Noticias del mercado

-

23:45

New Zealand: CPI, y/y, Quarter III 0.4% (forecast 0.3%)

-

23:45

New Zealand: CPI, q/q , Quarter III 0.3% (forecast 0.2%)

-

20:20

American focus: the dollar rose after the release of US inflation data

The US dollar strengthened against the major currencies after data on inflation and the US labor market. The report submitted by the Ministry of Labour showed that consumer prices in September fell slightly compared to August, but remained unchanged in annual terms.

According to the data, the seasonally adjusted consumer price index fell 0.2% in September. Meanwhile, the core index, which excludes prices of food and energy categories, rose 0.2%. Economists had expected overall prices decreased by 0.2% and the core index increased only 0.1%. In annual terms, prices have not changed, but the core index rose by 1.9%. It forecasts a decline of 0.1% and growth of 1.8%, respectively.

The Labor Department reported that, as in previous months, the decline in oil prices had the greatest pressure on inflation in September. The economic slowdown in China and emerging markets, coupled with the expectation of the Fed raising interest rates, as did the US dollar is stronger, leading to cheaper imports.

The report also showed that the index of energy prices fell by 4.7% in September, the head of which stood a reduction in the cost of gasoline (by 9% to a seasonally adjusted). Over the past year energy prices fell by 18.4%, and gasoline prices have fallen by 29.6%. Meanwhile, the cost of food rose in September by 0.4% MoM and 1.6% per annum. Housing costs rose by 3.2% per annum, and the cost of public services, excluding energy rose 2.7%.

Too low inflation has become a major problem for Fed officials to discuss when to begin raising interest rates, which remain unchanged from 2008. Fed Chairman Yellen and other officials said they are waiting for clear signs of inflation to start raising rates.

In addition, the US Department of Labor said the number of Americans who first applied for unemployment benefits, sharply decreased last week, while reaching the lowest level in more than 40 years.

According to the report for the week ended October 10, the number of initial applications for unemployment benefits fell by 7,000 (seasonally adjusted) and reached 255 000, which is the lowest since November 1973. Economists had expected 270,000 new claims. The figure for the previous week was revised downward - to 262 000 to 263 000. It is worth emphasizing the number of calls remained below the psychological threshold of 300 000 for 32 th consecutive week, which is the longest series in more than 40 years. Also, the Labor Department said that there were no special factors influencing the latest weekly data.

Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly figures, dropped to 2250 - up to 265 000 (the lowest figure since December 1973). Meanwhile, the number of people who continue to receive unemployment benefits fell by 50,000 to 2.158 million. For the week ended October 3rd. Recall data on re-treatment come with a week delay

The euro earlier fell sharply against the US dollar, the main pressure exerted statements by the European Central Bank Ewald Nowotny. He noted that the ECB does not hold out much to the inflation target, in connection with which the regulator requires a new set of tools. "It is clear that we need additional tools," - said Nowotny, stressing that the basic inflation indicators are also below the target mark, so that new instruments should include structural measures. Recall that in September, consumer prices fell by 0.1% per annum. The decrease in prices occurred for the first time since March, when the ECB began a program of asset purchases, which gave rise to speculation about a possible continuation or increase in the program.

According to the latest forecasts of the ECB at the end of 2015 inflation will be at 0.1 percent and will rise to 1.1 percent next year. "Thus, we are clearly not up to the target value. The main reason for low inflation is the sharp fall in oil prices and raw materials - said Nowotny. - It is obvious that in this situation need a strong economic growth, which should help reduce the unemployment rate and bring inflation to the target level. "

-

17:00

U.S.: Crude Oil Inventories, October 7.562 (forecast 2.5)

-

16:15

Philadelphia Federal Reserve Bank’s manufacturing index is up to -4.5 in October

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to -4.5 in October from -6.0 in September, missing expectations for a rise to -1.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"For the second consecutive month, regional manufacturers reported declines in overall activity. Indexes for new orders, shipments, employment, and average work hours all dipped into negative territory this month," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was down -6.1 in October from 14.8 in September.

