Noticias del mercado

-

17:44

Bank of Canada's Business Outlook Survey: business sentiment in Canada remains positive

The Bank of Canada released its Business Outlook Survey on Monday. The survey showed that business sentiment in Canada has remained positive, but falling oil prices have a negative impact on the outlook for companies tied to the energy sector. Sales are expected to grow at a slightly faster pace in 2015, the report said.

According to the report, "firms anticipating a positive impact from the U.S. economic recovery are more optimistic than others".

-

17:32

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after the release of the Bank of Canada's Business Outlook Survey

The U.S. dollar traded mixed against the most major currencies. The greenback recovered Friday's losses. The U.S. currency declined on Friday as investors speculated that the Fed might delay its first interest rate hike due to the weak wage growth. Average hourly earnings decreased 0.2% in December.

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 252,000 jobs in December. The U.S. unemployment rate fell to 5.6% in December from 5.8% in November, exceeding expectations for a decline to 5.7%.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Political uncertainty in Greece and inflation data from the Eurozone still weighed on the euro.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the release of the Bank of Canada's Business Outlook Survey. The survey showed that business sentiment in Canada has remained positive, but falling oil prices have a negative impact on the outlook for companies tied to the energy sector.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the mixed economic data from Australia. Job advertisements in Australia increased 1.8% in December, after a 0.7% rise in November. That was the seventh consecutive increase.

Home loans in Australia fell 0.7% in November, missing expectations for a 1.8% rise, after a 0.2% increase in October. October's figure was revised down from a 0.3% gain. That are signs of a weakening in the housing sector.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback. Markets in Japan were closed for a public holiday.

Japan's government released its growth forecasts for the next fiscal year on Monday. The economy is expected to expand 1.5% in the fiscal year through March 2016, up from an earlier forecast of 1.4%. But the government lowered its growth forecast for the current fiscal year to a -0.5%, down from the previous forecast of 1.2%.

-

17:15

European Central Bank’s (ECB) governing council member Jozef Makuch: the central bank is ready to implement quantitative easing if needed

The Slovak news agency TASR quoted the European Central Bank's (ECB) governing council member Jozef Makuch on Monday. Makuch said the ECB is ready to implement quantitative easing if needed.

He also said that he did not expect inflation in the Eurozone to reach the ECB's 2% earlier than at the end of 2016.

-

16:59

Eurozone’s economy is expected to grow 0.3% in first and second quarter of 2015

Statistical offices in France and Italy and Germany's Ifo Institute released its growth forecast on Monday. The gross domestic product (GDP) is expected to grow 0.3% in first and second quarter of 2015, driven by domestic.

Inflation in the Eurozone is expected to be near zero in the first quarter 2015 and +0.2% in the second 2015.

The report said that upside risks are a further depreciation of the euro and a greater fall in oil prices. Downside risks are the outcome of the parliamentary elections in Greece, according to the report.

-

16:37

The European Central Bank purchased 48 million euros of asset-backed securities and 1.659 billion euros of covered-bond purchases last week.

-

16:15

Japan’s government cut its economic growth forecast for the next fiscal year

Japan's government released its growth forecasts for the next fiscal year on Monday. The economy is expected to expand 1.5% in the fiscal year through March 2016, up from an earlier forecast of 1.4%. But the government lowered its growth forecast for the current fiscal year to a -0.5%, down from the previous forecast of 1.2%.

-

16:05

OECD’s leading composite leading indicator increased in November

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator increased to 100.5 in November from 100.4 in October.

The leading indicators signalled stable growth momentum for the United States, Canada and China, while it showed a slowdown in Germany, Italy, Russia and the U.K.

Lower level of momentum is expected in France, Brazil and in the whole Eurozone.

The economic growth of the U.S. and Canada will remain at current level.

The leading indicators for China, India and Japan indicate positive and firming changes.

The OECD's leading indicators provide early signals of turning points between the expansion and slowdown of economic activity.

