- Asian session review: Euro rose slightly

Noticias del mercado

Asian session review: Euro rose slightly

The euro rose slightly on the eve of tomorrow's data on the dynamics of consumer prices in Germany. It is expected that prices in August remained unchanged from July and rose only slightly in comparison with the same period last year. In addition to this, on Wednesday inflation data will be released in France and Italy, which are the second and third largest economies in the euro zone. In France, as expected by economists, consumer prices increased in comparison with the previous month and the same period of the previous year, and in Italy - fell slightly compared with the same period of the previous year, but increased compared to July.

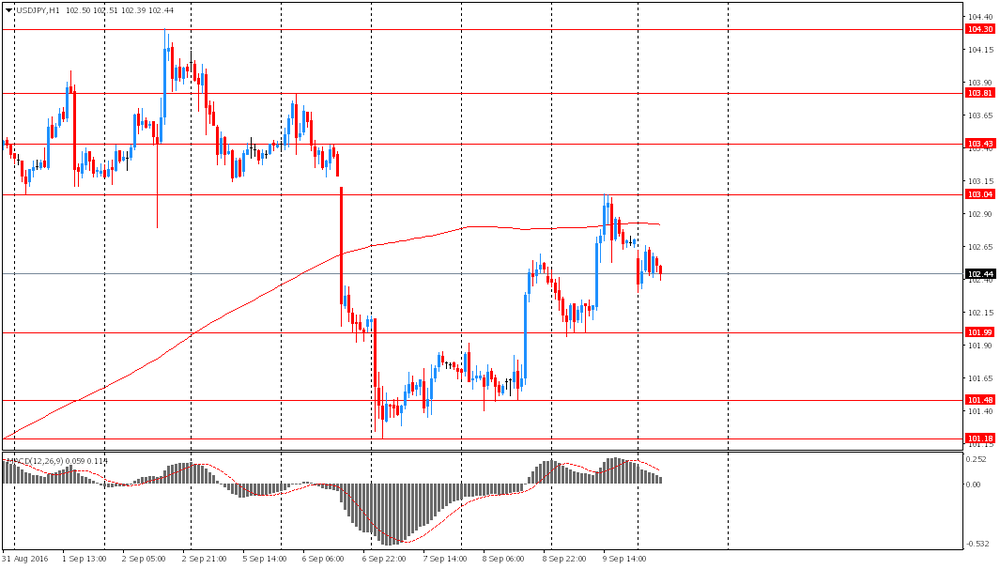

The yen traded almost unchanged after the publication of mixed economic data from Japan. According to a report published by the Cabinet of Ministers of Japan, in July the country's orders for engineering products increased by 4.9%, after rising in June by 8.3%. Analysts had expected a decline of -3.5%. In annual terms, the indicator was also higher than economists forecast, and its growth was 5.2%. In July, a year earlier, the number of orders was -0.9%. Also today, the Bank of Japan said that the price index for corporate goods decreased by 0.3% in August, which is slightly more than the 0.2% expected decline. In annual terms, the price index declined in August to -3.6% after easing 3.9% prior.

The dollar fell slightly against the major currencies, after a significant increase after Friday's comments from the US Fed's Eric Rosengren, who signaled a tendency to tighten monetary policy. Boston Fed President Eric Rosengren said on Friday that "there are substantial grounds" for the tightening of monetary policy, which will allow to avoid overheating of the economy.

EUR / USD: during the Asian session, the pair rose to $ 1.1250

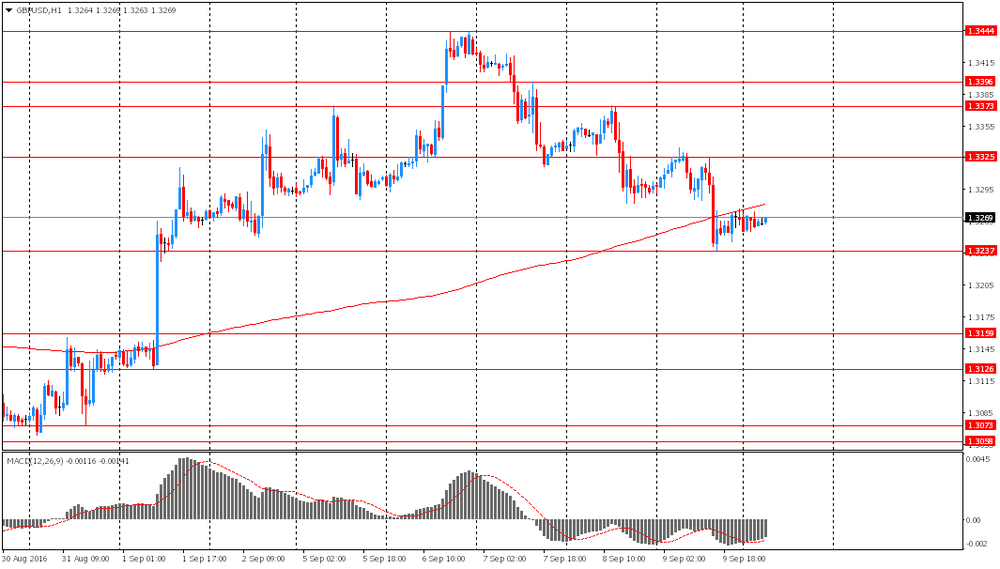

GBP / USD: during the Asian session, the pair was trading in the $ 1.3255-75 range

USD / JPY: during the Asian session, the pair was trading in Y102.30-65 range