Noticias del mercado

-

23:59

Schedule for today, Tuesday, May 31’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Private Sector Credit, m/m April 0.4% 0.5%

01:30 Australia Private Sector Credit, y/y April 6.4%

01:30 Australia Building Permits, m/m April 3.7% -3%

01:30 Australia Current Account, bln Quarter I -21.1 -19.5

05:00 Japan Construction Orders, y/y April 19.8%

05:00 Japan Housing Starts, y/y April 8.4% 3.5%

06:00 Germany Retail sales, real adjusted April -1.1% 0.9%

06:00 Germany Retail sales, real unadjusted, y/y April 0.7% 1.9%

07:55 Germany Unemployment Rate s.a. May 6.2% 6.2%

07:55 Germany Unemployment Change May -16 -5

08:00 Eurozone Private Loans, Y/Y April 1.6%

08:00 Eurozone M3 money supply, adjusted y/y March 5% 5%

09:00 Eurozone Unemployment Rate April 10.2% 10.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) May 0.7% 0.8%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) May -0.2% -0.1%

12:30 Canada GDP (m/m) March -0.1% 0.0%

12:30 Canada GDP (YoY) Quarter I 0.8%

12:30 Canada GDP QoQ Quarter I 0.2%

12:30 U.S. PCE price index ex food, energy, m/m April 0.1% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y April 1.6%

12:30 U.S. Personal spending April 0.1% 0.6%

12:30 U.S. Personal Income, m/m April 0.4% 0.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March 5.4% 5.1%

13:45 U.S. Chicago Purchasing Managers' Index May 50.4 50.6

14:00 U.S. Consumer confidence May 94.2 95.8

23:30 Australia AIG Manufacturing Index May 53.4

23:50 Japan Capital Spending March 8.5%

-

17:22

St. Louis Fed President James Bullard: global financial markets are “well-prepared” for an interest rate hike in the summer

St. Louis Fed President James Bullard said in Seoul on Monday that global financial markets were "well-prepared" for an interest rate hike in the summer. He did not specify a date.

Bullard noted that the U.S. economy seemed to rebound in the second quarter.

St. Louis Fed president also said that an interest rate hike would depend on the incoming U.S. economic data.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:12

Producer prices in Italy drop 0.7% in April

The Italian statistical office Istat released its producer price inflation data for Italy on Monday. Italian producer prices decreased 0.7% in April, after a 0.2% increase in March.

Producer price slid by 0.9% on domestic market and rose by 0.2% on non-domestic market in April.

On a yearly basis, Italian PPI fell 4.1% in April, after a 3.6% drop in February. February's figure was revised down from a 3.5% decline.

Producer price slid 4.5% on domestic market and by 2.1% on non-domestic market in April.

-

17:05

Greek revised GDP decreases 0.5% in the first quarter

The Hellenic Statistical Authority released its revised gross domestic product (GDP) data for Greece on Monday. The Greek GDP decreased 0.5% in the first quarter, down from the preliminary reading of a 0.4% fall, after a 0.1% rise in the fourth quarter.

On a yearly basis, the Greek revised GDP fall at a seasonally-and-calendar adjusted 1.4% rate in the first quarter, down from the preliminary reading of a 1.3% drop, after a 0.8% decline in the fourth quarter.

Total consumption expenditure dropped 0.5% year-on-year in the first quarter.

Exports slid 3.3% year-on-year in the first quarter, while imports declined 0.3%.

-

16:47

Greek producer prices increase 0.4% in April

The Hellenic Statistical Authority released its producer price index (PPI) data on Monday. Greek producer prices increased 0.4% in April, after a 2.1% rise in March.

Domestic market prices climbed by 0.2% in April, while foreign market prices rose 0.9%.

On a yearly basis, Greek PPI plunged 10.2% in April, after a 10.2% drop in March.

Domestic market prices slid 8.8% year-on-year in April, while foreign market prices dropped 14.8%.

