Noticias del mercado

-

23:46

Australia: AiG Performance of Construction Index, October 52.1

-

18:00

European stocks closed: FTSE 100 6,364.9 -47.98 -0.75% CAC 40 4,980.04 +31.75 +0.64% DAX 10,887.74 +42.50 +0.39%

-

17:48

Oil prices fall on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. Market participants continued to eye the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.85 million barrels to 482.8 million in the week to October 30. It was the sixth consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.8 million barrels.

Gasoline inventories decreased by 3.3 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, fell by 0.2 million barrels.

U.S. crude oil imports dropped by 89,000 barrels per day.

Refineries in the U.S. were running at 88.7% of capacity, up from 87.6% the previous week.

WTI crude oil for December delivery declined to $45.91 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $48.35 a barrel on ICE Futures Europe.

-

16:50

European Central Bank Governing Council member Jan Smets: the ECB could use other tools to combat downward risks to growth and inflation

European Central Bank (ECB) Governing Council member Jan Smets says in an interview with German newspaper Handelsblatt Thursday that the ECB could use other tools to combat downward risks to growth and inflation, adding that downward risks increased.

"Yes, inflation is too low. Even if it's related mainly to falling oil prices, there is a danger it will have a negative impact on inflation expectations - and they could lose their anchor," he said.

"If necessary, we could, for example, adjust the range, make-up and term of bond purchases," Smets pointed out.

-

16:42

Bank of England Governor Mark Carney signals that the interest rates in the U.K. may stay longer at low levels

The Bank of England (BoE) Governor Mark Carney signalled at a press conference on Thursday that the interest rates in the U.K. may stay longer at low levels due to the slowdown in the Chinese economy.

"Monetary policy must continue to balance two fundamental forces -- domestic strength and foreign weakness. The outlook for global growth has weakened since August. Many emerging-market economies have slowed markedly this year, and the committee has downgraded its assessment of their medium-term growth prospects," he said.

"We are in a situation where we have resilient domestic demand and, even in the face of global weakness, we still see the need for gradual interest rate rises to bring inflation back to target," Carney added.

-

16:29

European Central Bank President Mario Draghi: the central bank will decide in December if to expand the asset-buying programme or not

The European Central Bank (ECB) President Mario Draghi said in Milan on Thursday that the central bank will decide in December if to expand the asset-buying programme or not.

"We need to examine whether, with a weakening of the global economy, it (the programme) is also effective in countering headwinds that could hamper a return to price stability in the medium term," he said.

Draghi added that if the decision regarding further stimulus is made, than the ECB will discuss what kind of stimulus measures should be implemented.

-

16:23

Canada’s Ivey purchasing managers’ index falls to 53.1 in October

Canada's seasonally adjusted Ivey purchasing managers' index fell to 53.1 in October from 53.7 in September. Analysts had expected the index to increase to 54.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up 51.9 in October from 49.8 in September, while employment index dropped to 48.3 from 57.1.

The prices index was decreased to 61.8 in October from 64.4 in September, while inventories fell to 46.6 from 52.1.

-

16:18

Bank of England's Monetary Policy Committee November minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its November meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate by 0.25%.

The consumer price inflation in the U.K. was -0.1% in September, below the central bank's 2% target. The BoE noted that the low inflation was mainly driven by lower prices for energy, food and other imported goods prices.

"The combined weakness in domestic costs and imported goods prices is evident in subdued measures of core inflation, which are currently around 1%," the minutes said.

The central bank said that the global outlook weakened.

"The outlook for global growth has weakened since the August Inflation Report. Many emerging market economies have slowed markedly and the Committee has downgraded its assessment of their medium-term growth prospects," the minutes said.

"While growth in advanced economies has continued and broadened, the Committee nonetheless expects the overall pace of UK-weighted global growth to be more modest than had been expected in August. There remain downside risks to this outlook, including that of a more abrupt slowdown in emerging economies," the central bank added.

The BoE noted the domestic economy remained resilient.

MPC members pointed out that the interest rate hike will be gradual when the Bank of England starts to raise its interest rate, adding that the decision will depend on the incoming economic data.

-

16:06

Bank of England keeps its interest rate on hold at 0.5% in November

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The central bank expect the U.K. economy to expand 0.6% in the fourth quarter.

The central bank lowered its growth forecasts to 2.7% this year, down from the previous forecast of 2.8%, and 2.5% next year, down from the previous forecast of 2.6%.

