- Deutsche Bank staying short EUR/USD, something special happened

Noticias del mercado

Deutsche Bank staying short EUR/USD, something special happened

"Something special happened last week: Fed funds - the interest rate on overnight dollars - rose to 66bps.

Why is this important? Because historically, it is not only the direction of US yields that matters for the dollar but also the absolute level.

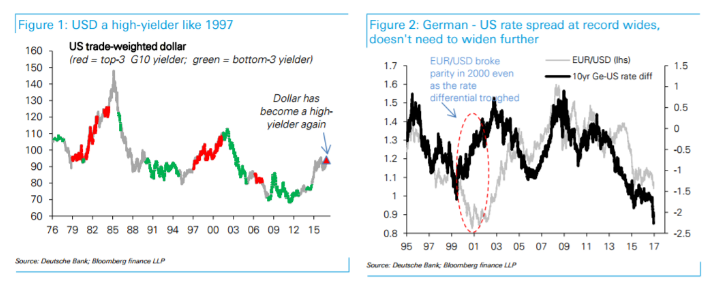

When the USD joins the ranks of the high-yielders - defined as having at least the third highest central bank yield in the G10 - it typically rallies very strongly. The dollar entered such a regime yesterday: only Australia and New Zealand now have higher central bank rates than the US.

The last time this happened for more than a few months was in 1979 and 1997; the dollar rallied by 30% and 20% respectively (chart 1).

What about long-end yields? The US comes out on top here too: among the world's 20 largest bond markets, US 10-year treasury yields are now at least the third highest across the 5, 10 and 30-yr tenors.The dollar is truly a high-yielder.

Summing up, there is a threshold of yields beyond which the dollar rallies even if the rate differential stops widening. Indeed, the break of EUR/USD parity back in the 2000s was accompanied by a narrowing, not widening in the EU-US rate differential as portfolio flows flocked to the US from Europe (chart 2). From this perspective, a stabilization in UST yields attracting fresh buyers may end up being even more negative for EUR/USD.

We remain bearish and expect a break of parity down to at least 95 cents next year".

Copyright © 2016 DB, eFXnews™