Noticias del mercado

-

17:31

Foreign exchange market. American session: the Canadian dollar traded slightly higher against the U.S. dollar despite the weaker-than-expected foreign investment figures from Canada

The U.S. dollar traded mixed against the most major currencies.

U.S. markets are closed for Martin Luther King holiday.

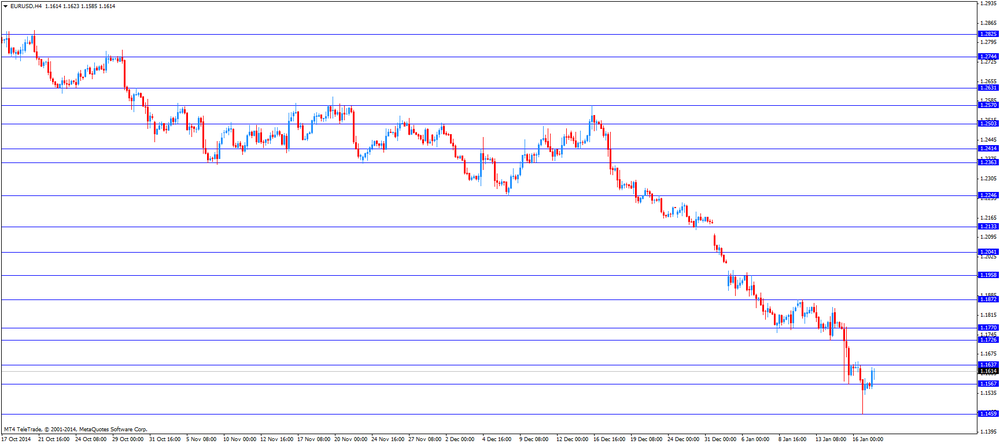

The euro traded higher against the U.S. dollar on speculation that the European Central Bank will announce the bond-buying programme on Thursday.

Eurozone's adjusted current account surplus fell to €18.1 billion in November from €19.5 billion in October. October's figure was revised down from a surplus of €20.5 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded slightly higher against the U.S. dollar despite the weaker-than-expected foreign investment figures from Canada. Foreign securities purchases in Canada rose by C$4.29 billion in November, missing expectations for a gain by C$7.23 billion, after a rise by C$9.53 billion in October.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 0.4% in December, beating forecasts of a 0.6% rise, after a 0.7% fall in November.

On a yearly basis, producer and import prices decreased 2.1% in December, missing expectation for a 1.5% decline, after a 1.6% drop in November.

The Swiss Franc plunged against the greenback last Thursday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded higher against the greenback.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback despite solid new motor vehicle sales data for Australia. Australia's new motor vehicle sales rose 3.0% in December, after a 0.5% drop in November. November's figure was revised up from a 0.6% decline.

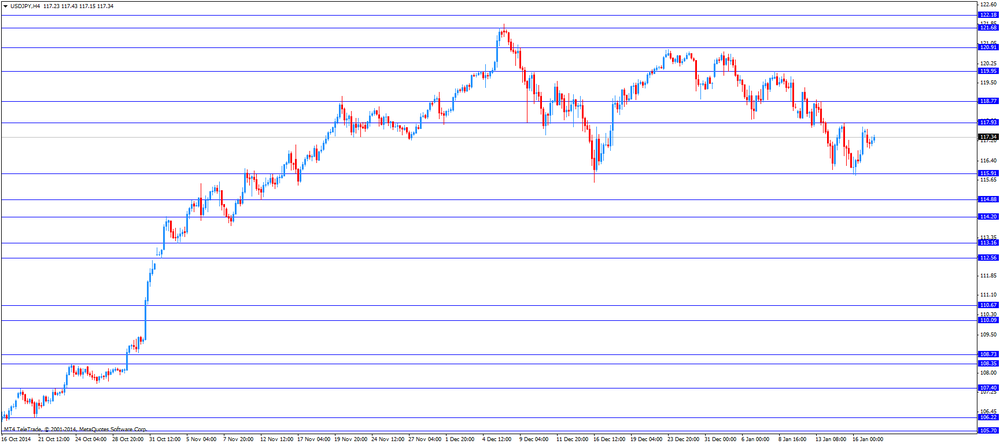

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback due to risk aversion and solid economic data from Japan. Japan's final industrial production declined 0.5% in November, up from the 0.6% drop estimated earlier.

Japan's consumer confidence index increased to 38.8 in December from 37.7 in November, beating expectations for a rise to 38.6.

