Noticias del mercado

-

19:00

U.S.: Federal budget , February -192.3 (forecast -187.3)

-

18:30

Reserve Bank of New Zealand Graeme Wheeler: New Zealand's situation "is quite different from some of those countries that have changed monetary policy or cut interest rates"

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The RBNZ kept its interest rate unchanged at 3.50%. This decision was expected by analysts.

The RBNZ Governor Graeme Wheeler said that New Zealand's situation "is quite different from some of those countries that have changed monetary policy or cut interest rates" as New Zealand's economy is growing at 3.25%, perhaps 3.5%. He added that the country's economy is expected "to grow at those sorts of rates over the next two years".

That could mean that the RBNZ's monetary policy will remain unchanged until 2017.

Wheeler noted that inflation in New Zealand declines due to higher exchange rate, low global inflation and fall in oil prices. The RBNZ expects that the country's inflation will decrease to around zero in the first quarter.

The RBNZ governor pointed out that the exchange rate of the kiwi "remains unjustifiably high and unsustainable in terms of New Zealand's long-term economic fundamentals". "A substantial downward correction in the real exchange rate is needed to put New Zealand's external accounts on a more sustainable footing", he said.

Wheeler also said that monetary policy adjustments "will depend on the emerging flow of economic data", he added.

The central bank revised its inflation. Inflation is expected to be below 1.0% until March 2016, rising to 1.7% by early 2017.

-

17:29

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed against the most major currencies after the mixed U.S. economic data. The U.S. business inventories were flat in January, beating expectations for a 0.2% increase, after a flat reading in December. December's figure was revised up from a 0.1% rise.

The U.S. retail sales dropped 0.6% in February, missing expectations for a 0.5% increase, after a 0.8% decline in January.

Retail sales excluding automobiles fell 0.1% in February, missing forecasts for a 0.6% rise, after a 1.1% drop in January. January's figure was revised down from a 0.9% decline.

The decline was driven by bad weather.

The number of initial jobless claims in the week ending March 07 in the U.S. fell by 36,000 to 289,000 from 325,000 in the previous week. The previous week's figure was revised down from 320,000. Analysts had expected the number of initial jobless claims to decrease to 317,000.

The U.S. import price index increased by 0.4 percent in February, beating expectations for a 0.2% rise, after a 3.1% drop in January. January's figure was revised down from a 2.8% decrease.

The U.S. business inventories will be released at 14:00 GMT0, and are expected to rise 0.2% in January, after a 0.1% gain in December.

The euro traded mixed against the U.S. dollar. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro. The ECB had started to purchase government bonds on Monday.

Industrial production in the Eurozone declined 0.1% in January, missing expectations for a 0.3% increase, after a 0.3% rise in December. December's figure was revised up from a flat reading.

On a yearly basis, Eurozone's industrial production rose 1.2% in January, after a 0.6% increase in December. December's figure was revised up from a 0.2 decrease.

