Noticias del mercado

-

23:59

Schedule for today, Tuesday, Oct 13’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence September 1

01:00 China New Loans September 809.6 900

02:00 China Trade Balance, bln September 60.24 46.79

05:00 Japan Consumer Confidence September 41.7

06:00 Germany CPI, m/m (Finally) September 0.0% -0.2%

06:00 Germany CPI, y/y (Finally) September 0.2% 0%

06:00 Japan Prelim Machine Tool Orders, y/y September -16.5%

08:30 United Kingdom BOE Credit Conditions Survey

08:30 United Kingdom Retail Price Index, m/m September 0.5% 0.1%

08:30 United Kingdom Retail prices, Y/Y September 1.1% 1%

08:30 United Kingdom Producer Price Index - Input (MoM) September -2.4% 0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) September -13.8% -12.8%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.4% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -1.8% -1.8%

08:30 United Kingdom HICP, m/m September 0.2% 0%

08:30 United Kingdom HICP, Y/Y September 0.0% 0%

08:30 United Kingdom HICP ex EFAT, Y/Y September 1.0% 1.1%

09:00 Eurozone ZEW Economic Sentiment October 33.3

09:00 Germany ZEW Survey - Economic Sentiment October 12.1 6

18:00 U.S. Federal budget September -64.4 95

20:30 U.S. API Crude Oil Inventories October -1.2

23:30 Australia Westpac Consumer Confidence October -5.6%

-

20:20

American focus: the US dollar fell

Today in quiet trading, the dollar fell against the world's currencies as reduced expectations the Federal Reserve raising interest rates before the end of the year continue to put pressure on the US currency. Trading volumes are expected to remain low today as US markets are closed in observance of Columbus Day.

Minutes of the Fed's September meeting released on Thursday showed that the majority of members of the leadership is inclined to raise rates this year, while the financial market turmoil "is not significantly affected" the prospects for the US economy.

However, the minutes also noted that the recent economic and financial developments in the world, is likely to increase the risk for the US economy.

Protocols reinforced expectations that US interest rates are likely to remain at current levels until 2016.

Fed Vice Chairman Stanley Fischer said Sunday that the US central bank chose a cautious approach to the issue of raising interest rates, given the events abroad, as well as the impact of higher interest rates in emerging markets and other countries.

Many economists believe that the Fed will raise interest rates in September. However, economic instability outside the United States has forced the central bank to refrain from raising. Since Fed officials have stated that it is still planning to raise rates before the end of the year. The prospect of continued low interest rates for a long time put pressure on the dollar, as higher borrowing costs will make the US currency more attractive for investors seeking yield.

The president of the Federal Reserve Bank of Atlanta Dennis Lockhart on Monday reiterated that he expects the US central bank will raise short-term interest rates this year.

However, he also warned that since the coming economic and financial news to influence Fed decisions taken by the leadership, the situation may change.

Little support for the euro had earlier statement by the representative of the ECB Ker. He noted that it is too early to take a decision to expand QE. In focus were also comments of the International Monetary Fund. Recall, the IMF stated that the forecast deterioration in opportunities for economic growth in the world economy in the medium term. "The global economic recovery continues, but growth remains modest and uneven. Global risks of economic growth increased despite the efforts of developed countries to overcome the crisis, as many developing economies are experiencing tighter financing conditions, reduced capital inflows and currency pressure due to the high currency indebtedness of the private sector, "- said the IMF.

Investors also await the publication of the German ZEW index for October, which is an early indicator of economic and business expectations. This index is likely to show that the trust company was undermined by concerns around China, as well as the scandal with Volkswagen.

The pound strengthened against the dollar, returning almost all the positions lost on Friday. Investors are waiting for the publication of data on inflation in Britain. It is expected that consumer prices in September remained at zero for the second month in a row. Extremely low commodity prices in the international markets and the strengthening of the British pound, which leads to a reduction in price of imported goods, since the beginning of the year to keep inflation at a level close to zero. According to the latest forecasts of the Bank of England, consumer price inflation will begin only next spring.

-

17:20

Chicago Fed President Charles Evans: the interest rate hike should be very gradual when the Fed will start raising its interest rates

Chicago Fed President Charles Evans said on Monday that the interest rate hike should be very gradual when the Fed will start raising its interest rates.

"After lift-off, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals," he said.

"And right now, regardless of the exact date for lift-off, I think it could well be appropriate for the funds rate to still be under 1 percent at the end of 2016," Evans added.

Chicago Fed president noted that he is not confident if the inflation target in the U.S. will be reached "within a reasonable time frame".

