Noticias del mercado

-

19:01

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

18:24

Bank of Japan expects the country’s inflation of 0.0% - 0.5%.

The Bank of Japan (BoJ) released its monthly economic report on Wednesday. The BoJ said that Japan's economy has continued to recover moderately.

The BoJ expects that consumer price inflation will be at an annual pace of 0.0% - 0.5%. The consumer will increase "on the whole from a somewhat longer-term perspective", the central bank noted.

Japan's central bank pointed out that financial conditions are accommodative.

The BoJ reiterated that private consumption has remained resilient.

"Exports are expected to increase moderately", the BoJ said.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies ahead of the Fed's monetary policy decision

The U.S. dollar traded lower against the most major currencies ahead of the Fed's monetary policy decision. Investors speculate that the Fed might remove "patient" from its outlook for monetary policy.

The euro traded higher against the U.S. dollar. Eurozone's unadjusted trade surplus fell to €7.9 billion in December from €23.9 billion in November. November's figure was revised down from a surplus of €24.3 billion.

Eurostat said that seasonally adjusted numbers were not available due to technical problems.

The British pound traded higher against the U.S. dollar. The U.K. unemployment rate remained unchanged at 5.7% in the November to January quarter. Analysts had expected the unemployment rate to decline to 5.6%.

The claimant count decreased by 31,000 people in February, in line with expectations, after a decrease of 39,400 people in January. January's figure was revised from a decline of 38,600.

Average weekly earnings, excluding bonuses, climbed by 1.6%.

Average weekly earnings, including bonuses, rose by 1.8%.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The U.K. Chancellor George Osborne announced the annual budget on Wednesday. He raised the economic growth forecasts for 2015 and next year. The growth forecast for 2015 was upgraded to 2.5% from the previous estimate 2.4%.

The economy in the U.K. is expected to expand 2.3% in 2016, up from 2.2%.

The Canadian dollar traded higher against the U.S. dollar. Wholesale sales dropped 3.1% in January, missing expectations for a 2.1% gain, after a 2.8% rise in December. December's figure was revised up from a 2.5% increase.

Sales declined in four of seven subsectors, driven by a in the sale of motor vehicles and parts.

The Swiss franc traded higher against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index rose to -37.9 points in March from -73.0 points in February.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weaker-than-expected current account data from New Zealand. New Zealand's current account deficit narrowed to NZ$3.19 billion in the fourth quarter from a deficit of NZ$5.02 billion in the third quarter. The third quarter's figure was revised down from a deficit of NZ$5.01 billion. Analysts had expected the current account deficit of NZ$3.12 billion.

The Australian dollar rose against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen climbed against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the Bank of Japan's (BoJ) monthly economic report. The BoJ reiterated that Japan's economy continues to recover moderately.

Japanese exports grew in February, driven by a weaker yen and strength in the U.S. economy, though the pace of gains was smaller than in previous months. It was the sixth consecutive increase. Exports increased 2.4% in February from the previous year, while imports declined 3.6%.

Japan's adjusted trade deficit widened to ¥638.8 billion in February from a deficit of ¥412.3 billion in January. Analysts had expected a deficit of ¥1,210.00 billion.

-

16:58

U.K. Chancellor George Osborne raised growth forecasts for 2015 and 2016

The U.K. Chancellor George Osborne announced the annual budget on Wednesday. He raised the economic growth forecasts for 2015 and next year. The growth forecast for 2015 was upgraded to 2.5% from the previous estimate 2.4%.

The economy in the U.K. is expected to expand 2.3% in 2016, up from 2.2%.

The unemployment rate is expected to decline to 5.3% this year, while the inflation forecast was revised down to 0.2%.

Mr Osborne noted that the inflation forecast for the following three years will be revised down due to falling global oil and food prices.

The budget deficit is expected to decline to 4% in 2015-16 and to 2% the following year.

The U.K. chancellor pointed out that the government expect a budget surplus of 0.2% in 2018-19 and a 0.3% surplus in 2019-20.