Inflation is expected to hit the central bank's 2% target by the end of 2017.

-

16:00

Canada: Ivey Purchasing Managers Index, October 52.3 (forecast 54)

-

15:55

State Secretariat for Economic Affairs’ consumer confidence index data for Switzerland rises to -18 in October

The State Secretariat for Economic Affairs released its consumer confidence index data for Switzerland on Thursday. The index rose to -18 in October from -19 in July.

"While a slight improvement in economic development is expected, household anticipations concerning future unemployment and job security have deteriorated," the State Secretariat for Economic Affairs said in a statement.

The household expectations sub-index climbed to -16 in October from -25 in July, while the expected unemployment sub-index was up to 74 from 65.

-

15:10

Productivity in the U.S. non-farm businesses rises 1.6% in the third quarter

The U.S. Labor Department released non-farm productivity figures on Thursday. Preliminary productivity in the U.S. non-farm businesses rose at a 1.6% annual rate in the third quarter, beating expectations for a 0.2% decrease, after a 3.5% increase in the second quarter. The second quarter's figure was revised up from a 3.3% gain.

The increase was driven by a rise in manufacturing productivity, which rose 4.9%. Hours worked fell by 2.1%.

Preliminary unit labour costs increased 1.4% in the third quarter, missing expectations for a 2.3% rise, after a 1.8 drop in the second quarter. The second quarter's figure was revised down from a 1.4% decrease.

