Noticias del mercado

-

20:20

American focus: the dollar rose against most major currencies

The euro depreciated significantly against the dollar, reaching a minimum of 9 de Julio. Experts say after eurozone leaders agreed on a new program to save Greece, investors have switched attention to the possibility of higher interest rates in the United States this year. Recall, last Friday, the head of the Federal Reserve Janet Yellen said that the central bank retains plans to raise interest rates this year. On Wednesday, Fed Chairman Yellen plans to address the Committee on Financial Services in Congress. Traders will closely monitor its performance, to get further guidance on the timing rise in US interest rates.

As for Greece, the results of Sunday's talks the leaders of the eurozone failed to reach unanimity on the third bailout. On Monday and Tuesday the Greek parliament to approve new legislation to implement the measures agreed in Brussels, including pension reform and a new sales tax regime. The parliaments of a number of eurozone countries also must approve any new funding crisis. President of the Eurogroup Deysselblum said that negotiations on the financing of Greece will begin immediately to help cope with debt payments. He also said that Greece will allocate state assets by € 50 billion in a fund to recapitalize Greek banks. We also learned that the ECB after the agreement of Greece with creditors decided not to change the funding of Greek banks in the framework of emergency provision of liquidity (ELA). Today, in a conference call members of the Governing Council of the ECB confirmed the upper limit of the ELA at the same level - 88.6 billion euros. ELA volumes remain unchanged from June 23, while on Monday the ECB tightened the requirements for collateral assets that Greek banks for emergency loans provided by the ECB. In accordance with the applicable rules of the ECB, the funds available ELA Greek banks as long as they are solvent and have adequate security.

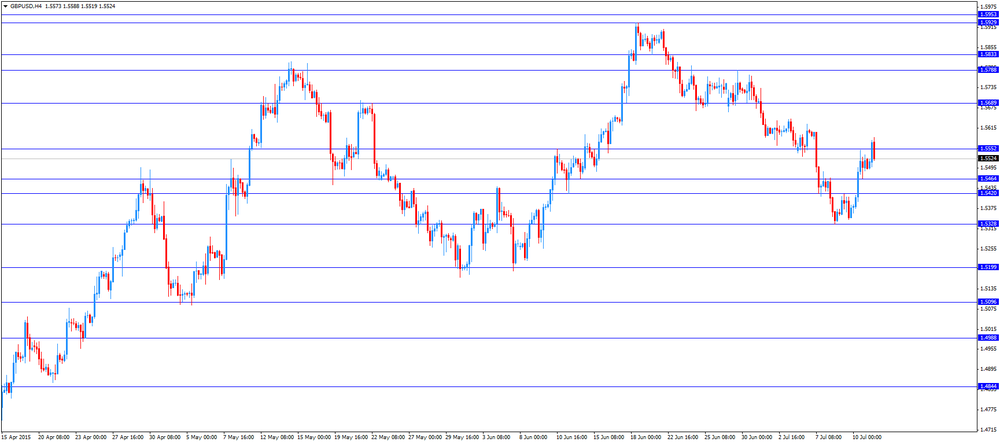

The pound fell moderately against the dollar, returning to the level of opening of the session. Recall GBP / USD pair reached session highs around $ 1.5590 after the announcement of an agreement between the EU and Greece, but bullish momentum quickly faded, and the pair began to fall. Experts say investors are gradually shift focus to tomorrow's report on inflation in Britain, and labor market data, which will be released on Wednesday. According to forecasts, the consumer price index rose 0.1% against + 0.2% in May, while the number of applications for unemployment benefits fell by 9 thousand., After declining by 6.5 thous. In May.

