Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,146.38 +28.10 +0.46% CAC 40 4,804.31 -3.64 -0.08% DAX 10,713.23 +4.83 +0.05%

-

17:18

Bundesbank’s monthly report: there is no risk of a drop in the global economy

The Bundesbank said in its monthly report on Monday that there is no risk of a drop in the global economy.

"A noticeable easing in economic growth or even a slump in the global economy, as has been expressed in the public debate about developments in some emerging markets, is not apparent," the Bundesbank said.

The Bundesbank noted that the slowdown in the global economy this year was driven by a weak economy in commodity-producing countries as commodity prices slid.

The German economy is expected to expand moderately, driven by consumer demand.

-

17:01

European Central Bank Vice President Vitor Constancio: terror attacks in Paris could have a negative impact on markets

The European Central Bank (ECB) Vice President Vitor Constancio said in Frankfurt on Monday that terror attacks in Paris could have a negative impact on markets.

"It can compound all the problems that we were already facing," he said.

"Markets, so far, are taking it calmly," Constancio added.

-

16:54

A citizens' petition forces a debate in Finish parliament whether to leave the Eurozone or not

A citizens' petition forced a debate in Finish parliament whether to leave the Eurozone or not, according to a senior parliamentary official. The parliament will debate next year.

Finns are disappointed with the country's economic performance.

-

16:47

Rightmove: U.K. house prices drop 1.3% in November

According to property tracking website Rightmove, the average asking price for a house in the U.K. declined by 1.3% in November, after a 0.6% rise in October.

"New-to-the-market sellers have dropped their asking prices at this time of year for the last eight years, with an average drop of 1.9% over the last five years. Those looking to market their property as Christmas gets closer often have a greater sense of urgency to find a buyer and sensibly recognise that trimming their asking price will provide an incentive to potential buyers more focussed on seasonal Christmas trimmings," Rightmove director and housing market analyst Miles Shipside said.

On a yearly basis, house prices in the U.K. climbed 6.2% in November, after a 5.6% increase in October.

-

16:31

European Central Bank purchases €12.58 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.58 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.61 billion of covered bonds, and €56 million of asset-backed securities.

-

15:12

NY Fed Empire State manufacturing index rises to -10.74 in November

The New York Federal Reserve released its survey on Monday. The NY Fed Empire State manufacturing index rose to -10.74 in November from -11.36 in October, missing expectations for an increase to -6.25.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The November 2015 Empire State Manufacturing Survey indicates that business activity declined for a fourth consecutive month for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to -11.82 in November from -18.91 in October, while the shipments index climbed to -4.10 from -13.61.

The general business conditions expectations index for the next six months increased to 20.33 in November from 23.36 in October.

The price-paid index increased to 4.55 in November from 0.94 in October.

The index for the number of employees was up to 4.55 in November from -8.49 last month.

-

15:00

Foreign investors add C$3.35 billion of Canadian securities in September

Statistics Canada released foreign investment figures on Monday. Foreign investors added C$3.35 billion of Canadian securities in September, after an investment of C$5.78 billion in August.

August's figure was revised up from a sale of C$3.1 billion.

Canadian investors sold C$6.2 billion of foreign securities in September, all non-US foreign instruments.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.50 (USD 660m) 123.00 (1.6bln)

EUR/USD 1.0650 (EUR 881m) 1.0700 (469m) 1.0770 (636m) 1.0900 (488m)

USD/CHF 0.9725 (USD 300m)

USD/CAD 1.3300 (USD 926m)

AUD/USD 0.7050 (AUD 754m) 0.7200 (649m)

NZD/USD 0.6620 (NZD 276m)

-

14:43

Canadian manufacturing shipments drop 1.5% in September

Statistics Canada released manufacturing shipments on Monday. Canadian manufacturing shipments fell 1.5% in September, after a 0.6% decline in August. August's figure was revised down from a 0.2% decrease.

The decline was driven by falls in the motor vehicle assembly and the petroleum and coal product industries.

Sales of petroleum and coal products dropped 7.1% in September, while sales in in the motor vehicle assembly industry slid 10.3%.

Inventories fell 0.4% in September.

Sales decreased in 13 of 21 categories.