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1810(E203mn), $1.1850(E247mn), $1.1875(E241mn), $1.1900(E908mn)

USD/JPY: Y118.00($383mn), Y118.35($200mn), Y118.40($325mn), Y118.50($250mn), Y118.75($220mn)Y119.65($570mn), Y120.00($2.65bn)

EUR/CHF: Chf1.1950(E720mn), Chf1.2010(E234mn)

AUD/USD: $0.8250(A$352mn)

AUD/JPY: Y95.75(A$332mn)

AUD/NZD: NZ$1.0550(A$391mn)

USD/CAD: C$1.1750($213mn)

EUR/CAD: C$1.4000(E230mn)

-

14:03

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies, recovering its Friday’s losses

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) December +0.7% +1.8%

00:30 Australia Home Loans November +0.2% Revised From +0.3% +1.8% -0.7%

The U.S. dollar traded higher against the most major currencies, recovering its Friday's losses. The greenback declined on Friday as investors speculated that the Fed might delay its first interest rate hike due to the weak wage growth. Average hourly earnings decreased 0.2% in December.

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 252,000 jobs in December. The U.S. unemployment rate fell to 5.6% in December from 5.8% in November, exceeding expectations for a decline to 5.7%.

The euro dropped against the U.S. dollar in the absence of any major economic reports from the Eurozone. Political uncertainty in Greece and inflation data from the Eurozone still weighed on the euro.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's Business Outlook Survey.

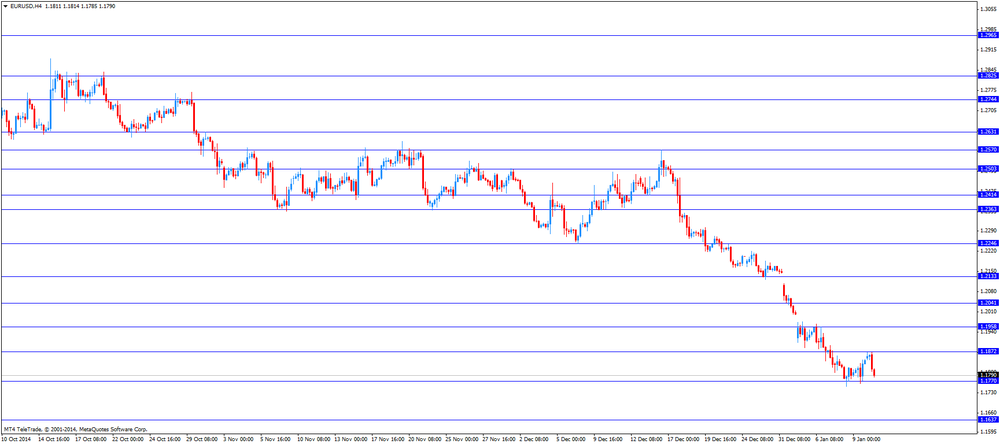

EUR/USD: the currency pair fell to $1.1785

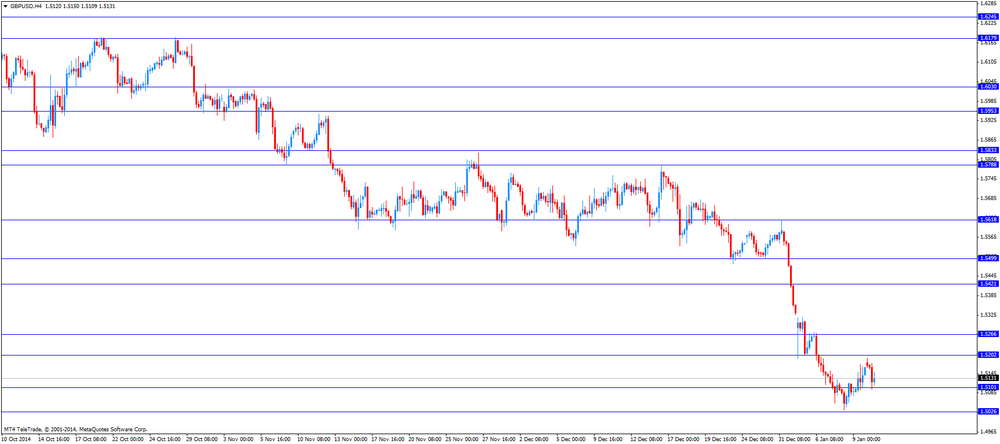

GBP/USD: the currency pair decreased to $1.5097

USD/JPY: the currency pair rose to Y119.31

The most important news that are expected (GMT0):

