Noticias del mercado

-

19:06

U.S.: Baker Hughes Oil Rig Count, December 747

-

16:08

U.S new home sales rose more than expected in November

Sales of new single-family houses in November 2017 were at a seasonally adjusted annual rate of 733,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 17.5 percent (±10.4 percent) above the revised October rate of 624,000 and is 26.6 percent (±16.6 percent) above the November 2016 estimate of 579,000.

The median sales price of new houses sold in November 2017 was $318,700. The average sales price was $377,100.

-

16:07

Goldman Sachs analysts see Fed hiking U.S. interest rates more times than what the market has priced in

-

Project U.S. 10-year treasury yield hitting 3 pct by end of 2018

-

-

16:01

U.S.: New Home Sales, November 0.733 (forecast 0.654)

-

16:01

U.S.: Reuters/Michigan Consumer Sentiment Index, December 95.9 (forecast 97.1)

-

15:03

Canadian GDP flat in October

Real gross domestic product (GDP) was essentially unchanged in October following 0.2% growth in September, as 9 of 20 industrial sectors expanded.

Service-producing industries rose 0.2%, mainly from growth in wholesale trade, retail trade and real estate. Meanwhile, goods-producing industries contracted 0.4%, largely due to the mining, quarrying, and oil and gas extraction sector.

The wholesale trade sector grew for the 9th time in 11 months in October, with a 1.4% rise more than offsetting September's decline of 0.9%. Six of nine subsectors expanded, led by wholesalers of machinery, equipment and supplies (+3.4%), personal and household goods (+3.2%) and petroleum products (+3.1%). The wholesaling of motor vehicles and parts declined 1.7% as automotive imports decreased.

-

15:02

U.S durable goods orders increased $3.1 billion or 1.3 percent in November

New orders for manufactured durable goods in November increased $3.1 billion or 1.3 percent to $241.4 billion, the U.S. Census Bureau announced today. This increase, up three of the last four months, followed a 0.4 percent October decrease. Excluding transportation, new orders decreased 0.1 percent. Excluding defense, new orders increased 1.0 percent. Transportation equipment, also up three of the last four months, drove the increase, $3.3 billion or 4.2 percent to $80.9 billion.

-

15:01

-

14:31

U.S.: PCE price index ex food, energy, m/m, November 0.1% (forecast 0.1%)

-

14:31

U.S.: PCE price index ex food, energy, Y/Y, November 1.5% (forecast 1.5%)

-

14:31

U.S.: Personal spending , November 0.6% (forecast 0.5%)

-

14:31

Canada: GDP (m/m) , October 0% (forecast 0.2%)

-

14:31

U.S.: Personal Income, m/m, November 0.3% (forecast 0.4%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , November -0.1% (forecast 0.5%)

-

14:30

U.S.: Durable Goods Orders , November 1.3% (forecast 2%)

-

14:30

U.S.: Durable goods orders ex defense, November 1% (forecast 0.9%)

-

10:52

The UK’s current account deficit was £22.8 billion in Q3

The UK's current account deficit was £22.8 billion (4.5% of gross domestic product) in Quarter 3 (July to Sept) 2017, a narrowing of £3.0 billion from a revised deficit of £25.8 billion (5.1% of gross domestic product) in Quarter 2 (Apr to June) 2017.

The narrowing in the current account deficit was driven by a narrowing of the deficits on primary income by £1.8 billion, secondary income by £1.0 billion and total trade by £0.3 billion in Quarter 3 2017.

-

10:51

UK business investment increased by 0.5% to £45.9 billion in Quarter 3

Gross fixed capital formation (GFCF), in volume terms, was estimated to have increased by 0.3% to £82.3 billion in Quarter 3 (July to Sept) 2017 from £82.1 billion in Quarter 2 (Apr to June) 2017.

Business investment was estimated to have increased by 0.5% to £45.9 billion in Quarter 3 2017 from £45.6 billion in Quarter 2 2017.

Between Quarter 3 2016 and Quarter 3 2017, GFCF was estimated to have increased by 2.4% from £80.4 billion; business investment was estimated to have increased by 1.7% from £45.1 billion.