-

16:40

Foreign securities purchases in Canada rose by C$4.29 billion in November

Statistics Canada released foreign investment figures on Monday. Foreign securities purchases in Canada rose by C$4.29 billion in November, missing expectations for a gain by C$7.23 billion, after a rise by C$9.53 billion in October.

International investors divested C$580 million of stocks, the first monthly divestment since August 2013.

-

16:08

French President François Hollande: the European Central Bank will decide on Thursday to buy government bonds

French President François Hollande said on Monday the European Central Bank (ECB) will decide on Thursday to buy government bonds, "which will provide significant liquidity to the European economy and create a movement that is favourable to growth".

An ECB spokesman declined to comment.

The comments from the French president were surprising as the ECB is independent from governments.

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1700(E335mn)

USD/JPY: Y114.00($800mn), Y117.00($600mn), Y118.50($390mn)

GBP/USD: $1.5340(stg195mn)

USD/CHF: Chf0.9160-70($800mn)

AUD/USD: $0.7980(A$450mn), $0.8250(A$325mn)

NZD/USD: $0.7780(NZ$200mn), $0.7900(NZ$221mn)

-

14:30

Canada: Foreign Securities Purchases, November 4.29 (forecast 7.23)

-

14:09

Foreign exchange market. European session: the euro rose against the U.S. dollar on speculation that the European Central Bank will announce the bond-buying programme on Thursday

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) January -2.2% Revised From -3.3% +1.4%

00:01 United Kingdom Rightmove House Price Index (YoY) January +7.0% +8.2%

00:30 Australia New Motor Vehicle Sales (MoM) December -0.5% Revised From -0.6% +3.0%

00:30 Australia New Motor Vehicle Sales (YoY) December -3.7% Revised From -3.8% -1.0%

04:30 Japan Industrial Production (MoM) (Finally) November -0.6% -0.6% -0.5%

04:30 Japan Industrial Production (YoY) (Finally) November -3.8% -3.8% -3.7%

05:00 Japan Consumer Confidence December 37.7 38.6 38.8

08:15 Switzerland Producer & Import Prices, m/m December -0.7% -0.6% -0.4%

08:15 Switzerland Producer & Import Prices, y/y December -1.6% -1.5% -2.1%

09:00 Eurozone Current account, adjusted, bln November 19.5 Revised From 20.5 21.3 18.1

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

The U.S. dollar traded mixed against the most major currencies.

U.S. markets are closed for Martin Luther King holiday.

The euro rose against the U.S. dollar on speculation that the European Central Bank will announce the bond-buying programme on Thursday.

Eurozone's adjusted current account surplus fell to €18.1 billion in November from €19.5 billion in October. October's figure was revised down from a surplus of €20.5 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded slightly higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of foreign securities purchases from Canada. Foreign securities purchases in Canada are expected to rise by C$7.23 billion in November, after a C$9.53 increase in October.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 0.4% in December, beating forecasts of a 0.6% rise, after a 0.7% fall in November.

On a yearly basis, producer and import prices decreased 2.1% in December, missing expectation for a 1.5% decline, after a 1.6% drop in November.

The Swiss Franc plunged against the greenback last Thursday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

EUR/USD: the currency pair rose to $1.1627

GBP/USD: the currency pair increased to $1.5180

USD/JPY: the currency pair climbed to $117.46

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases November 9.53 7.23

21:00 New Zealand NZIER Business Confidence Quarter IV 19

-

13:51

Orders

EUR/USD

Offers $1.1710, $1.1700, $1.1675, $1.1640/50

Bids $1.1500/490, $1.1450, $1.1400

GBP/USD

Offers $1.5230/35, $1.5200/10

Bids $1.5055/50

AUD/USD

Offers $0.8390/00, $0.8350, $0.8300, $0.8250

Bids $0.8180, $0.8150, $0.8110/00

EUR/JPY

Offers Y137.90/00, Y137.50, Y137.00, Y136.50

Bids Y135.50, Y135.00, Y134.50

USD/JPY

Offers Y118.50, Y118.00, Y117.45/50

Bids Y116.80, Y116.50, Y116.20/00

EUR/GBP

Offers stg0.7700, stg0.7680

Bids

-

13:41

Swiss National Bank may have intervened before discontinuing the 1.20 per euro exchange rate floor

The Swiss National Bank (SNB) released its monetary policy data for the week ending 16 January 2015 on Monday. The report showed that the amount of cash commercial banks hold with the SNB rose last week. Sight deposits increased by 10.6 billion francs to 339.6 billion francs, according to SNB data. That was the biggest weekly increase since the end of December.