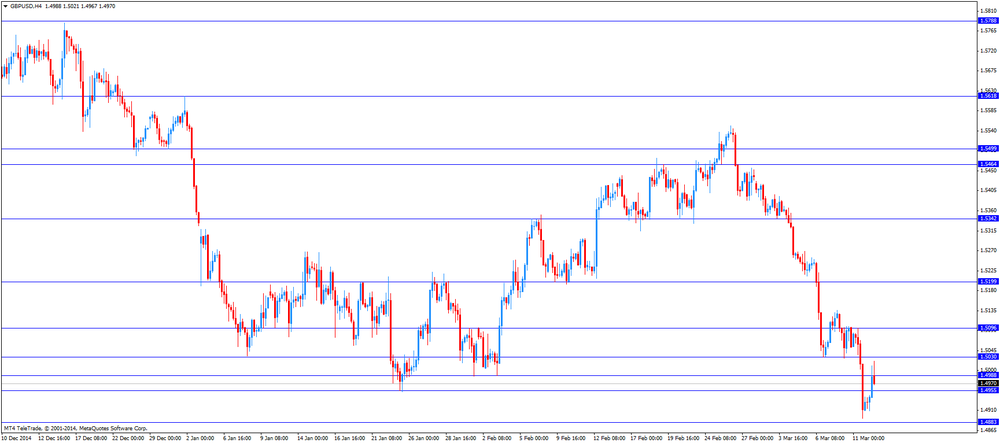

The British pound fell against the U.S. dollar after comments by the Bank of England (BoE) Governor Mark Carney. He said in a speech in Sheffield that a stronger pound and low global inflation could weigh on inflation in the U.K. for some time. Carney added that a persistent period of low global inflation is possible, driven by lower oil prices and a slowdown in global demand.

Carney pointed out that future interest rate hike might depend on events overseas. "The pace and degree of these increases will be affected by a variety of factors, including the evolution of foreign prices and our exchange rate, as well as domestic cost pressures", the BoE governor said.

The U.K. trade deficit in goods narrowed to £8.4 billion in January from £9.9 billion in December, beating expectations for a deficit of £9.7 billion. That was the lowest level since March 2014.

December's figure was revised up from a deficit of £10.2 billion.

The decline was driven by higher service exports and lower oil imports.

Exports fell by £1 billion, while imports declined by £2.5 billion. The decline in imports was the largest monthly decline since July 2006.

The Canadian dollar traded lower against the U.S. dollar. New housing price index in Canada fell 0.1% in January, missing expectations for a 0.2% gain, after a 0.1% increase in December.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the Reserve Bank of New Zealand's (RBNZ) interest decision. The RBNZ kept interest rate unchanged at 3.50%.

The RBNZ Governor Graeme Wheeler said that New Zealand's situation "is quite different from some of those countries that have changed monetary policy or cut interest rates" as New Zealand's economy is growing at 3.25%, perhaps 3.5%. He added that the country's economy is expected "to grow at those sorts of rates over the next two years".

That could mean that the RBNZ's monetary policy will remain unchanged until 2017.

New Zealand's food price index fell 0.7% in February, after a 1.3% increase in January.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the better-than-expected labour market data from Australia. Australia's unemployment rate fell to 6.3% in February from 6.4% in January. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

The number of employed people in Australia rose by 15,600 in February, exceeding expectations for an increase by 15,300, after a drop by 14,600 in January. January's figure was revised down from a decline by 12,200.

These figures might be not enough to ease pressure on the Reserve Bank of Australia to lower its interest rate again. The central bank said that rising unemployment was one of the main reasons for the interest rate cut in February.

The Melbourne Institute's consumer inflation expectations for Australia decreased to 3.2% in March from 4.0% in February.

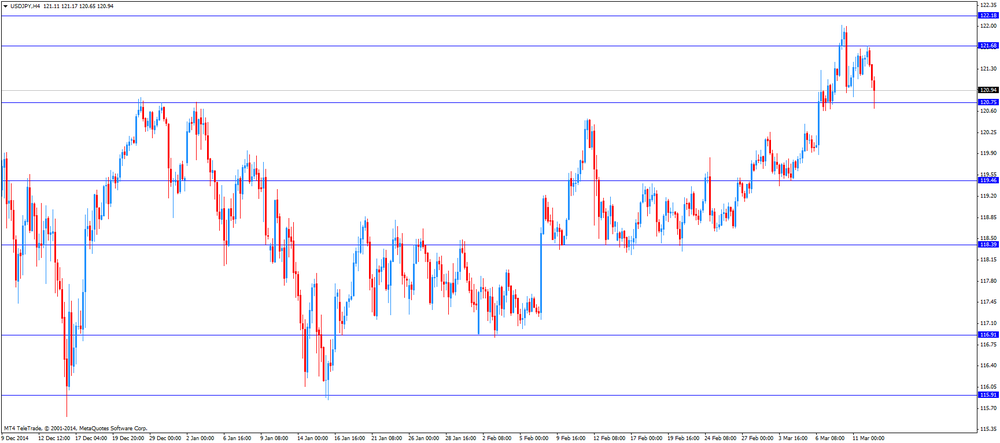

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the mixed economic data from Japan. Japan's consumer confidence index increased to 40.7 in February from 39.1 in January, exceeding expectations for a rise to 39.9.