15:30 Canada Bank of Canada Business Outlook Survey Quarter IV

17:40 U.S. FOMC Member Dennis Lockhart Speaks

23:50 Japan Current Account (adjusted), bln November 883.4 133.2

-

13:50

Orders

EUR/USD

Offers $1.1975-85, $1.1950/60, $1.1930, $1.1890-900

Bids $1.1700

GBP/USD

Offers $1.5250, $1.5195/205

Bids $1.5055/50

AUD/USD

Offers $0.8300, $0.8200

Bids $0.8150, $0.8100, $0.8060/50

EUR/JPY

Offers Y141.95/00, Y141.50, Y141.00

Bids Y140.00, Y139.50, Y139.00

USD/JPY

Offers Y120.00, Y119.50

Bids Y118.85/80, Y118.50, Y118.00

EUR/GBP

Offers stg0.7950/55, stg0.7900, stg0.7880/85

Bids stg0.7720, stg0.7700

-

13:45

Home loans in Australia unexpectedly dropped 0.7% in November

The Australian Bureau of Statistics released its home loans data on Monday. Home loans in Australia fell 0.7% in November, missing expectations for a 1.8% rise, after a 0.2% increase in October. October's figure was revised down from a 0.3% gain. That are signs of a weakening in the housing sector.

Growth in recent months was driven by cheap credit as interest rate in Australia has remained at a record low of 2.5% since August 2013. The Reserve Bank of Australia is concerned over the sharp increase in house prices, and it is eager to prevent Australian housing market from overheating.

-

13:27

Australian ANZ job advertisements rose 1.8% in December, the seventh consecutive increase

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements in Australia increased 1.8% in December, after a 0.7% rise in November. That was the seventh consecutive increase.

The ANZ chief economist Warren Hogan noted: "The good news is that the economy continues to produce new employment opportunities. The bad news is that this has not been quite enough to counteract the flow of new workers into the economy plus the on-going loss of jobs in certain sectors".

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1810(E203mn), $1.1850(E247mn), $1.1875(E241mn), $1.1900(E908mn)

USD/JPY: Y118.00($383mn), Y118.35($200mn), Y118.40($325mn), Y118.50($250mn), Y118.75($220mn)Y119.65($570mn), Y120.00($2.65bn)

EUR/CHF: Chf1.1950(E720mn), Chf1.2010(E234mn)

AUD/USD: $0.8250(A$352mn)

AUD/JPY: Y95.75(A$332mn)

AUD/NZD: NZ$1.0550(A$391mn)

USD/CAD: C$1.1750($213mn)

EUR/CAD: C$1.4000(E230mn)

-

10:20

Press Review: Oil prices extend falls; Goldman Sachs slashes forecasts

REUTERS

Oil prices extend falls; Goldman Sachs slashes forecasts

(Reuters) - Global oil prices fell by more than $1 a barrel on Monday as Goldman Sachs lowered its short-term forecasts, while refineries in Ohio and Pennsylvania were hit by fires over the weekend, curtailing demand for crude in the United States.

Both Brent and U.S. crude are at their lowest since April 2009 and have fallen for seven straight weeks.

Analysts at Goldman Sachs cut their average forecast for Brent in 2015 to $50.40 a barrel from $83.75. They lowered their forecast for U.S. crude to $47.15 a barrel from $73.75, saying it would need to stay near $40 for most of the first half of 2015 before it would hold up shale oil investments.

Source: http://www.reuters.com/article/2015/01/12/us-markets-oil-idUSKBN0KL03Y20150112

BLOOMBERG

ECB Weighs Bond Purchases Up to 500 Billion Euros to Juice Economy

European Central Bank staff presented policy makers with models for buying as much as 500 billion euros ($591 billion) of investment-grade assets, according to a person who attended a meeting of the Governing Council.

Various quantitative-easing options focused on government bonds were shown to governors on Jan. 7 in Frankfurt, including buying only AAA-rated debt or bonds rated at least BBB minus, the euro-area central bank official said. Governors took no decision on the design or implementation of any package after the presentation, according to the person and another official who attended the meeting. The people asked not to be identified because the talks were private.

BLOOMBERG

Japan Plans Record Budget to Help Economy Hit by Recession

Japan plans a record budget for next fiscal year to support an economy that fell into recession after Prime Minister Shinzo Abe's government increased the sales tax.

