- WSE: Session Results

Noticias del mercado

WSE: Session Results

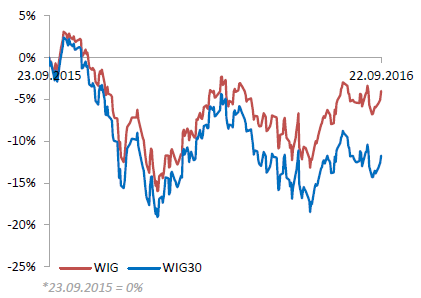

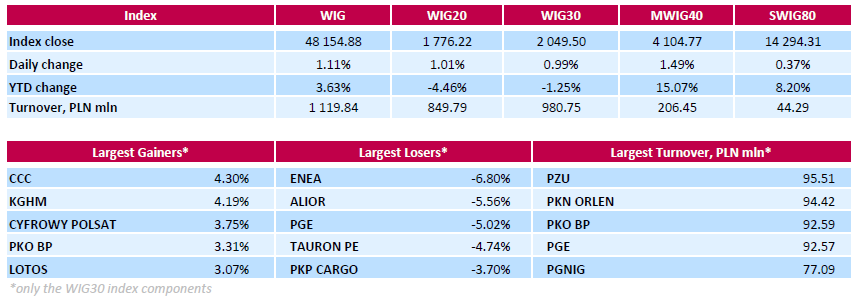

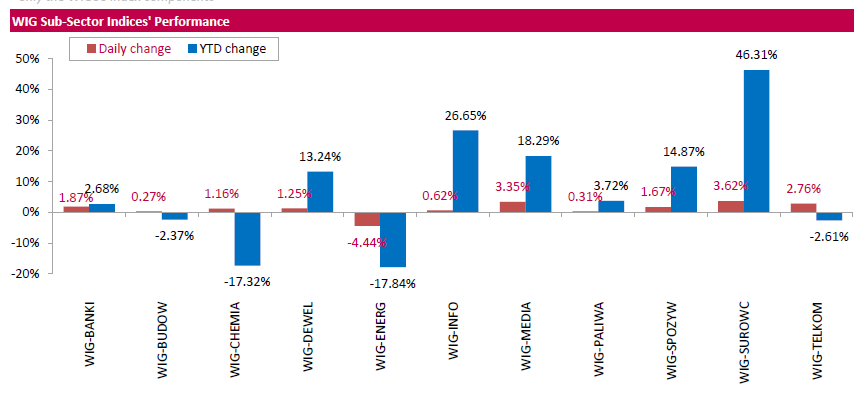

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 1.11%. Almost all sectors in the WIG generated positive returns. The only exception was utilities sector (-4.44%), dragged down by the announcement Poland's government intends to claim extra taxes from state-run utilities from 2017, in a move that is expected to hurt minority shareholders. The government's plan involves raising capital by increasing the nominal value of the utilities' shares, and not issuing new shares. As a result, the utilities will be obliged to flat-rate income tax of 19 percent on the increased nominal value.

The large-cap benchmark, the WIG30 Index, rose by 0.99%. Within the index components, footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH) led the gainers, climbing by 4.3% and 4.19% respectively. Other major advancers were media group CYFROWY POLSAT (WSE: CPS), bank PKO BP (WSE: PKO) and oil refiner LOTOS (WSE: LTS), gaining between 3.07% and 3.75%. On the other side of the ledger, all four utilities names TAURON (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) were among the day's weakest performers, losing between 3.42% and 6.8%. Elsewhere, banking name ALIOR (WSE: ALR) fell by 5.56% on fears the bank may issue new shares to finance the purchase of Raiffeisen Bank Polska. ALIOR reportedly started exclusive negotiations with Austria's Raiffeisen Bank International to buy its Polish core banking business.