The business survey index (BSI) of manufacturers' sentiment declined to 2.4 in first quarter from 8.1 in the fourth quarter, missing expectations for a decrease to 5.9.

Japan's tertiary industry index climbed 1.4% in January, beating expectations for a 0.6% rise, after a flat reading in December. December's figure was revised up from a 0.3% drop.

-

17:15

Australia's unemployment rate declines to 6.3% in February

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate fell to 6.3% in February from 6.4% in January. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

The number of employed people in Australia rose by 15,600 in February, exceeding expectations for an increase by 15,300, after a drop by 14,600 in January. January's figure was revised down from a decline by 12,200.

Full-time employment surged by 10,300 in February, while part-time employment rose 5,300.

Participation rate decreased to 64.6% in February from 64.7% in January. January's figure was revised down from 64.8%.

These figures might be not enough to ease pressure on the Reserve Bank of Australia to lower its interest rate again. The central bank said that rising unemployment was one of the main reasons for the interest rate cut in February.

-

17:02

Eurozone’s industrial production declines 0.1% in January

Eurostat released its industrial production figures for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.1% in January, missing expectations for a 0.3% increase, after a 0.3% rise in December. That was the first decrease in five months.

December's figure was revised up from a flat reading.

On a yearly basis, Eurozone's industrial production rose 1.2% in January, after a 0.6% increase in December. December's figure was revised up from a 0.2 decrease.

Production of durable consumer goods dropped by 2.2% in January, output of intermediate goods fell 0.5, energy output rose by 0.9%, while capital and non-durable consumer goods output increased 0.1% each.

The largest declines in industrial production were registered in Latvia and Finland, and the highest rises in Malta.

These figures indicate that GDP growth in the Eurozone will remain weak in the first quarter.

-

16:44

Canada’s new housing price index drops 0.1% in January, the first decline since July 2010

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada fell 0.1% in January, missing expectations for a 0.2% gain, after a 0.1% increase in December. That was the first decline since July 2010.

The drop was driven by declines in the Toronto and Oshawa region where prices decreased 0.1% due to lower negotiated sales prices.

Prices fell in five of the 21 metropolitan areas, while five climbed. Prices were unchanged in 11 metropolitan areas.

-

16:23

Bank of England Governor Mark Carney: a stronger pound and low global inflation could weigh on inflation in the U.K. for some time

The Bank of England (BoE) Governor Mark Carney said in a speech in Sheffield that a stronger pound and low global inflation could weigh on inflation in the U.K. for some time. He added that a persistent period of low global inflation is possible, driven by lower oil prices and a slowdown in global demand.

Carney pointed out that future interest rate hike might depend on events overseas. "The pace and degree of these increases will be affected by a variety of factors, including the evolution of foreign prices and our exchange rate, as well as domestic cost pressures", Carney said.

The BoE governor noted that the U.K. performs well and consumers benefit from low inflation.

-

15:55

U.S. business inventories are flat in January

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories were flat in January, beating expectations for a 0.2% increase, after a flat reading in December. December's figure was revised up from a 0.1% rise.

Business sales declined 2.0% in January, the largest decrease since March 2009.

Retail inventories excluding autos climbed 0.1% in January, after a flat reading in December.

The business inventories/sales ratio climbed 1.35 months in January from 1.33 in December, the highest ration since July 2009. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:18

U.S. import price index rises by 0.4 percent in February

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index increased by 0.4 percent in February, beating expectations for a 0.2% rise, after a 3.1% drop in January. That was the first increase in eight months.