Data indicates that the central bank may have intervened before discontinuing the 1.20 per euro exchange rate floor.

-

13:24

European Central Bank Governing Council member Ewald Nowotny: possibilities are limited

The European Central Bank (ECB) Governing Council member Ewald Nowotny told in an interview to Austrian newspaper Tiroler Tageszeitung published on Monday that the ECB's possibilities "are limited".

Nowotny does not believe that there will deflation in the Eurozone in 2015.

-

12:00

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1700(E335mn)

USD/JPY: Y114.00($800mn), Y117.00($600mn), Y118.50($390mn)

GBP/USD: $1.5340(stg195mn)

USD/CHF: Chf0.9160-70($800mn)

AUD/USD: $0.7980(A$450mn), $0.8250(A$325mn)

NZD/USD: $0.7780(NZ$200mn), $0.7900(NZ$221mn)

-

10:20

Press Review: Draghi Push Seen Delivering $635 Billion With QE Forecast

BLOOMBERG

Draghi Push Seen Delivering $635 Billion With QE Forecast

Mario Draghi is likely to announce a 550 billion-euro ($635 billion) bond-purchase program this week and won't skimp too much on the details, economists say.

The European Central Bank president will make his biggest push yet to steer the euro area away from deflation by announcing quantitative easing on Jan. 22, according to 93 percent of respondents in a Bloomberg News survey. The median estimate of the size of the package tops the 500 billion euros in models presented to officials this month.

REUTERS

'Abenomics' architect says no need for more BOJ easing

(Reuters) - The Bank of Japan does not need to ease monetary policy further this year unless the economy is hit by a severe external shock, a ruling party lawmaker and one of the architects of Prime Minister Shinzo Abe's "Abenomics" reflationary policies told Reuters on Monday.

Slumping oil prices and the hit on consumption from a sales tax hike mean the central bank is unlikely to meet its pledge of achieving its 2 percent inflation target during the fiscal year beginning in April, Kozo Yamamoto, a leading expert on fiscal and monetary policy in Abe's ruling Liberal Democratic Party, said.

Source: http://www.reuters.com/article/2015/01/19/us-japan-economy-boj-idUSKBN0KS0MO20150119

BLOOMBERG

Swiss Franc Eclipses Ruble on Volatility Scale: Chart of the Day

There is a new volatility leader in town and it's not the Russian ruble.

The CHART OF THE DAY shows that price swings in the Swiss franc surpassed those on the ruble, the world's most volatile currency of the past 12 months, after Switzerland's central bank unexpectedly abandoned a cap on its value on Jan. 15. Fluctuations in the franc jumped to five times of those in the Russian currency on a 24-hour basis that day and they're still higher, according to data compiled by Bloomberg.

-

10:00

Eurozone: Current account, adjusted, bln , November 18.1 (forecast 21.3)

-

09:15

Switzerland: Producer & Import Prices, m/m, December -0.4% (forecast -0.6%)

-

09:15

Switzerland: Producer & Import Prices, y/y, December -2.1% (forecast -1.5%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers during the Asian session after Friday’s solid U.S. data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) January -2.2% (revised) +1.4%

00:01 United Kingdom Rightmove House Price Index (YoY) January +7.0% +8.2%

00:30 Australia New Motor Vehicle Sales (MoM) December -0.5% (revised) +3.0%

00:30 Australia New Motor Vehicle Sales (YoY) December -3.7% (revised) -1.0%

04:30 Japan Industrial Production (MoM) (Finally) November -0.6% -0.6% -0.5%

04:30 Japan Industrial Production (YoY) (Finally) November -3.8% -3.8% -3.7%

05:00 Japan Consumer Confidence December 37.7 38.6 38.8

The U.S. dollar traded mixed against its major peers during the Asian session after Friday's data showed U.S. household confidence rose on a strengthening job market and slumping fuel costs. The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 98.2 in January from a final reading of 93.6 in December, exceeding expectations for an increase to 94.2. That was the highest level since January 2004. The euro recovered from 12-year lows but is still under pressure by the prospect of QE by the ECB. Today U.S. markets are closed due to a bank holiday.

The Australian dollar traded slightly lower against the greenback after reaching a one-month high last week. New Motor Vehicle Sales rose more-than-expected from revised -0.5% in November to +3.0% in December. On a yearly basis Sales declined by -1.0% compared to -3.7 in the previous month. Inflation for December declined to 0.0% after a previous reading of +0.1% making it 1.5% on a yearly basis.