Energy prices plunged 21.3% year-on-year in April, while intermediate goods industrial prices were down 3.6%.

-

16:32

European Central Bank purchases €19.3 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €19.3 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.18 billion of covered bonds, and €1 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

-

16:14

Canadian current account deficit widens to C$16.8 billion in the first quarter

Statistics Canada released current account data on Monday. Canadian current account deficit widened to C$16.8 billion in the first quarter from a deficit of C$15.7 billion in the fourth quarter. The fourth quarter figure was revised down from a deficit of C$15.38 billion.

The trade in goods deficit rose by C$1.3 billion to C$6.3 billion in the first quarter, while the deficit on international trade in services declined by $0.2 billion to C$5.7 billion.

-

15:51

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 200m) 110.75 (250m)

EUR/USD: 1.1100 (EUR 248m) 1.1150 (660m)

GBP/USD 1.4450 (GBP 526m) 1.4585 (493m)

EUR/GBP 0.7635 (EUR 730m) 0.7750 (875m) 0.7800 (420m)

AUD/USD 0.7210 (AUD 1.08bln) 0.7500 (340m)

USD/CAD 1.3000 (USD 560m) 1.3150 (360m)

-

15:16

Canadian industrial product prices drop 0.5% in April

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) dropped 0.5% in April, after a 0.6% decline in March.

The decrease was mainly driven by lower prices for motorized and recreational vehicles, which plunged 2.1% in April.

14 of the 21 commodity groups decreased, 4 were unchanged, while 3 rose.

The Raw Materials Price Index (RMPI) climbed 0.7% in April, after a 4.5% increase in May.

The rise was driven by higher prices for crude energy products. Crude energy products jumped by 4.2% in April.

2 of the 6 commodity groups rose and 4 decreased.

-

14:39

German consumer price inflation increases 0.3% in May

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index increased 0.3% in May, in line with expectations, after a 0.4% drop in April.

On a yearly basis, German preliminary consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

Energy prices slid 7.9% year-on-year in May.

Goods prices dropped 0.9% year-on-year in May, while services prices increased 1.2%.

-

14:30

Canada: Industrial Product Price Index, m/m, April -0.5%

-

14:30

Canada: Current Account, bln, Quarter I -16.8

-

14:30

Canada: Industrial Product Price Index, y/y, April -1.6%

-

14:26

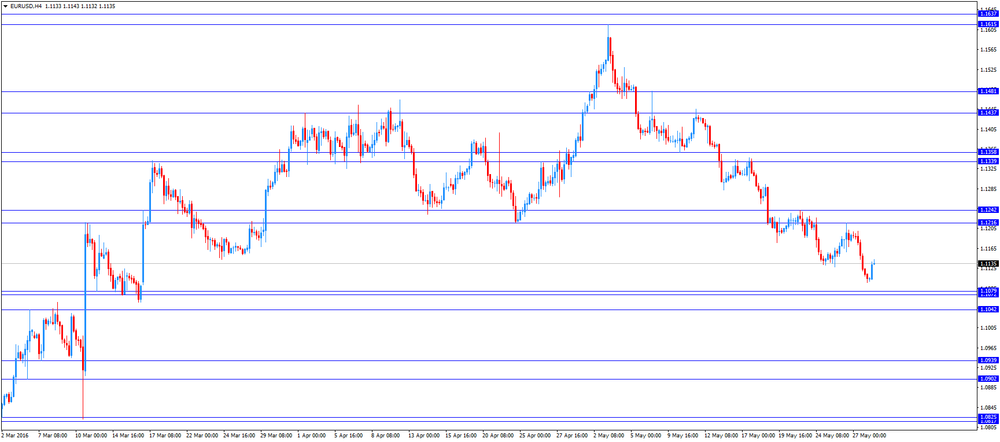

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:20 U.S. FOMC Member James Bullard Speaks