The new orders index increased to 10.6 in October from 9.4 in September.

The prices paid index slid to -0.1 in October from 0.5 in September, while the prices received index increased to 1.3 from -5.0.

The number of employees index dropped to -1.7 in October from 10.2 last month.

According to the report, the future general activity index was down to 36.7 in October from 44.0 in September.

-

16:00

Fitch Ratings: New Zealand’s budget surplus “underscores the positive outlook on the sovereign's 'AA' rating”

Fitch Ratings said on Thursday that New Zealand's budget surplus "underscores the positive outlook on the sovereign's 'AA' rating".

The New Zealand government reached its budget surplus in the fiscal year ending June 30. It was the first budget surplus since 2008. The budget surplus was driven by stronger-than-expected tax revenue.

"Fitch believes that some of the improvement in revenue may be sustained into FY16. But the outlook for the dairy sector, and the implications for the wider economy, will be an important determinant of revenue growth," the agency said in its statement.

-

16:00

U.S.: Philadelphia Fed Manufacturing Survey, October -4.5 (forecast -1)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.00 (USD 268m) 120.00 (501m) 120.35 (300m)

EUR/USD 1.1300 (EUR 312m) 1.1365 (324m)

USD/CAD 1.3000 (USD 595m) 1.3050 (466m) 1.3100 (785m)

AUD/USD 0.7200 (AUD 537m) 0.7250 (391m) 0.7300 (1bln)

-

15:15

NY Fed Empire State manufacturing index rises to -11.36 in October

The New York Federal Reserve released its survey on Thursday. The NY Fed Empire State manufacturing index rose to -11.36 in October from -14.67 in September, missing expectations for an increase to -8.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

The new orders index decreased to -18.91 in October from -12.90 in September, while the shipments index climbed to -13.61 from -7.9.

The general business conditions expectations index for the next six months increased to 23.6 in October from 23.2 in September.

The price-paid index decreased to 0.94 in October from 4.1 in September.

The index for the number of employees fell to -8.5 in October from -6.2 last month.

-

15:04

U.S. consumer price inflation falls 0.2% in September

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

Food prices increased 0.4% in September. It was the largest rise since May 2014.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

-

14:41

Initial jobless claims decrease by 7,000 to 255,000 in the week ending October 10

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 10 in the U.S. declined by 7,000 to 255,000 from 262,000 in the previous week. The previous week's figure was revised down from 263,000.

Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 32th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 50,000 to 2,158,000 in the week ended October 03. It was the lowest level since November 2000.

-

14:30

U.S.: CPI excluding food and energy, Y/Y, September 1.9% (forecast 1.8%)

-

14:30

U.S.: Initial Jobless Claims, October 255 (forecast 270)

-

14:30

U.S.: CPI, Y/Y, September 0.0% (forecast -0.1%)

-

14:30

U.S.: CPI excluding food and energy, m/m, September 0.2% (forecast 0.1%)

-

14:30

U.S.: Continuing Jobless Claims, October 2158 (forecast 2195)

-

14:30

U.S.: CPI, m/m , September -0.2% (forecast -0.2%)

-

14:30

U.S.: NY Fed Empire State manufacturing index , October -11.36 (forecast -8)

-

14:19

People's Bank of China: bank lending in China rises to 1.05 trillion yuan in September

The People's Bank of China (PBoC) said on Thursday that bank lending in China rose to 1.05 trillion yuan ($165.5 billion) in September from CNY809.6 billion in August.

Total social financing climbed to 1.3 trillion yuan in September from 1.08 trillion yuan in August.

M2 money supply jumped 13.1% year-on-year in September, after a 13.3% gain in August.

-

14:09

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October 3.2% 3.5%

00:30 Australia New Motor Vehicle Sales (MoM) September -1.7% Revised From -1.6% 5.5%

00:30 Australia New Motor Vehicle Sales (YoY) September 2.6% Revised From 2.1% 7.7%

00:30 Australia Unemployment rate September 6.2% 6.3% 6.2%

00:30 Australia Changing the number of employed September 18 Revised From 17.4 5 -5.1

04:30 Japan Industrial Production (MoM) (Finally) August -0.8% -0.5% -1.2%

04:30 Japan Industrial Production (YoY) (Finally) August 0.0% 0.2% -0.4%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. consumer price inflation is expected to decline to -0.1% year-on-year in September from 0.2% in August.

