- Asian session review: NZD declines

Noticias del mercado

Asian session review: NZD declines

The New Zealand dollar has fallen against the US dollar as investors continue to assess the likelihood of a intrest rate change by the Reserve Bank of New Zealand in the coming months. Earlier, the Central Bank made it clear that the NZD / USD is expected to decline, and that the regulator intends to continue to lower interest rates. Most economists expect RBNZ to cut rates in November. The greatest decrease in the New Zealand Dollar was vs AUD.

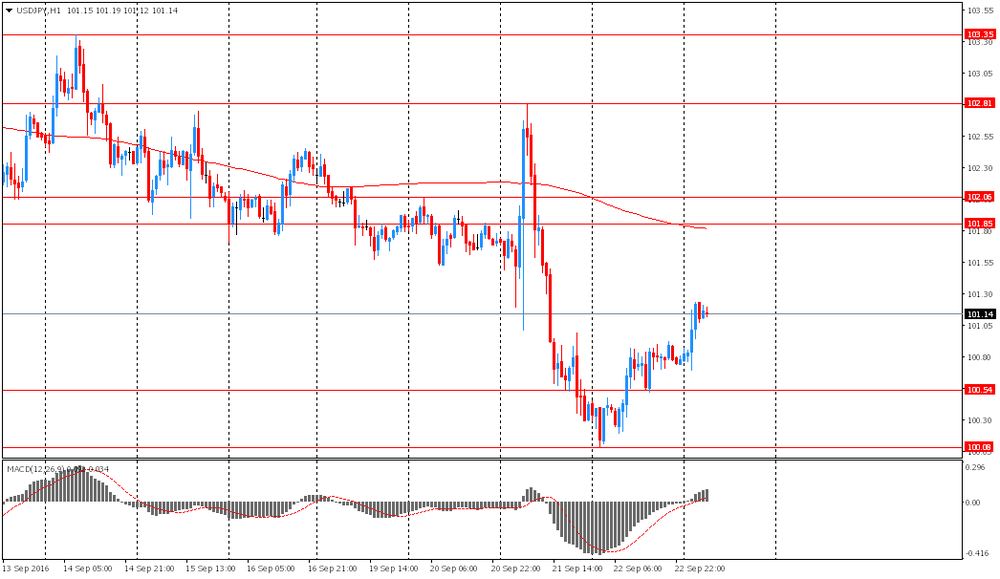

The yen fell against the dollar amid wariness of investors about the possible reaction of the Japanese government. Earlier, the yen has increased significantly on the Bank of Japan'smeeting outcome, as the central bank announced new measures by introducing the target level for the 10-year interest rates. Many investors have regarded this step as the Bank of Japan's waiver policy, which allows to control the exchange rate of the yen over the years.

Japanese data was better tha forecast. In September manufacturing PMI was 50.3 points higher than the previous value of 49.5 and economists' expectations of 49.3. Nikkei PMI provides a preliminary assessment of the health of the manufacturing sector in Japan.

Nikkei / Markit report says that the current rate of groth was the most significant in the last 7 months and is a positive sign for the Japanese production. Growth in the sector is mainly due to the increase in export orders, which previously rose to the final value of 47.2.

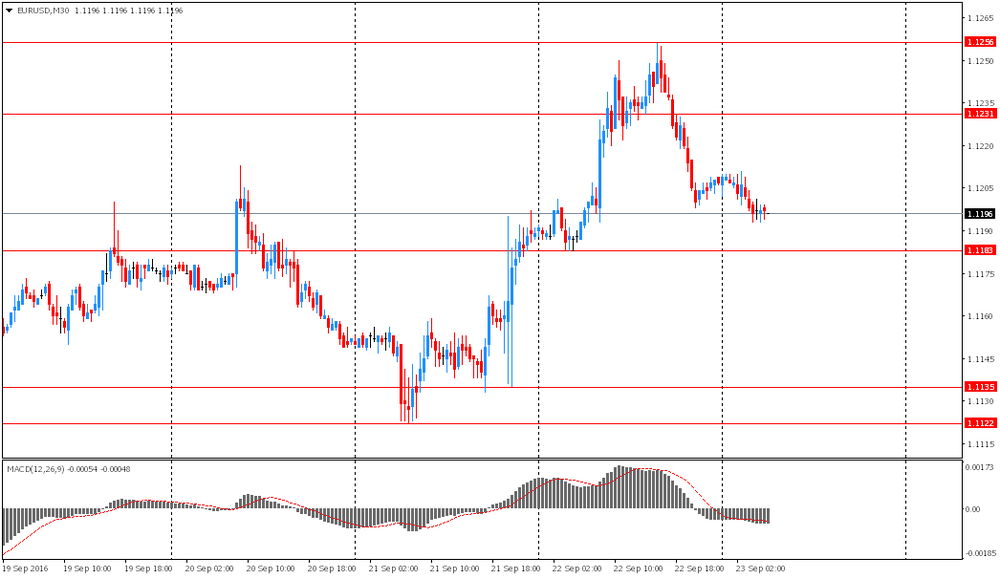

EUR / USD: during the Asian session, the pair was trading in the $ 1.1195-10 range

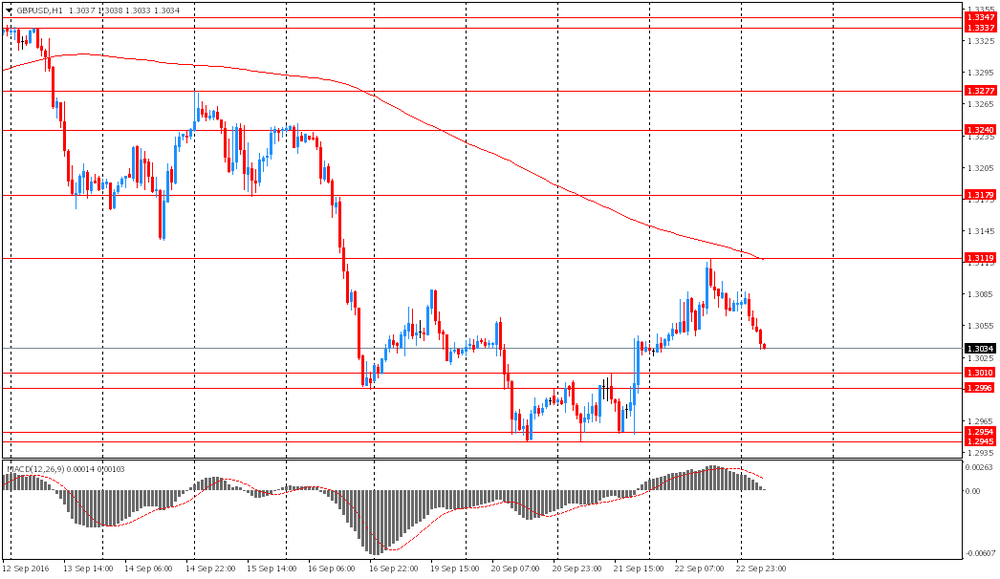

GBP / USD: during the Asian session the pair fell to $ 1.3030

USD / JPY: rose to Y101.25