-

16:25

OECD left unchanged forecasts for economies that import oil, and downgraded forecasts for energy exporters

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Wednesday. "Overall, the near-term outlook remains for moderate, rather than rapid, world GDP growth; real investment remains sluggish, and labor is not yet fully engaged," the OECD said.

The OECD noted that "the outlook for the world economy has improved in the early months of 2015" due to lower oil prices and additional stimulus measures by several central banks.

The OECD left unchanged forecasts for economies that import oil, and downgraded forecasts for energy exporters such as Canada.

The OECD cut its Canadian growth forecasts to 2.2% for 2015 and to 2.1% in 2016, down from November estimate of 2.6% for 2015 and 2.4% for 2016.

It expect the U.S. will grow by 3.1% in 2015 and by 3% in 2016.

Japan's economy is expected to grow by 1% in 2015 and by 1.4% in 2016, up from November estimate of 0.8% for 2015 and 1.0% for 2016.

Eurozone's forecasts were upgraded to 1.4% in 2015 and to 2% in 2016.

China is expected to expand by about 7 percent in 2015, down from 7.1% estimate in November. Growth forecast for 2016 was left unchanged at 6.9%.

Global GDP is estimated to grow 4% in 2015 and 4.3% in 2016, up from 3.9% and from 4.1%.

-

15:51

Eurozone's trade surplus declines to €7.9 billion in December

Eurostat released trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus fell to €7.9 billion in December from €23.9 billion in November. November's figure was revised down from a surplus of €24.3 billion.

Unadjusted imports dropped 6% in January, while exports were flat.

The unadjusted traded balance was driven by a decline in the cost of energy imports.

The EU's trade deficit with Russia fell in January, while the trade deficit with China climbed.

For 2014 as whole, Eurozone's trade surplus rose to €192.9 billion from €151.9 billion in 2013. Exports increased 2%, while imports were unchanged.

Eurostat said that seasonally adjusted numbers were not available due to technical problems.

-

15:30

U.S.: Crude Oil Inventories, March +9.6

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.0bn), $1.0575(E350mn), $1.0600(E378mn), $1.0630(E225mn), $1.0720(E701mn)

USD/JPY: Y120.50 ($300mn), Y121.00 ($279mn), Y121.50($580mn), Y121.70($621mn)

EUR/JPY: Y129.95(E200mn), Y130.40-60(E340mn)

GBP/USD: $1.4815-20(Gbp320mn), $1.4900 (Gbp521mn)

AUD/USD: $0.7700(A$334mn), $0.7800(A$222mn)

NZD/USD: $0.7350(NZ$581mn)

USD/CAD: C$1.2690($600mn)

-

14:34

Canada’s wholesale sales drops 3.1% in January, the largest monthly decline since January 2009

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales dropped 3.1% in January, missing expectations for a 2.1% gain, after a 2.8% rise in December. It was the largest monthly decline since January 2009.

December's figure was revised up from a 2.5% increase.

Sales declined in four of seven subsectors, driven by a in the sale of motor vehicles and parts. Sales of motor vehicles and parts plunged 11.3% in January.

Sales excluding the motor vehicle sector decreased 1.3% in January.

-

14:08

Foreign exchange market. European session: the Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian wholesales data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +1.7% +1.6%

09:30 United Kingdom Average Earnings, 3m/y January +2.1% +2.2% +1.8%

09:30 United Kingdom Claimant Count Rate February 2.5% 2.4% 2.4%

09:30 United Kingdom Claimant count February -39.4 Revised From -38.6 -31.0 -31.0

09:30 United Kingdom ILO Unemployment Rate February 5.7% 5.6% 5.7%

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Trade balance unadjusted January 23.9 7.9

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) March -73.0 -37.9

12:30 United Kingdom Annual Budget Release

12:30 Canada Wholesale Sales, m/m January +2.8% Revised From +2.5% +2.1% -3.1%

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's monetary policy decision. Investors speculate that the Fed might remove "patient" from its outlook for monetary policy.

The euro traded mixed against the U.S. dollar after the weak trade data from the Eurozone. Eurozone's unadjusted trade surplus fell to €7.9 billion in December from €23.9 billion in November. November's figure was revised down from a surplus of €24.3 billion.

