Noticias del mercado

-

17:32

Foreign exchange market. American session: the Canadian dollar rose against the U.S. dollar after the mostly better-than-expected Canadian economic data

The U.S. dollar traded lower against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded higher against the U.S. dollar. German adjusted retail sales climbed 2.9% in January, after a 0.6% gain in December. December's figure was revised up from a 0.2% increase. Analysts had expected retail sales to rise 0.6%.

Eurozone's producer price index dropped 0.9% in January, missing expectations for a 0.6% decrease, after a 1.0% decline in December.

The British pound traded higher against the U.S. dollar. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 60.1 in February from 59.1 in January, beating expectations for a decline to 59.0.

The Canadian dollar rose against the U.S. dollar after the mostly better-than-expected Canadian economic data. Canada's GDP increased 0.3% in December, exceeding expectations for a 0.1% gain, after a 0.2% fall in November.

The increase was driven by higher manufacturing output.

The Industrial Product Price Index (IPPI) fell 0.4% in January, beating forecasts for a 2.2% drop, after a 1.5% decrease in December. December's figure was revised up from a 1.6% decline.

The decline was driven by lower prices for energy and petroleum products.

The Raw Materials Price Index (RMPI) dropped 7.7% in January, missing expectations for a 6.8% fall, after a 7.5% decline in December. December's figure was revised up from a 7.6% decrease.

The drop was driven by lower prices for crude energy products.

The Swiss franc traded higher against the U.S. dollar. Switzerland's GDP rose 0.6% in the fourth quarter, beating expectations for a 0.3% increase, after a 0.7% gain in the third quarter. The third quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the fourth quarter, after a 1.9% increase in the third quarter.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi increased against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the Reserve Bank of Australia's (RBA) interest rate decision. The RBA kept its interest rate unchanged at 2.25%. Analysts had expected the RBA to cut its interest rate to 2.00%.

The RBA Governor Glenn Stevens said today that further interest rate cut is possible, "in order to foster sustainable growth in demand and inflation consistent with the target".

Building approvals in Australia climbed 7.9% in January, beating expectations for a 1.7% decline, after a 2.8% decrease in December. December's figure was revised up from a 3.3% fall.

Australia's current account deficit narrowed to A$9.6 billion in the fourth quarter from A$12.1 billion in the third quarter, beating forecasts for a rise to A$10.8 billion. The third quarter's figure was revised up from a deficit of A$12.5 billion.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen increased against the greenback. Japan's monetary base increased 36.7% in February, after a 37.4% gain in January.

Labour cash earnings in Japan climbed 1.3% in January, exceeding expectations for a 0.6% rise, after a 1.3% gain in December. December's figure revised down from 1.6% increase.

-

17:05

Reserve Bank of Australia kept its interest rate unchanged at 2.25%, further interest rate cut is possible

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.25%. Analysts had expected the RBA to cut its interest rate to 2.00%.

Australia's central bank cut its interest rate to 2.25% on February 03, 2015, down from 2.50%.

The RBA Governor Glenn Stevens said today that further interest rate cut is possible, "in order to foster sustainable growth in demand and inflation consistent with the target".

Stevens noted that the Australian dollar "remains above most estimates of its fundamental value", and "a lower exchange rate is likely to be needed to achieve balanced growth in the economy".

-

16:14

Canadian industrial product and raw materials price indexes decline in January

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) fell 0.4% in January, beating forecasts for a 2.2% drop, after a 1.5% decrease in December. December's figure was revised up from a 1.6% decline.

That was the fifth straight monthly fall.

The decline was driven by lower prices for energy and petroleum products. Energy and petroleum products plunged 11.2% in January.

The Raw Materials Price Index (RMPI) dropped 7.7% in January, missing expectations for a 6.8% fall, after a 7.5% decline in December. December's figure was revised up from a 7.6% decrease.

That was the seventh straight monthly decline.

The drop was driven by lower prices for crude energy products. Crude energy products declined 19.1% in January.

-

15:44

Canada's GDP climbs 0.3% in December

Statistics Canada released GDP (gross domestic product) data on Tuesday. Canada's GDP increased 0.3% in December, exceeding expectations for a 0.1% gain, after a 0.2% fall in November.