-

14:30

Canada: Manufacturing Shipments (MoM), September -1.5%

-

14:30

Canada: Foreign Securities Purchases, September 3.35

-

14:30

U.S.: NY Fed Empire State manufacturing index , November -10.74 (forecast -6.25)

-

14:29

European Central Bank (ECB) Executive Board member Yves Mersch: the central bank has not decided yet if to add further stimulus measures or not

The European Central Bank (ECB) Executive Board member Yves Mersch said in an interview with the French newspaper Les Echos on Sunday that the central bank has not decided yet if to add further stimulus measures or not. The ECB will decide on it in December, he added.

"We will examine the effects of measures taken so far and decide if there is a need for further action or not," Mersch said.

He pointed out that the central bank's decision will depend on the outlook for 2017.

-

14:13

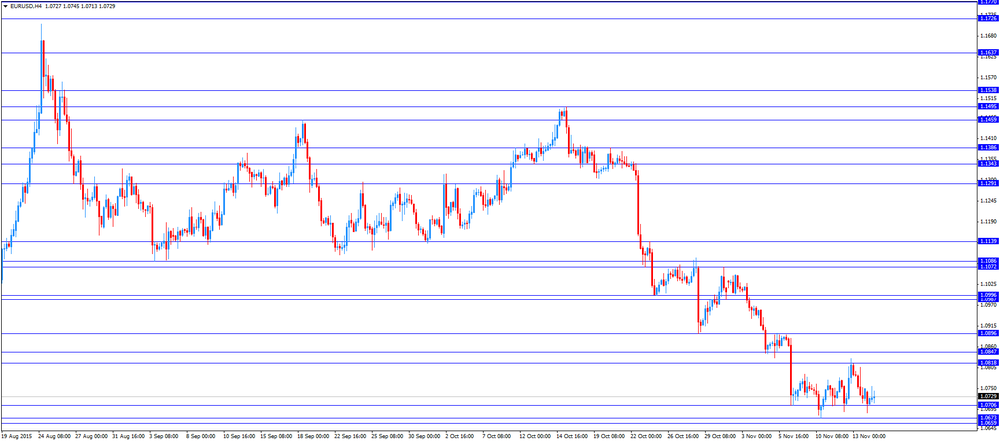

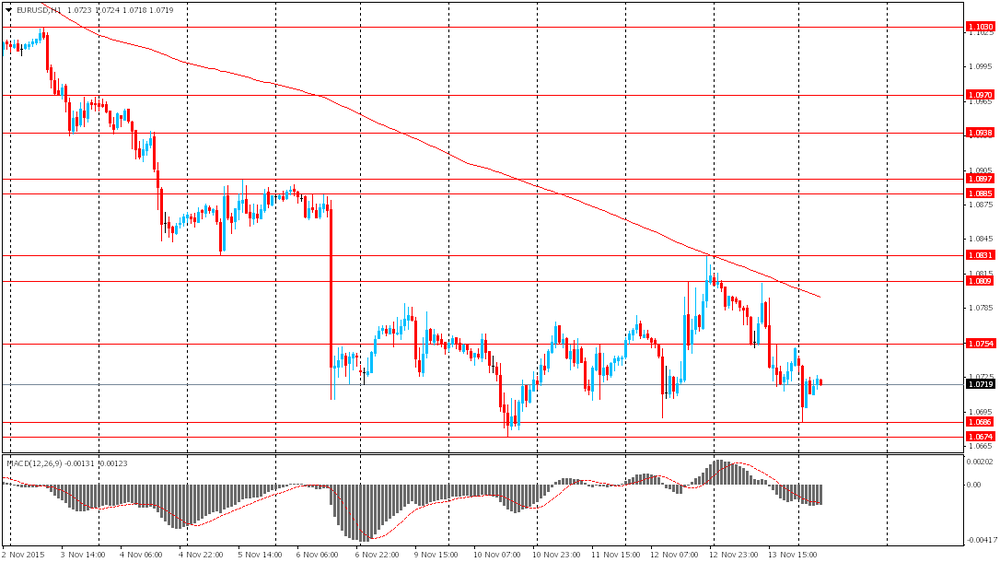

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the better-than-expected final consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) October 5.9% Revised From 5.5% -3.6%

00:30 Australia New Motor Vehicle Sales (YoY) October 7.7% 4.2%

10:00 Eurozone Harmonized CPI October 0.2% 0.1% 0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October -0.1% 0.0% 0.1%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) October 0.9% 1.0% 1.1%

10:15 Eurozone ECB President Mario Draghi Speaks

11:00 Germany Bundesbank Monthly Report

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the NY Fed Empire State manufacturing index. The index is expected to rise to -6.25 in November from -11.36 in October.