-

14:45

Option expiries for today's 10:00 ET NY cut

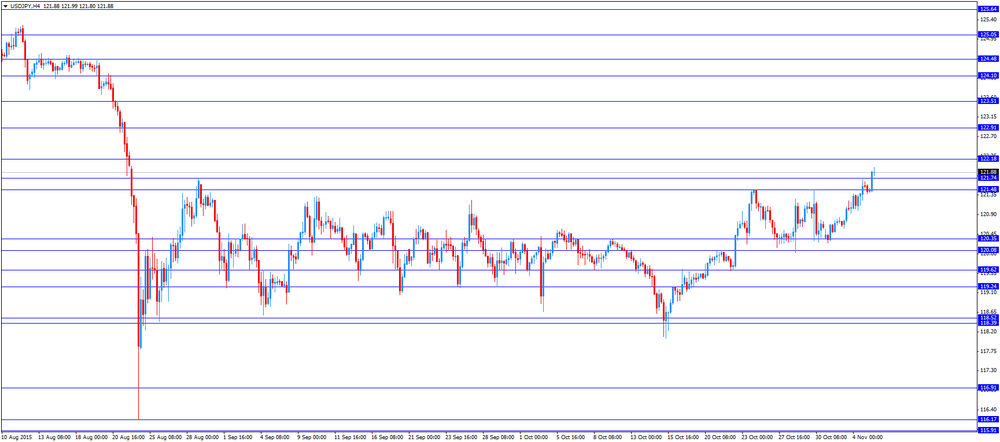

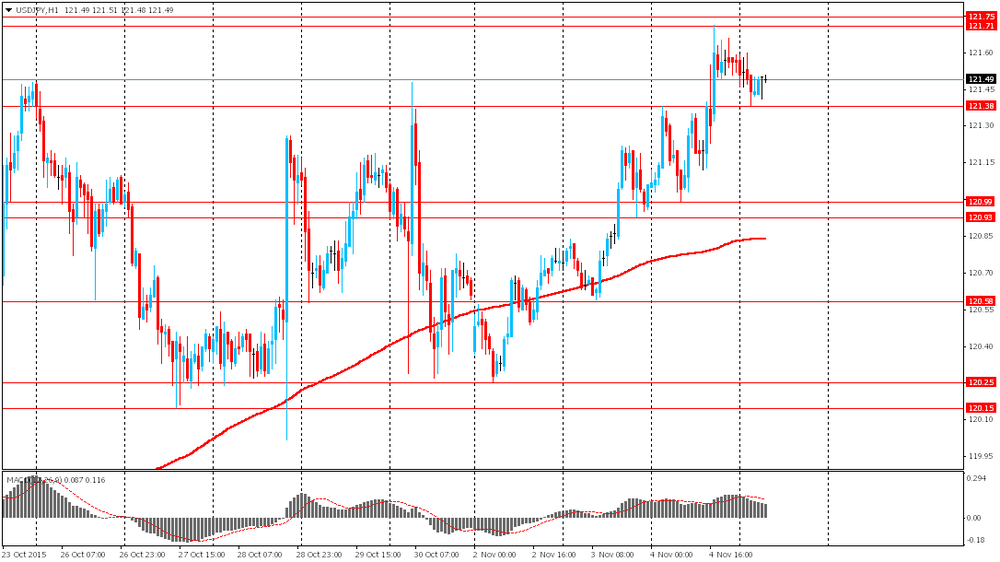

USD/JPY 120.00 (USD 1.4bln) 121.00 (1.4bln) 122.00 (607m) 122.50 (1.3bln)

EUR/USD 1.0800 (EUR 556m) 1.0875 ( 397m) 1.0890-1.0900 (709m) 1.0950 (647m) 1.1000 (1bln)

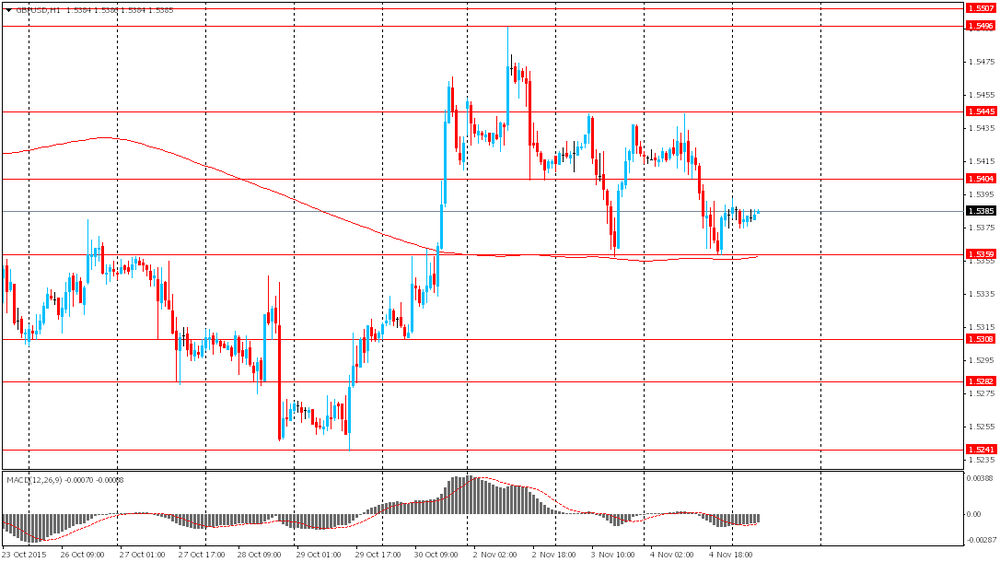

GBP/USD 1.5475 (GBP 223m) 1.5500 (150m)

USD/CHF 11000 (USD 230m)

USD/CAD 1.3050 (USD 300m) 1.3145 (240m) 1.3200 (400m)

AUD/USD 0.7160 (AUD 782m) 0.7200 (2bln)

EUR/JPY 130.55 (EUR 250m)

AUD/NZD 1.1000 (591m)

-

14:38

Initial jobless claims increase by 16,000 to 276,000 in the week ending October 31

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 31 in the U.S. rose by 16,000 to 276,000 from 260,000 in the previous week.

Analysts had expected the initial jobless claims to increase to 262,000.

Jobless claims remained below 300,000 the 35th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 17,000 to 2,163,000 in the week ended October 24.

-

14:32

Germany's retail PMI falls to 52.4 in October

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Thursday. Germany's retail purchasing managers' index (PMI) declined to 52.4 in October from 54.0 in September.

The decline was driven by a drop in gross margins.

"German retailers reported further moderate, although unspectacular, growth of sales during October, with the headline PMI falling to an eight month low. A worry is that the rate of growth failed to accelerate despite retailers offering promotional sales," an economist at Markit, Oliver Kolodseike, said.

-

14:30

U.S.: Initial Jobless Claims, October 276 (forecast 262)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter III 1.4% (forecast 2.3%)

-

14:30

U.S.: Continuing Jobless Claims, October 2163 (forecast 2144)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter III 1.6% (forecast -0.2%)

-

14:29

Germany's construction PMI falls to 51.8 in October

Markit Economics released construction purchasing managers' index (PMI) for Germany on Thursday. Germany's construction purchasing managers' index (PMI) fell to 51.8 in October from 52.4 in September.

