Noticias del mercado

-

22:01

U.S.: Net Long-term TIC Flows , February $9.8B (forecast 23.4)

-

22:00

U.S.: Total Net TIC Flows, February $4.1B

-

17:47

Federal Reserve Bank of St. Louis President James Bullard: that the Fed should raise its interest rate soon

The Federal Reserve Bank of St. Louis President James Bullard said on Wednesday that the Fed should raise its interest rate soon. He added that the interest rate is needed to boost the U.S. economy.

"Now may be a good time to begin normalizing monetary policy so that it is set appropriately for an improving economy over the next couple of years," Bullard said.

The Federal Reserve Bank of St. Louis president pointed out that the combination of a coming boom in the U.S. economy and low interest rates could lead to asset market bubbles.

He expects that the unemployment rate in the U.S. will decline below 5%.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

17:02

Bank of Canada kept its interest rate unchanged at 0.75%, the economy is expected to expand at about 2.5% on a quarterly basis in the second quarter

The Bank of Canada (BoC) announced its interest rate decision on Wednesday. The BoC kept its interest rate unchanged at 0.75%. This decision was expected by analysts.

Canada's central bank said that the consumer price inflation is 1.0% due to falling energy prices, while the core consumer price inflation is close to 2%.

The BoC noted that the economy has stalled in the first quarter of 2015. The economy is expected to expand at about 2.5% on a quarterly basis in the second quarter until the middle of 2016.

The central bank expects real GDP to grow at 1.9% in 2015, 2.5% in 2016, and 2.0% in 2017.

The central bank also said that risks to the outlook for inflation are now balanced and risks to financial stability are evolving as expected.

The BoC decided that the current monetary policy remains appropriate.

-

16:41

NAHB housing market index climbs to 56 in April

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Wednesday. The NAHB housing market index climbed to 56 in April from 52 in March. March's figure was revised down from 53.

Analysts had expected the index to rise to 55.

The index increased as new home sales jumped.

A level above 50.0 is considered positive, below indicates a negative outlook.

"As the spring buying season gets underway, home builders are confident that current low interest rates and continued job growth will draw consumers to the market," the NAHB Chairman Tom Woods said.

The NAHB Chief Economist, David Crowe noted that builders are optimistic that the housing market will strengthen in 2015.

-

16:30

U.S.: Crude Oil Inventories, April 1.294M

-

16:21

European Central Bank President Mario Draghi: there are signs that quantitative easing by the central bank has been effective

The European Central Bank (ECB) President Mario Draghi said at a press conference on Wednesday that there are signs that quantitative easing by the central bank has been effective. He added that the economy in the Eurozone "has gained further momentum since the end of 2014".

Draghi pointed out the need to complete the full asset-buying programme. "The full implementation of all our monetary policy measures will provide the necessary support to the euro area recovery and bring inflation rates towards levels below, but close to, 2% in the medium term," the ECB president said.

Draghi dismissed concerns that the central bank will not find enough bonds to purchase.

The ECB president noted that there is no evidence for asset bubbles.

-

16:00

U.S.: NAHB Housing Market Index, April 56 (forecast 55)

-

16:00

Canada: Bank of Canada Rate, 0.75% (forecast 0.75%)

-

15:58

U.S. industrial production declines 0.6% in March

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production dropped 0.6% in March, missing expectations for a 0.2% decrease, after a 0.1% rise in February.

The decline was driven by lower output of utilities. Utility output plunged by 5.9% in March.

Mining output dropped by 0.7% in March.

The U.S. manufacturing production increased 0.1% in March. It was the first gain since November 2014.

Capacity utilisation rate fell to 78.4% in March from 79.0% in February. February's figure was revised up 78.9% Analysts had expected a capacity utilisation rate of 78.7%.

The Fed tend to use capacity utilisation as a signal of how much "slack" remains in the economy.

These figures are pointing to a slower economic growth in the U.S. in the first quarter.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0300(E1.6bn), $1.0400(E630mn), $1.0500(E631mn), $1.0600 (E426mn)

