- Deutsche Bank selling USD/JPY at 115

Noticias del mercado

Deutsche Bank selling USD/JPY at 115

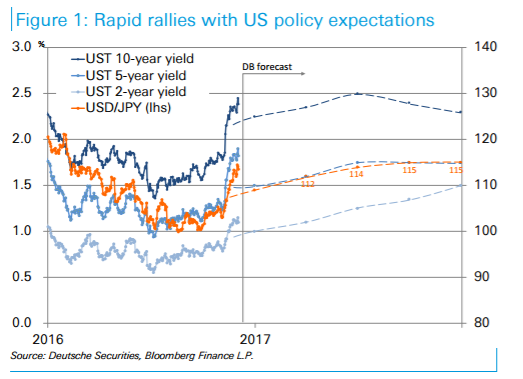

"In the short term, we may need to be alert to the risk of a correction to this USD/JPY rapid rally. The cause could be any of several factors, such as questions over the viability of US policies or politics, a weakening in emerging market or resource price trends leading to a high dollar, recurring concerns on China's capital outflow, or political uncertainties with major EU elections. On the other hand, we feel that the rally, though led largely by expectations, has not fully discounted the policies of the incoming Trump government, which remain highly indeterminate. As such, we believe the USD/JPY still has ample upside once Donald Trump takes office.

From a supply/demand perspective, we feel the USD/JPY will be underpinned at ¥110 or lower on buying on weakness by pension funds and life insurers. Some importers have seen their long-term hedge for USD buying knocked out and may move to acquire dollars at an even higher level. The USD/JPY has been steadily supported by such buyers.

Overseas USD/JPY bulls should try the upside with a close eye on these trends and on the viability of the Trump administration's policies. We believe Japanese exporters should quietly smooth their activity and undertake USD sell hedging in line with this uptrend. We do not rule out a possible upswing in the USD/JPY to over ¥115. This trend might last beyond next year and into 2018.

Based on this understanding, we recommend a tactical approach of buying at the low ¥110 level or below and selling expeditiously at over ¥115".

Copyright © 2016 DB, eFXnews™