A reading above 50 indicates expansion in the sector.

The index was driven by a drop in new business.

"October's construction PMI data signalled that building firms remained busy at the start of the fourth quarter. While the pace of expansion in construction output slowed since September, growth has now been reported in each of the past nine months," an economist at Markit, Oliver Kolodseike, said.

-

14:15

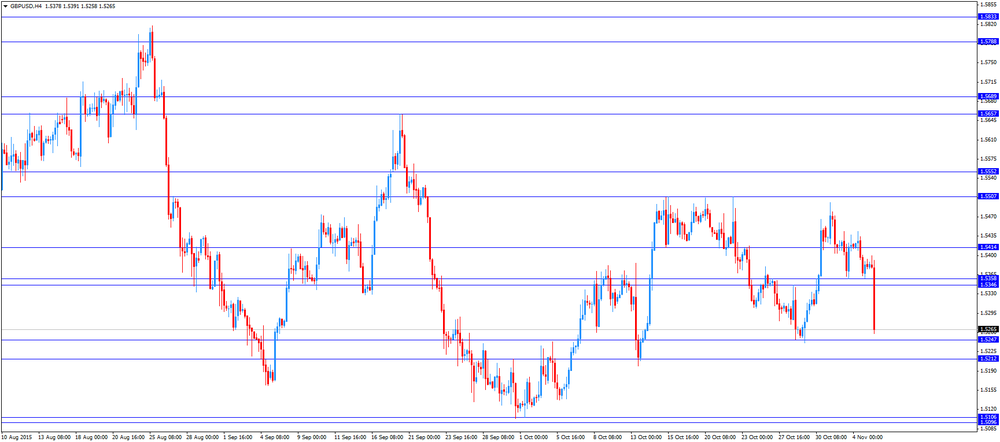

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 U.S. FED Vice Chairman Stanley Fischer Speaks

01:00 Australia RBA Assist Gov Lowe Speaks

07:00 Germany Factory Orders s.a. (MoM) September -1.8% 1% -1.7%

08:00 United Kingdom Halifax house price index October -0.9% 0.6% 1.1%

08:00 United Kingdom Halifax house price index 3m Y/Y October 8.6% 9.5% 9.7%

08:15 Switzerland Consumer Price Index (MoM) October 0.1% 0% 0.1%

08:15 Switzerland Consumer Price Index (YoY) October -1.4% -1.4% -1.4%

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone Retail Sales (MoM) September 0.0% 0.2% -0.1%

10:00 Eurozone Retail Sales (YoY) September 2.2% Revised From 2.3% 3% 2.9%

10:00 Eurozone European Commission Economic Growth Forecasts

10:45 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom MPC Rate Statement

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 2,000 to 262,000 last week.

Preliminary productivity in the U.S. non-farm businesses is expected to decline at a 0.2% annual rate in the third quarter, after a 3.3% rise in the second quarter.

Preliminary unit labour costs are expected to increase 2.3% in the third quarter, after a 1.4 fall in the second quarter.

The euro traded higher against the U.S. dollar on the mixed economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in July.

The decline was driven by lower food, drinks and tobacco sales, which slid 0.6% in September.

On a yearly basis, retail sales in the Eurozone climbed 2.9% in September, missing forecasts of a 3.0% gain, after a 2.2% increase in August. August's figure was revised down from a 2.3% rise.

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders dropped 1.7% in September, missing expectations for a 1.0% decrease, after a 1.8% fall in August.

The decline was driven by a drop in foreign and domestic orders. Foreign orders decreased by 2.4% in September, while domestic orders fell by 0.6%.

The European Commission released it economic growth forecast for the Eurozone on Thursday. Eurozone's economic growth for 2015 was upgraded to 1.6%, up from a previous estimate of 1.5%. Eurozone's economic growth for 2016 was cut to 1.8% from a previous estimate of 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted.

"The impact of the positive factors is fading, while new challenges are appearing, such as the slowdown in emerging market economies and global trade," it added.

The British pound traded lower against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its November meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

The central bank lowered its growth forecasts to 2.7% this year, down from the previous forecast of 2.8%, and 2.5% next year, down from the previous forecast of 2.6%.