Eurostat said that seasonally adjusted numbers were not available due to technical problems.

The British pound dropped against the U.S. dollar after the mostly weaker-than-expected labour market data from the U.K. The U.K. unemployment rate remained unchanged at 5.7% in the November to January quarter. Analysts had expected the unemployment rate to decline to 5.6%.

The claimant count decreased by 31,000 people in February, in line with expectations, after a decrease of 39,400 people in January. January's figure was revised from a decline of 38,600.

Average weekly earnings, excluding bonuses, climbed by 1.6%.

Average weekly earnings, including bonuses, rose by 1.8%.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian wholesales data. Wholesale sales dropped 3.1% in January, missing expectations for a 2.1% gain, after a 2.8% rise in December. December's figure was revised up from a 2.5% increase.

Sales declined in four of seven subsectors, driven by a in the sale of motor vehicles and parts.

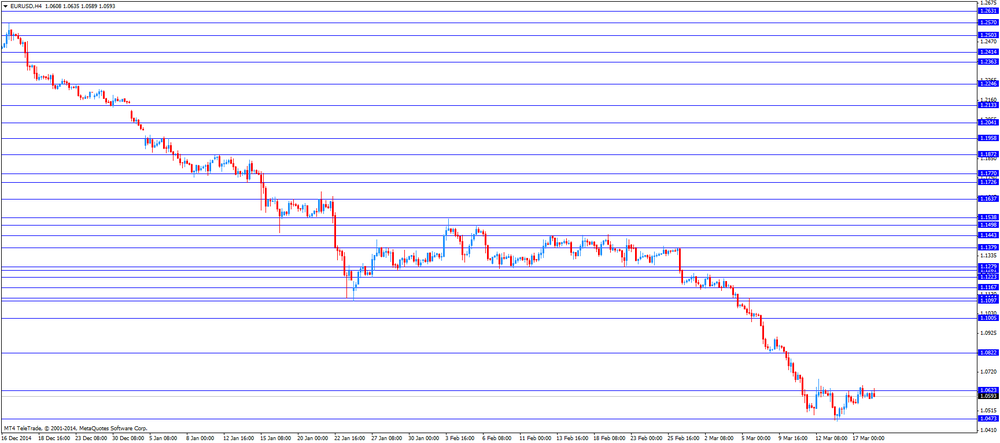

EUR/USD: the currency pair traded mixed

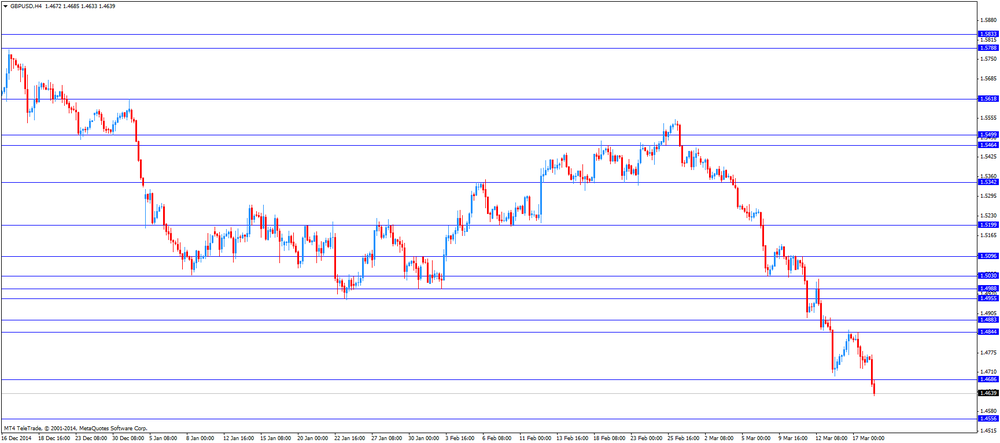

GBP/USD: the currency pair decreased to $1.4633

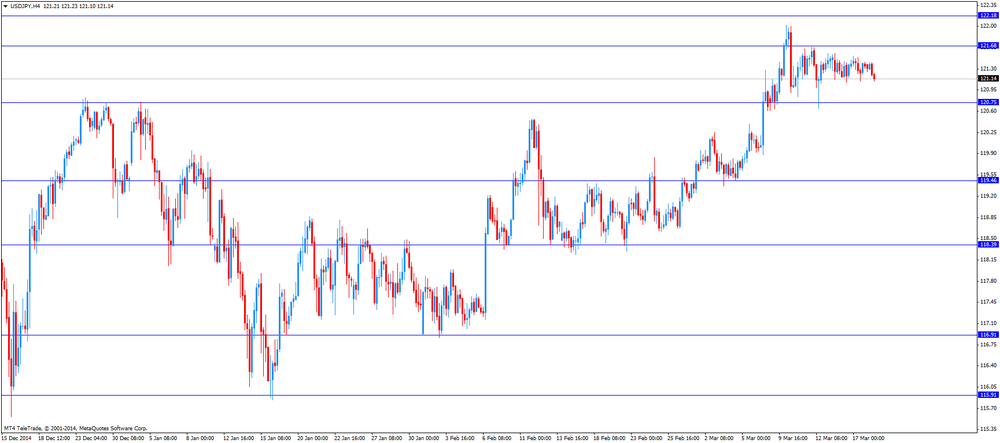

USD/JPY: the currency pair fell to Y121.10

The most important news that are expected (GMT0):

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV +1.0% +0.8%

21:45 New Zealand GDP y/y Quarter IV +3.2%

-

14:00

Orders

EUR/USD

Offers 1.0680 1.0700 1.0720 1.0735 1.0750 1.0800

Bids 1.0500 1.0460 1.0400 1.0300

GBP/USD

Offers 1.4900 1.4925 1.4940-50 1.4985 1.5000 1.5030-35 1.5060 1.5080 1.5100

Bids 1.4600 1.4500

EUR/JPY

Offers 129.15 129.60 129.80 130.00 130.20

Bids 128.00-10 127.00 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7220-25 0.7245-50 0.7285 0.7300

Bids 0.7120 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7680 0.7700-10 0.7725 0.7740 0.7760

Bids 0.7585 0.7565 0.7550

-

13:32

Japan’s exports rise 2.4% in February

