- Top 10 trades for 2017 according to Morgan Stanley

Noticias del mercado

Top 10 trades for 2017 according to Morgan Stanley

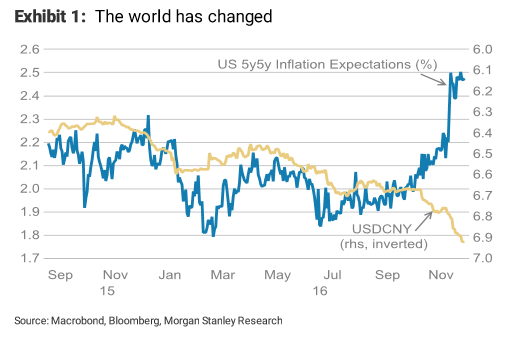

"USD has entered its last leg within a secular bull market. We expect USD to be driven by widening rate and investment return differentials.

USD strength should be front-loaded against low-yielding currencies, particularly JPY and KRW.

Later in the cycle we see USD strength broadening out with the help of rising US real rates, specifically hitting high-yielding currencies. Higher real rates should eventually tighten financial conditions, increasing the headwinds for the US economy and marking the turning point for USD after 1Q18.

1) Long USD/JPY: Yield differentials driving outflows from Japan and higher inflation expectations.

Copyright © 2016 Morgan Stanley, eFXnews