The euro traded mixed against the U.S. dollar after the release of the better-than-expected final consumer price inflation data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Monday. Eurozone's final harmonized consumer price index rose 0.1% in October, in line with the preliminary reading, after a 0.2% increase in September.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.1% in October from -0.1% in September, exceeding the preliminary reading of 0.0%.

Restaurants and cafés prices were up 0.10% year-on-year in October, vegetables prices rose by 0.14%, fruit gained 0.07%, fuel prices for transport declined by 0.68%, heating oil prices decreased by 0.22%, while gas prices were down by 0.09%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.1% in October from 0.9% in September, beating the preliminary reading of 1.0%.

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in Frankfurt on Monday that the central bank will continue its asset-buying programme until the inflation will pick up toward the central bank's 2% target.

Constancio pointed out that there are downside risks to the outlook for growth and inflation in the Eurozone from the slowdown in in emerging economies and "unfavourable developments in financial and commodity markets".

He noted that the inflation in the Eurozone remains low due to low oil prices and a lack of demand.

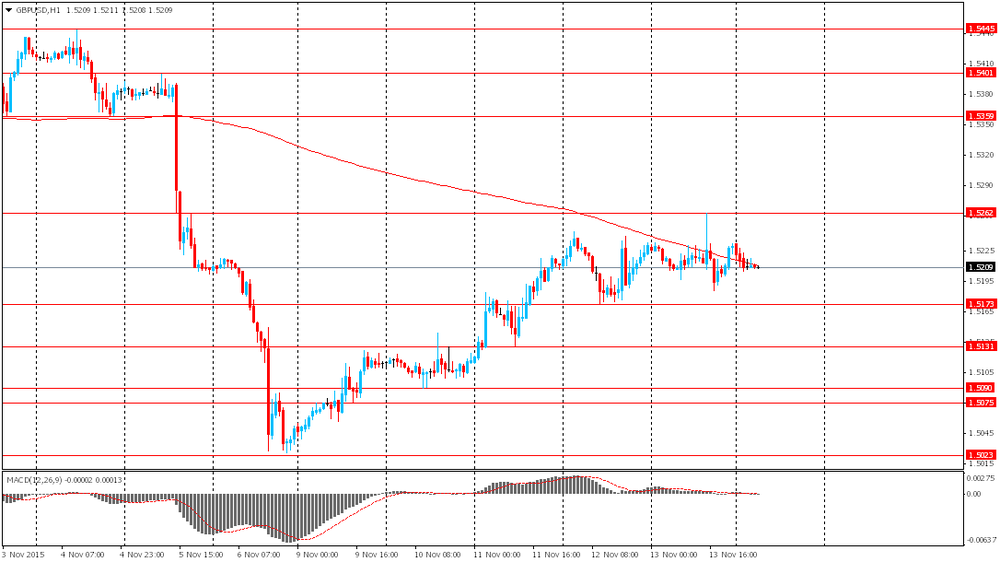

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5180

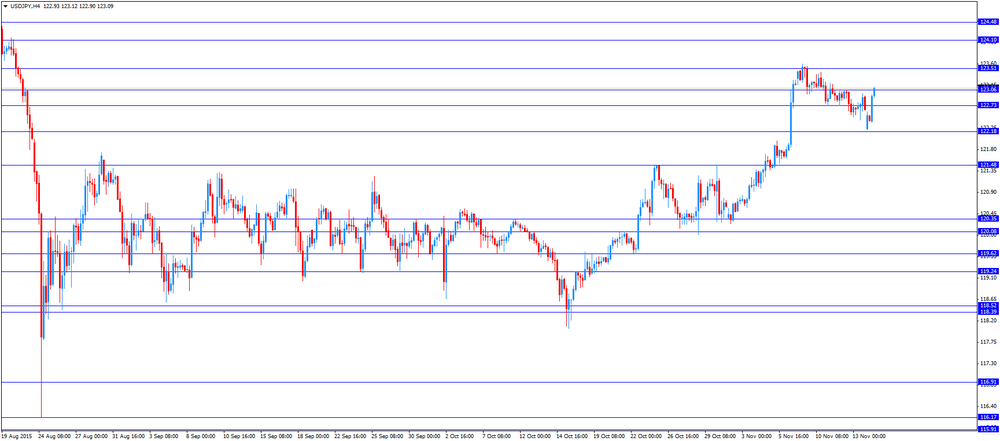

USD/JPY: the currency pair increased to Y123.12

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 Canada Foreign Securities Purchases September 3.11