01:00 Australia HIA New Home Sales, m/m April 8.9% -4.7%

01:30 Australia Company Gross Profits QoQ Quarter I -2.8% 0% -4.7%

06:00 United Kingdom Bank holiday

07:00 Switzerland KOF Leading Indicator May 102.6 Revised From 102.7 102.8 102.9

09:00 Eurozone Economic sentiment index May 104 Revised From 103.9 104.4 104.7

09:00 Eurozone Consumer Confidence (Finally) May -9.3 -7 -7

09:00 Eurozone Industrial confidence May -3.6 Revised From -3.7 -3.6 -3.6

09:00 Eurozone Business climate indicator May 0.15 Revised From 0.13 0.16 0.26

12:00 Germany CPI, m/m (Preliminary) May -0.4% 0.3% 0.3%

12:00 Germany CPI, y/y (Preliminary) May -0.1% 0.1% 0.1%

12:00 U.S. Bank holiday

The U.S. dollar traded lower against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for a public holiday.

The euro traded higher against the U.S. dollar after the release of the positive economic data from the Eurozone. Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index increased 0.3% in May, in line with expectations, after a 0.4% fall in April.

On a yearly basis, German preliminary consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

European Commission released its economic sentiment index for the Eurozone on Monday. The index rose to 104.7 in May from 104.0 in April. April's figure was revised up from 103.9.

Analysts had expected the index to increase to 104.4.

The rise was driven by improvements in confidence among consumers and managers in the retail trade and construction sectors.

The industrial confidence index remained unchanged at -3.6 in May, in line with expectations. April's figure was revised up from -3.7.

The final consumer confidence index was up to -7.0 in May from -9.3 in April, in line with expectations.

The business climate index increased to 0.26 in May from 0.15 in April. April's figure was revised up from 0.13. Analysts had expected the index to climb to 0.16.

The rise in business climate index was driven by a more favourable managers' assessment of past production, the stocks of finished products and overall order books.

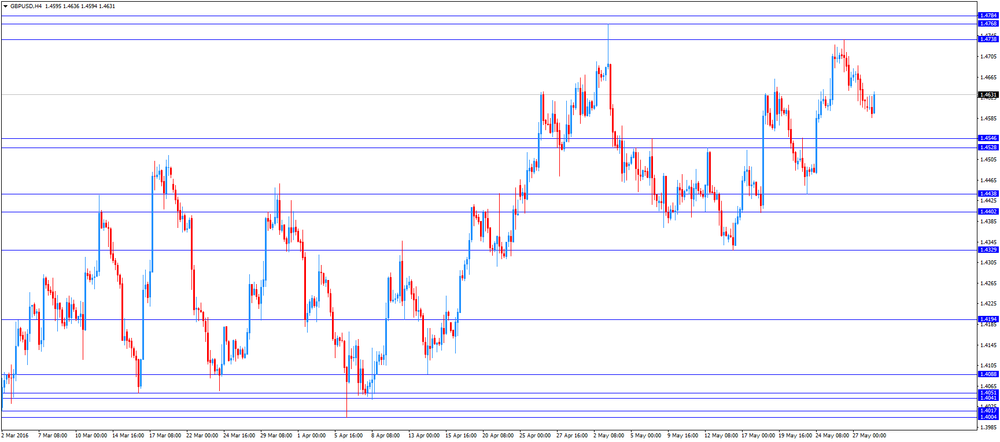

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K. Markets in the U.K. were closed for a public holiday.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data.

The Swiss franc traded higher against the U.S. dollar. The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator rose to 102.9 in May from 102.6 in April. April's figure was revised down from 102.7. Analysts had expected the index to increase to 102.8.

The rise was driven by positive signals from the manufacturing sector, the financial sector and the export sector.