January's figure was revised down from a 2.8% decrease.

Import prices increased as oil prices have mostly stabilized. Petroleum import prices surged 8.1% in February.

A stronger U.S. currency lowers the price of imported goods.

Prices of goods imported from the European Union declined 1% in February, prices of Chinese imports decreased 0.2%.

Prices of imports from Canada, Mexico and Latin American countries increased in February.

U.S. export prices declined by 0.1% in February, after a revised 1.9% drop in January.

-

15:00

U.S.: Business inventories , January 0.0% (forecast +0.2%)

-

14:54

U.S. retail sales dropped 0.6% in February

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales dropped 0.6% in February, missing expectations for a 0.5% increase, after a 0.8% decline in January.

The decline was driven by bad weather.

That was the first time since 2012 that retail sales had declined for three consecutive months.

Retail sales excluding automobiles fell 0.1% in February, missing forecasts for a 0.6% rise, after a 1.1% drop in January. January's figure was revised down from a 0.9% decline.

Automobiles sales decreased 2.5% in February.

Gasoline station sales climbed 1.5% as gasoline prices increased about 9 cents in February.

Sales at clothing retailers were flat. Sales at electronics and appliance outlets declined 1.2%, sales at building material and garden equipment stores dropped 2.3% and sales at restaurants and bars fell 0.6%.

Sales at online stores climbed 2.2%, whiles ales at sporting goods and hobby shops rose 2.3%.

These figures indicate that the U.S. economic growth and consumer spending will slow down the first quarter.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 120.50 (USD 650m) 120.75 (USD 200m) 121.00 (USD 268m) 121.85 (USD 500m)

USDCAD 1.2700-25 (USD 200m)

AUDUSD 0.7600 (AUD 200m) 0.7700 (AUD 782m)

NZDUSD 0.7300-0.7330 (NZD 350m)

-

14:07

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation March +4.0% +3.2%

00:01 United Kingdom RICS House Price Balance February 7% 6% 14%

00:30 Australia Changing the number of employed February -14.6 Revised From -12.2 15.3 15.6

00:30 Australia Unemployment rate February 6.4% 6.4% 6.3%

05:00 Japan Consumer Confidence February 39.1 39.9 40.7

07:00 Germany CPI, m/m (Finally) February +0.9% +0.9% +0.9%

07:00 Germany CPI, y/y February +0.1% +0.1% +0.1%

07:45 France CPI, m/m February -1.0% +0.6% +0.7%

07:45 France CPI, y/y February -0.4% -0.3%

09:30 United Kingdom Trade in goods January -9.9 Revised From -10.2 -9.7 -8.4

10:00 Eurozone Industrial production, (MoM) January +0.3% Revised From 0.0% +0.3% -0.1%

10:00 Eurozone Industrial Production (YoY) January +0.6% Revised From -0.2% +1.2%

12:30 Canada New Housing Price Index, MoM January +0.1% +0.2% -0.1%

12:30 U.S. Retail sales February -0.8% +0.5% -0.6%

12:30 U.S. Retail sales excluding auto February -1.1% Revised From -0.9% +0.6% -0.1%

12:30 U.S. Initial Jobless Claims March 325 Revised From 320 317 289

12:30 U.S. Import Price Index February -3.1% Revised From -2.8% +0.2% +0.4%

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales. The U.S. retail sales dropped 0.6% in February, missing expectations for a 0.5% increase, after a 0.8% decline in January.

Retail sales excluding automobiles fell 0.1% in February, missing forecasts for a 0.6% rise, after a 1.1% drop in January. January's figure was revised down from a 0.9% decline.

The decline was driven by bad weather.

