Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jan 10’2018 (GMT0)

01:30 China PPI y/y December 5.8% 4.8%

01:30 China CPI y/y December 1.7% 1.9%

07:45 France Industrial Production, m/m November 1.9% -0.5%

09:30 United Kingdom Industrial Production (YoY) November 3.6% 1.8%

09:30 United Kingdom Industrial Production (MoM) November 0.0% 0.3%

09:30 United Kingdom Manufacturing Production (MoM) November 0.1% 0.3%

09:30 United Kingdom Manufacturing Production (YoY) November 3.9% 2.8%

09:30 United Kingdom Total Trade Balance November -1.405

13:00 United Kingdom NIESR GDP Estimate December 0.5% 0.5%

13:30 Canada Building Permits (MoM) November 3.5% -0.3%

13:30 U.S. Import Price Index December 0.7% 0.5%

14:00 U.S. FOMC Member Charles Evans Speaks

15:00 U.S. Wholesale Inventories November -0.4% 0.7%

15:30 U.S. Crude Oil Inventories January -7.419 -4.1

18:30 U.S. FOMC Member James Bullard Speaks

-

17:44

USD/CHF Analysis

As we can see on 4-hour time frame chart, the price has been correcting its last bearish movement on the last few days.

However, it can be interesting to see how the price will reacts close to the downside trend line and the Fibonacci levels (78.6%) which can slow down the bullish movement in order to start a new bearish movement.

-

16:29

Fed's Kashkari says right now the main concern is inflation is going to continue to be too low

-

16:02

U.S jobs openings a little lower than expected in November

The number of job openings was little changed at 5.9 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.5 million and 5.2 million, respectively.

Within separations, the quits rate was unchanged at 2.2 percent and the layoffs and discharges rate was little changed 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

-

16:00

U.S.: JOLTs Job Openings, November 5.879 (forecast 6.038)

-

15:48

N.Korea's nuclear programme is not an issue between North and South Korea - N.Korea official

-

N.Korea's weapons are only aimed at the U.S., not S.Korea, Russia or China

-

-

14:59

N.Korea agrees there is need to guarantee peaceful environment on Korean peninsula - S. Korea statement

-

South Korea asks N.Korea to halt hostile acts that raise tension on Korean peninsula

-

North, South Korea agree to resolve problems between two Koreas through dialogue and negotiations

-

-

14:56

Canadian housing starts in line with expectations in December

The trend in housing starts was 226,777 units in December 2017, compared to 226,178 units in November 2017, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"Despite the variation in activity across the country, the national trend in housing starts held steady at its highest level since 2008," said Bob Dugan, CMHC's chief economist. "Total urban housing starts in 2017 were up 6.2% compared to 2016 due to the rise in apartment construction."

-

14:16

Canada: Housing Starts, December 217 (forecast 212.5)

-

12:18

U.S. 10-year treasury yields rise to highest since march 2017 at 2.506 pct

-

11:39

Kremlin says Russia welcomes dialogue between North and South Korea

-

11:16

-

11:07

The euro area unemployment rate was 8.7% in November, down 0.1%

The euro area (EA19) seasonally-adjusted unemployment rate was 8.7% in November 2017, down from 8.8% in October 2017 and from 9.8% in November 2016. This is the lowest rate recorded in the euro area since January 2009. The EU28 unemployment rate was 7.3% in November 2017, down from 7.4% in October 2017 and from 8.3% in November 2016. This is the lowest rate recorded in the EU28 since October 2008.

Eurostat estimates that 18.116 million men and women in the EU28, of whom 14.263 million in the euro area, were unemployed in November 2017.

-

11:00

Eurozone: Unemployment Rate , November 8.7% (forecast 8.7%)

-

10:47

German deputy economy minister says expects 2017 growth of 2.2 percent, this year's to be similar

-

09:18

Swiss retail sales rose 0.2% in November

Turnover in the retail sector rose by 0.2% in nominal terms in November 2017 compared with the previous year. Seasonally adjusted, nominal turnover rose by 1.4% compared with the previous month. These are the provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.2% in November 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 1.3%. # Retail sector excluding service stations.

-

09:15

Switzerland: Retail Sales (MoM), November 1.3%

-

09:15

Switzerland: Retail Sales Y/Y, November -0.2% (forecast -2.5%)

-

09:05

Switzerland: Foreign Currency Reserves, December 744

-

08:45

France: Trade Balance, bln, November -5.7 (forecast -4.7)

-

08:30

Options levels on tuesday, January 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2090 (3321)

$1.2068 (2052)

$1.2039 (2193)

Price at time of writing this review: $1.1964

Support levels (open interest**, contracts):

$1.1923 (2371)

$1.1894 (2649)

$1.1861 (2510)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 86028 contracts (according to data from January, 8) with the maximum number of contracts with strike price $1,2100 (5117);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3652 (1457)

$1.3626 (1062)

$1.3603 (905)

Price at time of writing this review: $1.3556

Support levels (open interest**, contracts):

$1.3501 (1045)

$1.3474 (2193)

