- Gold surged to the highest in almost two years

Noticias del mercado

Gold surged to the highest in almost two years

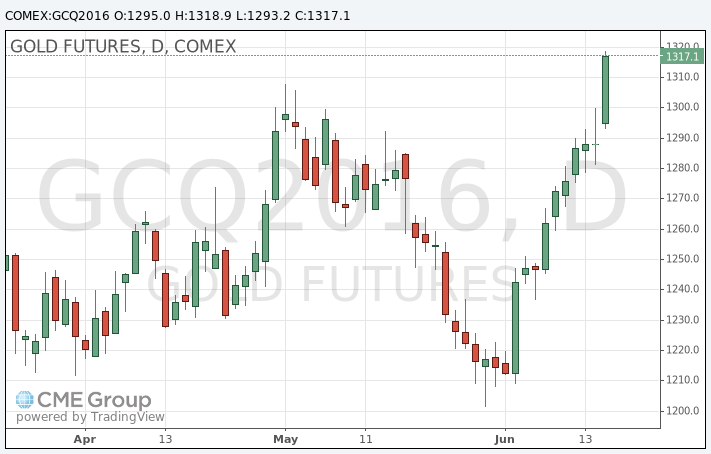

Gold surged to the highest in almost two years as the outlook for low U.S. interest rates and concern that the U.K. will leave the European Union boosted demand for a haven. Base metals declined amid concerns the global economy is losing steam.

Bullion advanced for a seventh day after the Federal Reserve reined in its projection for rate increases over the next two years. Fed Chair Janet Yellen said Wednesday that the U.K.'s June 23 referendum on whether to leave the EU was a factor in holding rates steady.

With recent polls showing U.K. voters favor leaving the bloc, investors are exiting equities and piling into precious metals. Gold holdings in exchange-traded funds are at the highest since October 2013 and silver-backed funds are at a record. Prices of both metals have surged more than 23 percent this year.

The economy seems at risk because of the threat of "Brexit, a China slowdown and doubts from the Fed that the U.S. economy may be performing sub-optimally," Bart Melek, the head of commodity strategy at TD Securities in Toronto, said in a telephone interview.

The number of Fed officials who see just a single rate hike this year rose to six, from one in March. The odds of a rate increase by December have dropped to 29 percent from 76 percent at the start of this month, Fed funds futures show. Low borrowing costs boost the appeal of owning precious metals, which don't pay interest.

Gold will rally if Britons choose to exit the EU, reaching $1,350 within a week of the vote, according to a survey of traders and analysts. Should a majority choose to remain in the bloc, bullion might slide to $1,250, it showed.

Gold futures for August delivery rose to $1,318.90 an ounce on the Comex in New York, after touching the highest since August 2014. The metal headed for a seventh day of gains, the longest stretch since March 2015.