The increase was driven by higher manufacturing output.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1180(E680mn), $1.1200(E320mn), $1.1290(E250mn), $1.1350(E350mn)

USD/JPY: Y119.00($330mn), Y119.75($250mn), Y121.00($430mn)

USD/CHF: Chf0.9500($250mn)

AUD/USD: $0.7700(A$255mn), $0.7750(A$273mn), $0.7800(A$364mn), $0.7900(A$398mn)

AUD/JPY: Y92.980(A$289mn)

-

14:30

Canada: GDP (m/m) , December +0.3% (forecast +0.1%)

-

14:30

Canada: Industrial Product Prices, m/m, January -0.4% (forecast -2.2%)

-

14:30

Canada: Raw Material Price Index, January -7.7% (forecast -6.8%)

-

14:03

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected construction PMI from the U.K.

Economic calendar (GMT0):

00:30 Australia Building Permits, m/m January -2.8% Revised From -3.3% -1.7% +7.9%

00:30 Australia Building Permits, y/y January +9.6% Revised From +8.8% +9.1%

00:30 Australia Current Account, bln Quarter IV -12.1 Revised From -12.5 -10.8 -9.6

01:30 Japan Labor Cash Earnings, YoY January +1.3% Revised From +1.6% +0.6% +1.3%

03:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.00% 2.25%

03:30 Australia RBA Rate Statement

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV +0.7% Revised From +0.6% +0.3% +0.6%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV +1.9% +1.9%

07:00 Germany Retail sales, real adjusted January +0.6% Revised From +0.2% +0.6% +2.9%

07:00 Germany Retail sales, real unadjusted, y/y January +4.8% Revised From +4.0% +5.3%

09:30 United Kingdom PMI Construction February 59.1 59.0 60.1

10:00 Eurozone Producer Price Index, MoM January -1.0% -0.6% -0.9%

10:00 Eurozone Producer Price Index (YoY) January -2.6% Revised From -2.7% -3.4%

The U.S. dollar traded mixed to higher against the most major currencies. There will released no major economic reports in the U.S. on Tuesday.

The euro declined against the U.S. dollar after the mixed economic data from the Eurozone. German adjusted retail sales climbed 2.9% in January, after a 0.6% gain in December. December's figure was revised up from a 0.2% increase. Analysts had expected retail sales to rise 0.6%.

Eurozone's producer price index dropped 0.9% in January, missing expectations for a 0.6% decrease, after a 1.0% decline in December.

The British pound traded lower against the U.S. dollar despite the better-than-expected construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 60.1 in February from 59.1 in January, beating expectations for a decline to 59.0.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian economic data. Canada's GDP is expected to rise 0.1% in December, after a 0.2% decline in November.

Canada's raw materials purchase price index is expected to decline 6.8% in January, after a 7.6% drop in December.

The Swiss franc traded lower against the U.S. dollar after the Swiss gross domestic product (GDP). Switzerland's GDP rose 0.6% in the fourth quarter, beating expectations for a 0.3% increase, after a 0.7% gain in the third quarter. The third quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Switzerland's economy grew at 1.9% in the fourth quarter, after a 1.9% increase in the third quarter.