13:30 U.S. NY Fed Empire State manufacturing index November -11.36 -6.25

21:30 Australia RBA Assist Gov Kent Speaks

-

13:50

Orders

EUR/USD

Offers 1.0760 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900

Bids 1.0720 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600 1.0580 1.0550

GBP/USD

Offers 1.5220-25 1.5235 1.5250 1.5265 1.5280 1.5300 1.5325 1.5350

Bids 1.5180-85 1.5165-70 1.5150 1.5125-30 1.5100 1.5080-85 1.5060

EUR/GBP

Offers 0.7080-85 0.7100 0.7125-30 0.7150 0.7170 0.7185 0.7200

Bids 0.7050-55 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 132.00 132.40 132.60 132.75-80 133.00 133.20 133.50-60

Bids 131.50 131.25-30 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 122.85-90 123.00 123.20-25 123.50 123.75-80 124.00 124.30 124.50

Bids 122.50 122.25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7140-50 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7100-10 0.7085 0.7065 0.7050 0.7035 0.7020 0.7000

-

11:28

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.50 (USD 660m) 123.00 (1.6bln)

EUR/USD 1.0650 (EUR 881m) 1.0700 (469m) 1.0770 (636m) 1.0900 (488m)

USD/CHF 0.9725 (USD 300m)

USD/CAD 1.3300 (USD 926m)

AUD/USD 0.7050 (AUD 754m) 0.7200 (649m)

NZD/USD 0.6620 (NZD 276m)

-

11:27

European Central Bank Vice President Vitor Constancio: the central bank will continue its asset-buying programme until the inflation will pick up

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in Frankfurt on Monday that the central bank will continue its asset-buying programme until the inflation will pick up toward the central bank's 2% target.

"The asset purchase programme will keep our balance sheet expanding until we see a sustained adjustment in the path of inflation," he said.

Constancio pointed out that there are downside risks to the outlook for growth and inflation in the Eurozone from the slowdown in in emerging economies and "unfavourable developments in financial and commodity markets".

He noted that the inflation in the Eurozone remains low due to low oil prices and a lack of demand.

-

11:10

Eurozone's final harmonized consumer price index rises 0.1% in October

Eurostat released its final consumer price inflation data for the Eurozone on Monday. Eurozone's final harmonized consumer price index rose 0.1% in October, in line with the preliminary reading, after a 0.2% increase in September.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.1% in October from -0.1% in September, exceeding the preliminary reading of 0.0%.

Restaurants and cafés prices were up 0.10% year-on-year in October, vegetables prices rose by 0.14%, fruit gained 0.07%, fuel prices for transport declined by 0.68%, heating oil prices decreased by 0.22%, while gas prices were down by 0.09%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 1.1% in October from 0.9% in September, beating the preliminary reading of 1.0%.

-

11:00

Eurozone: Harmonized CPI, Y/Y, October 0.1% (forecast 0.0%)

-

11:00

Eurozone: Harmonized CPI, October 0.1% (forecast 0.1%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, October 1.1% (forecast 1.0%)

-

10:34

Bank of Canada Deputy Governor Carolyn Wilkins: there is a transition to non-resource-intensive industries in Canada

The Bank of Canada Deputy Governor Carolyn Wilkins said on Friday that there is a transition to non-resource-intensive industries in Canada.

"Resources are going to need to move from the oil industry - investment is down a lot, we think it's going to be down 40 per cent this year and another 20 per cent next year - to non-resource-intensive industries, like manufacturing," she said.

Wilkins added that when the transition is done, Canada's economy could expand in the 2% range next year and 2.5% in 2017".

-

10:20

Japan’s final GDP shrinks 0.2% in the third quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Sunday. Japan's GDP declined by 0.2% in the third quarter, missing expectations for a 0.1% fall, after a 0.3% decrease in the second quarter.

Business investment fell 5.0% year-on-year in the third quarter, while private consumption rose 2.1%.

On a yearly basis, Japan's economy shrank 0.8% in the third quarter, missing forecasts of 0.2% decline, after a 1.2% fall in the second quarter.