The U.S. consumer price index excluding food and energy is expected to remain unchanged 1.8% year-on-year in September.

The number of initial jobless claims in the U.S. is expected to rise by 7,000 270,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -1.0 in October from -6.0 in September.

The FOMC member Dudley will speak at 14:30 GMT.

The euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny. He said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

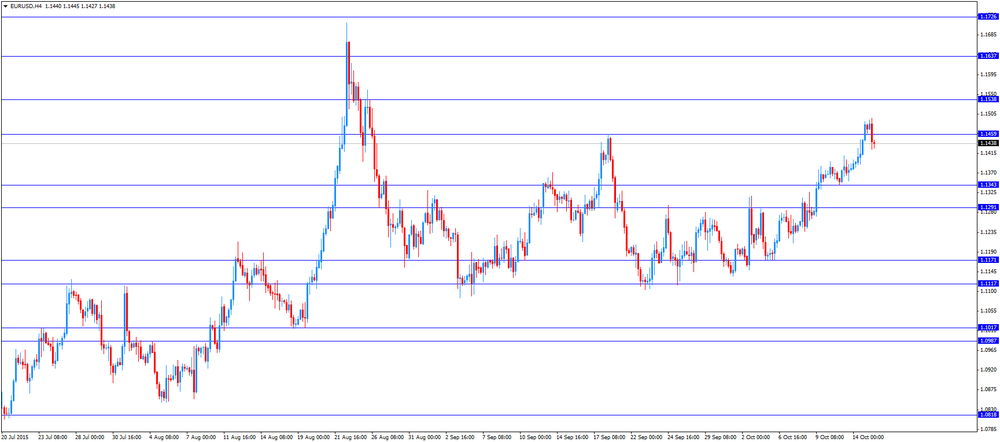

EUR/USD: the currency pair fell to $1.1424

GBP/USD: the currency pair traded mixed

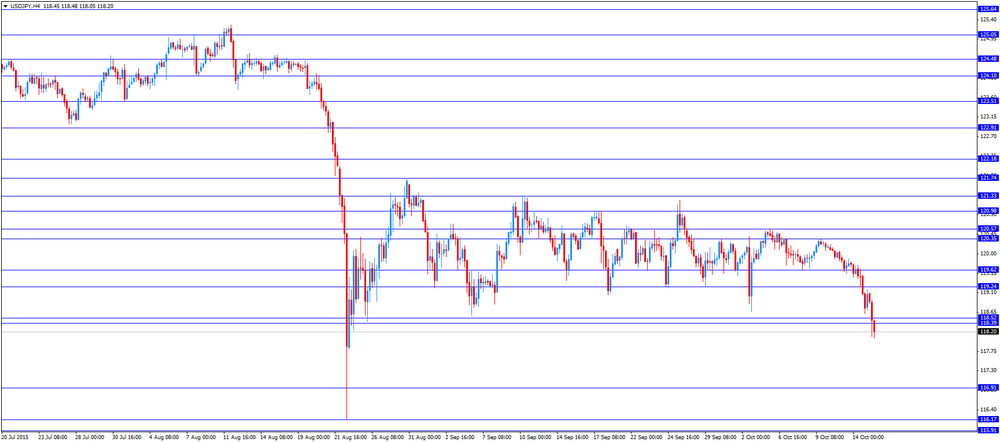

USD/JPY: the currency pair declined to Y118.05

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index October -14.67 -8

12:30 U.S. Initial Jobless Claims October 263 270

12:30 U.S. CPI, m/m September -0.1% -0.2%

12:30 U.S. CPI, Y/Y September 0.2% -0.1%

12:30 U.S. CPI excluding food and energy, m/m September 0.1% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y September 1.8% 1.8%

