- Asian session review: Gbp/Usd retreated from a 31-year low

Noticias del mercado

Asian session review: Gbp/Usd retreated from a 31-year low

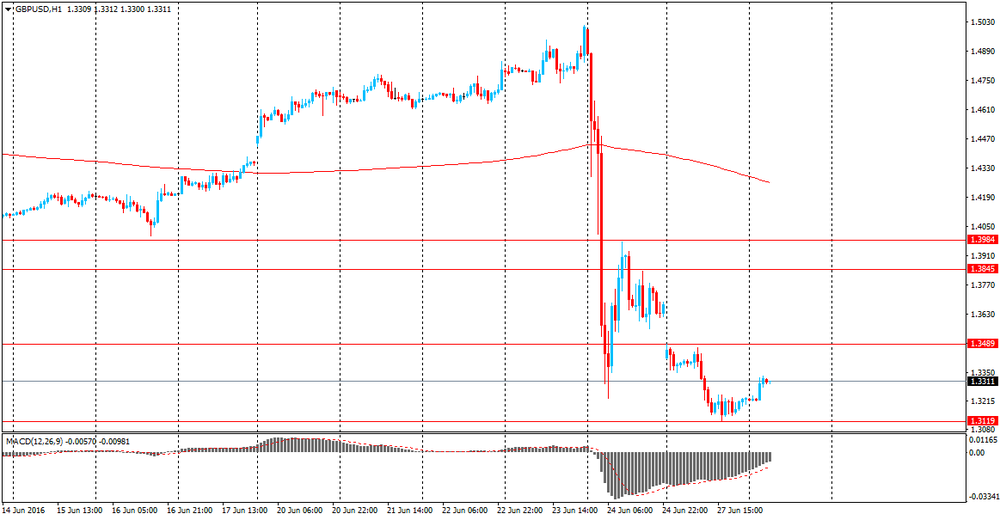

Pound Sterling retreated from a 31-year low against the US dollar while the market remains concerned about the possible consequences of the UK decision to leave the European Union.

The pound touched its lowest level since mid-1985 - $ 1.3119, having fallen by 11.5% compared to the closing level on June 23.

Most economists agree that the referendum affected the economy of Britain, Europe, and possibly other countries. Some of them believe that the short-term damage can be limited, if the authorities in Britain and other countries will manage the consequences. Impact of Brexit is expected to increase due to the potential negative impact in the European economic and political landscape. "The focus right now is Europe, where Brexit can cause a domino effect among the States that wish to withdraw from the EU. The main problem for the foreign exchange market is the European political uncertainty, which could lead to monetary and credit paralysis." - Said Junichi Ishikawa, an analyst at IG Securities .

Yesterday, the pound dropped after failing to recover, despite assurances from the UK finance minister George Osborne that the fifth-largest economy in the world is able to cope with the upcoming challenges. He said that the government has a plan of action in emergency situations, which will help support the economy. However, he explained that it is not necessary to wait for the launch of new financial measures until the new prime minister will be elected, that is, until the autumn.

Today, the international rating agency Fitch downgraded the UK long-term credit rating in foreign and national currencies to "AA" from "AA +" with "negative" outlook on the background of the referendum held in the UK on 23 June.

"The uncertainty surrounding the referendum could lead to slower growth in UK GDP in the short term", - said the agency.

Fitch downgraded the outlook for GDP growth in the UK in 2016 to 1.6% from the previous value of 1.9% and to 0.9% in 2017 - 2018 from 2%.

The euro was also stable and is trading near yesterday's high against the backdrop of reviving risk appetite, which reflects the dynamics of futures on the DAX and FTSE. In addition, players take profits on short positions in anticipation of the start of the EU Economic Summit, where the main issue on the agenda may be Brexit. Accordingly, it can have a strong impact on the euro and pound.

Europe's economic calendar is empty today. The market is awaiting for US GDP data.

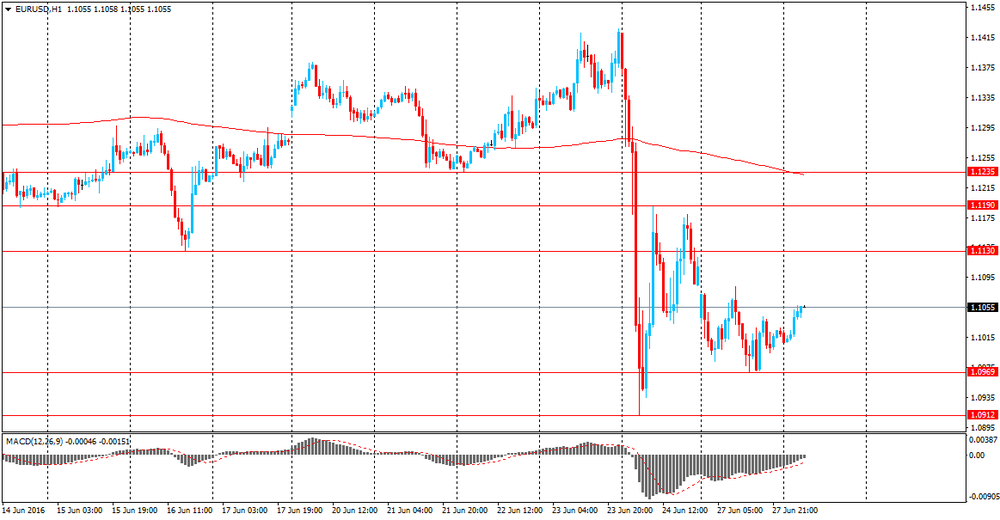

EUR / USD: during the Asian session, the pair was trading in the $ 1.1010-50 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3215-85 range.

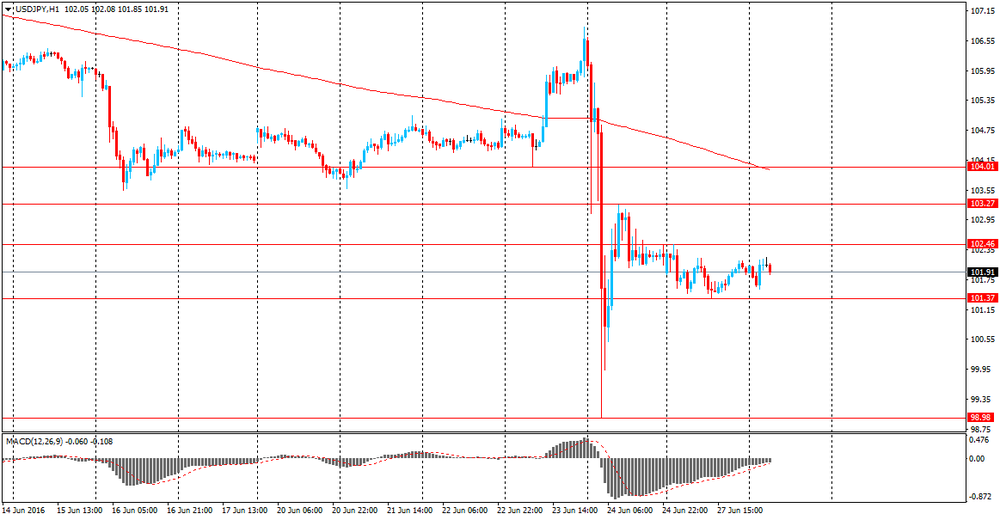

USD / JPY: during the Asian session, the pair was trading in range Y101.55-95 range.