Noticias del mercado

-

21:00

U.S.: Consumer Credit , April 13.42 (forecast 18)

-

20:20

American focus: The US dollar was down against the pound and the Canadian dollar

The dollar consolidated against the euro while remaining near the level of opening of the session, due to the uncertain prospects of higher interest rates the Fed in the coming months. Experts point out that market participants are likely to continue to exercise caution until next week, when a meeting of the Fed's monetary policy. Yesterday, Fed Chairman Janet Yellen said that a gradual rise in interest rates in the United States possible while maintaining good macroeconomic indicators. However, she did not say anything about the timing of such an increase. In late May, Yellen mentioned the likelihood of higher interest rates "in the coming months", but in yesterday's speech such temporary signs were absent. The Fed chief added that investors should not place too much focus on the weak statistics on the labor market. "If the situation on the market labor improves, inflation close to the target level, it would be appropriate to raise rates gradually if inflation remains low, the Fed can only take limited measures to stimulate in the background of almost zero interest rates loose monetary policy remains appropriate..", - He explained Yellen. Investors expect that next week the Fed will keep rates unchanged, and many continue to believe that at the meeting in July, rates will remain at the same level. Futures on interest rates Fed indicate that the probability of a rate hike of 2% in June. The chances of an increase in rates are estimated at 23% in July.

A slight effect on the dollar was data indicated that labor productivity in the US non-agricultural sector decreased by 0.6 percent during the first quarter. The volume of production increased by 0.9 percent and the number of hours worked increased by 1.5 per cent. Since the first quarter of 2015 to the first quarter of 2016, productivity increased by 0.7 per cent. Unit labor costs in the non-agricultural sector increased by 4.5 percent in the first quarter, an increase of 3.9 per cent decrease in hourly compensation and productivity by 0.6 percent. Unit labor costs increased by 3.0 per cent over the past four quarters.

The British pound lost some of the previously-earned positions against the dollar, but still shows a significant increase. The main support for the currency have had results of a survey which showed that a somewhat larger number of respondents want Britain to remain in the EU. According to the poll Times / YouGov, for the preservation of EU membership voted 43% of respondents, with the output from the block - 42%. According to the ORB / Telegraph poll, for the preservation of the current order of things have voted 48% for its change - 47%. The attention of investors is also switched on the TV debate between Prime Minister David Cameron and the leader of the Party of Independence of the United Kingdom and a supporter of exit from the EU Nigel Farage. Debates to be held on Thursday.

Later this week, the focus will be on industrial production statistics and foreign trade, which is likely to point to the weakness of the British economy. Manufacturing probably felt the most strongly negative impact from the global challenges for the manufacturing sector and uncertainty about the outcome of the referendum on EU membership. Meanwhile, the trade deficit is likely to increase slightly. The reason for this is the weak support from external demand, the deterioration of the situation in the manufacturing sector and a referendum on Britain's membership of the EU.

The Canadian dollar rose modestly against the US dollar, approaching to a maximum of 4 May, helped by the increase in oil prices. Today, oil prices rose to their highest level in eight months against the backdrop of the fall of the US dollar and a reduction in oil production in Nigeria due to a series of attacks on oil installations. Oil prices jumped nearly doubled since January, when it reached the lowest level since the end of 2003, which was mainly due to the unplanned interruptions in oil production in countries such as Canada, Venezuela, Libya and Nigeria. Sentiment in the market has also improved against the background of decline in US shale oil production. However, as prices have reached a level where drilling activity is profitable for some companies, the number of rigs may begin to grow and the reduction of production volumes in the United States may slow down.

In the course of trading is also affected by expectations the publication of weekly data on US oil inventories. Today its report on stocks of the American Petroleum Institute will publish and tomorrow will leave government data. Analysts expect the US Energy Department reported a drop of oil to 3.5 million. Barrels. Yesterday Genscape industry group reported that for the week of June 3 at oil terminal in Cushing fell by 1.0 mln. Barrels.

-

17:42

China’s foreign-exchange reserves drop in May

According to data released by the People's Bank of China (PBoC) on Tuesday, China's foreign-exchange reserves declined by $28 billion to $3.19 trillion in May, the lowest level since December 2011, after a rise by $7.1 billion in April.

The decline was likely driven by a stronger U.S. dollar

-

17:06

Japan's leading index increases to 100.5 in April

Japan's Cabinet Office released its preliminary leading index data on Tuesday. The leading index increased to 100.5 in April from 99.1 in March, missing expectations for a rise to 100.8. It was the highest level since November 2015.