The number of initial jobless claims in the week ending March 07 in the U.S. fell by 36,000 to 289,000 from 325,000 in the previous week. The previous week's figure was revised down from 320,000. Analysts had expected the number of initial jobless claims to decrease to 317,000.

The U.S. import price index increased by 0.4 percent in February, beating expectations for a 0.2% rise, after a 3.1% drop in January. January's figure was revised down from a 2.8% decrease.

The U.S. business inventories will be released at 14:00 GMT0, and are expected to rise 0.2% in January, after a 0.1% gain in December.

The euro traded higher against the U.S. dollar. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro. The ECB had started to purchase government bonds on Monday.

The Eurogroup of euro zone finance ministers continued to discuss proposed Greek economic reforms.

Industrial production in the Eurozone declined 0.1% in January, missing expectations for a 0.3% increase, after a 0.3% rise in December. December's figure was revised up from a flat reading.

On a yearly basis, Eurozone's industrial production rose 1.2% in January, after a 0.6% increase in December. December's figure was revised up from a 0.2 decrease.

The British pound traded higher against the U.S. dollar after the better-than-expected trade data from the U.K. The U.K. trade deficit in goods narrowed to £8.4 billion in January from £9.9 billion in December, beating expectations for a deficit of £9.7 billion. That was the lowest level since March 2014.

December's figure was revised up from a deficit of £10.2 billion.

The decline was driven by higher service exports and lower oil imports.

Exports fell by £1 billion, while imports declined by £2.5 billion. The decline in imports was the largest monthly decline since July 2006.

The Canadian dollar traded higher against the U.S. dollar despite the weaker-than-expected Canadian new housing price index. New housing price index in Canada fell 0.1% in January, missing expectations for a 0.2% gain, after a 0.1% increase in December.

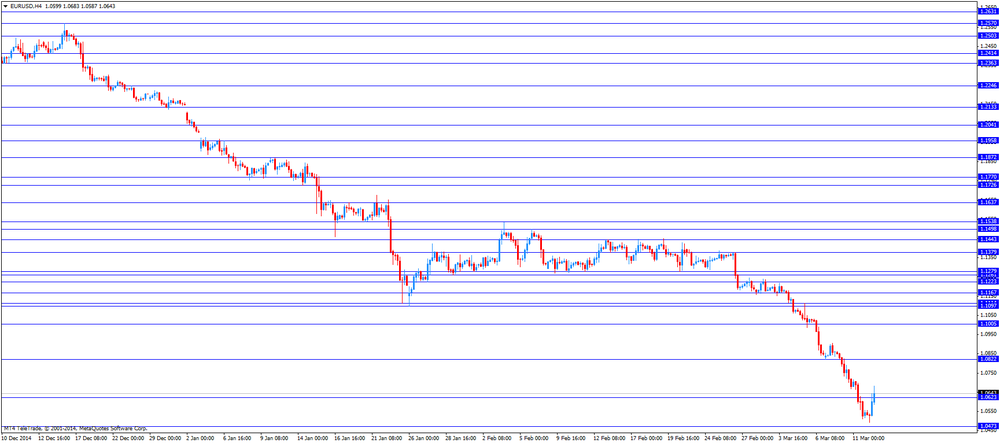

EUR/USD: the currency pair rose to $1.0683

GBP/USD: the currency pair increased to $1.5021

USD/JPY: the currency pair fell to Y120.65

The most important news that are expected (GMT0):

14:00 U.S. Business inventories January +0.1% +0.2%

21:30 New Zealand Business NZ PMI February 50.9

-

14:00

Orders

EUR/USD

Offers 1.0610 1.0625 1.0640 1.0665 1.0680 1.0700 1.0720 1.0735 1.0750

Bids 1.0560 1.0540 1.0520 1.0500 1.0485 1.0460

GBP/USD

Offers 1.5000-10 1.5030-35 1.5060 1.5080 1.5100 1.5120-25 1.5150

Bids 1.4940 1.4925 1.4900-10 1.4885 1.4865 1.4850

EUR/JPY

Offers 128.80 129.00 129.60 129.80 130.00 130.20

Bids 128.00 127.80 127.50 127.00

USD/JPY

Offers 121.35 121.50 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7100 0.7120 0.7145-50 0.7185 0.7200 0.7220-25 0.7245-50