EUR/USD: the currency pair fell to $1.1153

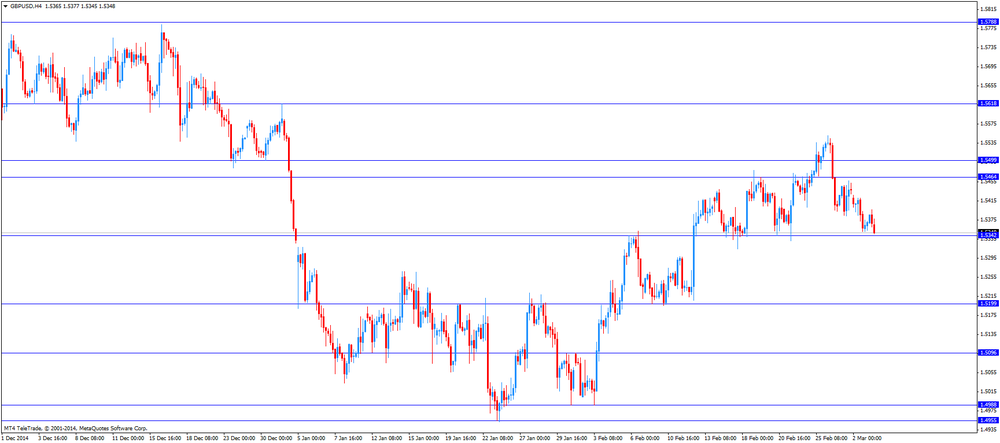

GBP/USD: the currency pair declined to $1.5345

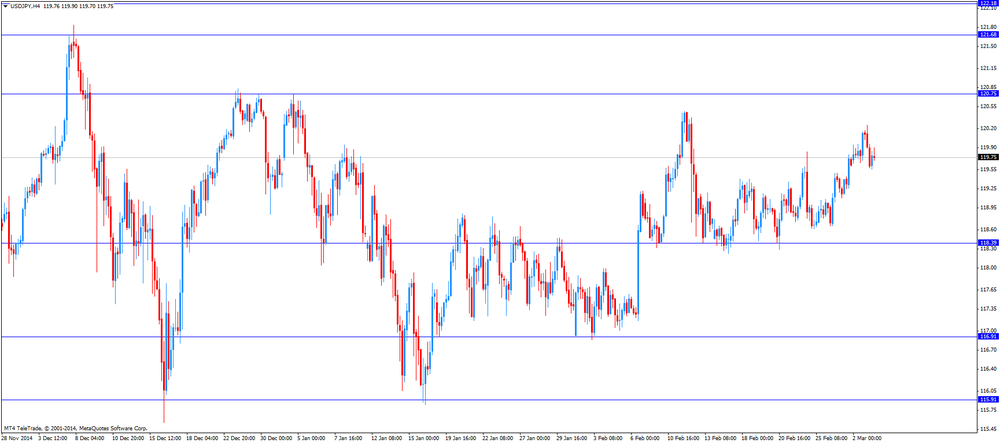

USD/JPY: the currency pair rose to Y119.90

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index January -7.6% -6.8%

13:30 Canada GDP (m/m) December -0.2% +0.1%

-

14:00

Orders

EUR/USD

Offers 1.1245 1.1260 1.1285 1.1300 1.1325 1.1350-60 1.1385

Bids 1.1150-60 1.1130 1.1100

GBP/USD

Offers 1.5420 1.5455 1.5475-80 1.5500 1.5530 1.5550-55 1.5580 1.5600

Bids 1.5350 1.5340 1.5325 1.5300 1.5285 1.5260

EUR/JPY

Offers 134.60 134.80 135.00 135.50 136.00

Bids 133.40 133.00 132.85 132.50

USD/JPY

Offers 120.25-30 120.50 120.85 121.00

Bids 119.50 119.00 118.85 118.60 118.40 118.20 118.00 117.85

EUR/GBP

Offers 0.7300 0.7320-25 0.7345-50 0.7385 0.7400

Bids 0.7250 0.7230 0.7200-10 0.7180-85 0.7160

AUD/USD

Offers 0.7840 0.7880 0.7900-10 0.7930

Bids 0.7800 0.7740-50 0.7720 0.7700 0.7640

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1180(E680mn), $1.1200(E320mn), $1.1290(E250mn), $1.1350(E350mn)

USD/JPY: Y119.00($330mn), Y119.75($250mn), Y121.00($430mn)

USD/CHF: Chf0.9500($250mn)

AUD/USD: $0.7700(A$255mn), $0.7750(A$273mn), $0.7800(A$364mn), $0.7900(A$398mn)

AUD/JPY: Y92.980(A$289mn)

-

11:01

Eurozone: Producer Price Index, MoM , January -0.9% (forecast -0.6%)

-

11:01

Eurozone: Producer Price Index (YoY), January -3.4%

-

10:31

United Kingdom: PMI Construction, February 60.1 (forecast 59.0)

-

10:20

Press Review: Draghi’s QE Moves to Starting Line as Outlook Brightens

BLOOMBERG

Draghi's QE Moves to Starting Line as Outlook Brightens

(Bloomberg) -- The euro-area economy has taken a step in the right direction.

While improving conditions over the past month won't change Mario Draghi's plan to start buying government bonds within days, continued economic recuperation may well stir a debate about when to end them. So far, officials have indicated the buying spree could be extended beyond its proposed timetable -- a less likely outcome if an easing in the region's price slump and a drop in unemployment mark the beginning of a trend.

Draghi will have an opportunity in two days to add to details of the 1.1 trillion-euro ($1.2 trillion) quantitative-easing plan, which was announced in January amid dissent from some policy makers. After a Governing Council meeting in Nicosia, he'll also unveil the ECB's first growth and inflation forecasts for 2017, numbers that will have significance for the duration of QE.

REUTERS

Saudi king keeps close hand on oil in remodelling strategic team(Reuters) - Saudi Arabia's subtle change of energy policymaker line-up since the accession of new King Salman in late January appears to give the monarch's inner circle a firmer hand on the kingdom's oil strategy than previous rulers have enjoyed.

The most notable change was the promotion of the king's son Prince Abdulaziz bin Salman, long a member of the No. 1 crude exporter's OPEC delegation, to the role of deputy oil minister from assistant oil minister, a post he had held for many years.

