Noticias del mercado

-

20:20

American focus: the dollar restoration of previously lost ground against the euro

Pound retreated from a session high against the dollar, but still continues to show a significant increase. Earlier today the pound rose sharply against the publication of the protocol the Bank of England, which was regarded as a bit of a hawk. The minutes of the April meeting was informed that all nine members of the committee voted to keep its benchmark interest rate unchanged at 0.5%. Although two members of the committee's April decision not to raise rates was "perfectly balanced". All nine members of the committee also agreed to leave unchanged the bond portfolio of the Bank of England, in the amount of 375 billion pounds (558.77 billion US dollars). Minutes showed that the leaders headed by Managing Mark Carney believed that the recent recovery of the eurozone economy would be beneficial to the UK economy, although some were concerned that any support for economic growth on the part of stronger economic dynamics in Europe can be neutralized by the weakness in the US and China. The Committee also noted that the financial woes of Greece continue to pose a risk to global economic growth. Annual inflation in the UK is at zero after the recent decline in oil prices, and in April the leaders of the Bank of England came to the conclusion that it may soon become negative. But executives expect that any period of falling prices would be temporary, although how fast the annual inflation returns to the target level of 2% will depend on the rate of growth of wages and force a pound, according to the protocols.

The Swiss franc depreciated significantly against the US dollar, reaching a minimum at the same time on April 16. Pressure had news that the SNB decided to significantly reduce the scope of an exception for holders of deposits in the framework of its scheme of negative rates. After completing the test, the Central Bank announced that the scheme would apply negative rates including pension funds. The minimum threshold, which do not apply negative rates will be 10 million. CHF. Recall SNB Commission imposes 0.75% deposits, on the balance of the Central Bank.

Previously, Frank received little support from the ZEW data and Credit Suisse, which showed that the indicator ZEW CS, which reflects the expectations of financial market experts surveyed in relation to economic development in the six months ahead, rose by 14.7 points to minus 23.2 points. The current conditions index rose by a modest survey of 0.3 points to -2.4 points. A significant majority of respondents believe that economic activity in Switzerland is in the "normal" state at the moment, which may be due to the fact that the labor market in Switzerland continues to be stable, the report said.

The euro fell against the dollar, while returning to a session low, which was associated with the anticipation of the publication of data on the US housing market and potrebdoveriyu eurozone. National Association of Realtors (NAR) reported that sales of existing US housing market increased by 6.1% last month from February to a seasonally adjusted annual rate reached 5.19 million. Economists had expected sales to rise in March to 5, 04 million. Sales for February were revised to 4.89 million. from the originally reported 4.88 million. Sales in March rose by 10.4% compared with a year earlier. The median sales price of homes in the secondary market increased by 7.8% compared with a year earlier to $ 212,100 in March, said NAR. "This increased prices by about 8% is not healthy, given that incomes grew by only 2%," says Lawrence Yun, chief economist for NAR. "The only way to relieve the pressure of housing costs is to have more houses coming on the market."

Meanwhile, preliminary data presented by the European Commission, showed that the consumer confidence index of the eurozone worsened in April, registering with the first decline in five months, contrary to the expectations of experts to further increase that was due to the uncertainty about Greece. According to the report, the April consumer confidence index fell to a level of -4.6 points compared with 3.7 points in March (the maximum value since July 2007). Economists predicted that this figure will improve to 3.0 points. Also add that the index for the European Union fell in April by 0.4 points to -2.2 points.

-

18:17

Swiss National Bank reduced the number of exemptions from negative interest rates

The Swiss National Bank (SNB) said on Wednesday that it reduced the number of sight deposit accounts exempt from its negative interest rate. Switzerland's central has been criticised that public institutions were being shielded from the charge.

Starting from May 01, the negative rate will apply to institutions such as the pension funds of the federal government and the central bank.

-

18:08

European Central Bank raised the amount the Greek central bank can lend its banks to €75.5 billion

According to the German newspaper Handelsblatt on Wednesday, the European Central Bank (ECB) on Tuesday raised the amount the Greek central bank can lend its banks to €75.5 billion from €74.0 billion the previous week.

The ECB declined to comment.

-

16:51

U.S. existing homes sales climbs 6.1% in March, the highest level since September 2013

The National Association of Realtors released existing homes sales figures in the U.S. on Wednesday. Sales of existing homes rose 6.1% to a seasonally adjusted annual rate of 5.19 million in March from 4.89 million in February. It was the highest level since September 2013.

