- WSE: Session Results

Noticias del mercado

WSE: Session Results

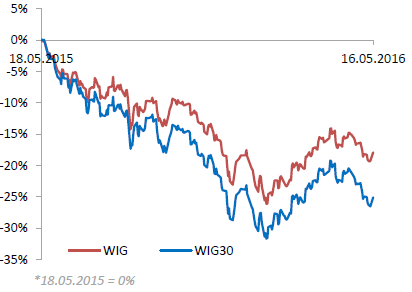

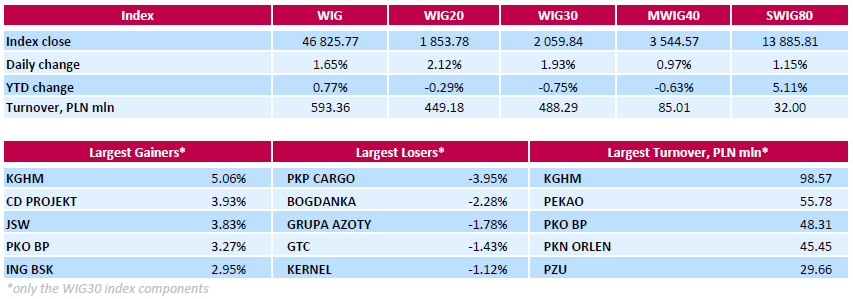

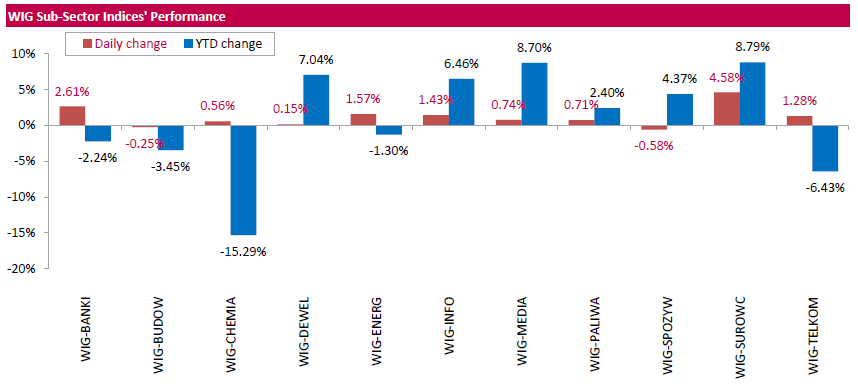

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.65%. Except for food sector (-0.58%) and construction (-0.25%), every sector in the WIG Index rose, with materials (+4.58%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.93%. There were only five decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 3.95% after the company reported Q1 net loss of PLN 66 mln, deeper than the expected loss of PLN 44 mln. Other laggards were thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT), property developer GTC (WSE: GTC) and agricultural producer KERNEL (WSE: KER), losing between 1.12% and 2.28%. At the same time, copper producer KGHM (WSE: KGH) became the strongest advancer with a 5.06% gain. On Friday, the company reported its net profit reached PLN 161 mln in Q1, above the analysts' forecasts of PLN 101 mln. KGHM also stated it was delaying the next phase of expansion at its key overseas mine in Chile as stubbornly low metals prices more than halved its net profit in Q1. Oher major outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and banking name PKO BP (WSE: PKO), climbing by 3.93%, 3.83% and 3.27% respectively.