Government ministers and the ruling coalition parties approved the 96.34 trillion yen ($814 billion) budget proposal for the 12 months starting April 1 at a meeting in Tokyo today, Finance Minister Taro Aso told reporters.

Japan, fighting to rein in the world's heaviest debt burden, will see tax revenue rise to the highest level in 24 years while new bond issuance declines to the lowest since 2008. Abe's already boosted public works spending and support for small businesses through a supplementary budget for the current year.

-

08:30

Foreign exchange market. Asian session: U.S. dollar trading flat to negative against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Japan Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) December +0.7% +1.8%

00:30 Australia Home Loans +0.2% +1.8% -0.7%

The U.S. dollar paused its rally against most major peers in Asian trade after Friday's mixed data on U.S. job reports showed showing incomes declined in December casting doubts on the FED's plans to raise interest rates rather sooner than later. Nevertheless the number of people employed rose more-than-expected to 252,000. The minutes of the FED's last policy meeting released last week showed that the FED is unlikely to raise the benchmark rates for "at least the next couple of meetings".

The Australian dollar traded higher for a third consecutive day after reaching multi-year lows on January 7th fuelled by solid local amid a broadly weakening U.S. dollar. ANZ job Advertisements rose by +1.8% in December, compared to a rise of +0.7% in November - growing at the fastest pace in 2 ½-years. Home Loans declined by -0.7%, not meeting forecasts of a growth at +1.8%. Revised last month's data had a reading of +0.2%.

New Zealand's dollar traded lower after new monthly highs against the greenback retreating from a four-day rally.

The Japanese yen traded stronger during the Asian against the greenback being currently quoted around USD118.29 rising close to its strongest level since December 17th. Japanese markets are closed today for a holiday.

EUR/USD: the euro gained slightly against the greenback

USD/JPY: the U.S. dollar traded slightly weaker against the yen

GPB/USD: The British pound gained against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

15:30 Canada Bank of Canada Business Outlook Survey Quarter IV

17:40 U.S. FOMC Member Dennis Lockhart Speaks

23:50 Japan Current Account (adjusted), bln November 883.4 133.2

-

07:19

Options levels on monday, January 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2035 (1582)

$1.1980 (745)

$1.1920 (451)

Price at time of writing this review: $ 1.1865

Support levels (open interest**, contracts):

$1.1763 (2114)

$1.1718 (1510)

$1.1661 (1822)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 44846 contracts, with the maximum number of contracts with strike price $1,2100 (4255);

- Overall open interest on the PUT options with the expiration date February, 6 is 50720 contracts, with the maximum number of contracts with strike price $1,1700 (5673);

- The ratio of PUT/CALL was 1.13 versus 0.80 from the previous trading day according to data from January, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5404 (332)

$1.5307 (313)

$1.5211 (252)

Price at time of writing this review: $1.5168

Support levels (open interest**, contracts):

$1.5089 (1061)

$1.4992 (684)

$1.4895 (954)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 12603 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 14206 contracts, with the maximum number of contracts with strike price $1,4800 (1244);

- The ratio of PUT/CALL was 1.13 versus 0.77 from the previous trading day according to data from January, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:31

Australia: ANZ Job Advertisements (MoM), December +1.8%

-

01:30

Australia: Home Loans , November -0.7% (forecast +1.8%)

-

00:30

Currencies. Daily history for Jan 9’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1842 +0,43%

GBP/USD $1,5164 +0,50%

USD/CHF Chf1,0139 -0,42%

USD/JPY Y118,54 -0,94%

EUR/JPY Y140,39 -0,50%

GBP/JPY Y179,76 -0,42%

AUD/USD $0,8202 +0,98%

NZD/USD $0,7839 +0,22%

USD/CAD C$1,1865 +0,30%

-

00:00

Schedule for today, Monday, Jan 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) December +0.7%

00:30 Australia Home Loans November +0.3% +1.8%

02:00 China New Loans December 853 885

15:30 Canada Bank of Canada Business Outlook Survey Quarter IV

17:40 U.S. FOMC Member Dennis Lockhart Speaks

23:50 Japan Current Account (adjusted), bln November 883.4 133.2

-