The Canadian dollar traded mixed against the U.S. dollar ahead the Canadian economic data. Canada's seasonally adjusted Ivey purchasing managers' index is expected to rise to 54.0 in October from 53.7 in September.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Thursday. Switzerland's consumer price index rose 0.1% in October, beating expectations for a flat reading, after a 0.1% increase in September.

The increase was driven by higher prices for clothing and new cars. Prices for clothing and shoes rose 5.5% in October.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.4% in October, in line with forecasts. It was the biggest fall since July 1959.

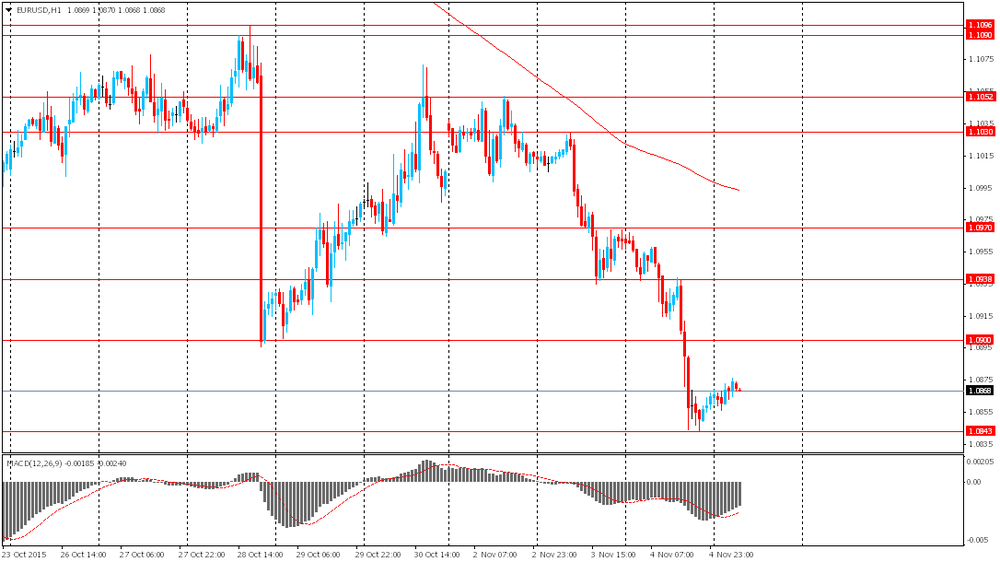

EUR/USD: the currency pair rose to $1.0892

GBP/USD: the currency pair was down to $1.5258

USD/JPY: the currency pair increased to Y121.99

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims October 260 262

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -1.4% 2.3%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III 3.3% -0.2%

13:30 U.S. FOMC Member Dudley Speak

14:10 U.S. FED Vice Chairman Stanley Fischer Speaks

15:00 Canada Ivey Purchasing Managers Index October 53.7 54

18:30 U.S. FOMC Member Dennis Lockhart Speaks

-

14:01

Orders

EUR/USD

Offers 1.0880-85 1.0900 1.0925-30 1.0960 1.0980 1.1000 1.1020-25 1.1050

Bids 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.5400 1.5420 1.5450 1.5465 1.5480-85 1.5500-10 1.5530 1.5550

Bids 1.5375 1.5350 1.5325-30 1.5300 1.5285 1.5250 1.5230 1.5200

EUR/GBP

Offers 0.7085 0.7100-10 0.7125-30 0.7150-55 0.7170 0.7185 0.7200

Bids 0.7050 0.7030-35 0.7000 0.6985 0.6960 0.6930 0.6900

EUR/JPY

Offers 132.50 132.80 133.00 133.20 133.50-60 133.75-80 134.00

Bids 132.20 132.00 131.80 131.50 131.30 131.00 130.85 130.50

USD/JPY

Offers 121.85 122.00 122.25-30 122.50 122.75 123.00

Bids 121.50 121.25-30 121.00 120.75-80 120.50 120.20-25 120.00

AUD/USD

Offers 0.7160 0;7185 0.7200 0.7220 0.7250 0.7265 0.7280-85 0.7300

Bids 0.7125-30 0.7100-05 0.7080 0.7065 0.7050 0.7030 0.7000

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

11:53

European Commission upgrades its 2015 GDP growth forecast for the Eurozone

The European Commission released it economic growth forecast for the Eurozone on Thursday. Eurozone's economic growth for 2015 was upgraded to 1.6%, up from a previous estimate of 1.5%. Eurozone's economic growth for 2016 was cut to 1.8% from a previous estimate of 1.9%.