March's figure was revised down from 99.3.

Japan's coincident index climbed to 112.2 in April from 110.2 in March. March's figure was revised down from 111.1.

-

16:35

Canada’s Ivey purchasing managers’ index slides to 49.4 in May

Canada's seasonally adjusted Ivey purchasing managers' index slid to 49.4 in May from 53.1 in April. Analysts had expected the index to decline to 51.5.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up to 53.3 in May from 46.8 in April, while employment index declined to 49.3 from 49.9.

The prices index climbed to 63.1 in May from 53.9 in April, while inventories declined to 49.6 from 52.3.

-

16:29

Ai Group/HIA Australian Performance of Construction Index slides to 46.7 in May

The Australian Industry Group (AiG) released its construction data for Australia on late Monday evening. The Ai Group/HIA Australian Performance of Construction Index dropped to 46.7 in May from 50.8 in April.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by a drop in apartment building.

-

16:03

Canada: Ivey Purchasing Managers Index, May 49.4 (forecast 51.5)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 938m) 1.1250 (450m) 1.1415 (401m)

USD/JPY 106.00 (USD 300m) 107.00 (350m) 107.15-20 (390m)

GBP/USD 1.4400 (GBP 279m) 1.4500 (306m)

AUD/USD 0.7235 (AUD 279m) 0.7310 (306m)

EUR/JPY 123.00 (EUR 400m)

-

15:04

Final productivity in the U.S. non-farm businesses declines at a 0.6% annual rate in the first quarter

The U.S. Labor Department released its final non-farm productivity figures on Tuesday. Final productivity in the U.S. non-farm businesses declined at a 0.6% annual rate in the first quarter, up from the preliminary reading a 1.0% drop, after a 1.7% decrease in the fourth quarter.

The upward revision was driven by higher nonfarm business output, which rose 0.9% in the first quarter, up from the preliminary reading of a 0.4% gain.

Hours worked increased by 1.5% in the first quarter, in line with the preliminary reading.

Final unit labour costs climbed 4.5% in the first quarter, up from the preliminary reading of a 4.1% increase, after a 2.7 gain in the fourth quarter.

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter I 4.5% (forecast 4%)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter I -0.6% (forecast -0.6%)

-

14:24

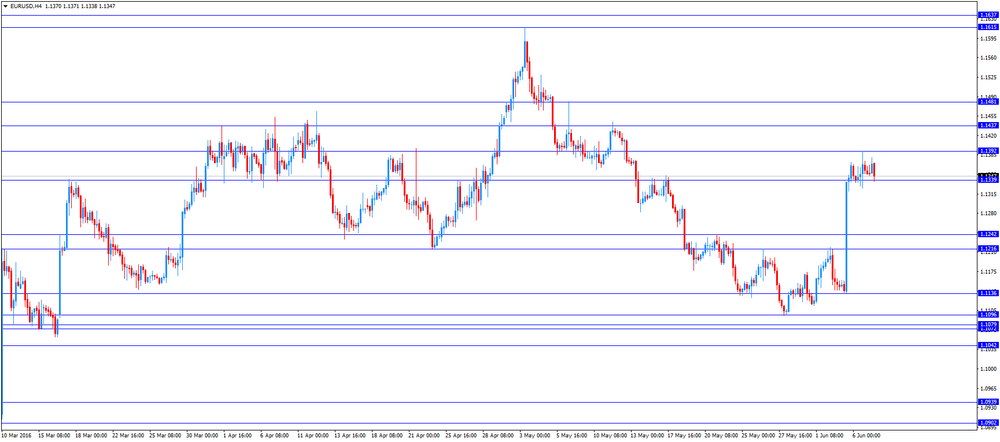

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Australia Announcement of the RBA decision on the discount rate 1.75% 1.75% 1.75%

04:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index (Preliminary) April 99.1 Revised From 93.3 100.8 100.5

05:00 Japan Coincident Index (Preliminary) April 110.2 Revised From 111.1 112.2

06:00 Germany Industrial Production s.a. (MoM) April -1.1% Revised From -1.3% 0.7% 0.8%

06:45 France Trade Balance, bln April -4.2 Revised From -4.37 -4 -5.2

07:30 United Kingdom Halifax house price index May -0.8% 0.3% 0.6%

07:30 United Kingdom Halifax house price index 3m Y/Y May 9.2% 8.9% 9.2%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Final productivity in the U.S. non-farm businesses is expected to decline at a 0.6% annual rate in the first quarter, after a 1.7% drop in the fourth quarter.