The Canadian dollar depreciated significantly against the US dollar, approaching to the lowest since March 18. In the course of trading influenced the data for China, as well as meeting the expectations of the Central Bank of Canada. Recall, the volume of Chinese exports rose in June by 2.1% compared to June of last year, official data showed. The indicator showed growth for the first time in four months. The volume of imports fell by 6.7%. Analysts on average had forecast export growth of 1.2% and a decrease in imports by 16.2%. In May, the volume of Chinese exports decreased by 2.8%, imports - fell by 18.1%. Export growth at the same time with the stabilization of domestic demand due to the measures taken by the Chinese authorities of monetary and fiscal stimulus is likely to allow China to avoid further weakening of economic growth, experts say. The report underlined expectations that Beijing may resort to further easing to bolster the economy.

As for the decision on the interest rate of the Bank of Canada, which will be announced on Wednesday, several economists have raised the probability that the Central Bank will lower the benchmark interest rate by another 25 basis points amid signs that the Canadian economy has not stabilized after the fall in oil prices. "The combination of falling oil prices and rising US dollar prevented the Canadian dollar showed an increase after the employment report, released last week," - said Scott Smith, an analyst at Cambridge Global Payments.

-

20:00

U.S.: Federal budget , June 51.8 (forecast 51)

-

17:14

Ifo President Hans-Werner Sinn: the latest agreement between Athens and its lenders is not good

The president of the Ifo Institute for Economic Research in Munich, Hans-Werner Sinn, said the latest agreement between Athens and its lenders is not good.

"Many people believe that the paper presented is good for Greece. It is not. While it will cost the rest of Europe a lot of money, all this money won't be enough to make the Greeks happy," he said.

"It makes no sense to want to pour in money to try to solve the country's problems. That won't create jobs," Sinn added.

He noted that the Greek tragedy will continue for the next three years.

-

17:04

European Central Bank (ECB) purchases €11.68 of public-sector assets last week

The European Central Bank (ECB) purchased €11.68 of public-sector assets last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.2188 billion of covered bonds, and €0.431 billion of asset-backed securities.

-

16:53

Head of the Eurogroup Jeroen Dijsselbloem: the deal includes a €50 billion Greece-based fund

The head of the Eurogroup Jeroen Dijsselbloem said on Monday that the deal includes a €50 billion Greece-based fund that will privatise or manage Greek assets. €25 billion of this fund would be used to recapitalise Greek banks, he added.

-

16:43

Credit Suisse said that the probability of a Greek exit from the Eurozone in the coming years is still 30%

-

16:31

Greece needs €7 billion by July 20

According to a deal, Greece needs €7 billion by July 20, when it have to repay loans to the European Central Bank (ECB). The country must make a payment of €12 billion to the ECB by mid-August.

Greece has already received two bailout programmes €240 billion from the Eurozone and the International Monetary Fund since 2010.

-

16:09

European Central Bank decides not to raise the amount of emergency funding (ELA) on Monday

According to a European Central Bank (ECB) spokesman, the ECB decided not to raise the amount of emergency funding (ELA) on Monday. The amount the Greek central bank can lend its banks totals around €88.6 billion.

Earlier, a deal between Greece and its lenders has been reached. The deal needs to be approved by national parliaments before talks about a bailout programme can start.

The Greek government should have to pass a series of reforms, including tax and pensions reforms, into law by Wednesday to restore trust.

-

15:37

International Monetary Fund Managing Director Christine Lagarde: a deal is a step to rebuild confidence

International Monetary Fund Managing Director Christine Lagarde said on Monday that a deal is a step to rebuild confidence.

"I think it's a good step to rebuild confidence," she said

"There will be many more steps," Lagarde added.

-

15:05

Czech Finance Minister Andrej Babiš criticizes the deal between Greece and its lenders

Czech Finance Minister Andrej Babiš on Monday criticized the deal between Greece and its lenders. He said that in a few years, the Eurozone will be again in the same position as today or already in 2011. Babiš pointed out that the right solution would be only the Greek exit from the Eurozone and a partial debt relief.

He said yesterday that he ruled out the Czech Republic to take any part in the repayment of Greek debts.

"We will certainly not take part in any repayment of Greece's debts," Babiš said.