Bids 0.7050 0.7035 0.7020 0.7000 0.6985

AUD/USD

Offers 0.7680 0.7700 0.7740 0.7760

Bids 0.7640 0.7620 0.7600 0.7585 0.7565 0.7550

-

13:32

U.K. trade deficit in goods narrowed to £8.4 billion in January

The U.K. Office for National Statistics (ONS) released trade data on Wednesday. The U.K. trade deficit in goods narrowed to £8.4 billion in January from £9.9 billion in December, beating expectations for a deficit of £9.7 billion. That was the lowest level since March 2014.

December's figure was revised up from a deficit of £10.2 billion.

The decline was driven by higher service exports and lower oil imports.

Exports fell by £1 billion, while imports declined by £2.5 billion. The decline in imports was the largest monthly decline since July 2006.

Imports of oil declined by £1.2 billion.

-

13:32

U.S.: Import Price Index, February +0.4% (forecast +0.2%)

-

13:31

U.S.: Retail sales, February -0.6% (forecast +0.5%)

-

13:31

Canada: New Housing Price Index, MoM, February -0.1% (forecast +0.2%)

-

13:30

U.S.: Initial Jobless Claims, March 289 (forecast 317)

-

13:30

U.S.: Retail sales excluding auto, February -0.1% (forecast +0.6%)

-

11:10

Option expiries for today's 10:00 ET NY cut

USDJPY 120.50 (USD 650m) 120.75 (USD 200m) 121.00 (USD 268m) 121.85 (USD 500m)

USDCAD 1.2700-25 (USD 200m)

AUDUSD 0.7600 (AUD 200m) 0.7700 (AUD 782m)

NZDUSD 0.7300-0.7330 (NZD 350m)

-

11:00

Eurozone: Industrial production, (MoM), January -0.1% (forecast +0.3%)

-

11:00

Eurozone: Industrial Production (YoY), January +1.2%

-

10:30

United Kingdom: Trade in goods , January -8.4 (forecast -9.7)

-

10:25

Press Review: Euro sell-off pauses; parity with dollar view intact

BLOOMBERG

China's Central Bank Chief Says End to Deposit-Rate Cap Is Close

(Bloomberg) -- China's central bank is pushing ahead with plans to liberalize interest rates even as the economy slows, a reform that would effectively end a dual-track rate system that has seen savers subsidize decades of investment-fueled growth.

Removal of a cap on what banks can pay depositors over the benchmark rate is "very close," People's Bank of China Governor Zhou Xiaochuan said Thursday at a press conference in Beijing at the National People's Congress. "If there is a chance this year, the deposit-rate ceiling will be lifted, and the last step that people have been expecting will be made," Zhou said. "The probability is very high," he said.

REUTERS

Euro sell-off pauses; parity with dollar view intact(Reuters) - The euro rose against the dollar for the first time in two weeks on Thursday, recovering from a 12-year low struck earlier in the day, as a sustained sell-off in single currency paused for breath.

But traders said gains would be limited with investors looking to sell the euro at higher levels. Both technical indicators and options market pricing EURVOL= showed more losses are in store for the beleaguered currency which has hit a 13-year against a basket of currencies. EURREER=ECBF

The one trillion euro bond-buying program the European Central Bank launched on Monday has dented the euro's appeal by driving yields of many euro zone bonds deeper into negative territory and others to all-time lows. A 30-year German bond DE30YT=RR now offers a yield which is below a two-year U.S. Treasury note US2YT=RR.