Final unit labour costs are expected to increase 4.0% in the first quarter, after a 2.7 gain in the fourth quarter.

The euro traded lower against the U.S. dollar despite the better-than-expected economic data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.6% in first quarter, up from the preliminary reading of 0.5%, after a 0.4% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.7% in first quarter, up from the preliminary reading of 1.5%, after a 1.7% rise in the fourth quarter.

Household spending gained 0.6% in the first quarter, while gross fixed capital formation climbed 0.8%.

Exports climbed by 0.4% in the first quarter, while imports rose by 0.7%.

Destatis released its industrial production data for Germany on Tuesday. German industrial production rose 0.8% in April, exceeding expectations for a 0.7% gain, after a 1.1% decline in March. March's figure was revised up from a 1.3% decrease.

German industrial production excluding energy and construction climbed by 1.1% in April.

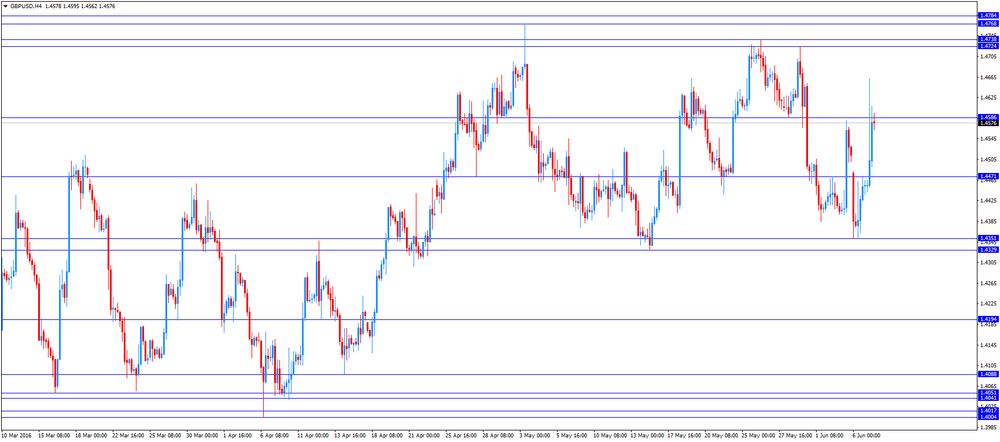

The British pound traded higher against the U.S. dollar on the latest poll results. According to a YouGov poll for the Times on Monday, 43% of respondents would vote for "Remain", while 42% would vote for "Leave".

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data. Canada's seasonally adjusted Ivey purchasing managers' index is expected to decline to 51.5 in May from 53.1 in April.

EUR/USD: the currency pair fell to $1.1338

GBP/USD: the currency pair rose to $1.4608

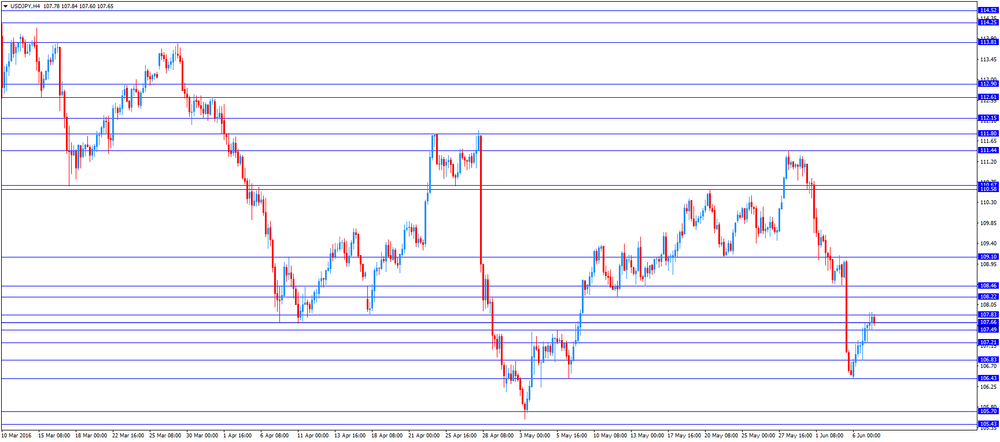

USD/JPY: the currency pair increased to Y107.89

The most important news that are expected (GMT0):