The European Central Bank's quantitative easing supports the economic growth in the Eurozone, the European Commission noted.

"The impact of the positive factors is fading, while new challenges are appearing, such as the slowdown in emerging market economies and global trade," it added.

"The European economy remains on recovery course. Looking to 2016, we see growth rising and unemployment and fiscal deficits falling. Yet the improvements are still unevenly spread: particularly in the euro area, convergence is not happening fast enough. Major challenges remain: insufficient investment, economic structures that hold back jobs and growth, and persistently high levels of private and public debt," Commissioner for Economic and Financial Affairs, Taxation and Customs, Pierre Moscovici, said in a statement.

German economic growth for 2015 was lowered to 1.7% from a previous estimate of 1.7%. Germany's economic growth for 2016 was downgraded to 1.9% from a previous estimate of 2.0%.

The European Commission downgraded the Greek GDP growth for 2015 to -1.4% from a previous estimate of 0.5%. Greece's economic growth for 2016 was lowered to -1.3% from a previous estimate of 2.9%.

French economic growth for 2015 remained unchanged at 1.1%. France's economic growth for 2016 was cut to 1.4% from a previous estimate of 1.7%.

The European Commission upgraded the Italian GDP growth for 2015 to 0.6% from a previous estimate of 0.9%. Italy's economic growth for 2016 was raised to 1.4% from a previous estimate of 1.5%.

Spanish economic growth for 2015 was raised to 3.1%, up from a previous estimate of 2.8%. Spain's economic growth for 2016 was upgraded to 2.7% from a previous estimate of 2.6%.

-

11:31

House prices in the U.K. rise 1.1% in October

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. increased 1.1% in October, exceeding expectations for a 0.6% gain, after a 0.9% rise in September.

On a yearly basis, house prices climbed 9.7% in the three months to October, exceeding expectations for a 9.5% gain, after a 8.6% increase in the three months to September.

"Improving economic conditions and household finances, together with sustained low mortgage rates, have boosted housing demand during 2015. Strengthening demand is filtering through in to higher sales levels although the ongoing shortage of supply is acting as a significant constraint on activity," Halifax's housing economist Martin Ellis said.

-

11:26

Switzerland’s consumer price inflation rises 0.1% in October

The Swiss Federal Statistics Office released its consumer inflation data on Thursday. Switzerland's consumer price index rose 0.1% in October, beating expectations for a flat reading, after a 0.1% increase in September.

The increase was driven by higher prices for clothing and new cars. Prices for clothing and shoes rose 5.5% in October.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.4% in October, in line with forecasts. It was the biggest fall since July 1959.

-

11:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1.4bln) 121.00 (1.4bln) 122.00 (607m) 122.50 (1.3bln)

EUR/USD 1.0800 (EUR 556m) 1.0875 ( 397m) 1.0890-1.0900 (709m) 1.0950 (647m) 1.1000 (1bln)

GBP/USD 1.5475 (GBP 223m) 1.5500 (150m)

USD/CHF 11000 (USD 230m)

USD/CAD 1.3050 (USD 300m) 1.3145 (240m) 1.3200 (400m)

AUD/USD 0.7160 (AUD 782m) 0.7200 (2bln)

EUR/JPY 130.55 (EUR 250m)

AUD/NZD 1.1000 (591m)

-

11:16

Eurozone’s retail sales fall 0.1% in September

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone fell 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in July.

The decline was driven by lower food, drinks and tobacco sales, which slid 0.6% in September.

Gasoline sales were flat in September, while non-food sales increased 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.9% in September, missing forecasts of a 3.0% gain, after a 2.2% increase in August. August's figure was revised down from a 2.3% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco sales.

Non-food sales gained 4.0% in September, gasoline sales increased 5.3%, while food, drinks and tobacco sales rose 1.6%.

-

11:05

German seasonal adjusted factory orders drop 1.7% in September

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders dropped 1.7% in September, missing expectations for a 1.0% decrease, after a 1.8% fall in August.

The decline was driven by a drop in foreign and domestic orders. Foreign orders decreased by 2.4% in September, while domestic orders fell by 0.6%.

New orders from the Eurozone slid 6.7% in September, while orders from other countries rose 0.7%.