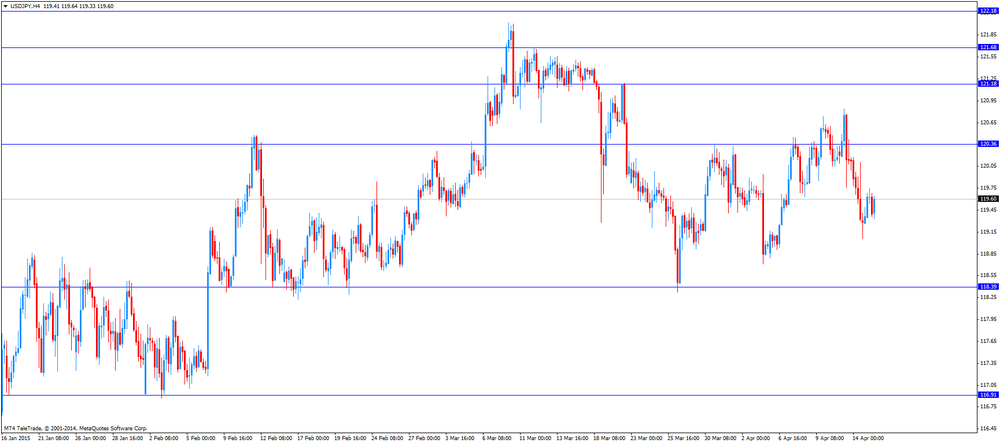

USD/JPY: Y118.00($332mn), Y120.00($345mn), Y120.15($1.13bn), Y121.00($780mn)

GBP/USD: $1.4400(Gbp479mn), $1.4700(Gbp734mn)

AUD/USD: $0.7600(A$371mn), $0.7675(A$485mn)

NZD/USD: $0.7500(NZ$288mn)

USD/CAD: C$1.2400($418mn), C$1.2700($535mn)

-

15:41

NY Fed Empire State manufacturing index declines to -1.19 in April

The New York Federal Reserve released its survey on Wednesday. The NY Fed Empire State manufacturing index declined to -1.19 in April from 6.90 in March, missing expectations for a rise to 7.0. It was the first negative reading since December 2014.

The decline was driven by a drop in new orders. The new orders index plunged to -6.0 in April from -2.39 in March.

"Many of the indexes assessing the six-month outlook conveyed more optimism about future business activity than they had in February and March," the report said.

The price-paid index increased to 19.15 in April from 12.37 in March.

The index for the number of employees decreased to 9.57 in April from 18.56 last month.

The general business conditions expectations index for the next six months climbed to 37.06 in April from 30.72 in March.

-

15:18

Canadian manufacturing shipments drops 1.7% in February

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments dropped 1.7% in February, missing forecasts of a 1.2% increase, after a 3.0% decrease in January.

January's figure was revised down from a 1.7% decline.

The decline was driven by a drop in the production of aerospace products and parts and lower sales of motor vehicles. Sales of motor vehicles slid 15.0% in February, while sales of aerospace products dropped 26%.

Sales of petroleum products rose 5.7% in February, while sales of chemical products climbed 8.2%.

Sales declined in 10 of 21 categories.

-

15:15

U.S.: Capacity Utilization, March 78.4% (forecast 78.7%)

-

15:15

U.S.: Industrial Production (MoM), March -0.6% (forecast -0.2%)

-

14:42

OECD: Japan should implement structural reforms to boost economy

The OECD said on Wednesday that Japan should be aware of risks of its quantitative and qualitative easing (QQE), and should implement structural reforms to boost economy. The OECD also urged Japan to boost labour productivity and remove trade barriers.

The OECD pointed out that no additional monetary easing was necessary.

-

14:32

U.S.: NY Fed Empire State manufacturing index , April -1.2 (forecast 7.0)

-

14:30

Canada: Manufacturing Shipments (MoM), February -1.7% (forecast 0.2%)

-

14:25

Foreign exchange market. European session: the euro traded lower against the U.S. dollar ahead of the European Central Bank’s (ECB) press conference

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Food Prices Index, m/m March -0.7% 0.1%

00:45 New Zealand Food Prices Index, y/y March 1.5% 1.9%

02:30 Australia Westpac Consumer Confidence April -1.2% -3.2%

04:00 China Retail Sales y/y March 10.7% 10.9% 10.2%

04:00 China Industrial Production y/y March 6.8% 6.9% 5.6%

04:00 China Fixed Asset Investment February 13.9% 13.9% 13.5%

04:00 China GDP q/q Quarter I 1.5% 1.4% 1.3%

04:00 China GDP y/y Quarter I 7.3% 7.0% 7.0%

06:30 Japan Industrial Production (MoM) (Finally) February -3.4% -3.1% -3.1%

06:30 Japan Industrial Production (YoY) February -2.6% -2.0%

08:00 Germany CPI, m/m (Finally) March 0.5% 0.5% 0.5%

08:00 Germany CPI, y/y (Finally) March 0.3% 0.3% 0.3%

08:45 France CPI, m/m March 0.7% 0.7% 0.7%

08:45 France CPI, y/y March -0.3% -0.1%

11:00 Eurozone Trade balance unadjusted February 7.6 €20.3B

13:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to rise to 7.0 in April from 6.9 in March.

The NAHB housing market index is expected to climb to 55 in April from 53 in March.

The U.S. industrial production is expected to drop 0.2% in March, after a 0.1% rise in February.