-

10:50

UK gross domestic product increased by 0.4% in Q3

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.4% between Quarter 2 (Apr to June) and Quarter 3 (July to Sept) 2017, unrevised from the second estimate of GDP.

Services remained the strongest contributor to growth in the output approach to GDP in Quarter 3 2017, with production also providing a positive contribution.

Household spending grew by 0.5% in Quarter 3 2017, providing the strongest contribution to the expenditure approach to GDP; while growth has increased compared with the first two quarters of 2017, the underlying story is one of a slowdown in growth of household spending, with quarter on same quarter a year ago growth at 1.0%, the lowest rate since Quarter 1 (Jan to Mar) 2012.

-

10:30

United Kingdom: Current account, bln , Quarter III -22.784 (forecast -21.2)

-

10:30

United Kingdom: Business Investment, y/y, Quarter III 1.7% (forecast 1.3%)

-

10:30

United Kingdom: Business Investment, q/q, Quarter III 0.5% (forecast 0.2%)

-

10:30

United Kingdom: GDP, y/y, Quarter III 1.7% (forecast 1.5%)

-

10:30

United Kingdom: GDP, q/q, Quarter III 0.4% (forecast 0.4%)

-

10:16

-

09:54

British prime minister May says UK foreign secretary will engage with Russia in a hard-headed way, mindful of issues such as Crimea, Ukraine and use of disinformation

-

09:49

Swiss KOF Economic Barometer continues its upward tendency in December

The KOF Economic Barometer continues its upward tendency in December. It has risen further by roughly one point to 111.3 points (after revised 110.4 in November). The Barometer now stands at its highest reading since June 2010. The Swiss economy is in an upswing.

The high standing of the Barometer in December is driven mainly by the positive development of the indicators for the banking sector, after a less positive development in the last month.

-

09:47

French household expenditure on goods bounced back by 2.2% in November

In November 2017, household expenditure on goods bounced back by 2.2% in volume, after −2.1% in October. Energy consumption increased strongly, enhanced by average temperatures lower than usual (in contrast with October). Textile-clothing purchases bounced back also, as well as food consumption. Only transport equipment purchases declined.

-

09:00

Switzerland: KOF Leading Indicator, December 111.3 (forecast 110.2)

-

08:45

France: Consumer spending , November 2.2% (forecast 1.4%)

-

08:45

France: GDP, q/q, Quarter III 0.5% (forecast 0.5%)

-

08:44

Options levels on friday, December 22, 2017

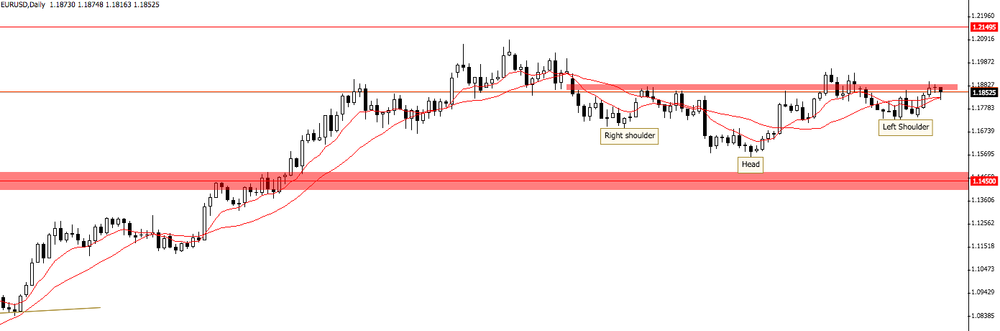

EUR/USD

Resistance levels (open interest**, contracts)

$1.2000 (3536)

$1.1978 (3730)

$1.1949 (616)

Price at time of writing this review: $1.1858

Support levels (open interest**, contracts):

$1.1793 (4743)

$1.1746 (3631)

$1.1698 (3896)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 93961 contracts (according to data from December, 21) with the maximum number of contracts with strike price $1,2200 (5585);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3499 (2572)

$1.3476 (2481)

$1.3439 (859)

Price at time of writing this review: $1.3382

Support levels (open interest**, contracts):

$1.3326 (1850)

$1.3286 (2828)