12:30 U.S. Unit Labor Costs, q/q (Finally) Quarter I 2.7% 4%

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter I -1.7% -0.6%

14:00 Canada Ivey Purchasing Managers Index May 53.1 51.5

19:00 U.S. Consumer Credit April 29.67 18

23:50 Japan Current Account, bln April 2980 2318.9

23:50 Japan GDP, q/q (Finally) Quarter I -0.4% 0.5%

23:50 Japan GDP, y/y (Finally) Quarter I -1.7% 1.9%

-

14:00

Orders

EUR/USD

Offers : 1.1380 1.1400 1.1420 1.1450 1.1465 1.1480 1.1500

Bids: 1.1350 1.1330 1.1300 1.1285 1.1265 1.1250 1.1220 1.1200

GBP/USD

Offers : 1.4550 1.4575-80 1.4600 1.4625-30 1.4650-60 1.4680 1.4700 1.4725-30 1.4750

Bids: 1.4500 1.4480 1.4450 1.4430 1.4400 1.4380 1.4365 1.4350 1.4300-10

EUR/GBP

Offers : 0.7850 0.7885 0.7900 0.7925-30 0.7950 0.7980 0.8000

Bids: 0.7800 0.7785 0.7750-60 0.7720 0.7700 0.7650

EUR/JPY

Offers : 122.60 122.80 123.00 123.30 123.50 123.80 124.00

Bids: 122.00 121.80 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers : 107.80 108.00 108.30 108.50 108.85 109.00 109.20 109.50-60

Bids: 107.50 107.20 107.00 106.85 106.70 106.50 106.25-30 106.00-06 105.75 105.50

AUD/USD

Offers : 0.7435 0.7450 0.7470 0.7485 0.7500 0.7520 0.7550

Bids: 0.7400 0.7385 0.7365 0.7350 0.7320 0.7300 0.7285 0.7250

-

11:54

Industrial production in Spain is flat in April

Spanish statistical office INE released its industrial production figures for Spain on Tuesday. Industrial production in Spain was flat in April, after a 1.3% rise in March.

On a yearly basis, industrial production in Spain climbed at adjusted 2.7% in April, after a 2.9% increase in March. March's figure was revised up from a 2.8% gain.

Output of capital goods jumped at seasonally adjusted 11.2% year-on-year in April, output of intermediate goods climbed 0.5%, energy production was down 1.6%, while consumer goods output rose 2.8%.

-

11:49

France’s current account deficit rises to €2.8 billion in April

The Bank of France released its current account data on Tuesday. France's current account deficit was €2.8 billion in April, down from a deficit of €1.9 billion in March.

The trade goods deficit widened to €3.2 billion in April from €2.5 billion in March, while the deficit on services surplus fell to €0.8 billion from €1.1 billion.

-

11:43

France's trade deficit widens to €5.2 billion in April

According to the French Customs, France's trade deficit widened to €5.2 billion in April from €4.2 billion in March, missing expectations for a decline to a deficit of €4.0 billion. March's figure was revised up from a deficit of €4.37 billion.

The increase in deficit was driven by higher imports. Exports rose 1.8% in April, while imports climbed by 4.1%.

-

11:36

Eurozone's revised GDP climbs 0.6% in first quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.6% in first quarter, up from the preliminary reading of 0.5%, after a 0.4% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.7% in first quarter, up from the preliminary reading of 1.5%, after a 1.7% rise in the fourth quarter.

Household spending gained 0.6% in the first quarter, while gross fixed capital formation climbed 0.8%.

Exports climbed by 0.4% in the first quarter, while imports rose by 0.7%.

-

11:29

Halifax: House prices in the U.K. are up 0.6% in May

Halifax released its house prices data for the U.K. on Tuesday. House prices in the U.K. were up 0.6% in May, exceeding expectations for a 0.3% rise, after a 0.8% decrease in April.

On a yearly basis, house prices jumped 9.2% in the three months to May, beating forecasts of a 8.9% gain, after a 9.2% increase in the three months to April.

"Low interest rates, increasing employment and rising real earnings, continue to support housing demand. The strength of demand, combined with very low supply, is causing house prices to rise at a brisk pace in quarterly and annual terms," Halifax's housing economist Martin Ellis said.

-

11:23

BRC and KPMG sales monitor: U.K. retail sales climbed by an annual rate of 0.5% on a like-for-like basis in May

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 0.5% on a like-for-like basis in May, after a 0.9% fall in April.