14:00 U.S. Philadelphia Fed Manufacturing Survey October -6.0 -1

14:30 U.S. FOMC Member Dudley Speak

21:45 New Zealand CPI, q/q Quarter III 0.4% 0.2%

21:45 New Zealand CPI, y/y Quarter III 0.4% 0.3%

-

13:50

Orders

EUR/USD

Offers 1.1500 1.1520 1.1535 1.1550 1.1575 1.1600 1.1620 1.1650

Bids 1.1465 1.1440 1.1425 1.1400-10 1.1380-85 1.1355-60 1.1330 1.1300

GBP/USD

Offers 1.5500-10 1.5530 1.5550 1.5565 1.5585 1.5600 1.5625-30 1.5650

Bids 1.5460 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7425-30 0.7450 0.7475-80 0.7500 0.7525-30 0.7550

Bids 0.7385-90 0.7365 0.7350 0.7330-35 0.7300

EUR/JPY

Offers 135.80 136.00 136.50 136.75 137.00 137.25 137.50

Bids 135.25 135.00 134.80 134.50 134.30 134.00 133.75 133.50

USD/JPY

Offers 119.00 119.20 119.50 119.80-85 120.00 120.20 120.35 120.50

Bids 118.65-70 118.50 118.30 118.00 117.85 117.50 117.30 117.00

AUD/USD

Offers 0.7350 0.7375 0.7400 0.7425 0.7450 0.7475 0.7500-10

Bids 0.7320 0.7300 0.7285 0.7260 0.7240 0.7220 0.7200 0.7185 0.7150

-

11:49

Final industrial production in Japan declines 1.2% in August

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Thursday. Final industrial production in Japan declined 1.2% in August, down from the preliminary estimate of a 0.5% decrease, after a 0.8% drop in July.

On a yearly basis, Japan's industrial production was down 0.4% in August, down from the preliminary estimate of a 0.2% increase, after a flat reading in July.

The output at factories and mines was revised down to 96.3 from the preliminary reading of 97.0.

Industrial shipments were downgraded to a 0.7% fall from the preliminary 0.5% decline, while inventories were revised down to a 0.3% rise from the preliminary 0.4% increase.

-

11:26

Business NZ performance of manufacturing index for New Zealand rises to 55.4 in September

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 55.4 in September from 55.1 in August. It was the highest level since February.

August's figure was revised up from 55.0.

A reading above 50 indicates expansion in the manufacturing sector.

The increase was mainly driven by a rise in the production and new orders.

"Production was at its highest level since December last year, while new orders continued to improve. Overall, this should flow through into healthy results for the last quarter of the year," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

11:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.00 (USD 268m) 120.00 (501m) 120.35 (300m)

EUR/USD 1.1300 (EUR 312m) 1.1365 (324m)

USD/CAD 1.3000 (USD 595m) 1.3050 (466m) 1.3100 (785m)

AUD/USD 0.7200 (AUD 537m) 0.7250 (391m) 0.7300 (1bln)

-

11:08

European Central Bank Vice President Vitor Constancio: the exit from the zero interest rate policy may have spillover on other countries in the short terms

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

"Global challenges require both domestic and global responses to ensure that the global financial system becomes more resilient," he concluded.

-

10:55

European Central Bank Governing Council Member Ewald Nowotny: further stimulus measures are needed as the central bank’s inflation target will be missed

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

-

10:43

Richmond Federal Reserve President Jeffrey Lacker notes his outlook for the U.S. economy has not changed since September despite the recent weak economic data

Richmond Federal Reserve President Jeffrey Lacker said in an interview with Fox Business Network on Wednesday that his outlook for the U.S. economy has not changed since September despite the recent weak economic data.

"My views haven't changed much since September," he said.

But he did not said if he will vote for the interest rate hike at the Fed's monetary policy meeting in October. Lacker was only one FOMC official who voted for the interest rate hike in September.

Richmond Federal Reserve president pointed out that interest rates should higher than they are now.

