- Credit Agricole thinks USD/JPY is still elevated

Noticias del mercado

Credit Agricole thinks USD/JPY is still elevated

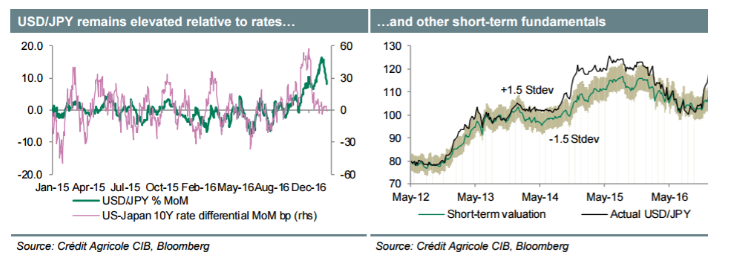

"While there has been significant pullback in the USD/JPY, it still remains significantly above where rates and other short-term fundamentals suggest it should be. USD/JPY remains vulnerable given extended short positioning in the JPY.

So it remains up to President Trump and US economic data to start pushing US rates higher again to justify the level of the USD/JPY. The weaker JPY should help push Japan's trade balance and inflation higher. Inflation data will be the main focus locally, but it is unlikely to accelerate enough to jeopardise any change in the BoJ's current stance.

The JGB yield curve has been steepening in 2017 relative to the UST curve, which is weighing on the USD/JPY. So, the outcome of the JGB 40Y auction this coming week could also be of some interest for the USD/JPY".

Copyright © 2017 Credit Agricole CIB, eFXnews™