Noticias del mercado

-

16:23

IMF's Obstfeld says recent U.S tax reform will contribute "noticeably" to U.S. growth in short term

-

Says China needs to take further steps to open its economy to imports

-

More can be done on EU's banking union project, notably on common deposit insurance

-

Without policy action next economic downturn will come sooner and be harder to fight

-

-

15:57

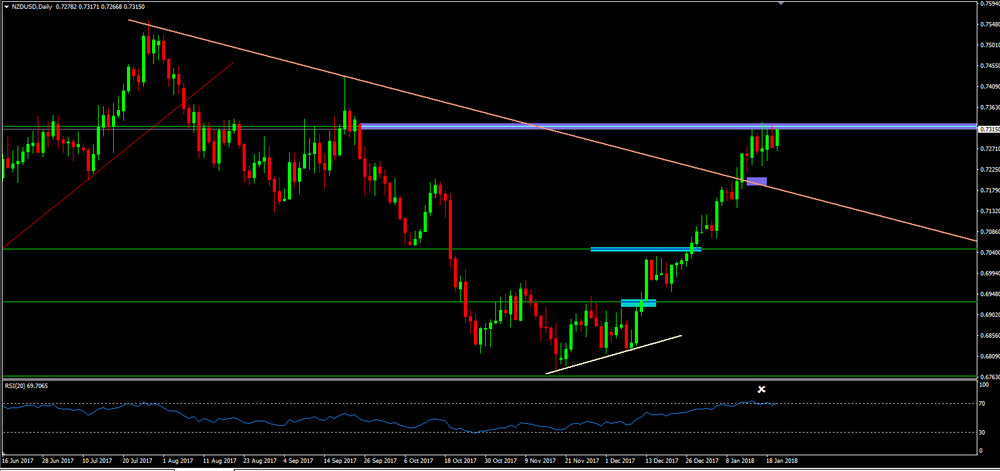

NZD/USD Analysis

On daily time frame chart, we can see that NZD/USD has been follwing a strong bullish trend on the last few weeks.

However, now the price is showing some difficults in break through the purple box (resistance level) and the indicator - RSI - is showing a "overbought" which it may give some indications of a reversal trend.

Therefore, we can expect a further bearish movement soon.

-

15:05

IMF revises up U.S. growth forecast to 2.7 percent in 2018 and 2.5 percent in 2019

-

Revises up growth forecasts for euro area, including Germany, Italy, cuts forecast for Spain

-

Maintains growth forecast for emerging markets and developing countries

-

Sees U.S. growth slowing from 2022 as impact from tax package starts to wane

-

Revision to its outlook reflects global growth momentum, expected impact of U.S. tax cuts

-

-

15:00

Canadian wholesale sales rose 0.7% to $63.6 billion in November, a second consecutive increase

Sales were up in six of seven subsectors, representing 99% of wholesale sales. The food, beverage and tobacco subsector and the motor vehicle and parts subsector led the gains.

In volume terms, wholesale sales increased 0.5%.

The food, beverage and tobacco subsector posted the largest increase in dollar terms in November, rising 1.9% to $12.2 billion. Higher sales in the food industry, up 2.2% to $11.1 billion, contributed the most to the gain. This was the highest level on record for both the subsector and the industry.

-

14:30

Canada: Wholesale Sales, m/m, November 0.7% (forecast 1%)

-

14:30

U.S.: Chicago Federal National Activity Index, December 0.27 (forecast 0.44)

-

13:20

Brexit campaigner Nigel Farage says has no thoughts whatever on creating a new political party amid UKIP chaos

-

12:42

Greece's short-dated government bond yields down 5 basis points at 1.33 pct following S&P's Greece ratings upgrade

-

11:43

German SPD leader Schulz says SPD, CDU and CSU party leaders to meet monday evening to discuss coalition talks

-

Says we will discuss all issues again in german coalition negotiations

-

SPD will consider this week how to position itself for coalition negotiations

-

-

11:42

Russia's foreign minister Lavrov: U.S. actions in Syria are either a provocation or show lack of understanding of situation - RIA

-

10:41

Swiss total sight deposits at 574.654 bln chf in week ending january 19 versus 573.812 bln chf a week earlier

-

Sight deposits of domestic banks at 468.854 bln chf in week ending january 19 versus 473.922 bln chf a week earlier

-

-

10:40

Pence says he is hopeful "we are at the dawn of a new era" of renewed discussions to achieve Israeli-Palestinian peace

-

09:28

Spain's 10-year bond yield falls to five-week low of 1.412 pct after Fitch upgrades spain rating to 'A-'

-

08:27

U.S. 10-year treasury note futures prices down 2/32 point as trading resumes on 2nd day of U.S govt shutdown

-

08:27

Senate to vote on stopgap spending bill noon est monday; U.S government to remain closed at least until vote

-

Senate majority leader Mitch Mcconnell says if DACA isn't resolved by feb. 8th and government is open, he would allow a vote

-

-

08:26

Mcconnell moves to allow a vote on stopgap spending measure to reopen U.S government; democratic leader Schumer says no deal yet

-

06:47

Options levels on monday, January 22, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2338 (4134)

$1.2321 (3106)

$1.2297 (2863)

Price at time of writing this review: $1.2225

Support levels (open interest**, contracts):

$1.2166 (1723)

$1.2137 (1651)

$1.2104 (2330)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 115033 contracts (according to data from January, 19) with the maximum number of contracts with strike price $1,1850 (7013);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3970 (2014)

$1.3953 (2994)

$1.3930 (2366)

Price at time of writing this review: $1.3864

Support levels (open interest**, contracts):

$1.3786 (244)

$1.3760 (328)

$1.3730 (309)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 36758 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 29760 contracts, with the maximum number of contracts with strike price $1,3500 (3054);

- The ratio of PUT/CALL was 0.81 versus 0.80 from the previous trading day according to data from January, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Currencies. Daily history for Jan 19’2018:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2220 -0,15%

GBP/USD $1,3861 -0,23%

USD/CHF Chf0,9629 +0,41%

USD/JPY Y110,74 -0,32%

EUR/JPY Y135,35 -0,46%

GBP/JPY Y155,51 +0,75%

AUD/USD $0,7993 -0,06%

NZD/USD $0,7273 -0,38%

USD/CAD C$1,2505 +0,57%

-

00:01

Schedule for today, Monday, Jan 22’2018 (GMT0)

11:00 Germany Bundesbank Monthly Report

13:30 Canada Wholesale Sales, m/m November 1.5% 1%

13:30 U.S. Chicago Federal National Activity Index December 0.15 0.44

-