-

14:33

China's trade surplus declines to $46.54 billion in June

The Chinese Customs Office released its trade data on Monday. China's trade surplus fell to $46.54 billion in June from $59.49 billion in May, missing expectations for a decline to a surplus of $55.7 billion.

Exports rose at an annual rate of 2.8% in June. It was the first increase in in four months.

Imports slid at an annual rate of 6.1% in June. It was the eight consecutive decline.

China's trade was driven by the Greek debt crisis, weak external demand in general, rising labour costs and a stronger yuan.

-

14:15

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed may start raising its interest rate this year

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Trade Balance, bln June 59.488 55.7 45.6

04:30 Japan Tertiary Industry Index May -0.2% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) May 1.2% -2.2% -2.1%

04:30 Japan Industrial Production (YoY) (Finally) May 0.1% -4.0% -3.9%

08:30 United Kingdom BOE Credit Conditions Survey Quarter II

09:00 Eurozone Eurogroup Meetings

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed may start raising its interest rate this year. Federal Reserve Chair Janet Yellen said on Friday that she expects the interest rate hike by the Fed at some point this year. But she added that the U.S. labour market remains week.

The euro traded lower against the U.S. dollar despite a deal between Greece and its lenders. "EuroSummit has unanimously reached agreement. All ready to go for ESM programme for Greece with serious reforms and financial support," European Council President Donald Tusk said on Monday.

The deal needs to be approved by national parliaments before talks about a bailout programme can start.

The Greek government should have to pass a series of reforms, including tax and pensions reforms, into law by Wednesday to restore trust.

"The advantages far outweigh the disadvantages. The country which we help has shown a willingness and readiness to carry out reforms," German Chancellor Angela Merkel said on Monday.

The British pound traded mixed against the U.S. dollar after the release of the Bank of England's quarterly Credit Conditions Survey. Demand for mortgages in the second quarter rose. It was the strongest increase in demand for mortgages since the end of 2013.

According to the report, demand for loans from small and big businesses climbed, and it was expected to increase in the third quarter too.