On the same day, King Salman formed a new body replacing the Supreme Petroleum Council and appointed another son, Prince Mohammed bin Salman, to head the new Supreme Council for Economic Development.

Source: http://www.reuters.com/article/2015/03/03/us-saudi-oil-policy-analysis-idUSKBN0LZ0MT20150303

REUTERS

Investor survey shows 38 percent chance of euro zone break-up in 12 months(Reuters) - Investor expectations of the euro zone breaking apart have risen to their highest level in two years, a survey showed on Tuesday, even after Greece agreed a financial lifeline with its euro zone partners.

The sentix Euro Break-up Index (EBI) gave its highest reading since March 2013, with 38 percent of respondents expecting the bloc to break-up in the next 12 months, up from 24.3 percent in January.

The current poll was conducted between Feb. 26-28, 2015, and surveyed 980 mainly German-based individual and institutional investors.

Source: http://www.reuters.com/article/2015/03/03/us-euro-investment-survey-idUSKBN0LZ0HG20150303

-

09:40

German Retail Sales expand the most since 2010

Retail Sales in Europe's largest economy expanded in January far more than analysts had expected. The Federal statistics office Destatis stated the boost in sales comes amid lower consumer prices and strong consumption. Retailers profited from the high employment rate, the highest in Europe. Falling energy prices left consumers with more money to spend. Seasonally adjusted sales rose +2.9%, compared to revised +0.6% (previous +0.2%) in December. Analysts expected an increase of +0.6%.

On an annual basis Retail Sales rose +5.3%, the most since 2010. The previous reading was revised up from +4.0% to +4.8%.

-

08:40

RBA keeps rate unchanged at 2.25% - aussie gains

The Australian dollar gained after the Reserve Bank of Australia left its cash rate unchanged today at 2.25% after having cut the benchmark rates to a record low last month.

Governor Glenn Stevens stated that further easing may be appropriate in the future in order to spur demand and achieve the targeted inflation rate as worldwide growth is moderate. Although the U.S. economy is recovering growth in China, Australia's biggest trade partner, is slowing.

The policy board of the RBA will assess the necessity for further easing in the next meetings. Stevens reiterated that the Australian dollar remains" above estimates of its fundamental value" given the slump in commodity prices and that a lower exchange rate is needed to ensure economic growth that is currently "below-trend pace". The Australian dollar has declined versus the greenback although less against other major currencies.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Building Permits, m/m January -3.3% -1.7% +7.9%

00:30 Australia Building Permits, y/y January +8.8% +9.1%

00:30 Australia Current Account, bln Quarter IV -12.5 -10.8 -9.6

01:30 Japan Labor Cash Earnings, YoY January +1.3% Revised From +1.6% +0.6% +1.3%

03:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.00% 2.25%

03:30 Australia RBA Rate Statement

06:40 Switzerland Gross Domestic Product (QoQ) Quarter IV +0.6% +0.3% +0.6%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV +1.9% +1.9%

07:00 Germany Retail sales, real adjusted January +0.6% +0.6% +2.9%

07:00 Germany Retail sales, real unadjusted, y/y January +4.8% +5.3%

The U.S. dollar traded lower against its major peers after the mixed U.S. economic data reported yesterday. The Institute for Supply Management's manufacturing purchasing managers' index declined to 52.9 in February from 53.5 in January, missing expectations for a decline to 53.4. That was the lowest reading since January 2014. Personal spending decreased 0.2% in January, after a 0.3% fall in December. Personal income climbed 0.3% in January, after a 0.3% rise in December. The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in January, in line with expectations, after a flat reading in December.

The Australian dollar rose versus the greenback after the Reserve Bank of Australia left its cash rate unchanged today at 2.25% after having cut the benchmark rates to a record low last month. Governor Glenn Stevens stated that further easing may be appropriate in the future in order to spur demand and achieve the targeted inflation rate. The policy board of the RBA will assess the necessity in the net meetings. He repeated that the Australian dollar remains" above estimates of its fundamental value" given the slump in commodity prices and that a lower exchange rate is needed to ensure economic growth that is currently "below-trend pace". Australia's Building Permits rose more-than-expected by +7.9% in January. Analyst expected a decrease of -1.7%. The December reading was revised up from -3.3% to -2.8%. The Current Account Balance fell less-than-expected las quarter to seasonally adjusted to -9.6 billion from -12.1 billion - the figure was revised up from 12.5 billion.

New Zealand's dollar traded higher against the greenback in the absence any major economic reports from New Zealand.