-

17:05

European Commission: Spain should adjust its budget plan

The European Commission said in its statement on Monday that Spain will not meet its deficit targets. According to the Spanish Draft Budgetary Plan (DBP), Spain expects the general government deficit to fall to 4.2% of GDP this year and 2.8% in 2016. But the European Commission forecasted that the government deficit to decline to 4.5% this year and to 3.5% of GDP in 2016.

The European Commission said that Spain should "ensure that the 2016 budget will be compliant with the Stability and Growth Pact".

-

16:22

European Central Bank purchases €12.46 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.46 billion of government and agency bonds under its quantitative-easing program last week.

The ECB said in its minutes of September meeting last week that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.82 billion of covered bonds, and €244 million of asset-backed securities.

-

16:14

The European Central Bank (ECB) Governing Council Member Vitas Vasiliauskas: there is no need for further stimulus measures in the Eurozone

The European Central Bank (ECB) Governing Council Member Vitas Vasiliauskas said in an interview with The Wall Street Journal on Saturday that there is no need for further stimulus measures in the Eurozone.

"I feel in your questions and market sentiments, everybody is asking, what you will do additionally. My message is very clear: There is no need for any additional measures," he said.

Vasiliauskas added that the asset-buying programme was working.

He pointed out that low inflation in the Eurozone's is driven by a decline in energy prices.

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E278mn), $1.1230(E200mn), $1.1250(E200mn), $1.1250(E581mn), $1.1300(E348mn), $1.1500(E711mn)

USD/JPY: Y120.25-30($300mn), Y120.85($230mn), Y121.00($380mn), Y122.00($800mn)

GBP/USD: $1.5100(Gbp203mn), $1.5155(Gbp191mn)

EUR/GBP: Gbp0.7400(E200mn)

AUD/USD: $0.7300(A$333mn), $0.7335(A$250mn)

-

14:48

Atlanta Fed President Dennis Lockhart: the interest rate hike by the Fed this year is still possible

Atlanta Fed President Dennis Lockhart repeated on Monday that the interest rate hike by the Fed this year is still possible.

He repeated his Friday's remarks.

-

14:12

Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies in the absence of any major economic reports from the U.S.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

12:10 U.S. FOMC Member Dennis Lockhart Speaks

The U.S. dollar traded mixed to lower against the most major currencies in the absence of any major economic reports from the U.S.

Thursday's minutes of the Fed's latest meeting still weighed on the greenback. The Fed said that it wanted to have more time to see if the slowdown in the global economy will have a negative effect on the U.S. economy.

Most Federal Open Market Committee (FOMC) members expect the Fed to start raising its interest rate this year.

FOMC members noted that the U.S. labour market continued to improve, while the inflation remained at low levels.

The euro traded mixed against the U.S. dollar in the absence of any major economic data from the Eurozone.

European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview with CNBC on Monday that it is too early to decide if to expand the asset-buying programme or not.

"If anything were needed, we would need to be ready. But it is too early to pass that kind of judgement," he said.

Coeure noted that the economy was recovering but there are risks from the slowdown in the emerging economies.

The ECB President Mario Draghi said in an interview with the Greek newspaper Kathimerini published on Saturday that the central bank's asset-buying programme is working better than expected but reaching the 2% inflation may take more time due to lower oil prices.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

