- CAD Supported On Inflows Vs EUR, GBP - CIBC

Noticias del mercado

CAD Supported On Inflows Vs EUR, GBP - CIBC

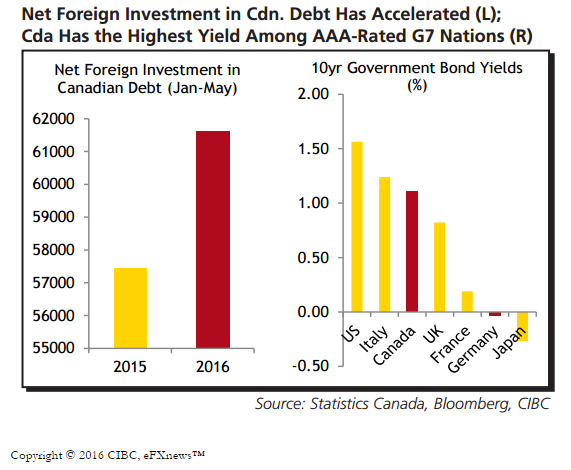

"So far this year foreign investors having been piling into Canadian debt at a striking rate. Year-to-date inflows into Canadian debt are running roughly $4 bn ahead of the pace seen in 2015. In some ways, though, that's not surprising since Canada is one of only two AAArated credits among G7 countries.

With the other being Germany, who's 10-year yield currently sits in negative territory, international investors are viewing Canada as both safe and rewarding.

Looking ahead, with the BoE and ECB likely to ease policy later in the year, and the BoJ already adding some stimulus earlier this week, the pace of inflows could remain healthy, supporting the Canadian dollar against those currencies".