- Gold price moderate increase

Noticias del mercado

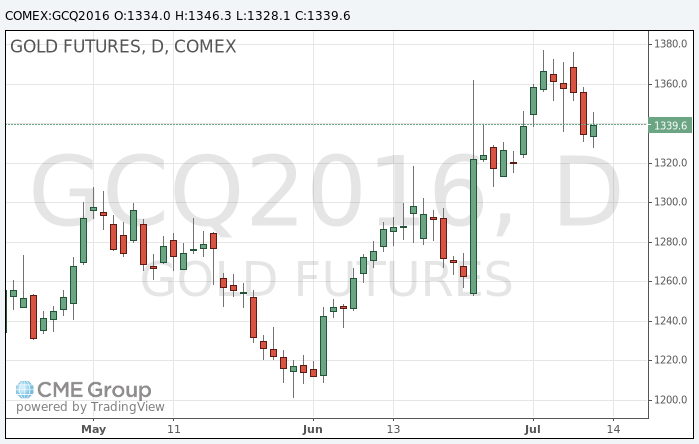

Gold price moderate increase

Gold rises in price during today's trading, recovering from a low of nearly two weeks as prospects for further economic stimulation led to an increase in investor' activity on the background of a stable dollar.

Easing monetary policy is beneficial to gold and shares, because low interest rates encourage investors to opt for assets that do not depend on interest income.

"The price of gold may continue to receive support from the uncertain prospects for the UK and Europe after the vote for Brexit, as well as from any of quantitative easing, which also means lower interest rates", - said an analyst at Natixis Bernard Dada.

Gold has risen in price by about $ 100 per ounce after the United Kingdom voted in favor of withdrawal from the European Union, and investors were quick to shift money into safer assets.

Asian and European stocks on Wednesday very close to the year highs, and the dollar has not changed against a basket of six currencies.

But, in spite of the data on jobs, the Fed will not rush to raise interest rates, said two of its officials.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust on Tuesday fell by 1.63 percent to 965.22 tons, this is the strongest one-day drop since 2 December.

The cost of the August gold futures on the COMEX rose to $ 1346.3 per ounce.