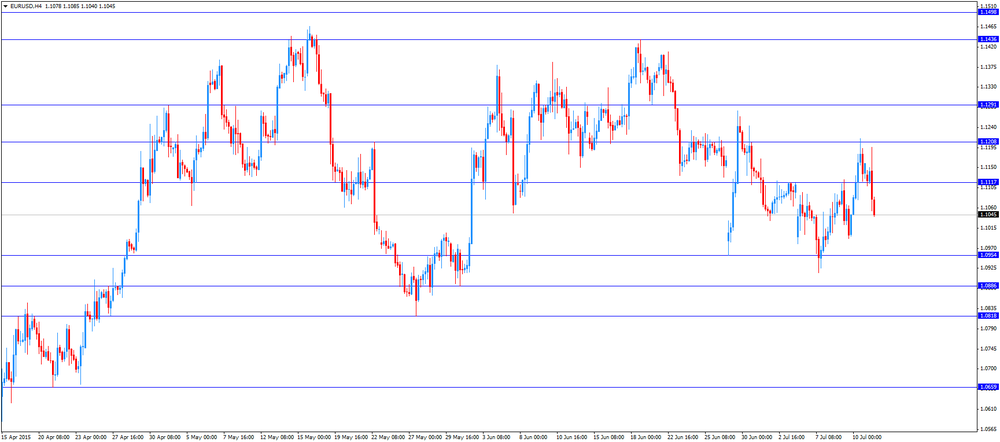

EUR/USD: the currency pair fell to $1.1040

GBP/USD: the currency pair traded mixed

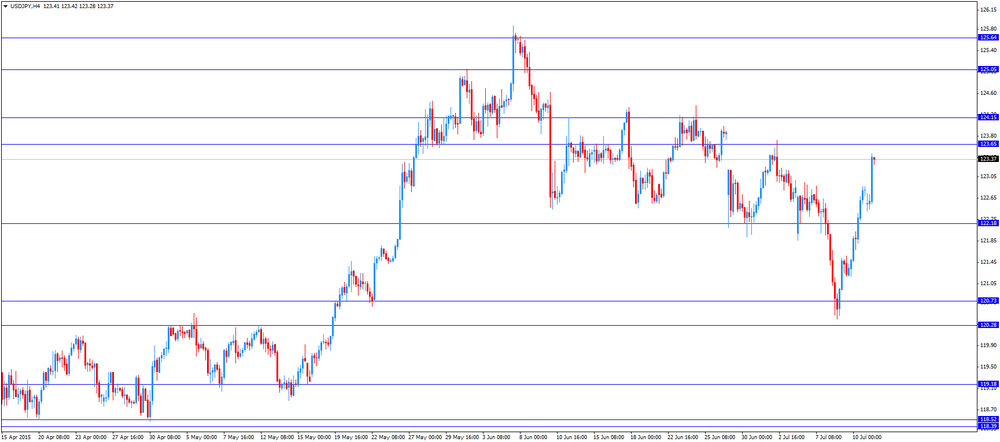

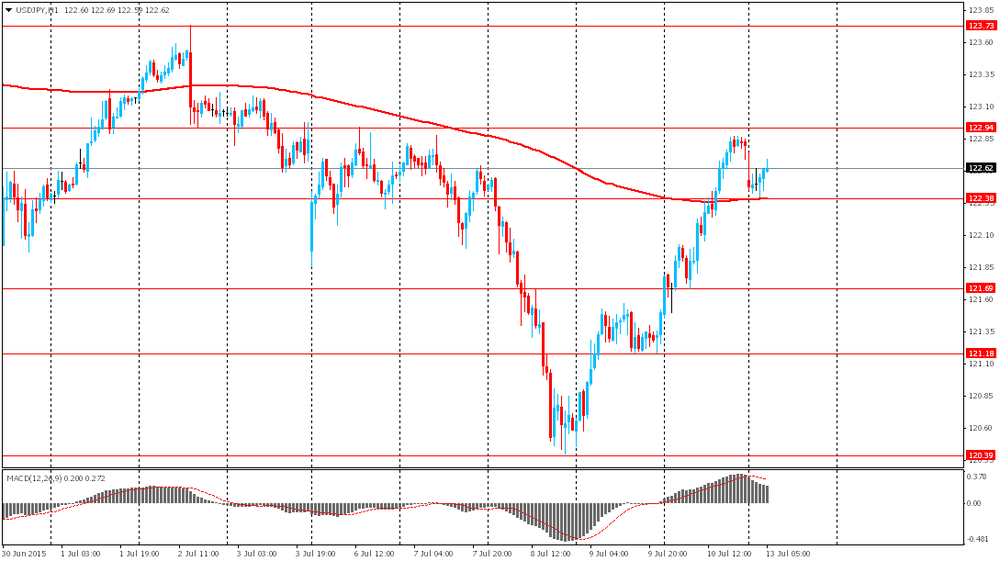

USD/JPY: the currency pair climbed to Y123.48

The most important news that are expected (GMT0):

18:00 U.S. Federal budget June -82.4 51

-

13:50

Orders

EUR/USD

Offers 1.1100 1.1125 1.1140 1.1165 1.1180 1.1200 1.1220-25 1.1245 1.1280 1.1300 1.1330

