- European session review: the pound traded higher

Noticias del mercado

European session review: the pound traded higher

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 UK House Price Index from Nationwide, m / m in August of 0.5% -0.3% 0.6%

6:00 UK House Price Index from Nationwide, y / y in August 5.2% 4.8% 5.6%

6:00 Germany Retail Sales seasonally adjusted -0.6% Revised July from -0.1% 0.5% 1.7%

6:00 Germany Retail sales, excluding seasonal adjustments, y / y 2.3% Revised July from 2.7% 0.3% -1.5%

6:00 Switzerland indicator of consumer activity from UBS in July 1.34 1.32

7:55 Germany Unemployment rate seasonally adjusted 6.1% in August 6.1% 6.1%

7:55 Germany Change in the number of unemployed in August Revised -8 from -7 -5 -7

9:00 Eurozone July unemployment rate 10.1% 10.0% 10.1%

9:00 Eurozone Consumer Price Index y / y (provisional) in August 0.2% 0.3% 0.2%

9:00 Eurozone consumer price index base value, y / y (provisional) in August 0.9% 0.9% 0.8%

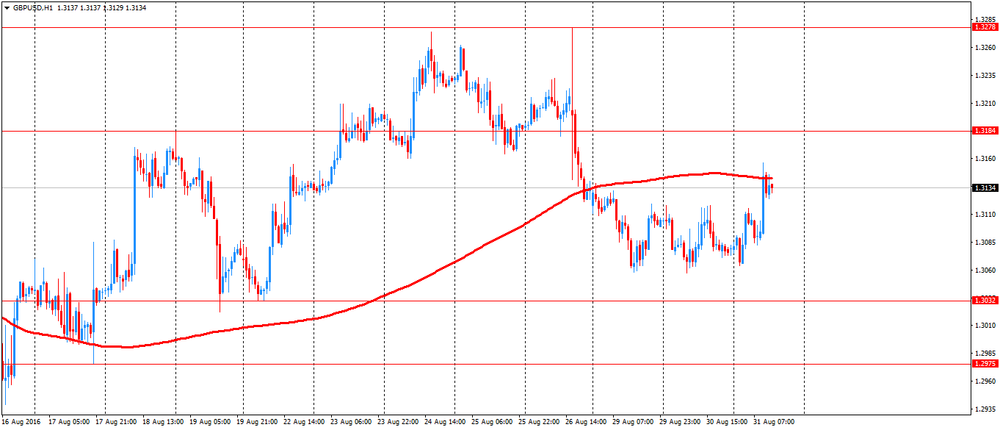

Pound rises sharply after data showed that the UK economy is going through a good period after Brexit. According to the report of Nationwide, house prices in the country remains stable. A survey conducted by the GfK, showed improvement in consumer sentiment. These data allow investors to take profits on short positions on the pound.

In the UK house prices rose at the fastest pace in five months in August, reported Nationwide Building Society. Housing prices rose 5.6 percent year on year in August, after rising 5.2 percent in July. It was the most rapid growth over the past five months. Economists had forecast that the annual growth rate will slow to 4.8 per cent. In monthly terms, housing prices unexpectedly rose 0.6 percent, slightly faster than the growth of 0.5 percent a month ago. Prices were expected to decline by 0.3 percent.

New buyer inquiries softened after the introduction of an additional fee for second homes in and the uncertainty surrounding the EU referendum, said Robert Gardner, chief economist at Nationwide. "What's next on the demand side will determine to a large extent the prospects of the labor market and confidence among potential buyers," says Gardner.

At the same time, the consumer confidence index from the GfK Group has dropped to -7 in August, while analysts expected a decline to -8. Despite the decline, the index was better than the value of July, when the indicator fell to -12. Consumer confidence is weaker than it was prior to the vote on 23 June when the index stood at -1. The index of consumer confidence from the GfK Group is a leading indicator that reflects the level of consumer confidence in economic activity. The index is based on a survey of 2,000 people, conducted from August 1-16.