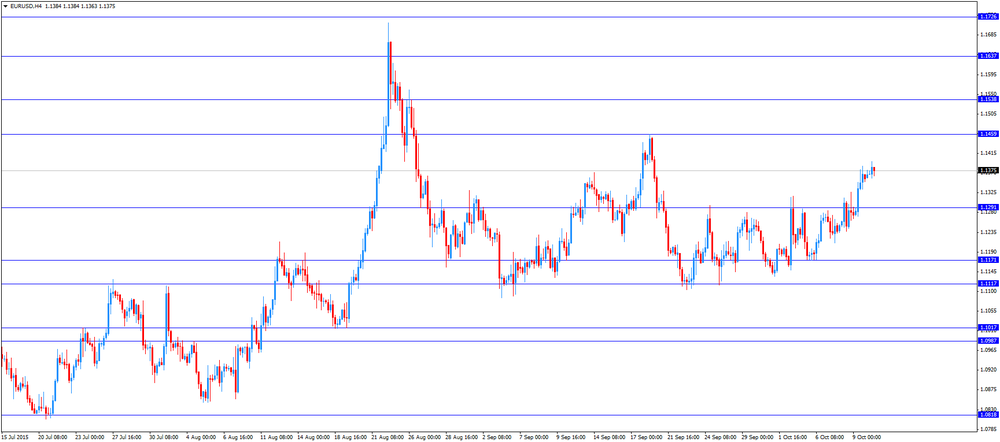

EUR/USD: the currency pair traded mixed

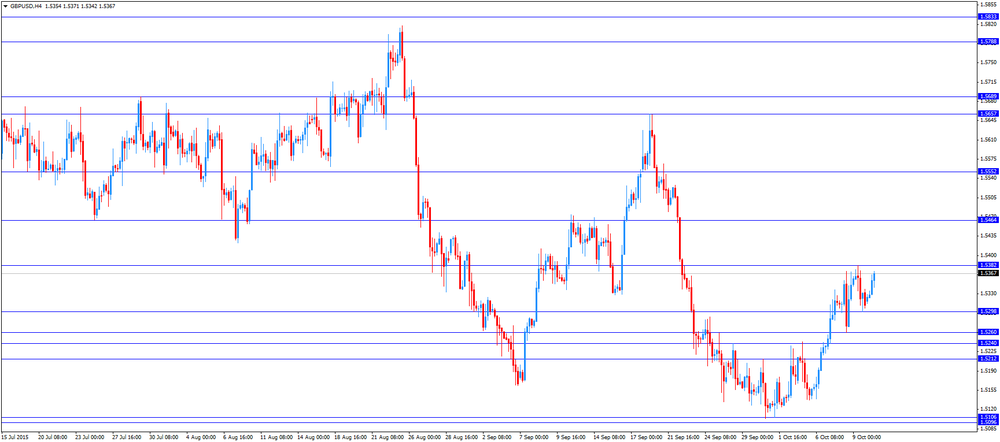

GBP/USD: the currency pair fell to $1.5321

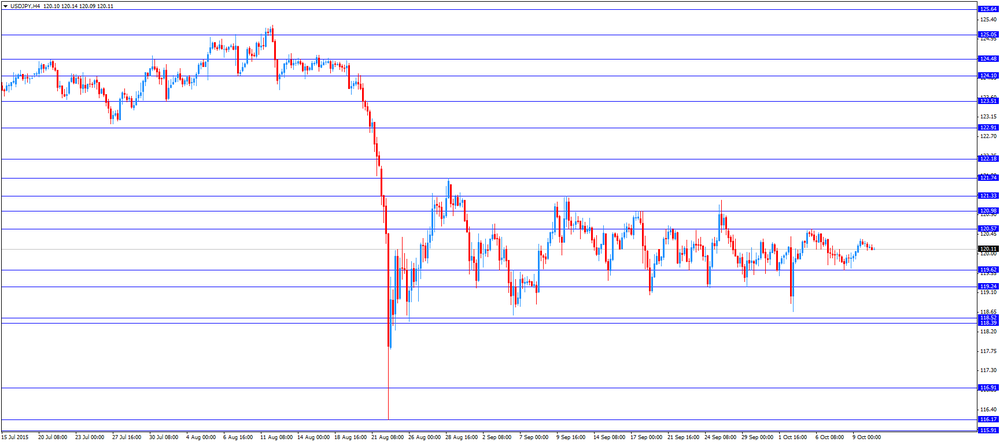

USD/JPY: the currency pair declined to Y120.09

The most important news that are expected (GMT0):

14:30 U.S. FOMC Member Charles Evans Speaks

17:20 Canada BOC Gov Stephen Poloz Speaks

20:30 U.S. FOMC Member Brainard Speaks

21:40 Australia RBA Assist Gov Lowe Speaks

23:50 Japan Monetary Policy Meeting Minutes

-

14:00

Orders

EUR/USD

Offers 1.1380 1.1400 1.1425-30 1.1450 1.1475 1.1500

Bids 1.1355-60 1.1330 1.1300 1.1285 1.1270 1.1250

GBP/USD

Offers 1.5360 1.5385 1.5400-10 1.5425-30 1.5450 1.5480 1.5500-10

Bids 1.5325-30 1.5300 1.5280 1.5255-60 1.5240 1.5220 1.5200

EUR/GBP

Offers 0.7420 0.7430-35 0.7450 0.7475-80 0.7500 0.7530 0.7550

Bids 0.7400 0.7380-85 0.7350 0.7330-35 0.7300 0.7285 0.7265 0.7250

EUR/JPY

Offers 136.85 137.00 137.25 137.50 137.80 138.00 138.30 138.50

Bids 136.50 136.25 136.00 135.80 135.50 135.25 135.00 134

USD/JPY

Offers 120.35 120.50 120.65 120.85 121.00 121.30 121.50

Bids 120.00 119.85 119.65 119.50 119.25 119.10 119.00

AUD/USD

Offers 0.7375 0.7400 0.7425 0.7450 0.7465 0.7480 0.7500

Bids 0.7320-25 0.7310 0.7300 0.7275 0.7260 0.7230 0.7200

-

11:20

European Central Bank (ECB) Executive Board Member Benoit Coeure: it is too early to decide if to expand the asset-buying programme or not

European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview with CNBC on Monday that it is too early to decide if to expand the asset-buying programme or not.