$1.3443 (2749)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 25628 contracts, with the maximum number of contracts with strike price $1,3600 (3123);

- Overall open interest on the PUT options with the expiration date February, 9 is 23850 contracts, with the maximum number of contracts with strike price $1,3500 (2749);

- The ratio of PUT/CALL was 0.93 versus 0.95 from the previous trading day according to data from January, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

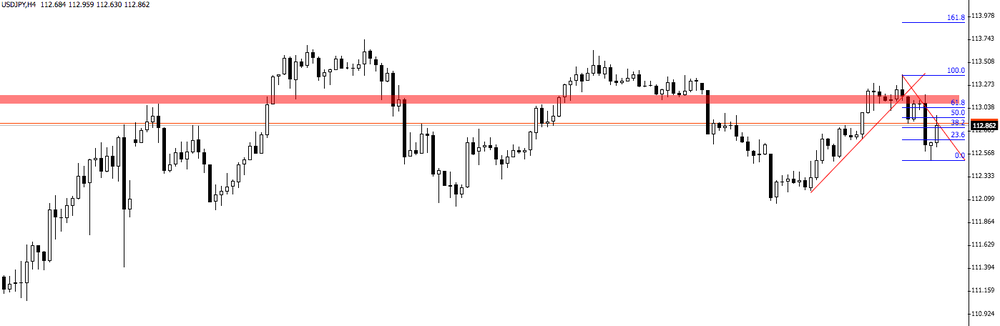

USDJPY and JGB Futures are tumbling after the Bank of Japan 'tapers' its purchasing of longer-dated bonds - zerohedge

-

08:21

Atlanta Fed's Bostic says U.S. central bank may not need to raise interest rates as many as three times in 2018 given weak inflation

-

Anticipates 'modest' impact of tax overhaul on growth, with few businesses in recent survey saying they expect to expand investment or hiring as a result

-

Concerned public may lose faith in commitment to 2 percent inflation goal, sees it as possible argument for being more patient with future rate increases

-

Says lack of wage and price pressures remains "puzzling" in light of low unemployment

-

Current Federal Funds rate of between 1.25 percent and 1.50 percent could already be "approaching" a neutral rate that could be "close to" 2 percent

-

-

08:19

Fed's Williams says inflation targeting has the problem of inflation on average being lower than target; price level targeting could solve that

-

08:16

South Korean media say the 2 Koreas have begun talks at the border on Olympic cooperation and overall ties @AP

-

08:14

Swiss unemployment rate stable at 3.0% in december

Registered unemployment in December 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, 146,654 unemployed people were enrolled at the Regional Employment Centers (RAV) at the end of December 2017, 9,337 more than in the previous month. The unemployment rate rose from 3.1% in November 2017 to 3.3% in the month under review. Compared to the same month of the previous year, unemployment fell by 12,718 (-8.0%).

-

08:10

German trade balance showed a surplus of 23.7 billion euros in November

Germany exported goods to the value of 116.5 billion euros and imported goods to the value of 92.8 billion euros in November 2017. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 8.2% and imports by 8.3% in November 2017 on the same month a year earlier. After calendar and seasonal adjustment, exports were up 4.1% and imports 2.3% compared with October 2017.

The foreign trade balance showed a surplus of 23.7 billion euros in November 2017. In November 2016, the surplus amounted to 22.0 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 22.3 billion euros in November 2017.

-

08:09

German industrial production up 3.4% in November

In November 2017, production in industry was up by 3.4% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In October 2017, the corrected figure shows a decrease of 1.2% (primary -1.4%) from September 2017.

In November 2017, production in industry excluding energy and construction was up by 4.3%. Within industry, the production of capital goods increased by 5.7% and the production of consumer goods by 3.6%. The production of intermediate goods showed an increase by 3.0%. Energy production was down by 3.1% in November 2017 and the production in construction increased by 1.5%.

-

08:02

Germany: Current Account , November 25.4 (forecast 25.5)

-

08:01

Germany: Trade Balance (non s.a.), bln, November 23.7

-

08:00

Germany: Industrial Production s.a. (MoM), November 3.4% (forecast 1.8%)

-

07:45

Switzerland: Unemployment Rate (non s.a.), December 3.3% (forecast 3.1%)

-

06:01

Japan: Consumer Confidence, December 44.7 (forecast 45.1)

-

01:31

Australia: ANZ Job Advertisements (MoM), December -2.3%

-

01:30

Australia: Building Permits, m/m, November 11.7% (forecast -0.9%)

-

01:00

Japan: Labor Cash Earnings, YoY, November 0.9%

-

00:26

Currencies. Daily history for Jan 08’2018:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1967 -0,62%

GBP/USD $1,3566 +0,00%

USD/CHF Chf0,97722 +0,22%

USD/JPY Y113,08 -0,02%

EUR/JPY Y135,33 -0,64%

GBP/JPY Y153,41 -0,02%

AUD/USD $0,7840 -0,42%

NZD/USD $0,7174 -0,06%

USD/CAD C$1,24188 +0,06%

-