Bids 1.1050 1.1030 1.1000 1.0980 1.0960 1.0940 1.0925 1.0900 1.0880 1.0850

GBP/USD

Offers 1.5450-60 1.5485 1.5500 1.5520 1.5550 1.5585 1.5600 1.5625 1.5650

Bids 1.5400 1.5375-80 1.5365 1.5350 1.5330 1.5300 1.5285 1.5265 1.5250

EUR/GBP

Offers 0.7150 0.7170 0.7185 0.7200 0.7225-30 0.7240 0.7260 0.7285 0.7300

Bids 0.7120-25 0.7100 0.7085 0.7055-60 0.7040 0.7020 0.7000 0.6980 0.6950

EUR/JPY

Offers 135.80 136.00 136.30 136.50 136.75 137.00 137.50

Bids 136.50 136.20 136.00 135.60 135.30 135.00 134.80 134.50 134.30 134.00

USD/JPY

Offers 123.50 123.80 124.00 124.30 124.50 124.75 125.00

Bids 123.00 122.80 122.50-60 121.85 121.60 121.40 121.20-25 121.00

AUD/USD

Offers 0.7450-60 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600

Bids 0.7400 0.7380 0.7350 0.7330 0.7300

-

11:41

Bank of England’ quarterly Credit Conditions Survey: demand for mortgages in the second quarter rises

The Bank of England released its quarterly Credit Conditions Survey on Monday. Demand for mortgages in the second quarter rose. It was the strongest increase in demand for mortgages since the end of 2013.

According to the report, demand for loans from small and big businesses climbed, and it was expected to increase in the third quarter too.

The demand for credit card lending was little changed in the second quarter.

-

11:28

European Council President Donald Tusk said on Monday that European leaders reached a compromise

European Council President Donald Tusk said on Monday that European leaders reached a compromise on the issue of Greece's exit from the current crisis at the weekend's summit of the Eurozone leaders.

"EuroSummit has unanimously reached agreement. All ready to go for ESM programme for Greece with serious reforms and financial support," he said.

-

11:17

The Greek government should have to pass a series of reforms, including tax and pensions reforms, into law by Wednesday to restore trust

Greece have to implement reforms before the talks on a financial rescue to keep it in the Eurozone could start. The Greek government should have to pass a series of reforms, including tax and pensions reforms, into law by Wednesday to restore trust.

-

11:05

Third Greek bailout programme could be around €86 billion

Officials in Brussels say that the third Greek bailout programme could be around €86 billion. The Greek government has requested a new loan of €53.5 billion over three years.

€16 billion could come from the IMF, the rest - from the European Stability Mechanism, sources have said.

-

10:59

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1060(E412mn), $1.1100(E338mn), $1.1200(E547mn), $1.1250-55(E430mn)

USD/JPY: Y121.00($809mn), Y121.60($260mn), Y122.45($600mn), Y123.00($990mn)

EUR/JPY: Y133.25(E700mn), Y134.00(E272mn)

GBP/USD: $1.5400(Gbp432mn)

EUR/GBP: Gbp0.7150(E300mn)

AUD/USD: $0.7300(A$799mn), $0.7450(A$400mn), $0.7500(A$1.2bn), $0.7550-60(A$331mn)

USD/CAD: C$1.2700($1.1bn), C$1.2800($205mn) -

10:55

Greek Economy Minister George Stathakis: capital controls will remain in place for at least another two months

Greek Economy Minister George Stathakis said on Saturday that capital controls will remain in place for at least another two months.

He also said that the banks could reopen next week if a deal between Greece and its lenders is reached. But restrictions on withdrawals and currency exports would remain in place, Stathakis added.

"That will stay in play for two months or some months," he said.

-

10:44

Boston Fed President Eric Rosengren: the Fed could raise its interest rate in September

Boston Fed President Eric Rosengren said on Friday that the Fed could raise its interest rate at every monetary meeting despite falling oil prices, China's economic slowdown, and the ongoing Greek debt crisis.

"I don't rule out any of the meetings from here on out. If we do continue to get improvement in labour markets, if we do become reasonably confident that we're moving back to 2% inflation, it may be appropriate as early as September," he said.

He added that if labour market unexpectedly weakens, if core inflation starts to decline, or if the wage do not climb, then he would like to wait before to raise the interest rate.

Rosengren is not a voting member of the Federal Open Market Committee this year.

-

10:35

Federal Reserve Chair Janet Yellen expects the interest rate hike by the Fed at some point this year

Federal Reserve Chair Janet Yellen said on Friday that she expects the interest rate hike by the Fed at some point this year. But she added that the U.S. labour market remains week.