Orders of the intermediate goods increased by 0.4% in September, capital goods orders were down 2.9%, while consumer goods orders decreased 0.4%.

-

11:00

Eurozone: Retail Sales (YoY), September 2.9% (forecast 3%)

-

11:00

Eurozone: Retail Sales (MoM), September -0.1% (forecast 0.2%)

-

10:49

Reserve Bank of Australia Governor Glenn Stevens: the interest rate cut is more likely in the near term than an interest rate hike

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at a conference in Melbourne on late Wednesday evening that the interest rate cut is more likely in the near term than an interest rate hike.

"Were a change to monetary policy to be required in the near term, it would almost certainly be an easing, not a tightening," he said.

The RBA governor noted that the economy continued to grow.

"We are still growing. It would be good if the growth was a bit stronger, but nonetheless over the past year the non-mining side of the economy has generated respectable growth in employment," Stevens said.

-

10:35

Bank of Japan’s October 6-7 monetary policy meeting minutes: exports and industrial production are affected by the slowdown in emerging economies

The Bank of Japan (BoJ) released its October 6-7 monetary policy meeting minutes on late Wednesday evening. According to minutes, the country's economy continued to recover moderately but exports and industrial production were flat due to the slowdown in emerging economies.

Labour market conditions continued to improve steadily, while employee income rose moderately, according to the minutes.

Private consumption was resilient, while housing investment picked up, the central bank noted.

Board members expect the inflation in Japan to be close to zero.

"As for prices, members concurred that the year-on-year rate of change in the CPI (all items less fresh food) was about 0 percent and was likely to remain at this level for the time being due to the effects of the decline in energy prices," the minutes said.

The BoJ decided to keep unchanged its monetary policy at its October meeting.

-

10:22

National Institute of Economic and Social Research (NIESR) lowers its U.K. growth forecasts

The National Institute of Economic and Social Research (NIESR) lowered its U.K. growth forecasts on Tuesday. Britain's economy is expected to expand 2.4% in 2015, down from its previous forecast of 2.5%, and 2.3% in 2016, down from its previous forecast of 2.4%.

"Domestic demand will continue to be the main driver of growth this year and next as households take advantage of purchasing power improvements from the low inflationary environment and firms continue to invest," the think tank said.

The unemployment rate throughout the rest of this year and next year is expected to be 5.25%, the consumer price inflation is expected to increase rises from close to 0.0% in 2015 to 1.1% in 2016, while the Bank of England is expected to start raising its interest rate at the start of 2016 and then to hike gradually by 50 basis points a year, reaching 2% by the end of 2018.

-

10:13

New York Fed President William Dudley: an interest rate hike in December is possible

New York Fed President William Dudley agreed with Fed Chairwoman Janet Yellen on Wednesday that an interest rate hike in December is possible, depending on the incoming economic data.

Next Fed monetary policy meeting will be held December 15-16.

-

09:15

Switzerland: Consumer Price Index (MoM) , October 0.1% (forecast 0%)

-

09:15

Switzerland: Consumer Price Index (YoY), October -1.4% (forecast -1.4%)

-

09:01

United Kingdom: Halifax house price index, October 1.1% (forecast 0.6%)

-

09:00

United Kingdom: Halifax house price index 3m Y/Y, October 9.7% (forecast 9.5%)

-

08:38

Options levels on thursday, November 5, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1058 (2522)

$1.0978 (976)

$1.0920 (1309)

Price at time of writing this review: $1.0846

Support levels (open interest**, contracts):

$1.0819 (5132)

$1.0765 (4827)

$1.0687 (2749)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 58067 contracts, with the maximum number of contracts with strike price $1,1200 (4634);

- Overall open interest on the PUT options with the expiration date November, 6 is 57380 contracts, with the maximum number of contracts with strike price $1,0900 (5132);

- The ratio of PUT/CALL was 0.99 versus 1.06 from the previous trading day according to data from November, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (813)

$1.5601 (1105)

$1.5502 (2903)

Price at time of writing this review: $1.5377

Support levels (open interest**, contracts):

$1.5297 (2805)

$1.5199 (2586)

$1.5100 (1913)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 22161 contracts, with the maximum number of contracts with strike price $1,5500 (2903);

- Overall open interest on the PUT options with the expiration date November, 6 is 21883 contracts, with the maximum number of contracts with strike price $1,5200 (2856);