EUR/USD: the currency pair rose to $1.1143

GBP/USD: the currency pair increased to $1.4636

USD/JPY: the currency pair was down to Y111.02

The most important news that are expected (GMT0):

12:30 Canada Industrial Product Price Index, m/m April -0.6%

12:30 Canada Industrial Product Price Index, y/y April -2.1%

12:30 Canada Current Account, bln Quarter I -15.38

22:45 New Zealand Building Permits, m/m April -9.8%

23:30 Japan Household spending Y/Y April -5.3% -1.4%

23:30 Japan Unemployment Rate April 3.2% 3.2%

23:50 Japan Industrial Production (MoM) (Preliminary) April 3.8% -1.5%

23:50 Japan Industrial Production (YoY) (Preliminary) April 0.2%

-

14:00

Germany: CPI, y/y , May 0.1% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, May 0.3% (forecast 0.3%)

-

13:44

Orders

EUR/USD

Offers 1.1185 1.1200 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60

Bids 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4700 1.4735 1.4750 1.4770 1.4800 1.4820 1.4850

Bids 1.4600 1.4585 1.4550 1.4500

EUR/GBP

Offers 0.7630-35 0.7650 0.7675-80 0.7700-05 0.7730 0.7755-60

Bids 0.7565-70 0.7550 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 124.00 124.30 124.50 124.70-75 125.00

Bids 123.30 123.00 122.80 122.30 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers 111.50 111.80 112.00

Bids 109.40-50 109.20 109.00 108.75 108.50 108.30 108.20 108.00

AUD/USD

Offers 0.7200 0.7220-25 0.7250 0.7260 0.7280 0.7300 0.7325-30 0.7350

Bids 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050

-

11:45

Preliminary consumer price inflation in Spain is up 0.6% in May

The Spanish statistical office INE released its preliminary consumer price inflation data on Monday. Consumer price inflation in Spain was up 0.6% in May, after a 0.7% rise in April.

On a yearly basis, consumer prices fell by 1.0% in May, after a 1.1% decrease in April.

The improvement in annual inflation was mainly driven by an increase in electricity prices and a slower fall in the prices of package holidays.

-

11:39

French final GDP rises 0.6% in the first quarter

The French statistical office Insee released its final gross domestic product data for France on Monday. The French final GDP rose 0.6% in the first quarter, up from the preliminary reading of a 0.5% growth, after a 0.4% increase in the fourth quarter of 2015.

Household spending climbed 1.0% in the first quarter, after a flat reading in the fourth quarter of 2015, while government spending rose 0.4%, after a 0.4% gain in the fourth quarter.

Business investment rose 1.6% in the first quarter, after a 1.2% increase in the fourth quarter

Total production in goods and services was up 0.7% in the first quarter, after a 0.6% rise in the fourth quarter.

Export were flat in the first quarter, while imports rose 0.6%.

-

11:31

French consumer spending falls 0.1% in April

French statistical office INSEE released its consumer spending data on Monday. French consumer spending fell 0.1% in April, after a 1.1% gain in March. March's figure was revised up from a 0.2% increase.

The decrease was mainly driven by a drop in food products. Spending on food products slid by 1.2% in April.

On a yearly basis, consumer spending climbed 2.5% in April.

-

11:24

German import prices are down 0.1% in April

Destatis released its import prices data for Germany on Monday. German import prices declined by 6.6% in April from last year, after a 5.9% fall in March. It was the biggest drop since October 2009.

The decline was driven by a drop in energy prices, which plunged 30.8% year-on-year in April.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.1% in April, after a 0.7% rise in March.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 4.0% in April.

Export prices dropped 2.0% year-on-year in April, after a 1.6% decrease in March.

On a monthly base, export prices were down 0.1% in April, after a 0.2% rise in March.

-

11:17

Eurozone’s economic sentiment index rises to 104.7 in May

The European Commission released its economic sentiment index for the Eurozone on Monday. The index rose to 104.7 in May from 104.0 in April. April's figure was revised up from 103.9.

Analysts had expected the index to increase to 104.4.

The rise was driven by improvements in confidence among consumers and managers in the retail trade and construction sectors.

The industrial confidence index remained unchanged at -3.6 in May, in line with expectations. April's figure was revised up from -3.7.