"If anything were needed, we would need to be ready. But it is too early to pass that kind of judgement," he said.

Coeure noted that the economy was recovering but there are risks from the slowdown in the emerging economies.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E278mn), $1.1230(E200mn), $1.1250(E200mn), $1.1250(E581mn), $1.1300(E348mn), $1.1500(E711mn)

USD/JPY: Y120.25-30($300mn), Y120.85($230mn), Y121.00($380mn), Y122.00($800mn)

GBP/USD: $1.5100(Gbp203mn), $1.5155(Gbp191mn)

EUR/GBP: Gbp0.7400(E200mn)

AUD/USD: $0.7300(A$333mn), $0.7335(A$250mn)

-

11:12

France’s current account surplus is €0.2 billion in August

The Bank of France released its current account data on Monday. France's current account surplus was €0.2 billion in August, up from a deficit of €0.4 billion in July.

The trade goods deficit widened to €1.1 billion in August from €0.9 billion in July, while the surplus on services rose to €0.9 billion from €0.1 billion.

The deficit on financial account increased to €10.4 billion in August from €9.7 billion in July.

-

10:52

Federal Reserve Vice Chairman Stanley Fischer: the Fed wants to start raising its interest rates this year

Federal Reserve Vice Chairman Stanley Fischer said on Sunday that the Fed wants to start raising its interest rates this year, adding that it is "an expectation, not a commitment", which depends on the developments in the global economy.

"Both the timing of the first rate increase and any subsequent adjustments to the federal funds rate target will depend critically on future developments in the economy," he said.

Fischer pointed out that the slowdown in the global economy already had an effect on the U.S as the Fed delayed its interest rate hike.

-

10:39

European Central Bank (ECB) President Mario Draghi: the central bank’s asset-buying programme is working better than expected

The European Central Bank (ECB) President Mario Draghi said in an interview with the Greek newspaper Kathimerini published on Saturday that the central bank's asset-buying programme is working better than expected but reaching the 2% inflation may take more time due to lower oil prices.

"We are satisfied with QE, as it has met and even surpassed our initial expectations," he said.

Draghi pointed out that the ECB is ready to expand its asset-buying programme if needed.

-

10:33

European Commission's Vice President Valdis Dombrovskis: the European Union’s (EU) economy benefits from lower oil prices and a weaker euro

The European Commission's Vice President Valdis Dombrovskis said on Friday that the European Union's (EU) economy benefits from lower oil prices and a weaker euro. But he added that there are risks to the EU's economy from the slowdown in the emerging economies.

Dombrovskis noted that the economy in the EU is still expected to expand 1.8% this year and 2.1% next year.

He pointed out that the central bank's asset-buying programme "cannot solve structural problems in the economy".

-

07:05

Options levels on monday, October 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1484 (2337)

$1.1446 (1329)

$1.1401 (738)

Price at time of writing this review: $1.1370

Support levels (open interest**, contracts):

$1.1291 (531)

$1.1243 (2351)

$1.1181 (2061)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 31283 contracts, with the maximum number of contracts with strike price $1,1500 (3421);

- Overall open interest on the PUT options with the expiration date November, 6 is 41197 contracts, with the maximum number of contracts with strike price $1,1200 (4337);

- The ratio of PUT/CALL was 1.32 versus 1.21 from the previous trading day according to data from October, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5603 (393)

$1.5505 (1397)

$1.5409 (1095)

Price at time of writing this review: $1.5330

Support levels (open interest**, contracts):

$1.5194 (1986)

$1.5096 (1457)

$1.4998 (1089)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 14510 contracts, with the maximum number of contracts with strike price $1,5350 (2047);

- Overall open interest on the PUT options with the expiration date November, 6 is 14471 contracts, with the maximum number of contracts with strike price $1,5200 (1986);

- The ratio of PUT/CALL was 1.00 versus 0.91 from the previous trading day according to data from October, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:43

Currencies. Daily history for Oct 9’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1356 +0,66%

GBP/USD $1,5309 -0,25%

USD/CHF Chf0,9614 -0,47%

USD/JPY Y120,24 +0,27%

EUR/JPY Y136,64 +1,01%

GBP/JPY Y184,27 +0,14%

AUD/USD $0,7334 +1,06%

NZD/USD $0,6694 +0,45%

USD/CAD C$1,2944 -0,51%

-

00:00

Schedule for today, Monday, Oct 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

12:10 U.S. FOMC Member Dennis Lockhart Speaks

14:30 U.S. FOMC Member Charles Evans Speaks

17:20 Canada BOC Gov Stephen Poloz Speaks

20:30 U.S. FOMC Member Brainard Speaks

21:40 Australia RBA Assist Gov Lowe Speaks

23:50 Japan Monetary Policy Meeting Minutes

-