The Japanese yen gained on solid wage data and traded higher against the greenback on Tuesday. Year on year the Japanese Monetary Base for February had a reading of +36.7% compared to +37.4% a year ago. Labor Cash Earnings rose by +1.3%, above expectations of an increase of +0.6% in January. The previous reading was revised down from +1.6% to +1.3%.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction February 59.1 59.0

10:00 Eurozone Producer Price Index, MoM January -1.0% -0.6%

10:00 Eurozone Producer Price Index (YoY) January -2.7%

13:30 Canada Industrial Product Prices, m/m January -1.6% -2.2%

13:30 Canada Raw Material Price Index January -7.6% -6.8%

13:30 Canada GDP (m/m) December -0.2% +0.1%

19:30 U.S. Total Vehicle Sales, mln February 16.7

21:30 U.S. API Crude Oil Inventories February +8.9

22:30 Australia AIG Services Index February 49.9

-

08:18

Options levels on tuesday, March 3, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1362 (2386)

$1.1321 (2719)

$1.1257 (1805)

Price at time of writing this review: $1.1208

Support levels (open interest**, contracts):

$1.1167 (4730)

$1.1131 (6238)

$1.1104 (3613)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 111779 contracts, with the maximum number of contracts with strike price $1,1500 (6169);

- Overall open interest on the PUT options with the expiration date March, 6 is 116389 contracts, with the maximum number of contracts with strike price $1,1100 (6946);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from March, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1136)

$1.5600 (2686)

$1.5501 (2884)

Price at time of writing this review: $1.5389

Support levels (open interest**, contracts):

$1.5297 (2265)

$1.5199 (2248)

$1.5100 (1613)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30529 contracts, with the maximum number of contracts with strike price $1,5500 (2884);

- Overall open interest on the PUT options with the expiration date March, 6 is 36051 contracts, with the maximum number of contracts with strike price $1,5300 (2265);

- The ratio of PUT/CALL was 1.18 versus 1.18 from the previous trading day according to data from March, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Retail sales, real unadjusted, y/y, January +5.3%

-

08:00

Germany: Retail sales, real adjusted , January +2.9% (forecast +0.6%)

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter IV +0.6% (forecast +0.3%)

-

07:45

Switzerland: Gross Domestic Product (YoY), Quarter IV +1.9%

-

04:31

Australia: Announcement of the RBA decision on the discount rate, 2.25% (forecast 2.00%)

-

02:30

Japan: Labor Cash Earnings, YoY, January +1.3% (forecast +0.6%)

-

01:32

Australia: Building Permits, y/y, January +9.1%

-

01:30

Australia: Building Permits, m/m, January +7.9% (forecast -1.7%)

-

01:30

Australia: Current Account, bln, Quarter IV -9.6 (forecast -10.8)

-

00:50

Japan: Monetary Base, y/y, February +36.7%

-

00:30

Currencies. Daily history for Mar 2’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1183 -0,05%

GBP/USD $1,5364 -0,48%

USD/CHF Chf0,9582 +0,52%

USD/JPY Y120,12 +0,41%

EUR/JPY Y134,33 +0,35%

GBP/JPY Y184,54 -0,07%

AUD/USD $0,7764 -0,63%

NZD/USD $0,7508 -0,72%

USD/CAD C$1,2533 +0,26%

-

00:00

Schedule for today, Tuesday, Mar 3’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m January -3.3% -1.7%

00:30 Australia Building Permits, y/y January +8.8%

00:30 Australia Current Account, bln Quarter IV -12.5 -10.8

01:30 Japan Labor Cash Earnings, YoY January +1.3% Revised From +1.6% +0.6%

03:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.00%

03:30 Australia RBA Rate Statement

06:4 Switzerland Gross Domestic Product (QoQ) Quarter IV +0.6% +0.3%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV +1.9%

07:00 Germany Retail sales, real adjusted January +0.2% +0.6%

07:00 Germany Retail sales, real unadjusted, y/y January +4.0%

09:30 United Kingdom PMI Construction February 59.1 59.0

10:00 Eurozone Producer Price Index, MoM January -1.0% -0.6%

10:00 Eurozone Producer Price Index (YoY) January -2.7%

13:30 Canada Industrial Product Prices, m/m January -1.6% -2.2%

13:30 Canada Raw Material Price Index January -7.6% -6.8%

13:30 Canada GDP (m/m) December -0.2% +0.1%

19:30 U.S. Total Vehicle Sales, mln February 16.7

21:30 U.S. API Crude Oil Inventories February +8.9

22:30 Australia AIG Services Index February 49.9

-