$1.3243 (2774)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 32878 contracts, with the maximum number of contracts with strike price $1,3500 (4724);

- Overall open interest on the PUT options with the expiration date January, 5 is 33863 contracts, with the maximum number of contracts with strike price $1,3300 (2828);

- The ratio of PUT/CALL was 1.03 versus 1.05 from the previous trading day according to data from December, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:36

U.S. Senate approves bill to fund federal government through jan. 19 and avert agency shutdowns on saturday; sends to Trump for signing into law

-

08:35

Japan econmin Motegi: next fiscal year's budget shows govt is able to lower new debt issuance by big margin

-

Govt stance is economic growth needed to improve public finances

-

Govt will continue to work toward achieving primary budget surplus

-

-

08:31

Consumers in Germany still appear to be in high spirits at the end of 2017 - Gfk

Both economic and income expectations are on the rise, whilst propensity to buy has taken a slight hit. GfK forecasts an increase in consumer climate for January 2018 of 0.1 points in comparison to the previous month to 10.8 points.

Consumers currently see the German economy as displaying a strong upward trend. Economic expectations confirm this very good trend as they are displaying slight growth. Income expectations are in fact rising considerably and seem to have overcome their dip. Propensity to buy, on the other hand, has had to take a slight hit but is still maintaining its excellent level. The failed attempts to form a "Jamaica" coalition do not seem to have had any lasting damage on consumer moods.

-

08:29

German import prices increased by 2.7% in November

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 2.7% in November 2017 compared with the corresponding month of the preceding year. In October 2017 and in September 2017 the annual rates of change were +2.6% and +3.0%, respectively. From October 2017 to November 2017 the index rose by 0.8%.

The index of import prices, excluding crude oil and mineral oil products, increased by 1.2% compared with the level of a year earlier.

The index of export prices increased by 1.2% in November 2017 compared with the corresponding month of the preceding year. In October 2017 and in September 2017 the annual rates of change were +1.5% and +1.7%, respectively. From October 2017 to November 2017 the export price index rose by 0.2%..

-

08:00

Germany: Gfk Consumer Confidence Survey, January 10.8 (forecast 10.8)

-

00:32

Currencies. Daily history for Dec 21’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1865 -0,05%

GBP/USD $1,3382 +0,06%

USD/CHF Chf0,9883 +0,16%

USD/JPY Y113,34 -0,03%

EUR/JPY Y134,49 -0,08%

GBP/JPY Y151,65 0,00%

AUD/USD $0,7699 +0,44%

NZD/USD $0,7016 +0,05%

USD/CAD C$1,2737 -0,76%

-

00:04

Schedule for today, Friday, Dec 22’2017 (GMT0)

07:00 Germany Gfk Consumer Confidence Survey January 10.7 10.8

07:45 France Consumer spending November -1.9% 1.5%

07:45 France GDP, q/q (Finally) Quarter III 0.6% 0.5%

08:00 Switzerland KOF Leading Indicator December 110.3 110.2

09:30 United Kingdom Current account, bln Quarter III -23.2 -21.2

09:30 United Kingdom Business Investment, y/y (Finally) Quarter III 2.5% 1.3%

09:30 United Kingdom Business Investment, q/q (Finally) Quarter III 0.5% 0.2%

09:30 United Kingdom GDP, y/y (Finally) Quarter III 1.5% 1.5%

09:30 United Kingdom GDP, q/q (Finally) Quarter III 0.3% 0.4%

13:30 Canada GDP (m/m) October 0.2% 0.2%

13:30 U.S. Durable goods orders ex defense November -0.8% 0.9%

13:30 U.S. Durable Goods Orders November -1.2% 2%

13:30 U.S. Durable Goods Orders ex Transportation November 0.4% 0.5%

13:30 U.S. PCE price index ex food, energy, Y/Y November 1.4% 1.5%

13:30 U.S. PCE price index ex food, energy, m/m November 0.2% 0.1%

13:30 U.S. Personal spending November 0.3% 0.5%

13:30 U.S. Personal Income, m/m November 0.4% 0.4%

15:00 U.S. New Home Sales November 0.685 0.654

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 98.5 97.1

18:00 U.S. Baker Hughes Oil Rig Count December 747

-