Source: http://www.reuters.com/article/2015/03/12/us-markets-forex-idUSKBN0M72NP20150312

REUTERS

Bank of Japan wages PR campaign to prepare markets for inflation slowdown

(Reuters) - Bank of Japan policymakers are sending a concerted signal to investors that they see no need to expand their already-massive monetary stimulus for a second time in response to a slowdown in inflation driven by the fall in oil prices.

Six of the BOJ's nine board members, including Governor Haruhiko Kuroda, went public in the past two weeks to push the message that, while they expect inflation to grind to a halt or even fall in coming months, they remain hopeful that a pick-up in consumption will rekindle consumer prices down the line.

While there was an element of coincidence in the cramming of the events, the fact the fragmented board is speaking with a single voice suggests a carefully-prepared campaign to correct market misconceptions that a temporary slowdown in inflation alone could trigger more monetary firepower.

Source: http://www.reuters.com/article/2015/03/12/us-japan-economy-boj-idUSKBN0M80C720150312

-

08:46

France: CPI, y/y, February -0.3%

-

08:45

France: CPI, m/m, February +0.7% (forecast +0.6%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation March +4.0% +3.2%

00:01 United Kingdom RICS House Price Balance February 7% 6% 14%

00:30 Australia Changing the number of employed February -12.2 15.3 15.6

00:30 Australia Unemployment rate February 6.4% 6.4% 6.3%

05:00 Japan Consumer Confidence February 39.1 39.9 40.7

07:00 Germany CPI, m/m)(Finally) February +0.9% +0.9% +0.9%

07:00 Germany CPI, y/y February +0.1% +0.1% +0.1%

The U.S. dollar traded lower against its major peers on Thursday in the absence of any major U.S. economic reports. Market participants look ahead to the upcoming FOMC meeting next week to see if the "patient" wording will change.

The euro stabilized after its recent plunge. Sterling is trading positive. Quantitative Easing and concerns over Greece continue to weigh on the single currency.

The Australian dollar added against the greenback although Consumer Inflation Expectations for March declined from a previous reading in February. March Inflation Expectations came in at +3.2%, compared to +4.0% in the previous month. The number of people employed rose more-than-expected by 15,600 compared to a revised decline in January of -14,600. Analyst expected an increase of 15,300. The Unemployment Rate came in at 6.3%, 0.1% below forecasts and the previous reading.

New Zealand's dollar lost added gains against the greenback after the RBNZ Interest Rate Decision and the following Rate Statement. The official benchmark rate remains unchanged at 3.5% even as the bank cut 90-day bill forecasts. RBZ Governor Wheeler said that rates are entering a period of stability. Future measures, rate cuts or hikes, taken by the bank will depend on economic data. New Zealand's Food Price Index for February came in at -0.7% compared to +1.3% in the previous period.

The Japanese yen traded higher against the greenback on Thursday recovering from new 8-year low at USD122.set on Tuesday. The Japanese Tertiary Industry Index improved by 1.4% beating estimates of +0.6% for the month of January. The BSI Manufacturing Index dropped more than predicted to 2.4 points compared to forecasts of a decline to 5.7. Consumer Confidence in February improved to 40.7, beating estimates of a rise from previous 39.1 to 39.9.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling recovered against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France CPI, m/m February -1.0% +0.6%

07:45 France CPI, y/y February -0.4%

09:30 United Kingdom Trade in goods January -10.2 -9.7

10:00 Eurozone Industrial production, (MoM) January 0.0% +0.3%

10:00 Eurozone Industrial Production (YoY) January -0.2%

12:30 Canada New Housing Price Index, MoM February +0.1% +0.2%

12:30 U.S. Retail sales February -0.8% +0.5%

12:30 U.S. Retail sales excluding auto February -0.9% +0.6%

12:30 U.S. Initial Jobless Claims March 320 317

12:30 U.S. Import Price Index February -2.8% +0.2%

14:00 U.S. Business inventories January +0.1% +0.2%

18:00 U.S. Federal budget February -17.5 -187.3

21:30 New Zealand Business NZ PMI February 50.9

-

08:11

Options levels on thursday, March 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0777 (1726)

