- Asian session review: Fed holds, dollar lower

Noticias del mercado

Asian session review: Fed holds, dollar lower

At the beginning of the trading session the New Zealand dollar rose after the Reserve Bank of New Zealand left interest rates unchanged at 2.0%, but said it would take further easing of monetary policy. " The New Zealand dollar makes difficult to achieve the inflation target. It is expected that annual CPI inflation will weaken, but long-term inflation expectations are well anchored at 2%, "- said the Central Bank. However, the later course of the pair NZD / USD was on the downside helped by declarations of the General Director of Fonterra Theo Spirings. The top manager said that the strong New Zealand dollar exchange rate hurts the company. For this reason, many analysts began to warn of possible verbal intervention on the part of central bank and governmens, to put pressure on NZD.

The dollar remained under pressure after the Federal Reserve left interest rates unchanged, but signaled that it may tighten monetary policy in the coming months. However, there are contradictions among the leaders of the central bank. One group is in favor of an immediate rate hike, while the other sees no need to tighten monetary policy later this year. "The Fed noted the emergence of more powerful arguments in favor of raising rates, but decided to wait until new evidence of further progress in achieving these goals," - said in a statement the central bank. Judging by the published forecasts of the Fed, 10 of 17 of its leaders expects a key rate hike by a quarter percentage point to 0.5% -0.75% range in December. Three members of the committee do not expect rate hikes this year, and four want rates raised more than once before the end of the year. This suggests that differences in the leadership of the central bank on further action. At the same time, futures on interest rates indicate a 55% probability of a rate hike at the December meeting. Many believe that the central bank will refrain from raising rates at its next meeting, which will end on November 2, a week before the presidential election.

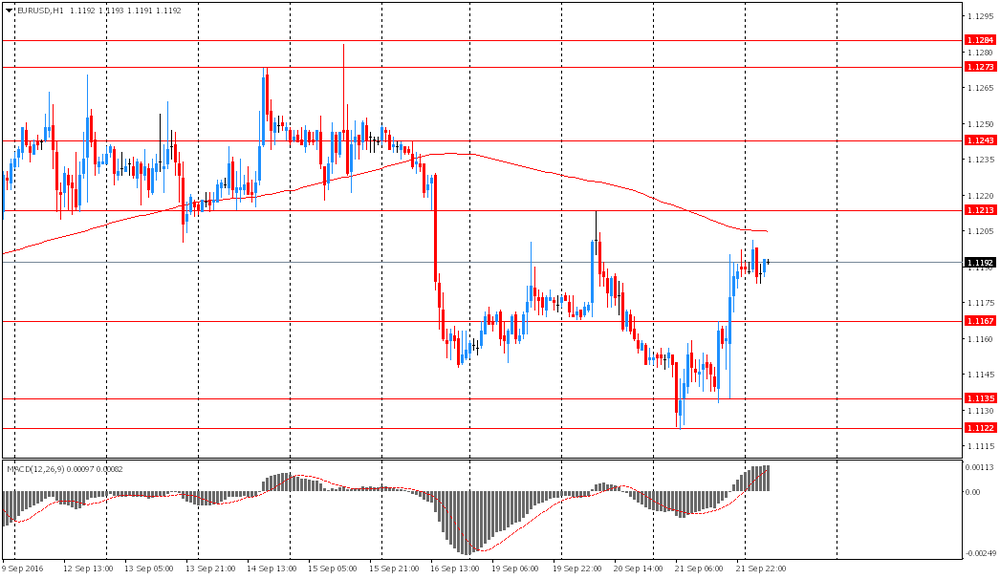

EUR / USD: during the Asian session, the pair was trading in the $ 1.1180-00 range

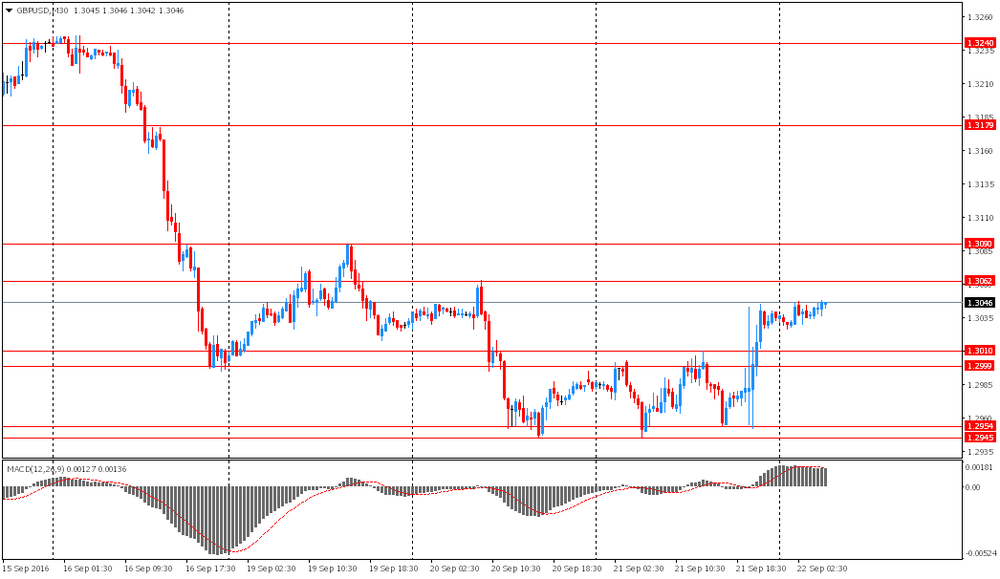

GBP / USD: during the Asian session, the pair was trading in the $ 1.3025-60 range

USD / JPY: during the Asian session, the pair was trading in Y110.10-50 range