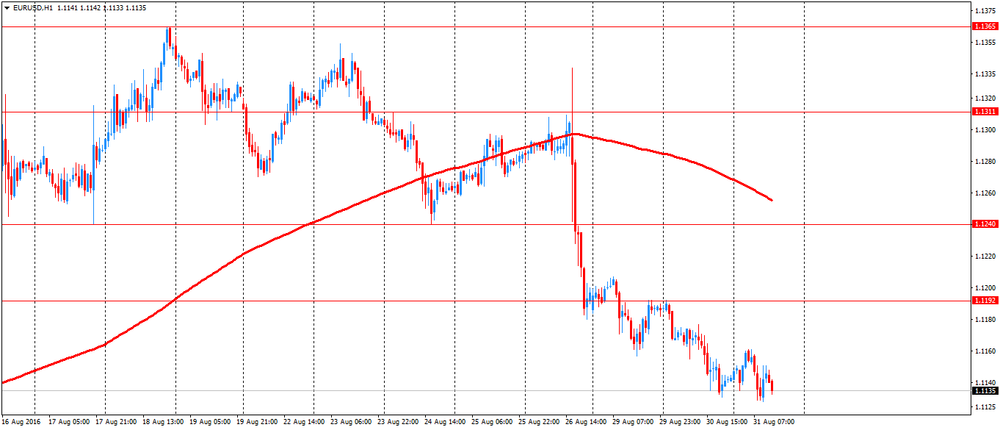

The euro declines against the background of large-scale strengthening of the US currency on expectations of a fed hike. At the same time, German unemployment dropped more than expected in August. The number of people out of work fell by 7,000 in August compared to July. Economists had forecast a decline of 5,000. At the same time, the unemployment rate remained stable at 6.1% in August. The result was in line with expectations. It was the lowest level since German reunification.

In addition, as shown by preliminary estimates from Eurostat, inflation in the eurozone remained stable in August. Inflation remained unchanged at 0.2%, while economists had expected the index to rise slightly to 0.3%. Inflation remains below the target level of the European Central Bank's' below but close to 2 percent since the beginning of 2013. Core inflation, which excludes energy, food, alcohol and tobacco decreased slightly to 0.8% from 0.9% in July. Core inflation was expected to remain at 0.9%.

EUR / USD: during the European session, the pair fell to $ 1.1128

GBP / USD: during the European session, the pair rose to $ 1.3156

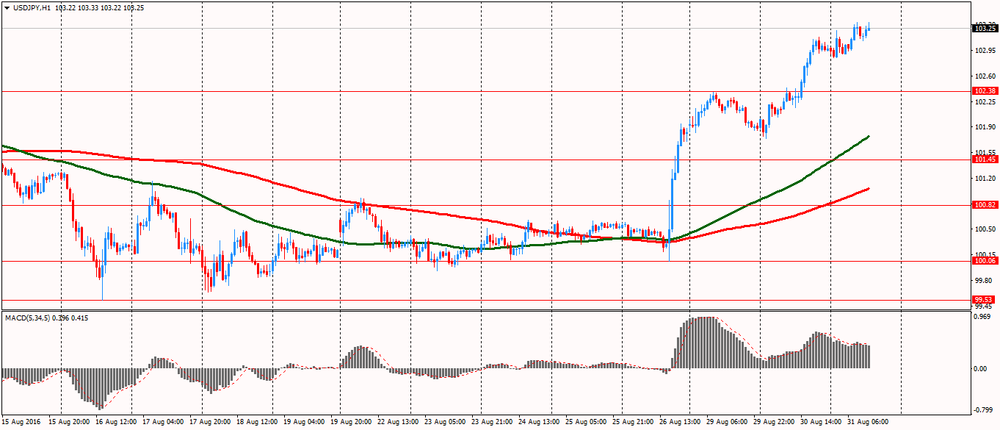

USD / JPY: during the European session, the pair rose to Y103.33