The final consumer confidence index was up to -7.0 in May from -9.3 in April, in line with expectations.

The business climate index increased to 0.26 in May from 0.15 in April. April's figure was revised up from 0.13. Analysts had expected the index to climb to 0.16.

The rise in business climate index was driven by a more favourable managers' assessment of past production, the stocks of finished products and overall order books.

-

11:01

Eurozone: Industrial confidence, May -3.6 (forecast -3.6)

-

11:00

Eurozone: Economic sentiment index , May 104.7 (forecast 104.4)

-

11:00

Eurozone: Business climate indicator , May 0.26 (forecast 0.16)

-

11:00

Eurozone: Consumer Confidence, May -7 (forecast -7)

-

10:24

Fed Chairwoman Janet Yellen: an interest rate hike will be likely appropriate “in the coming months”

The Fed Chairwoman Janet Yellen said at t Harvard University on Friday that an interest rate hike would be likely appropriate "in the coming months". She noted that the U.S. economy continued to improve, while inflation would reach the Fed's 2% target "over the next couple of years".

-

10:14

Company gross profits in Australia drop 4.7% in the first quarter

The Australian Bureau of Statistics released its company gross profits data on Monday. Company gross profits in Australia dropped seasonally adjusted 4.7% in the first quarter, missing expectations for a flat reading, after a 3.6% decrease in the fourth quarter. The fourth quarter's figure was revised down from a 2.8% decline.

Sales of goods and services in the manufacturing sector dropped seasonally adjusted 0.3% in the first quarter, sales of goods and services in wholesale trade climbed 3.2%.

Inventories rose seasonally adjusted 0.4% in the first quarter, while wages and salaries increased 0.6%.

-

09:46

HIA new home sales in Australia drop 4.7% in April

The Housing Industry Association (HIA) released its new home sales data for Australia on Monday. New home sales fell 4.7% in April, after a 8.9% rise in March. January's figure was revised down from a 3.1% increase.

"The trend in new home sales reiterates that the peak for the cycle has passed, but the descent we're now observing is very mild. This signals the potential for very healthy home construction activity throughout 2016, much as we have been anticipating," the HIA's economist Diwa Hopkins said.

Sales of detached homes decreased 3.0% in April, while sales for multi-units slid 10.8%.

-

09:40

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.10/15, 109.65, 109.95, 110.00, 111.00, 111.50, 112.05

EUR/USD 1.0975/80/85 (699m), 1.0995, 1.1010/15/20, 1.1070, 1.1150, 1.1200

-

09:39

Retail sales in Japan are down at an annual rate of 0.8% in April

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan were down at an annual rate of 0.8% in April, beating expectations for a 1.2% drop, after a 1.0% decrease in March. March's figure was revised up from 1.1% decline.

Sales at large-scale retailers decreased 0.8% year-on-year in April, after a 1.0% drop in March.

On a monthly basis, retail sales were flat in April, after a 1.5% increase in March.

-

09:29

KOF leading indicator for Switzerland rises to 102.9 in May

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator rose to 102.9 in May from 102.6 in April. April's figure was revised down from 102.7.

Analysts had expected the index to increase to 102.8.

The rise was driven by positive signals from the manufacturing sector, the financial sector and the export sector.

"Since February, the Barometer has been solidly standing above its long-term average. This indicates an on-going positive development of the Swiss economy in the coming months," the KOF said.

