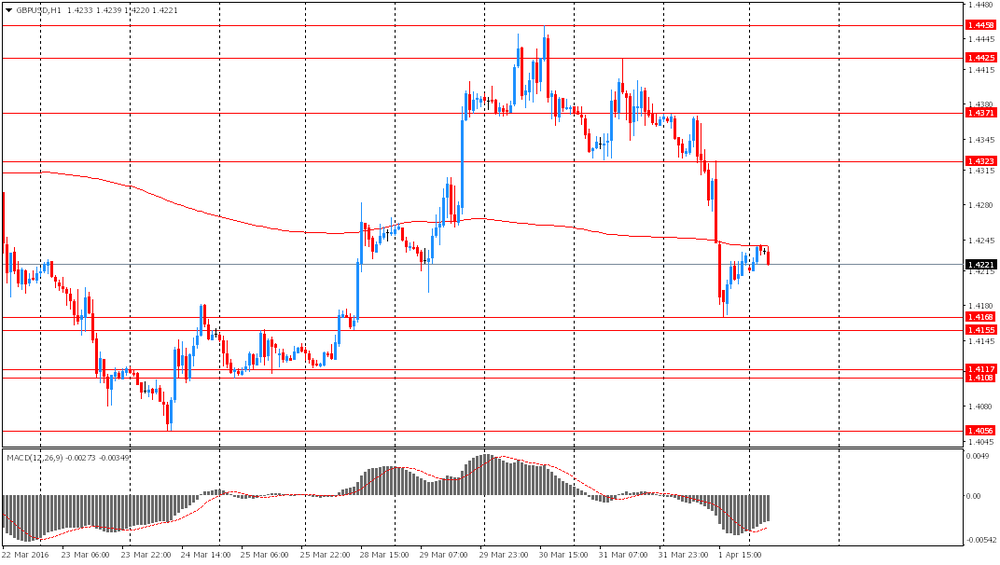

Sterling failed to capitalise on the dollar's broad weakness, weighed down by a weak UK manufacturing survey. Muted retail sales, subdued inflation and a survey suggesting that labour demand may have peaked all pressured the Aussie.

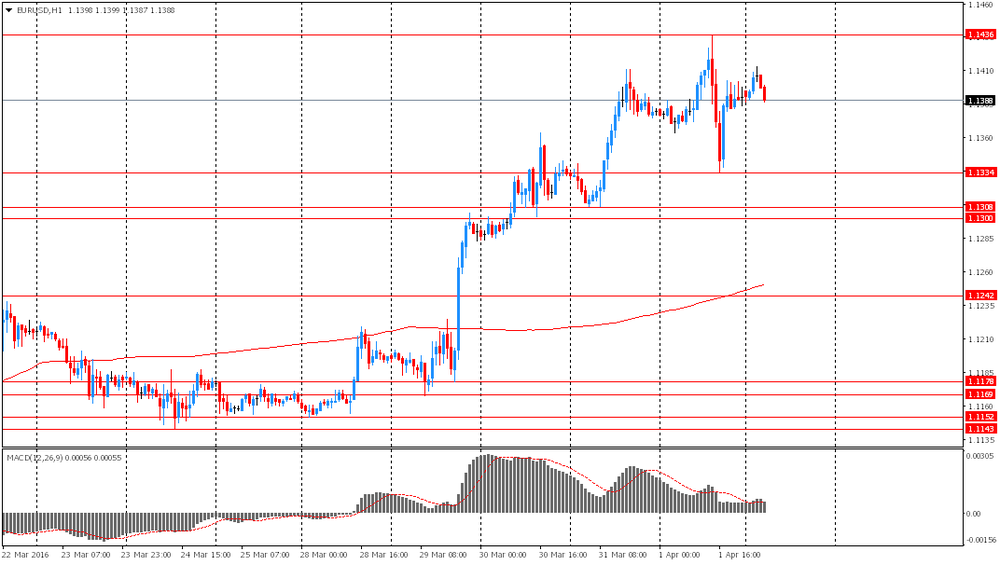

EUR/USD: during the Asian session the pair traded in the range of $1.1380-15

GBP/USD: during the Asian session the pair traded in the range of $1.4215-40

USD/JPY: during the Asian session the pair dropped to Y111.30

Based on Reuters materials