On a total basis, retail sales climbed 1.4% year-on-year in May.

"Clothing made a big comeback this month after suffering declines in April. This appears to be due to consumers waiting for just the right moment before embarking on their pre-summer spending," BRC Chief Executive, Helen Dickinson, said.

"However, with signs that the UK's economy is slowing it's unlikely that this is the beginning of a complete reversal of fortunes. The uncertain outlook means that customers will remain cautious with their spending, therefore we expect sales figures to remain volatile for the time being," she added.

-

11:19

German industrial production rises 0.8% in April

Destatis released its industrial production data for Germany on Tuesday. German industrial production rose 0.8% in April, exceeding expectations for a 0.7% gain, after a 1.1% decline in March. March's figure was revised up from a 1.3% decrease.

The output of capital goods increased 2.2% in April, energy output rose 1.1%, and the production in the construction sector was down 1.7%, while the production of intermediate goods was flat.

The output of consumer goods rose 0.4% in April.

German industrial production excluding energy and construction climbed by 1.1% in April.

-

10:43

St. Louis Fed President James Bullard: the Fed would unlikely raise its interest rates this month due to the weak May labour data

St. Louis Fed President James Bullard said in an interview with The Wall Street Journal on Monday that the Fed would unlikely raise its interest rates this month due to the weak May labour data, adding that an interest rate hike in July was still possible.

St. Louis Fed president noted that the experience of the European Central Bank and the Bank of Japan with negative interest rates was not great.

He also said that the referendum on Britain's membership in the European Union would not have a great impact on the U.S. economy.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:36

According to a YouGov poll for the Times on Monday, 43% of respondents would vote for “Remain”, while 42% would vote for “Leave”

-

10:27

Fed Chairwoman Janet Yellen: further interest rate hikes are appropriate

The Fed Chairwoman Janet Yellen said in a speech on Monday that further interest rate hikes were appropriate as the U.S. labour market continued to strengthen and inflation was picking up toward 2% target.

"I expect the U.S. economy will continue to improve and why I expect that further gradual increases in the federal funds rate will probably be appropriate to best promote the FOMC's goals of maximum employment and price stability," she said.

Yellen pointed out that there were uncertainties to the outlook for the economic growth and to the path of the federal funds rate. She noted that Britain's exit from the European Union (EU) could have a negative impact on the U.S. economy.

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1200 (EUR 938m) 1.1250 (450m) 1.1415 (401m)

USD/JPY 106.00 (USD 300m) 107.00 (350m) 107.15-20 (390m)

GBP/USD 1.4400 (GBP 279m) 1.4500 (306m)

AUD/USD 0.7235 (AUD 279m) 0.7310 (306m)

EUR/JPY 123.00 (EUR 400m)

-

10:12

Reserve Bank of Australia keeps its interest rate unchanged at 1.75% in June

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 1.75% on Tuesday as widely expected by analysts.

The RBA Governor Glenn Stevens said that the board's decision was reasonable for "sustainable growth in the economy and inflation returning to target over time".

The RBA governor said that the Australian economy continued to grow, despite a drop in business investment.

Stevens also said that domestic demand and exports rose at or above trend.

According to Stevens, labour market indicators were mixed of late, but are expected to increase in the near term.

The RBA governor also said that consumer price inflation remained "quite low", adding that inflation in Australia was likely to remain low "for some time".

The RBA cut its interest rate to 1.75% from 2.00% in May. This decision was not expected by analysts.

-

09:31

United Kingdom: Halifax house price index 3m Y/Y, May 9.2% (forecast 8.9%)

-

09:31

United Kingdom: Halifax house price index, May 0.6% (forecast 0.3%)

-

08:45

France: Trade Balance, bln, April -5.2 (forecast -4)

-

08:34

Options levels on tuesday, June 7, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1516 (1587)

$1.1484 (1965)

$1.1461 (706)

Price at time of writing this review: $1.1360

Support levels (open interest**, contracts):

$1.1303 (1462)

$1.1248 (1337)

$1.1180 (1819)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 30179 contracts, with the maximum number of contracts with strike price $1,1500 (5591);

- Overall open interest on the PUT options with the expiration date July, 8 is 55872 contracts, with the maximum number of contracts with strike price $1,0900 (12562);

- The ratio of PUT/CALL was 1.85 versus 1.52 from the previous trading day according to data from June, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.4819 (1709)

$1.4724 (763)

$1.4629 (668)