-

07:48

Foreign exchange market. Asian session: the euro declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia New Motor Vehicle Sales (MoM) October 5.5% -3.6%

00:30 Australia New Motor Vehicle Sales (YoY) October 7.7% 4.2%

The euro fell to a six-month low against the U.S. dollar after attacks in Paris, which left over 130 dead and hundreds injured. However even before these events the single currency was under pressure amid ECB Draghi's comments that the quantitative easing program would be revised in December.

Investors are waiting for data from the Centre for European Economic Research (ZEW) due tomorrow.

The yen fell against the greenback after rising earlier in the session. The yen was weighed by data on the country's GDP, which showed a 0.2% contraction in the third quarter vs -0.1% expected. The annualized reading came in at -0.8%, while economists had expected a more modest 0.2% drop. The GDP declined amid negative trends in China's economy and weak demand from overseas. Nevertheless domestic consumer demand, which accounts for 60% of GDP, rose by 0.5% in the third quarter. Citing the increase Minister in charge of Economic Revitalization Akira Amari said he expects an increase in GDP in the fourth quarter. However many economists started saying that weak data might persuade the central bank of Japan to take aditional steps to stimulate the economy.

EUR/USD: the pair fell to $1.0685 in Asian trade

USD/JPY: the pair fell to Y122.20

GBP/USD: the pair fell to $1.5205

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Harmonized CPI October 0.2% 0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October -0.1% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) October 0.9% 1.0%

10:15 Eurozone ECB President Mario Draghi Speaks

11:00 Germany Bundesbank Monthly Report

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 Canada Foreign Securities Purchases September 3.11

13:30 U.S. NY Fed Empire State manufacturing index November -11.36 -6.25

21:30 Australia RBA Assist Gov Kent Speaks

-

07:03

Options levels on monday, November 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0930 (1294)

$1.0873 (1565)

$1.0828 (384)

Price at time of writing this review: $1.0724

Support levels (open interest**, contracts):

$1.0661 (3250)

$1.0618 (5755)

$1.0592 (7858)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 85933 contracts, with the maximum number of contracts with strike price $1,1000 (5943);

- Overall open interest on the PUT options with the expiration date December, 4 is 112342 contracts, with the maximum number of contracts with strike price $1,0700 (7858);

- The ratio of PUT/CALL was 1.31 versus 1.33 from the previous trading day according to data from November, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (996)

$1.5403 (1687)

$1.5306 (2117)

Price at time of writing this review: $1.5213

Support levels (open interest**, contracts):

$1.5192 (2221)

$1.5095 (2725)

$1.4997 (2819)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 27120 contracts, with the maximum number of contracts with strike price $1,5600 (3584);

- Overall open interest on the PUT options with the expiration date December, 4 is 31924 contracts, with the maximum number of contracts with strike price $1,5050 (4471);

- The ratio of PUT/CALL was 1.18 versus 1.20 from the previous trading day according to data from November, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:31

Australia: New Motor Vehicle Sales (YoY) , October 4.2%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , October -3.6%

-

01:06

Currencies. Daily history for Nov 13’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0750 -0,59%

GBP/USD $1,5230 -0,01%

USD/CHF Chf1,0069 +0,69%

USD/JPY Y122,65 +0,06%

EUR/JPY Y131,84 -0,54%

GBP/JPY Y186,79 +0,04%

AUD/USD $0,7125 +0,01%

NZD/USD $0,6534 -0,11%

USD/CAD C$1,3315 +0,20%

-

00:50

Japan: GDP, y/y, Quarter III -0.8% (forecast -0.2%)

-

00:50

Japan: GDP, q/q, Quarter III -0.2% (forecast -0.1%)

-

00:01

Schedule for today, Monday, Nov 16’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia New Motor Vehicle Sales (MoM) October 5.5%

00:30 Australia New Motor Vehicle Sales (YoY) October 7.7%

10:00 Eurozone Harmonized CPI October 0.2% 0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October -0.1% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) October 0.9% 1.0%

10:15 Eurozone ECB President Mario Draghi Speaks

11:00 Germany Bundesbank Monthly Report

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 Canada Foreign Securities Purchases September 3.11

13:30 U.S. NY Fed Empire State manufacturing index November -11.36 -6.25

21:30 Australia RBA Assist Gov Kent Speaks

-