$1.0717 (378)

$1.0669 (344)

Price at time of writing this review: $1.0558

Support levels (open interest**, contracts):

$1.0498 (2540)

$1.0469 (2332)

$1.0429 (6384)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 50605 contracts, with the maximum number of contracts with strike price $1,1550 (2691);

- Overall open interest on the PUT options with the expiration date April, 2 is 57838 contracts, with the maximum number of contracts with strike price $1,0600 (6384);

- The ratio of PUT/CALL was 1.14 versus 1.20 from the previous trading day according to data from March, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5204 (894)

$1.5107 (1799)

$1.5011 (849)

Price at time of writing this review: $1.4963

Support levels (open interest**, contracts):

$1.4887 (1116)

$1.4791 (1311)

$1.4693 (1193)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 19599 contracts, with the maximum number of contracts with strike price $1,5100 (1799);

- Overall open interest on the PUT options with the expiration date April, 2 is 24742 contracts, with the maximum number of contracts with strike price $1,5050 (2427);

- The ratio of PUT/CALL was 1.26 versus 1.29 from the previous trading day according to data from March, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: CPI, y/y , February +0.1% (forecast +0.1%)

-

08:00

Germany: CPI, m/m, February +0.9% (forecast +0.9%)

-

06:02

Japan: Consumer Confidence, February 40.7 (forecast 39.9)

-

01:30

Australia: Unemployment rate, February 6.3% (forecast 6.4%)

-

01:30

Australia: Changing the number of employed, February 15.6 (forecast 15.3)

-

01:02

United Kingdom: RICS House Price Balance, February 14% (forecast 6%)

-

01:01

Australia: Consumer Inflation Expectation, March +3.2%

-

00:51

Japan: Tertiary Industry Index , January +1.4% (forecast +0.6%)

-

00:50

Japan: BSI Manufacturing Index, Quarter I 2.4 (forecast 5.7)

-

00:28

Currencies. Daily history for Mar 11’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0544 -1,28%

GBP/USD $1,4928 -0,83%

USD/CHF Chf1,0088 +0,95%

USD/JPY Y121,48 +0,27%

EUR/JPY Y128,09 -1,01%

GBP/JPY Y181,34 -0,57%

AUD/USD $0,7588 -0,46%

NZD/USD $0,7276 +0,08%

USD/CAD C$1,2741 +0,44%

-

00:00

Schedule for today, Thursday, Mar 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation March +4.0%

00:01 United Kingdom RICS House Price Balance February 7% 6%

00:30 Australia Changing the number of employed February -12.2 15.3

00:30 Australia Unemployment rate February 6.4% 6.4%

05:00 Japan Consumer Confidence February 39.1 39.9

07:00 Germany CPI, m/m)(Finally) February +0.9% +0.9%

07:00 Germany CPI, y/y February +0.1% +0.1%

07:45 France CPI, m/m February -1.0% +0.6%

07:45 France CPI, y/y February -0.4%

09:30 United Kingdom Trade in goods January -10.2 -9.7

10:00 Eurozone Industrial production, (MoM) January 0.0% +0.3%

10:00 Eurozone Industrial Production (YoY) January -0.2%

12:30 Canada New Housing Price Index, MoM February +0.1% +0.2%

12:30 U.S. Retail sales February -0.8% +0.5%

12:30 U.S. Retail sales excluding auto February -0.9% +0.6%

12:30 U.S. Initial Jobless Claims March 320 317

12:30 U.S. Import Price Index February -2.8% +0.2%

14:00 U.S. Business inventories January +0.1% +0.2%

18:00 U.S. Federal budget February -17.5 -187.3

21:30 New Zealand Business NZ PMI February 50.9

-