- WSE: Session Results

Noticias del mercado

WSE: Session Results

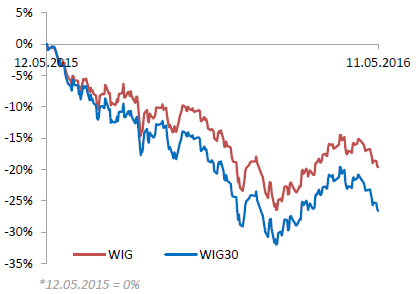

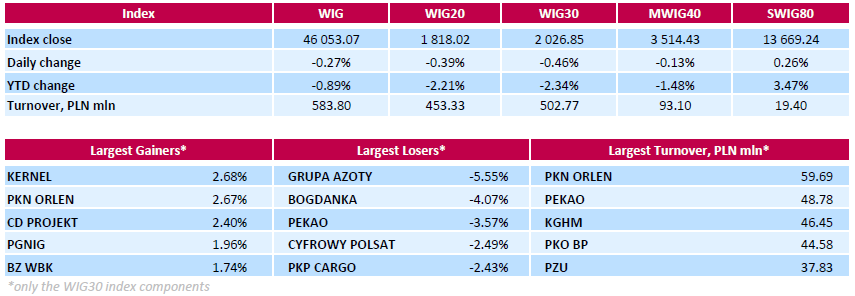

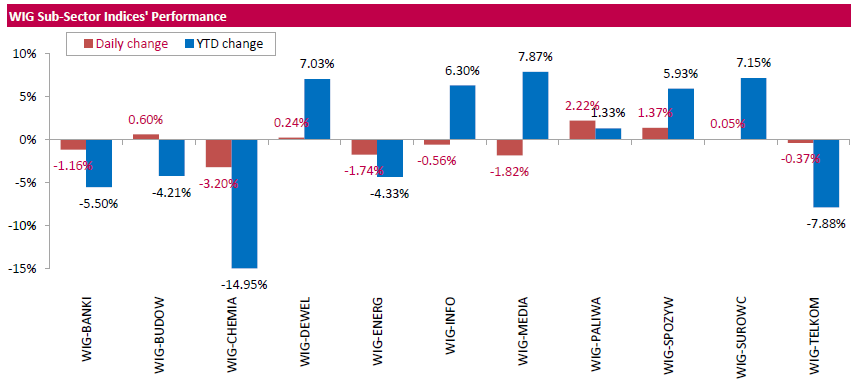

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.27%. Sector performance in the WIG Index was mixed. Chemicals (-3.20%) recorded the biggest decline, while oil and gas sector (+2.22%) fared the best.

The large-cap stocks' measure, the WIG30 Index, lost 0.46%. Within the WIG30 Index components, chemical producer GRUPA AZOTY (WSE: ATT) was hit the hardest, down 5.55%, after the company reported a 1.4% fall in its Q1 net profit to PLN 272.4 mln or $70.1 mln (versus analysts' consensus estimate of PLN 307.6 mln), as falling fertilizer prices outweighed lower gas costs. In addition, the company's deputy chief executive stated the management sees worse prospects for 2016 compared to 2015. Other major laggards were thermal coal miner BOGDANKA (WSE: LWB) and PEKAO (WSE: PEO, plunging by 4.07% and 3.57% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER), oil refiner PKN ORLEN (WSE: PKN) and videogame developer CD PROJEKT (WSE: CDR) were the best performers, advancing 2.68%, 2.67% and 2.4% respectively.