- Gold price increased moderately

Noticias del mercado

Gold price increased moderately

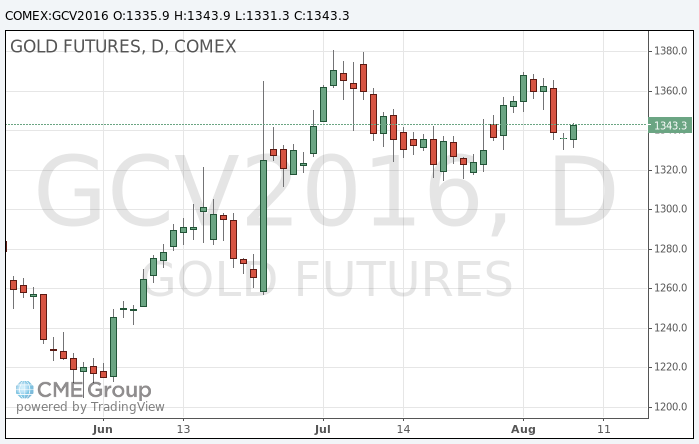

Gold moved from decline to growth, but fears that the US Federal Reserve may raise interest rates this year undermining the interest in the metal.

According to the data by CME Group Fed Watch, traders' views on the possible lUS interest rates hike in December is now divided exactly evenly.

"Gold is generally settled at a higher range between $ 1.335 and $ 1.365, - said the chief commodities analyst at Saxo Bank Ole Hansen -. I think we are waiting for clues, especially the dollar, as investors are not ready to force without the support of a weaker dollar. "

The dollar was little changed against the currency basket on Tuesday. Stock markets rose due to investors' appetite for risk.

Senior Fed official Jerome Powell said on Monday that the increased risk of a long phase of slow growth of the US economy points to the need for lower interest rates than previously expected.

Stocks of the world's largest gold exchange-traded fund SPDR Gold Shares on Monday fell by 6.5 tons, it is the strongest one-day outflow in the past month.

The cost of the October futures on COMEX gold rose to $ 1,343.90 an ounce.