February's figure was revised up from 4.88 million units.

Analysts had expected an increase to 5.04 million units.

The NAR chief economist Lawrence Yun said that sales activity picked up in March.

"The combination of low interest rates and the ongoing stability in the job market is improving buyer confidence and finally releasing some of the sizable pent-up demand that accumulated in recent years," he noted.

-

16:30

U.S.: Crude Oil Inventories, April 5.315M

-

16:14

U.S. house price index rise 0.7% in February

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Wednesday. The U.S. house price index rose 0.7% on a seasonally adjusted basis in February, in line with expectations, after a 0.3% gain in January.

On a yearly basis, the house price index climbed 5.4% in February.

These figures showed that housing demand increased.

-

16:01

U.S.: Existing Home Sales, m/m, March 6.1%

-

16:00

Eurozone: Consumer Confidence, April -4.6 (forecast -3)

-

16:00

U.S.: Existing Home Sales , March 5.19M (forecast 5.04)

-

15:52

Canadian government projects a surplus of 1.4 billion Canadian dollars for the fiscal year

The Canadian government Tuesday released its budget for this financial year ending on March 31, 2016. Canada's Finance Minister Joe Oliver said that the government projects a surplus of 1.4 billion Canadian dollars (US$1.15 billion) for the fiscal year.

"A balanced budget is the only way to ensure long-term prosperity for Canadians," Oliver noted.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E375mn), $1.0700-10(E1.457bn), $1.0725-30(E223mn), $1.0740(E318mn), $1.0800(E2.926bn), $1.0820(E700mn), $1.0835(E587mn)

USD/JPY: Y119.00($526mn), Y120.65, Y121.00($1.0bn)

USD/CHF: Chf0.9800($295mn)

AUD/USD: 0.7655-60(A$225mn), $0.7800(A$687mn)

NZD/USD: $0.7500(NZ$1.0bn), $0.7800(NZ$686mn)

USD/CAD: C$1.2285($250mn), C$1.2375-80($700mn)

-

15:20

China’s leading index climbs 0.2% in March

The Conference Board released its Leading Economic Index (LEI) for China on Wednesday. The index rose 0.2% in March, after a 1.4% increase in February. The rise was driven by increases in three of the six components.

The economist at The Conference Board Andrew Polk said that exports, consumer confidence, and real estate had a negative impact on the index.

-

15:02

U.S.: Housing Price Index, y/y, February 5.4%

-

15:00

U.S.: Housing Price Index, m/m, February 0.7% (forecast 0.7%)

-

14:54

Government debt in the Eurozone reached 91.9% of GDP in 2014

According to Eurostat, government debt in the Eurozone reached 91.9% of GDP in 2014. It was the highest level since the euro was introduced in 1999. Only 4 of the Eurozone's 19 countries were below the Maastricht Treaty's 60% debt limit.

The highest ratios of government debt were recorded in Greece (177.1% of GDP), followed by Italy (132.1%), Portugal (130.2%) and Ireland (109.7%).

The lowest ratios of government debt were recorded in in Estonia (10.6%), Luxembourg (23.6%) and Latvia (40.0%).

Germany' ratio of government debt decreased to 74.7% in 2014 from 77.1% in 2013.

France's ratio of government debt rose to 95% in 2014 from 92.3% in 2013.

UK's ratio of government debt declined to 89.4% in 2014 from 87.3% in 2013.

-

14:32

Foreign exchange market. European session: the British pound climbed against the U.S. dollar after the Bank of England’s (BoE) April meeting minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index March 0.3% -0.3%

01:30 Australia CPI, q/q Quarter I 0.2% 0.1% 0.2%

01:30 Australia CPI, y/y Quarter I 1.7% 1.3% 1.3%

01:30 Australia Trimmed Mean CPI q/q Quarter I 0.6% Revised From 0.7% 0.6% 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter I 2.2% 2.2% 2.3%

02:00 China Leading Index March 1.4% Revised From 1.5% 2%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed against the most major currencies ahead the U.S. existing home sales data. The existing home sales in the U.S. are expected to increase to 5.04 million units in March from 4.88 million units in February.