Japanese exports grew in February, driven by a weaker yen and strength in the U.S. economy, though the pace of gains was smaller than in previous months. It was the sixth consecutive increase. Exports increased 2.4% in February from the previous year, while imports declined 3.6%. Exports to China dropped 17.3% due to lower shipments of cars and car parts. Exports to the U.S. climbed 14.3% due to higher shipments of cars, car parts and construction equipment. Japan's trade deficit narrowed to ¥424.6 billion.

Japan's adjusted trade deficit widened to ¥638.8 billion in February from a deficit of ¥412.3 billion in January. Analysts had expected a deficit of ¥1,210.00 billion.

-

13:30

Canada: Wholesale Sales, m/m, January -3.1% (forecast +2.1%)

-

11:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.0bn), $1.0575(E350mn), $1.0600(E378mn), $1.0630(E225mn), $1.0720(E701mn)

USD/JPY: Y120.50 ($300mn), Y121.00 ($279mn), Y121.50($580mn), Y121.70($621mn)

EUR/JPY: Y129.95(E200mn), Y130.40-60(E340mn)

GBP/USD: $1.4815-20(Gbp320mn), $1.4900 (Gbp521mn)

AUD/USD: $0.7700(A$334mn), $0.7800(A$222mn)

NZD/USD: $0.7350(NZ$581mn)

USD/CAD: C$1.2690($600mn)

-

11:05

BOE Monetary Policy Committee voted unanimously to keep rates on hold at record low

Minutes from the last policy meeting showed that all members of the committee voted unanimously to keep rates at the record-low level of 0.5% and its QE program unchanged. The strong economy could further strengthen the British pound and lead to inflation-rates below the targeted 2% - a level not seen for more than a year. A rate hike over the course of the next three years is seen more likely than not - although there was a "range of views" in the committee.

U.K.'s Unemployment Rate for February remained at 5.7%, a six-year low, analyst expected a decline to 5.6%. The Claimant Count fell seasonally adjusted 31,000 in February, compared to expectations for a decline of 30,000 people.