Price at time of writing this review: $1.4517

Support levels (open interest**, contracts):

$1.4462 (460)

$1.4366 (641)

$1.4270 (257)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 14857 contracts, with the maximum number of contracts with strike price $1,5000 (1746);

- Overall open interest on the PUT options with the expiration date July, 8 is 22057 contracts, with the maximum number of contracts with strike price $1,3500 (1657);

- The ratio of PUT/CALL was 1.48 versus 1.54 from the previous trading day according to data from June, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:03

Asian session: The Australian dollar rose

The Australian dollar rose to one-month highs after the Reserve Bank of Australia held policy steady as expected, and said its decision was consistent with sustainable growth.

The Reserve Bank of Australia have left interest rates on hold and the Aussie $ has rallied strongly 7 June 2016

The decision was largely as expected but that hasn't stopped the Aussie $ from enjoying a relief rally with AUDUSD posting one-month highs of 0.7420 so far.

Nothing of real note in the RBA statement that I can see but the decision is enough to have shorts running for cover. The nod to rising housing prices is still tempered by talk of low inflation remaining for "some time" but overall the statement is less dovish than some might have expected in the wake of last month's surprise cut.

The dollar edged up but still wallowed close to four-week lows against a basket of currencies on Tuesday, after Federal Reserve Chair Janet Yellen's remarks failed to toss a lifebuoy to the recently foundering greenback.

While Yellen remained relatively optimistic about the overall U.S. economic outlook and said the Fed would hike interest rate hikes, she gave no fresh hints about timing, and called last month's U.S. jobs data "disappointing."

The dollar has been under pressure since the U.S. nonfarm payrolls report on Friday showed the slowest job growth in more than five years in May, quashing expectations for a near-term U.S. interest rate hike.

Even before Yellen spoke, U.S. interest rates futures implied traders had all but priced out any chance the Fed will raise rates at its policy meeting next week.

Against the yen, the dollar reversed its earlier losses and rose 0.2 percent to 107.81 yen, pulling away from the previous session's low of 106.35, its weakest in a month. It remained well shy of levels above 109 yen, where it stood as recently as Friday.

Earlier on Tuesday, Japanese Finance Minister Taro Aso told reporters that he would refrain from commenting on Japan's possible response in the currency market if the yen were to rise further.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1350-70

GBP / USD: during the Asian session, the pair briefly rose to $ 1.4660

USD / JPY: during the Asian session, the pair is trading in the range of $ 107.20-107.90

Based on Reuters materials

-

08:00

Germany: Industrial Production s.a. (MoM), April 0.8% (forecast 0.7%)

-

07:01

Japan: Coincident Index, April 112.2

-

07:01

Japan: Leading Economic Index , April 100.5 (forecast 100.8)

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 1.75% (forecast 1.75%)

-

01:30

Australia: AiG Performance of Construction Index, May 46.7

-

00:34

Currencies. Daily history for Jun 06’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1356 -0,09%

GBP/USD $1,4454 -0,41%

USD/CHF Chf0,9705 -0,53%

USD/JPY Y107,53 +0,94%

EUR/JPY Y122,12 +0,85%

GBP/JPY Y155,41 +0,51%

AUD/USD $0,7363 -0,03%

NZD/USD $0,6913 -0,59%

USD/CAD C$1,2823 -0,90%

-

00:01

Schedule for today, Tuesday, Jun 7’2016:

(time / country / index / period / previous value / forecast)

04:30 Australia Announcement of the RBA decision on the discount rate 1.75% 1.75%

04:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index (Preliminary) April 93.3

05:00 Japan Coincident Index (Preliminary) April 111.1

06:00 Germany Industrial Production s.a. (MoM) April -1.3% 0.6%

06:45 France Trade Balance, bln April -4.37

07:30 United Kingdom Halifax house price index May -0.8% 0.3%

07:30 United Kingdom Halifax house price index 3m Y/Y May 9.2% 8.9%

12:30 U.S. Unit Labor Costs, q/q (Finally) Quarter I 2.7% 4%

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter I -1.7% -0.6%

14:00 Canada Ivey Purchasing Managers Index May 53.1

19:00 U.S. Consumer Credit April 29.67 18

23:50 Japan Current Account, bln April 2980 2318.9

23:50 Japan GDP, q/q (Finally) Quarter I -0.4% 0.5%

23:50 Japan GDP, y/y (Finally) Quarter I -1.7% 1.9%

-