The euro traded lower against the U.S. dollar ahead of the European Central Bank's (ECB) press conference. Earlier today, the ECB released its interest decision. The central bank kept its interest rate unchanged at 0.05%.

Eurozone's unadjusted trade surplus jumped to €20.3 billion in February from €7.6 billion in January. January's figure was revised down from a surplus of €7.9 billion.

Exports climbed by 4% due to a weaker euro, while imports were flat.

Concerns over Greece's debt problems continue to weigh on the euro. The Greek Finance Minister Yanis Varoufakis is to meet U.S. President Barack Obama in Washington on Thursday.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's (BoC) interest rate decision. Analysts expect the Bank of Canada to keep unchanged its interest rate at 0.75%.

Canada's manufacturing shipments are expected to increase 0.2% in February, after a 1.7% drop in January.

EUR/USD: the currency pair decreased to $1.0570

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:30 Eurozone ECB Press Conference

14:30 Canada Manufacturing Shipments (MoM) February -1.7% 0.2%

14:30 U.S. NY Fed Empire State manufacturing index April 6.9 7.0

15:15 U.S. Industrial Production (MoM) March 0.1% -0.2%

15:15 U.S. Industrial Production YoY March 3.5%

15:15 U.S. Capacity Utilization March 78.9% 78.7%

16:00 Canada Bank of Canada Rate 0.75% 0.75%

16:00 Canada BOC Rate Statement

16:00 Canada Bank of Canada Monetary Policy Report

16:00 U.S. NAHB Housing Market Index April 53 55

17:15 Canada BOC Press Conference

20:00 U.S. Fed's Beige Book

-

14:10

Eurozone's unadjusted trade surplus soars to €20.3 billion in February

Eurozone's unadjusted trade surplus jumped to €20.3 billion in February from €7.6 billion in January. January's figure was revised down from a surplus of €7.9 billion.

Exports climbed by 4% due to a weaker euro, while imports were flat.

-

14:00

Orders

EUR/USD

Offers 1.0640 1.0660 1.0680 1.0700 1.0725-30 1.0760 1.0780 1.0800

Bids 1.0600 1.0580 1.0560 1.0525-30 1.0500 1.0460-70 1.0435

GBP/USD

Offers 1.4780 1.4800 1.4825-30 1.4860 1.4885 1.4900

Bids 1.4720-25 1.4700 1.4680 1.4650 1.4625 1.4600 1.4585 1.4555-60 1.4525-30

EUR/JPY

Offers 127.20 127.50 127.80 128.00 128.60

Bids 126.50 126.00 125.80 125.50 125.30 125.00

USD/JPY

Offers 119.75-80 120.00 120.20 120.50 120.65 120.80-85 121.00

Bids 119.35-40 119.20 119.00 118.85 118.55-60

EUR/GBP

Offers 0.7220-25 0.7250-55 0.7270 0.7285 0.7300 0.7320-25 0.7350

Bids 0.7180-85 0.7165 0.7150 0.7135 0.7115 0.7100

AUD/USD

Offers 0.7620-25 0.7650 0.7680 0.7700 0.7720-25 0.7750

Bids 0.7570-75 0.7550 0.7530 0.7500 0.7485

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

11:27

China’s gross domestic product (GDP) grew at an annual rate of 7.0% in the first quarter of 2015

The National Bureau of Statistics (NBS) said on Wednesday that China's gross domestic product (GDP) grew at an annual rate of 7.0% in the first quarter of 2015, in line with expectations, down from a 7.3% in the fourth quarter of 2014.

It was the slowest pace since the first quarter of 2009.

"Despite the slowing down of economic growth, employment, consumer price and market expectation remained stable," the NBS said.

"Positive factors were accumulating with restructuring work advancing steadily, transformation and upgrading showing good momentum, and new impetus experiencing rapid development," the NBS added.

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0300(E1.6bn), $1.0400(E630mn), $1.0500(E631mn), $1.0600 (E426mn)

USD/JPY: Y118.00($332mn), Y120.00($345mn), Y120.15($1.13bn), Y121.00($780mn)

GBP/USD: $1.4400(Gbp479mn), $1.4700(Gbp734mn)

AUD/USD: $0.7600(A$371mn), $0.7675(A$485mn)

NZD/USD: $0.7500(NZ$288mn)

USD/CAD: C$1.2400($418mn), C$1.2700($535mn)

-

11:00

Eurozone: Trade balance unadjusted, February €20.3B

-

10:53

European Central Bank raised the amount the Greek central bank can lend its banks to €74 billion

The European Central Bank (ECB) on Tuesday raised the amount the Greek central bank can lend its banks to €74 billion from €73.2 billion the previous week, according to a Greek bank official. The ECB declined to comment.