New Zealand's dollar traded higher against the greenback in the absence of major economic data. Today investors await the NZIER Business confidence for the fourth quarter due at 21:00 GMT.

The Japanese yen declined after a sharp rise on Friday versus the greenback. Friday's gains were driven by a steep rout in Chinese equities which led to a stronger demand for the haven currency as market participants became more risk sensitive. In today's session data on Japanese Industrial Production for November was better than expected with a decline by -0.5%, analysts expected -0.6%. On a yearly basis Industrial Production had a reading of -3.7% versus the estimated -3.8%. Consumer Confidence rose to 38.8 beating forecasts of 38.6 and a previous reading of 37.7 in November. The BOJ policy meeting will start tomorrow to decide on further stimulus measures after it's unprecedented bond-buying program starter in October last year.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded almost flat against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m December -0.7% -0.6%

08:15 Switzerland Producer & Import Prices, y/y December -1.6% -1.5%

09:00 Eurozone Current account, adjusted, bln November 20.5 21.3

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

13:30 Canada Foreign Securities Purchases November 9.53 7.23

21:00 New Zealand NZIER Business Confidence Quarter IV 19

-

07:16

Options levels on monday, January 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1874 (3016)

$1.1783 (820)

$1.1697 (119)

Price at time of writing this review: $ 1.1557

Support levels (open interest**, contracts):

$1.1480 (6973)

$1.1432 (5816)

$1.1375 (4076)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 56208 contracts, with the maximum number of contracts with strike price $1,2100 (5544);

- Overall open interest on the PUT options with the expiration date February, 6 is 66095 contracts, with the maximum number of contracts with strike price $1,1700 (6973);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from January, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5405 (393)

$1.5308 (410)

$1.5212 (999)

Price at time of writing this review: $1.5143

Support levels (open interest**, contracts):

$1.5089 (1632)

$1.4992 (912)

$1.4894 (1418)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15406 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 16390 contracts, with the maximum number of contracts with strike price $1,5100 (1632);

- The ratio of PUT/CALL was 1.06 versus 1.12 from the previous trading day according to data from January, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:00

Japan: Consumer Confidence, December 38.8 (forecast 38.6)

-

05:33

Japan: Industrial Production (MoM) , November -0.5% (forecast -0.6%)

-

05:31

Japan: Industrial Production (YoY), November -3.7% (forecast -3.8%)

-

01:32

Australia: New Motor Vehicle Sales (YoY) , December -1.0%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , December +3.0%

-

01:01

Currencies. Daily history for Jan 16’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1568 -0,55%

GBP/USD $1,5157 -0,16%

USD/CHF Chf0,8563 +2,09%

USD/JPY Y117,60 +1,23%

EUR/JPY Y136,03 +0,68%

GBP/JPY Y178,24 +1,05%

AUD/USD $0,8235 +0,22%

NZD/USD $0,7785 -0,46%

USD/CAD C$1,1965 +0,04%

-

00:31

Australia: MI Inflation Gauge, y/y, December +1.5%

-

00:30

United Kingdom: Rightmove House Price Index (YoY), January +8.2%

-

00:30

Australia: MI Inflation Gauge, m/m, December 0.0%

-

00:29

United Kingdom: Rightmove House Price Index (MoM), January +1.4%

-

00:00

Schedule for today, Monday, Jan 19’2015:

(time / country / index / period / previous value / forecast)

00:01 United Kingdom Rightmove House Price Index (MoM) January -3.3%

00:01 United Kingdom Rightmove House Price Index (YoY) January +7.0%

00:30 Australia New Motor Vehicle Sales (MoM) December -0.6%

00:30 Australia New Motor Vehicle Sales (YoY) December -3.8%

04:30 Japan Industrial Production (MoM) (Finally) November -0.6% -0.6%

04:30 Japan Industrial Production (YoY) (Finally) November -3.8% -3.8%

05:00 Japan Consumer Confidence December 37.7 38.6

08:15 Switzerland Producer & Import Prices, m/m December -0.7% -0.6%

08:15 Switzerland Producer & Import Prices, y/y December -1.6% -1.5%

09:00 Eurozone Current account, adjusted, bln November 20.5 21.3

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

13:30 Canada Foreign Securities Purchases November 9.53 7.23

21:00 New Zealand NZIER Business Confidence Quarter IV 19

-