Average earnings increased less-than-expected in the 3 months to January. Average earnings rose 1.8% compared to a previous reading of +2.1%, below the forecasted increase of +2.2%. Average earnings excluding boni rose +1.6%.

-

11:00

Eurozone: Trade balance unadjusted, January 7.9

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), March -37.9

-

10:31

United Kingdom: Claimant count , February -31.0 (forecast -31.0)

-

10:31

United Kingdom: Average Earnings, 3m/y , January +1.8% (forecast +2.2%)

-

10:31

United Kingdom: Average earnings ex bonuses, 3 m/y, January +1.6%

-

10:30

United Kingdom: ILO Unemployment Rate, February 5.7% (forecast 5.6%)

-

10:20

Press Review: Fed set to ditch 'patient' rate vow as it eyes U.S., world growth

BLOOMBERG

Euro Selling Climax Signals Reversal to Mizuho on Fundamentals

(Bloomberg) -- The euro is ripe for a rebound after its slump to a 12-year low went too far, too fast based on the region's economic fundamentals, including one of the world's largest current-account surpluses, according to Mizuho Bank Ltd.

The 19-nation common currency fell to $1.0458 on March 16, its lowest since January 2003, as euro bloc's monetary policies diverge from those of the U.S. The European Central Bank on March 9 began buying euro-area government bonds in the secondary market, a step President Mario Draghi referred to as "the final set of measures" of a series of decisions that the bank has taken since June last year.

"The euro is equipped with two highly significant elements justifying its strength, yet it is the weakest currency now thanks to speculative selling," Daisuke Karakama, chief market economist at Mizuho Bank in Tokyo and a former European Commission official, said in an interview in Tokyo on March 10. "With the start of quantitative easing that is the final set of measures, euro selling is at its climax. We should be mindful of waning incentives to push it lower."

REUTERS

Fed set to ditch 'patient' rate vow as it eyes U.S., world growth(Reuters) - The Federal Reserve on Wednesday is expected to lay the groundwork for its first interest rate hike in nearly a decade, as it continues to weigh whether the U.S. recovery can hold up against collapsing oil prices and a soaring dollar.

The U.S. central bank's latest policy meeting will conclude with certainty expected on one point: it will likely discard a pledge to remain "patient" before hiking rates, trimming one of the final verbal cues it has used through crisis, recession and recovery to describe its intent to keep rates near zero for a period of time.

The move would mark an important moment for Fed Chair Janet Yellen who, despite being seen as a policy dove, has overseen a steady whittling away of loose money promises: the policy statement during her first year as Fed chief shrank from 790 words to 529.

Source: http://www.reuters.com/article/2015/03/18/us-usa-fed-idUSKBN0ME0D520150318

BLOOMBERG

Goldman Bets Against Yuan as China Slowdown Spurs Outflows

(Bloomberg) -- Goldman Sachs Asset Management has been betting against the Chinese currency as a slowdown in the world's second-largest economy spurs capital outflows.

"We've been short the yuan for several months," Yacov Arnopolin, who helps oversee about $39 billion in emerging-market debt as a managing director at Goldman Sachs Asset, said in a March 16 interview in New York. "It's certainly difficult to continue the strengthening trend in the face of the slowing economy. It's a challenging time."

The yuan has fallen 0.4 percent against the greenback this year, following a 2.4 percent drop in 2014 that was the first annual decline in five years. Premier Li Keqiang has set China's 2015 economic growth target at 7 percent, the least in more than 15 years.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers - all eyes on the FED

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan BoJ monthly economic report

The U.S. dollar traded mixed against its major peers ahead of the Fed's monetary policy decision on Wednesday scheduled for 18:00 GMT. Yesterday data showed that Housing starts in the U.S. dropped 17.0% to 897,000 annualized rate in February from a 1.081 million pace in January, missing expectations for a decrease to 1.050 million. January's figure was revised up from 1.065 million units. Building permits in the U.S. increased 3.0% to 1.092 million annualized rate in February from a 1.06 million pace in January. Analysts had expected building permits to climb to 1.07 million units.