Earlier on Tuesday, a report said that Greece was preparing for a debt default if the government did not reach a deal with its creditors by the end of the month. Greece denied the report.

-

08:47

France: CPI, y/y, March -0.1%

-

08:45

France: CPI, m/m, March 0.7% (forecast 0.7%)

-

08:19

Options levels on wednesday, April 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0791 (1124)

$1.0752 (557)

$1.0712 (69)

Price at time of writing this review: $1.0633

Support levels (open interest**, contracts):

$1.0596 (2264)

$1.0553 (4495)

$1.0498 (4536)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 55129 contracts, with the maximum number of contracts with strike price $1,1200 (5964);

- Overall open interest on the PUT options with the expiration date May, 8 is 71187 contracts, with the maximum number of contracts with strike price $1,0000 (8981);

- The ratio of PUT/CALL was 1.29 versus 1.30 from the previous trading day according to data from April, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5008 (2441)

$1.4911 (741)

$1.4816 (1272)

Price at time of writing this review: $1.4758

Support levels (open interest**, contracts):

$1.4686 (2876)

$1.4590 (829)

$1.4492 (1734)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 22618 contracts, with the maximum number of contracts with strike price $1,5000 (2441);

- Overall open interest on the PUT options with the expiration date May, 8 is 29309 contracts, with the maximum number of contracts with strike price $1,4700 (2876);

- The ratio of PUT/CALL was 1.30 versus 1.32 from the previous trading day according to data from April, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: CPI, m/m, March 0.5% (forecast 0.5%)

-

08:00

Germany: CPI, y/y , March 0.3% (forecast 0.3%)

-

06:46

Japan: Industrial Production (MoM) , February -3.1% (forecast -3.1%)

-

04:03

China: GDP q/q, Quarter I 1.3% (forecast 1.4%)

-

04:02

China: Fixed Asset Investment, February 13.5% (forecast 13.9%)

-

04:01

China: Retail Sales y/y, March 10.2% (forecast 10.9%)

-

04:00

China: GDP y/y, Quarter I 7.0% (forecast 7.0%)

-

04:00

China: Industrial Production y/y, March 5.6% (forecast 6.9%)

-

02:31

Australia: Westpac Consumer Confidence, April -3.2%

-

00:59

New Zealand: Food Prices Index, y/y, March 1.9%

-

00:47

New Zealand: Food Prices Index, m/m, March 0.1%

-

00:32

Currencies. Daily history for Apr 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0654 +0,81%

GBP/USD $1,4775 +0,70%

USD/CHF Chf0,9725 -0,53%

USD/JPY Y119,35 -0,65%

EUR/JPY Y127,17 +0,18%

GBP/JPY Y176,35 +0,08%

AUD/USD $0,7623 +0,51%

NZD/USD $0,7518 +0,90%

USD/CAD C$1,2489 -3,69%

-

00:12

U.S.: API Crude Oil Inventories, April 2.6

-

00:01

Schedule for today, Wednesday, Apr 15’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence April -1.2%

02:00 China Retail Sales y/y March 10.7% 10.9%

02:00 China Industrial Production y/y March 6.8% 6.9%

02:00 China Fixed Asset Investment February 13.9% 13.9%

02:00 China GDP q/q Quarter I 1.5% 1.4%

02:00 China GDP y/y Quarter I 7.3% 7.0%

04:30 Japan Industrial Production (MoM) (Finally) February -3.4% -3.1%

04:30 Japan Industrial Production (YoY) February -2.6%

06:00 Germany CPI, m/m (Finally) March 0.5% 0.5%

06:00 Germany CPI, y/y (Finally) March 0.3% 0.3%

06:45 France CPI, m/m March 0.7% 0.7%

06:45 France CPI, y/y March -0.3%

09:00 Eurozone Trade balance unadjusted February 7.9

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Manufacturing Shipments (MoM) February -1.7% 0.2%

12:30 U.S. NY Fed Empire State manufacturing index April 6.9 7.0

13:15 U.S. Industrial Production (MoM) March 0.1% -0.2%

13:15 U.S. Industrial Production YoY March 3.5%

13:15 U.S. Capacity Utilization March 78.9% 78.7%

14:00 Canada Bank of Canada Rate 0.75% 0.75%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Monetary Policy Report

14:00 U.S. NAHB Housing Market Index April 53 55

14:30 U.S. Crude Oil Inventories April 10.9

15:15 Canada BOC Press Conference

18:00 U.S. Fed's Beige Book

20:00 U.S. Total Net TIC Flows February 88.3

20:00 U.S. Net Long-term TIC Flows February -27.2 23.4

22:30 New Zealand Business NZ PMI March 55.9

23:01 United Kingdom RICS House Price Balance March 14% 15%

23:30 U.S. FOMC Member Laсker Speaks

-