- Gold price rose

Noticias del mercado

Gold price rose

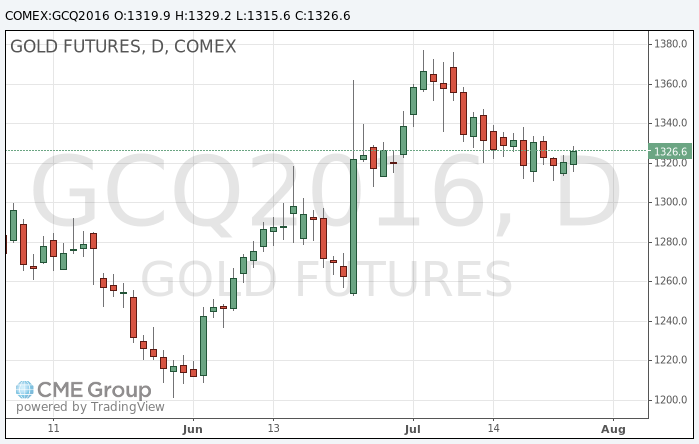

Gold prices rose during the American session, in anticipation of the Fed statement. Previously, prices were kept within a narrow range.

Investors expect the central bank's guidance as good recent US economic data is more likely to put interest rates hikes on the table this year.

Julius Baer Carsten Menke: " the Fed wants to prepare markets for higher interest rates, which could put pressure on gold."

Rising interest rates typically reduce the attractiveness of gold as it leads to the strengthening of the dollar. Rising interest rates typically reduces investment in safe-haven assets such as gold, which does not provide interest income and stimulate investment in more profitable assets.

Some investors rushed to close their positions in gold before Fed statement says George Gero, managing director of RBC Wealth Management. Although traders do not expect a hike, this scenario have become more active to the end of this year.

"Most traders believe the Fed can except to hint at a rate hike in December, however, the incentive to close the short position remains very strong." - Said Gero.

The cost of the August gold futures on COMEX rose to $ 1329.20 per ounce.