The euro is trading almost flat after rebounding from 12-year lows set on Monday. Quantitative Easing and concerns over Greece continue to weigh on the single currency.

The Australian dollar lost against the greenback. Australia's Leading Index came in at +0.3% for February, 0.2% higher than the previous reading.

New Zealand's dollar declined against the greenback today. The country's Current Account for the fourth quarter fell more-than-expected to a seasonally adjusted -3.19 billion from -5.01 billion in the preceding quarter. Analysts expected a reading of -3.12 billion. Late in the day New Zealand's is to report data on GDP.

The Japanese yen traded slightly higher against the greenback on Wednesday currently trading at USD121.33 on a light data day in Asia. Japan's Trade Balance came in at -424.6 billion for February compared to -1177 billion in January. The Adjusted Merchandise Trade Balance had a reading of -638.8 billion compared to forecasts of -1210 billion.

EUR/USD: the euro traded moderately lower against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling added gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +2.1% +2.2%

09:30 United Kingdom Claimant Count Rate February 2.5%

09:30 United Kingdom Claimant count February -38.6 -31.0

09:30 United Kingdom ILO Unemployment Rate February 5.7% 5.6%

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Trade balance unadjusted January 24.3

10:00 Eurozone Trade Balance s.a. January 23.3 21.1

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) March -73.0

12:30 United Kingdom Annual Budget Release

12:30 Canada Wholesale Sales, m/m January +2.5% +2.1%

14:30 U.S. Crude Oil Inventories March +4.5

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV +1.0% +0.8%

21:45 New Zealand GDP y/y Quarter IV +3.2%

-

08:19

Options levels on wednesday, March 18, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0784 (1850)

$1.0731 (1415)

$1.0675 (186)

Price at time of writing this review: $1.0587

Support levels (open interest**, contracts):

$1.0527 (2295)

$1.0480 (6563)

$1.0420 (4723)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 63086 contracts, with the maximum number of contracts with strike price $1,1200 (3436);

- Overall open interest on the PUT options with the expiration date April, 2 is 70859 contracts, with the maximum number of contracts with strike price $1,0400 (6987);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from March, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5004 (1282)

$1.4907 (1154)

$1.4811 (655)

Price at time of writing this review: $1.4753

Support levels (open interest**, contracts):

$1.4688 (1421)

$1.4592 (1580)

$1.4494 (604)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 25502 contracts, with the maximum number of contracts with strike price $1,5100 (1719);

- Overall open interest on the PUT options with the expiration date April, 2 is 27678 contracts, with the maximum number of contracts with strike price $1,5050 (2364);

- The ratio of PUT/CALL was 1.09 versus 1.08 from the previous trading day according to data from March, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:01

Currencies. Daily history for Mar 17’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0596 +0,28%

GBP/USD $1,4743 -0,56%

USD/CHF Chf1,0058 -0,22%

USD/JPY Y121,35 -0,01%

EUR/JPY Y128,58 +0,23%

GBP/JPY Y178,9 -0,58%

AUD/USD $0,7620 -0,26%

NZD/USD $0,7316 -0,74%

USD/CAD C$1,2786 + 0,09%

-

00:52

Japan: Adjusted Merchandise Trade Balance, bln, February -638.8 (forecast -1210)

-

00:50

Japan: Trade Balance Total, bln, February -424.6

-

00:30

Australia: Leading Index, February +0.3%

-

00:00

Schedule for today, Wednesday, Mar 18’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan BoJ monthly economic report

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y January +2.1% +2.2%

09:30 United Kingdom Claimant Count Rate February 2.5%

09:30 United Kingdom Claimant count February -38.6 -31.0

09:30 United Kingdom ILO Unemployment Rate February 5.7% 5.6%

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Trade balance unadjusted January 24.3

10:00 Eurozone Trade Balance s.a. January 23.3 21.1

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) March -73.0

12:30 United Kingdom Annual Budget Release

12:30 Canada Wholesale Sales, m/m January +2.5% +2.1%

14:30 U.S. Crude Oil Inventories March +4.5

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV +1.0% +0.8%

21:45 New Zealand GDP y/y Quarter IV +3.2%

-