The euro traded lower against the U.S. dollar as concerns over Greece's debt crisis weighed on the euro. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

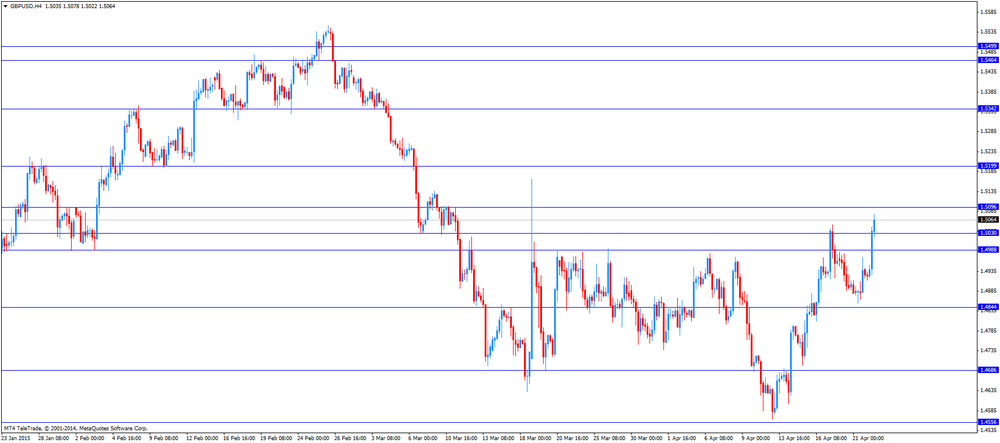

The British pound climbed against the U.S. dollar after the Bank of England's (BoE) April meeting minutes. All MPC members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

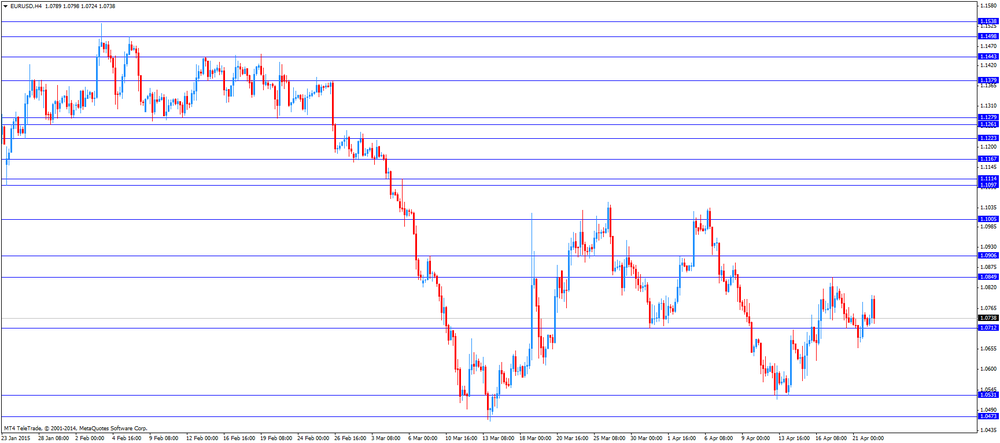

EUR/USD: the currency pair decreased to $1.0724

GBP/USD: the currency pair climbed to $1.5078

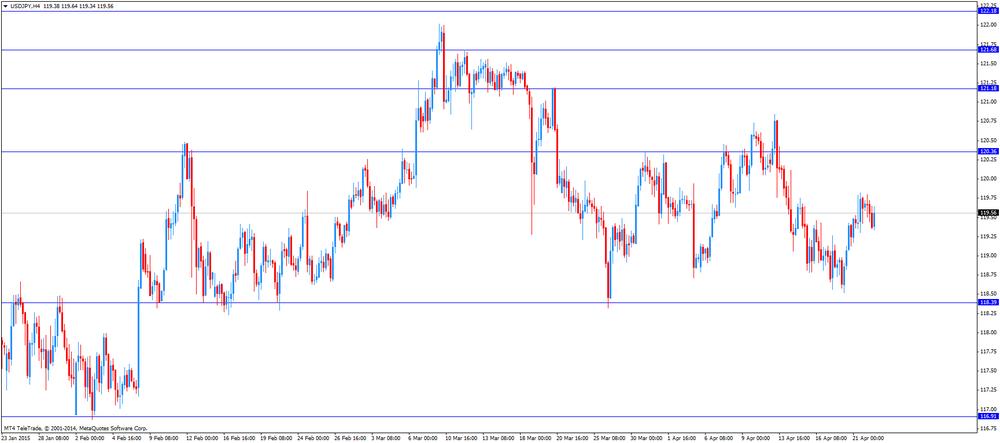

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 Eurozone Consumer Confidence (Preliminary) April -4 -3

14:00 U.S. Existing Home Sales March 4.88 5.04

14:00 U.S. Existing Home Sales, m/m March 1.2%

-

14:07

Federal Reserve Bank of Boston President Eric Rosengren: central banks including the Fed should set higher inflation targets

The Federal Reserve Bank of Boston President Eric Rosengren said in an interview with the Financial Times on Tuesday that central banks including the Fed should set higher inflation targets to avoid dealing with low economic growth.