"I expect it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy. But I want to emphasize that the course of the economy and inflation remains highly uncertain…," Yellen said.

-

10:21

International Energy Agency’s report: oil prices will fall further due to a massive oversupply

The International Energy Agency (IEA) said in its report on Friday that oil prices will fall further due to a massive oversupply. Global oil supply climbed by 550,000 barrels a day in June to 96.6 million barrels a day, up 3.1 million barrels a day in June last year.

The IEA expects the global oil demand to slow down in 2016.

The agency forecasts the global oil demand in 2016 to decline to 1.2 million barrels per day from an average 1.4 million this year.

-

08:53

Foreign exchange market. Asian session: the euro traded in a narrow range

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Trade Balance, bln June 59.488 55.7 45.6

04:30 Japan Tertiary Industry Index May -0.2% -0.7%

04:30 Japan Industrial Production (MoM) (Finally) May 1.2% -2.2% -2.1%

04:30 Japan Industrial Production (YoY) (Finally) May 0.1% -4.0% -3.9%

The euro traded in a narrow range after Friday's advance. Euro zone leaders decided not to expel Greece from the single currency area in exchange for the country's consent to meet its obligations. Parties agreed that Greece will receive help stepwise. Greece has to "push" 6 reform projects through parliament until July 14. Greek PM Alixis Tsipras said he would go for these projects to persuade its partners to start negotiations on a third bailout program worth €86 billion ($95.5 billion). If Greece meets these conditions German parliament will meet Thursday to provide German chancellor and finance minister with a mandate for negotiations regarding a new loan.

The Australian dollar rose after China (its biggest trading partner) reported that its imports fell 6.1% in June. However traders welcomed this decline as analysts expected a 16.0% drop. Thus the Australian dollar advanced. In June China trade surplus came in at $45.61 billion vs $55.7 billion expected.

EUR/USD: the pair stayed around $1.1110-50 in Asian trade

USD/JPY: the pair fell to Y122.40

GBP/USD: the pair traded around $1.5490-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BOE Credit Conditions Survey Quarter II

09:00 Eurozone Eurogroup Meetings

18:00 U.S. Federal budget June -82.4 51

-

06:54

Options levels on monday, July 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1324 (2305)

$1.1275 (2013)

$1.1237 (885)

Price at time of writing this review: $1.1133

Support levels (open interest**, contracts):

$1.1069 (772)

$1.1035 (1015)

$1.0990 (1225)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 45619 contracts, with the maximum number of contracts with strike price $1,1400 (3327);

- Overall open interest on the PUT options with the expiration date August, 7 is 58718 contracts, with the maximum number of contracts with strike price $1,0800 (5916);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from July, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1712)

$1.5705 (936)

$1.5609 (1719)

Price at time of writing this review: $1.5495

Support levels (open interest**, contracts):

$1.5391 (1111)

$1.5294 (935)

$1.5196 (869)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 19102 contracts, with the maximum number of contracts with strike price $1,5750 (2401);

- Overall open interest on the PUT options with the expiration date August, 7 is 20711 contracts, with the maximum number of contracts with strike price $1,5250 (2075);

- The ratio of PUT/CALL was 1.08 versus 1.04 from the previous trading day according to data from July, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:46

Japan: Tertiary Industry Index , May -0.7%

-

06:32

Japan: Industrial Production (MoM) , May -2.1% (forecast -2.2%)

-

06:32

Japan: Industrial Production (YoY), May -3.9% (forecast -4.0%)

-

04:11

China: Trade Balance, bln, June 45.6 (forecast 55.7)

-

00:28

Currencies. Daily history for Jul 10’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1160 +1,03%

GBP/USD $1,5519 +0,92%

USD/CHF Chf0,9387 -0,94%

USD/JPY Y122,80 +1,06%

EUR/JPY Y136,97 +2,02%

GBP/JPY Y190,55 +1,95%

AUD/USD $0,7442 -0,09%

NZD/USD $0,6723 -0,27%

USD/CAD C$1,2655 -0,37%

-