- The ratio of PUT/CALL was 0.99 versus 0.99 from the previous trading day according to data from November, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Factory Orders s.a. (MoM), September -1.7% (forecast 1%)

-

07:51

Foreign exchange market. Asian session: the dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 U.S. FED Vice Chairman Stanley Fischer Speaks

01:00 Australia RBA Assist Gov Lowe Speaks

The U.S. dollar little changed this morning after climbing against most major currencies on Wednesday. Positive data on the U.S. economy and comments from Fed Chairwoman Janet Yellen and New York Federal Reserve Bank President William Dudley supported the dollar. Yellen said that the U.S. economy is likely to continue making substantial progress and that a liftoff in rates in December is "a live possibility". William Dudley agreed with her point of view. Most of all greenback rose against the euro and the yen because these two currencies are facing risks of monetary policy easing by the ECB and Bank of Japan.

At the beginning of the session the Australian dollar declined amid comments from RBA Governor Glenn Stevens, but rebounded later. He said if policy were to change, it would almost certainly be an easing.

Today market participants will be focused on Bank of England minutes and BOE Governor Mark Carney's speech.

EUR/USD: the pair fluctuated within $1.0855-75 in Asian trade

USD/JPY: the pair fell to Y121.40

GBP/USD: the pair traded within $1.5375-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Factory Orders s.a. (MoM) September -1.8% 1%

08:00 United Kingdom Halifax house price index October -0.9% 0.6%

08:00 United Kingdom Halifax house price index 3m Y/Y October 8.6% 9.5%

08:15 Switzerland Consumer Price Index (MoM) October 0.1% 0%

08:15 Switzerland Consumer Price Index (YoY) October -1.4% -1.4%

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone Retail Sales (MoM) September 0.0% 0.2%

10:00 Eurozone Retail Sales (YoY) September 2.3% 3%

10:00 Eurozone European Commission Economic Growth Forecasts

10:45 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom MPC Rate Statement

12:00 United Kingdom Asset Purchase Facility 375 375

12:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims October 2144 2144

13:30 U.S. Initial Jobless Claims October 260 262

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -1.4% 2.3%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III 3.3% -0.2%

13:30 U.S. FOMC Member Dudley Speak

14:10 U.S. FED Vice Chairman Stanley Fischer Speaks

15:00 Canada Ivey Purchasing Managers Index October 53.7 54

18:30 U.S. FOMC Member Dennis Lockhart Speaks

22:30 Australia AiG Performance of Construction Index October 51.9

-

01:02

Currencies. Daily history for Nov 4’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0865 -0,89%

GBP/USD $1,5383 -0,24%

USD/CHF Chf0,9931 +0,23%

USD/JPY Y121,56 +0,41%

EUR/JPY Y132,07 -0,48%

GBP/JPY Y187 +0,18%

AUD/USD $0,7146 -0,55%

NZD/USD $0,6591 -1,09%

USD/CAD C$1,3148 +0,69%

-

00:04

Schedule for today, Thursday, Nov 5’2015:

(time / country / index / period / previous value / forecast)

00:30 U.S. FED Vice Chairman Stanley Fischer Speaks

01:00 Australia RBA Assist Gov Lowe Speaks

07:00 Germany Factory Orders s.a. (MoM) September -1.8% 1%

08:00 United Kingdom Halifax house price index October -0.9% 0.6%

08:00 United Kingdom Halifax house price index 3m Y/Y October 8.6% 9.5%

08:15 Switzerland Consumer Price Index (MoM) October 0.1% 0%

08:15 Switzerland Consumer Price Index (YoY) October -1.4% -1.4%

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone Retail Sales (MoM) September 0.0% 0.2%

10:00 Eurozone Retail Sales (YoY) September 2.3% 3%

10:00 Eurozone European Commission Economic Growth Forecasts

10:45 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom MPC Rate Statement

12:00 United Kingdom Asset Purchase Facility 375 375

12:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims October 2144 2144

13:30 U.S. Initial Jobless Claims October 260 262

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III -1.4% 2.3%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III 3.3% -0.2%

13:30 U.S. FOMC Member Dudley Speak

14:10 U.S. FED Vice Chairman Stanley Fischer Speaks

15:00 Canada Ivey Purchasing Managers Index October 53.7 54

18:30 FOMC Member Dennis Lockhart Speaks

22:30 Australia AiG Performance of Construction Index October 51.9

-