Higher inflation rate target could mean more room to lower interest rate, Rosengren said.

The Federal Reserve Bank of Boston president expects the U.S. economy to expand slower than 2.2% in the first quarter.

Rosengren is not a voting member of the Federal Open Market Committee this year.

-

14:00

Orders

EUR/USD

Offers 1.0800

Bids 1.0660 1.0625/20 1.0600

GBP/USD

Offers 1.5090/100

Bids 1.5000 1.4975/70 1.4950 1.4900

EUR/JPY

Offers 130.00 129.50 129.00

Bids 128.10/00 127.55/50 127.10/00

USD/JPY

Offers 120.50 120.35/40 120.00

Bids 119.00 118.50

EUR/GBP

Offers 0.7215-25

Bids 0.7080/75

AUD/USD

Offers 0.7900 0.7850

Bids 0.7710/00 0.7650 0.7610/00

-

12:01

European stock markets mid session: stocks traded lower on concerns over Greece’s debt crisis

Stock indices traded lower on concerns over Greece's debt crisis. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

Corporate earnings also weighed on markets.

The Bank of England's Monetary Policy Committee (MPC) released its April meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

Current figures:

Name Price Change Change %

FTSE 100 7,025.68 -37.25 -0.53 %

DAX 11,859.45 -80.13 -0.67 %

CAC 40 5,166.98 -25.66 -0.49 %

-

11:34

Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel on Thursday

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that he expects that Greece and its creditors will sign an agreement in the coming weeks.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0650(E375mn), $1.0700-10(E1.457bn), $1.0725-30(E223mn), $1.0740(E318mn), $1.0800(E2.926bn), $1.0820(E700mn), $1.0835(E587mn)

USD/JPY: Y119.00($526mn), Y120.65, Y121.00($1.0bn)

USD/CHF: Chf0.9800($295mn)

AUD/USD: 0.7655-60(A$225mn), $0.7800(A$687mn)

NZD/USD: $0.7500(NZ$1.0bn), $0.7800(NZ$686mn)

USD/CAD: C$1.2285($250mn), C$1.2375-80($700mn)

-

11:21

European Commission President Jean-Claude Juncker ruled out the Greek exit from the Eurozone

The European Commission President Jean-Claude Juncker said on Tuesday that Greece should step up efforts to sign an agreement with its creditors. He added that he is not satisfied with the course of talks.

"The intensity of talks has increased in the past four or five days but is not yet at the maturity needed to be able to reach a quick conclusion," Juncker.

The European Commission president ruled out the Greek exit from the Eurozone.

-

11:01

Bank of England's Monetary Policy Committee minutes: inflation could recover strongly next year

The Bank of England's Monetary Policy Committee (MPC) released its April meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

The Bank of England (BoE) still expects the consumer inflation to decline into negative territory in the coming months, but inflation could recover strongly next year.

Some policymakers said that weakness in the U.S. and China offset the stronger growth in the Eurozone.

MPC members pointed out that Greece's debt problem still pose a risk to global growth.

-

10:34

Australia's consumer price inflation rises 0.2% in the first quarter

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia increased 0.2% in the first quarter, exceeding expectations for a 0.1% gain, after a 0.2% rise in fourth quarter.

On a yearly basis, Australia's consumer price inflation declined to 1.3% in the first quarter from 1.7% in the fourth quarter, in line with expectations.

The decline was driven by a drop in fuel prices. Fuel prices dropped more than 12%.

Fruit prices slid 8%.

Domestic travel and accommodation prices rose 3.5% in the first quarter, while tertiary education prices climbed 5.7%.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) gained to 0.6% in the fourth quarter, in line with expectations, after 0.6% rise in the fourth quarter. The fourth quarter's figure was revised down from a 0.7% increase.

The trimmed mean consumer price index (CPI) rose to 2.3% year-on-year in the fourth quarter from 2.2% in the fourth quarter.

However, the RBA could cut its interest rate at the May meeting despite this slightly increase in inflation. But the small rise could mean that the central bank may wait.