"The higher sustained growth we've seen in real consumer spending strongly suggests that real interest rates need to be higher than they are now," he said.

-

10:35

Beige Book: the U.S. economic activity continued to grow modestly from mid-August through early October

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from mid-August through early October, but a strong U.S. dollar and the slowdown in the Chinese economy weighed on the manufacturing sector in the U.S.

The New York, Philadelphia, Cleveland, Atlanta, Chicago, and St. Louis Districts expanded modestly, the Minneapolis, Dallas, and San Francisco Districts grew moderately, Boston's and Richmond's activity rose, while Kansas City' activity declined.

The Fed noted that labour markets tightened in most districts, but wage growth was mostly subdued.

-

10:23

UBS Group AG expects central bank and sovereign wealth fund assets to decline by $1.2 trillion by the end of the year

UBS Group AG said on Tuesday that it expects central bank and sovereign wealth fund assets will decline by $1.2 trillion by the end of the year as China and oil-producing countries including Russia and Saudi Arabia use their foreign exchange reserves to boost the economic growth.

Massimiliano Castelli, head of global strategy at UBS Asset Management, said in a phone interview with Bloomberg on Tuesday that the decline in sovereign assets is likely to continue into next year.

UBS said that central banks and sovereign wealth funds totalled more than $18 trillion at the end of 2014.

-

10:10

Australia's unemployment rate remains unchanged at 6.2% in September

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 6.2% in September, beating expectations for a rise to 6.3%. The number of employed people in Australia declined by 5,100 in September, missing forecast of a rise by 5,000, after a gain by 18,000 in August. August's figure was revised up from a rise by 17,400.

Full-time employment fell by 13,900 in September, while part-time employment climbed by 8,900.

The participation rate declined to 64.9% in September from 65.0% in August.

-

08:33

Options levels on thursday, October 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1579 (1892)

$1.1543 (2355)

$1.1519 (1322)

Price at time of writing this review: $1.1487

Support levels (open interest**, contracts):

$1.1443 (250)

$1.1409 (162)

$1.1360 (782)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 33663 contracts, with the maximum number of contracts with strike price $1,1500 (3016);

- Overall open interest on the PUT options with the expiration date November, 6 is 45126 contracts, with the maximum number of contracts with strike price $1,1200 (4624);

- The ratio of PUT/CALL was 1.34 versus 1.30 from the previous trading day according to data from October, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (508)

$1.5606 (977)

$1.5510 (1928)

Price at time of writing this review: $1.5486

Support levels (open interest**, contracts):

$1.5392 (552)

$1.5295 (2321)

$1.5197 (2069)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 18567 contracts, with the maximum number of contracts with strike price $1,5350 (2606);

- Overall open interest on the PUT options with the expiration date November, 6 is 18725 contracts, with the maximum number of contracts with strike price $1,5300 (2321);

- The ratio of PUT/CALL was 1.01 versus 1.00 from the previous trading day according to data from October, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:32

Japan: Industrial Production (YoY), August -0.4% (forecast 0.2%)

-

06:31

Japan: Industrial Production (MoM) , August -1.2% (forecast -0.5%)

-

02:46

Australia: New Motor Vehicle Sales (YoY) , September 7.7%

-

02:32

Australia: New Motor Vehicle Sales (MoM) , September 5.5%

-

02:31

Australia: Changing the number of employed, September -5.1 (forecast 5)

-

02:31

Australia: Changing the number of employed, September -5.1 (forecast 5)

-

02:30

Australia: Unemployment rate, September 6.2% (forecast 6.3%)

-

02:01

Australia: Consumer Inflation Expectation, October 3.5%

-

00:32

Currencies. Daily history for Oct 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1481 +0,87%

GBP/USD $1,5479 +1,48%

USD/CHF Chf0,9491 -0,90%

USD/JPY Y118,75 -0,85%

EUR/JPY Y136,33 +0,02%

GBP/JPY Y183,82 +0,65%

AUD/USD $0,7305 +1,33%

NZD/USD $0,6800 2,47%

USD/CAD C$1,2926 -0,78%

-