-

09:00

Switzerland: KOF Leading Indicator, May 102.9 (forecast 102.8)

-

08:19

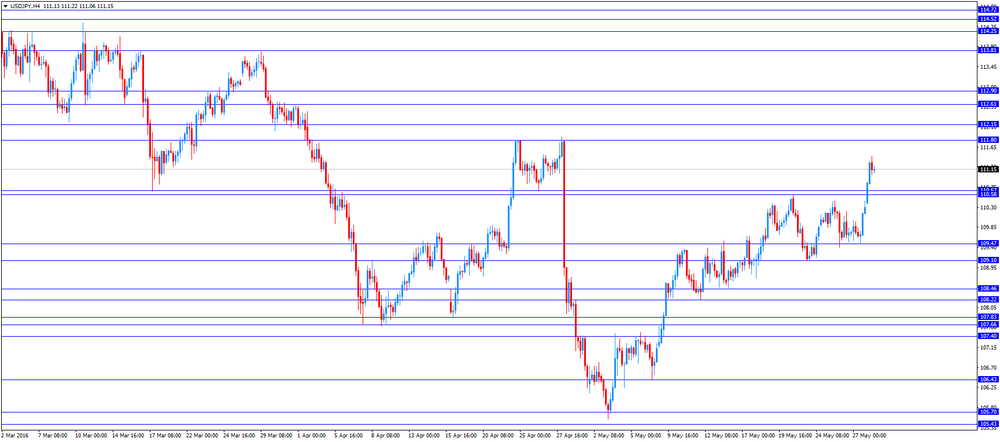

Asian session: The dollar hit a one-month high against the yen

The dollar hit a one-month high against the yen on Monday and stood tall against other peers after comments by Federal Reserve Chair Janet Yellen enhanced the prospects of a near-term U.S. interest rate hike. In addition to the latest round of hawkish-sounding comments from Yellen, political developments in Tokyo were also seen supporting the dollar against the yen. Japanese Prime Minister Shinzo Abe said he would delay a sales tax hike scheduled for next April by two and a half years, a senior ruling party official said after a meeting with the premier on Monday.

Japan is also seen compiling a supplementary budget to boost the sputtering economy, a move which is widely expected to be followed by further monetary easing by the Bank of Japan.

Yellen's rate hike endorsement was just what the currency market was looking for to take the already-bullish dollar yet higher after a recent run of upbeat U.S. economic indicators and comments from top Fed officials that supported a near-term tightening.

EUR/USD: during the Asian session the pair fell to $1.1095

GBP/USD: during the Asian session the pair traded in the range of $1.4595-25

USD/JPY: during the Asian session the pair rose to Y111.20

Based on Reuters materials

-

07:12

Options levels on monday, May 30, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1309 (3959)

$1.1267 (2942)

$1.1201 (1452)

Price at time of writing this review: $1.1103

Support levels (open interest**, contracts):

$1.1064 (5149)

$1.1028 (3649)

$1.0987 (3611)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 72860 contracts, with the maximum number of contracts with strike price $1,1400 (5049);

- Overall open interest on the PUT options with the expiration date June, 3 is 87800 contracts, with the maximum number of contracts with strike price $1,1200 (7911);

- The ratio of PUT/CALL was 1.21 versus 1.23 from the previous trading day according to data from May, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.4901 (2014)

$1.4802 (1633)

$1.4705 (2042)

Price at time of writing this review: $1.4611

Support levels (open interest**, contracts):

$1.4497 (1205)

$1.4398 (1766)

$1.4299 (2628)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 32819 contracts, with the maximum number of contracts with strike price $1,4600 (2449);

- Overall open interest on the PUT options with the expiration date June, 3 is 34998 contracts, with the maximum number of contracts with strike price $1,4200 (3023);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from May, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Company Gross Profits QoQ, Quarter I -4.7% (forecast 0%)

-

03:00

Australia: HIA New Home Sales, m/m, April -4.7%

-

01:50

Japan: Retail sales, y/y, April -0.8% (forecast -1.2%)

-

00:31

Currencies. Daily history for May 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1113 -0,71%

GBP/USD $1,4619 -0,31%

USD/CHF Chf0,9944 +0,54%

USD/JPY Y110,29 +0,49%

EUR/JPY Y122,51 -0,26%

GBP/JPY Y161,25 +0,21%

AUD/USD $0,7124 -1,39%

NZD/USD $0,6694 -0,69%

USD/CAD C$1,3023 +0,38%

-