-

08:22

Options levels on wednesday, April 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0848 (1445)

$1.0810 (3017)

$1.0784 (222)

Price at time of writing this review: $1.0734

Support levels (open interest**, contracts):

$1.0682 (1861)

$1.0645 (2323)

$1.0594 (4820)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 60447 contracts, with the maximum number of contracts with strike price $1,1200 (6652);

- Overall open interest on the PUT options with the expiration date May, 8 is 73906 contracts, with the maximum number of contracts with strike price $1,0000 (9303);

- The ratio of PUT/CALL was 1.22 versus 1.24 from the previous trading day according to data from April, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5206 (730)

$1.5109 (1578)

$1.5013 (2345)

Price at time of writing this review: $1.4933

Support levels (open interest**, contracts):

$1.4884 (1546)

$1.4788 (2335)

$1.4692 (2479)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 22669 contracts, with the maximum number of contracts with strike price $1,5000 (2345);

- Overall open interest on the PUT options with the expiration date May, 8 is 32163 contracts, with the maximum number of contracts with strike price $1,4400 (2784);

- The ratio of PUT/CALL was 1.42 versus 1.41 from the previous trading day according to data from April, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session: The Australian dollar gained

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index March 0.3% -0.3%

01:30 Australia CPI, q/q Quarter I 0.2% 0.1% 0.2%

01:30 Australia CPI, y/y Quarter I 1.7% 1.3% 1.3%

01:30 Australia Trimmed Mean CPI q/q Quarter I 0.7% 0.6% 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter I 2.2% 2.2% 2.3%

02:00 China Leading Index March 1.4% Revised From 1.5% 2%

The Australian dollar gained ahead of consumer price data while the yen was mostly flat before trade data in early Asia on Wednesday. Australia's first quarter CPI is due and expected to show a 0.2% quarter-on-quarter rise, the same pace as the fourth quarter with the annual pace seen at a gain of 1.3%.

In Japan today, March trade data are due at 0850 Tokyo time (2350 GMT). The forecast is for a trade surplus worth ¥50.0 billion, the first surplus in 33 months.

The dollar regained some strength after a recent string of soft economic data dampened optimism on the U.S. recovery, adding to uncertainty over the timing of a rate hike.

EUR / USD: during the Asian session the pair fell to $ 1.0715

GBP / USD: during the Asian session the pair traded in the range of $ 1.4910-35

USD / JPY: during the Asian session the pair traded in the range Y119.55-75

-

04:45

China: Leading Index , March 2%

-

03:33

Australia: Trimmed Mean CPI q/q, Quarter I 0.6% (forecast 0.6%)

-

03:31

Australia: Trimmed Mean CPI y/y, Quarter I 2.3% (forecast 2.2%)

-

03:30

Australia: CPI, q/q, Quarter I 0.2% (forecast 0.1%)

-

03:30

Australia: CPI, y/y, Quarter I 1.3% (forecast 1.3%)

-

02:46

Australia: Leading Index, March -0.3%

-

01:55

Japan: Adjusted Merchandise Trade Balance, bln, March 0.00 (forecast -410)

-

01:52

Japan: Trade Balance Total, bln, 229.3 (forecast 50)

-

00:30

Currencies. Daily history for Apr 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0737 -0,04%

GBP/USD $1,4926 +0,14%

USD/CHF Chf0,9553 -0,06%

USD/JPY Y119,68 +0,39%

EUR/JPY Y128,50 +0,37%

GBP/JPY Y178,63 +0,53%

AUD/USD $0,7713 -0,16%

NZD/USD $0,7668 +0,12%

USD/CAD C$1,2276 +0,39%

-

00:04

Schedule for today, Wednesday, Apr 22’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index March 0.3%

01:30 Australia CPI, q/q Quarter I 0.2% 0.1%

01:30 Australia CPI, y/y Quarter I 1.7% 1.3%

01:30 Australia Trimmed Mean CPI q/q Quarter I 0.7% 0.6%

01:30 Australia Trimmed Mean CPI y/y Quarter I 2.2% 2.2%

02:00 China Leading Index March 1.5%

08:30 United Kingdom Bank of England Minutes

13:00 U.S. Housing Price Index, m/m February 0.3% 0.7%

13:00 U.S. Housing Price Index, y/y February 3.1%

14:00 Eurozone Consumer Confidence (Preliminary) April -4 -3

14:00 U.S. Existing Home Sales March 4.88 5.04

14:00 U.S. Existing Home Sales, m/m March 1.2%

14:30 U.S. Crude Oil Inventories April 1.3

22:45 New Zealand Visitor Arrivals March 6.9%

-