Noticias del mercado

-

23:30

Australia: AIG Manufacturing Index, November 52.5

-

18:00

European stocks closed: FTSE 100 6,356.09 -19.06 -0.30% CAC 40 4,957.6 +27.46 +0.56% DAX 11,382.23 88.47 +0.78%

-

16:58

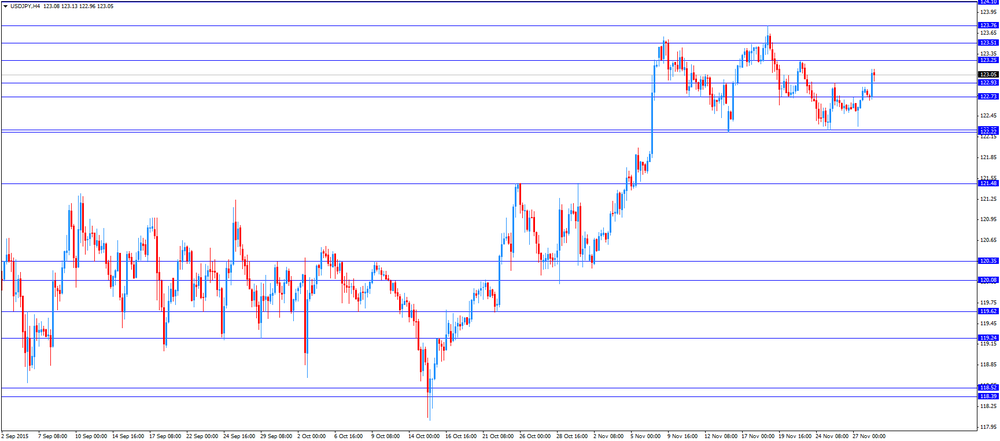

Bank of Japan Governor Haruhiko Kuroda reiterates that the central bank will add further stimulus measures to boost inflation toward 2% target if needed

The Bank of Japan (BoJ) Governor Haruhiko Kuroda reiterated on Monday that the central bank will add further stimulus measures to boost inflation toward 2% target if needed.

"We'll ease policy or take whatever steps necessary without hesitation if an early achievement of our price target becomes difficult," he said.

Kuroda pointed out that further slowdown in the emerging economies may hurt Japanese exports and production.

The BoJ governor noted that companies should raise wages.

"If Japan were to emerge from deflation and see inflation hit 2 percent, it's important that companies start preparing for that moment by investing more on human resources and capital expenditure," Kuroda said.

-

16:29

European Central Bank purchases €13.75 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.75 billion of government and agency bonds under its quantitative-easing program last week.

The ECB will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

The ECB President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.14 billion of covered bonds, and €234 million of asset-backed securities.

-

16:21

U.S. pending home sales rise 0.2% in October

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. rose 0.2% in October, missing expectations for a 1.5% gain, after a 1.6% drop in September. September's figure was revised up from a 2.3% decline.

The increase was mainly lead by a rise the Northeast and West.

"Contract signings in October made the most strides in the Northeast, which hasn't seen much of the drastic price appreciation1 and supply constraints that are occurring in other parts of the country. In the most competitive metro areas - particularly those in the South and West - affordability concerns remain heightened as low inventory continues to drive up prices," the NAR's chief economist Lawrence Yun said.

"Areas that are heavily reliant on oil-related jobs are the exception and have already started to see some softness in sales because of declining energy prices," he added.

-

16:00

U.S.: Pending Home Sales (MoM) , October 0.2% (forecast 1.5%)

-

15:57

Chicago purchasing managers' index plunges to 48.7 in November

The Institute for Supply Management released its Chicago purchasing managers' index on Monday. The Chicago purchasing managers' index dropped to 48.7 in November from 56.2 in October, missing expectations for a decrease to 54.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The drop was mainly driven by a fall in new orders. The new orders index was down to 44.1 in November from 59.4 in October. It was the lowest reading since March.

The production index fell to 50.9 in November from 63.4 in October, while the employment index rose to 51.6 from 50.6.

"The slowdown in the global economy, the strong dollar and decline in oil prices have all impacted businesses this year to varying degrees. While it looks likely that the Fed will begin to raise rates in December, the latest setback supports the case for a gradualist approach to monetary tightening," Chief Economist of MNI Indicators Philip Uglow said.

-

15:45

U.S.: Chicago Purchasing Managers' Index , November 48.7 (forecast 54)

-

15:41

Private sector credit in Australia rises 0.7% in October

The Reserve Bank of Australia (RBA) released its private sector credit data on Monday. The total value of private sector credit in Australia rose 0.7% in October, exceeding expectations for a 0.6% gain, after a 0.7% increase in September. September's figure was revised down from a 0.8% rise.

Housing credit increased 0.6% in October, personal credit was down 0.3%, while business credit rose 10.0%.

On a yearly basis, the private sector credit in Australia jumped 6.7% in October, after a 6.6% in September.

-

14:49

Producer prices in Italy decrease 0.1% in October

The Italian statistical office Istat released its producer price inflation data for Italy on Monday. Italian producer prices decreased 0.1% in October, after a 0.3% decline in September. September's figure was revised down from a 0.2% drop.

Producer price declined by 0.1% on domestic market and by 0.1% on non-domestic market in October.

On a yearly basis, Italian PPI fell 2.9% in October, after a 3.9% drop in September. September's figure was revised down from a 3.0% fall.

Producer price slid 3.5% on domestic market and by 0.8% on non-domestic market in October.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 1.25bln)

EUR/USD 1.0500 (EUR 909m) 1.0600 (1bln)

GBP/USD 1.5175 (GBP 428m)

EUR/GBP 0.6950 (EUR 690m) 0.7050 (600m)

EUR/JPY 132.30 (EUR 1.1bln)

NZD/USD 0.6300 (NZD 834m)

AUD/NZD 1.0840 (AUD 373m) 1.1000 (225m)

AUD/JPY 87.00 (AUD 774m)

-

14:37

Canadian current account deficit narrows to C$16.2 billion in the third quarter

Statistics Canada released current account data on Monday. Canadian current account deficit narrowed to C$16.2 billion in the third quarter from a deficit of C$16.4 billion in the second quarter. The second quarter figure was revised up from a deficit of C$17.4 billion.

The fall in deficit was driven by declines in the trade in goods and services deficit. The trade in goods deficit fell by C$1.3 billion to C$5.1 billion in the third quarter, while the deficit on international trade in services declined by $0.1 billion to C$5.6 billion.

-

14:30

Canada: Current Account, bln, Quarter III -16.2 (forecast -15.15)

-

14:26

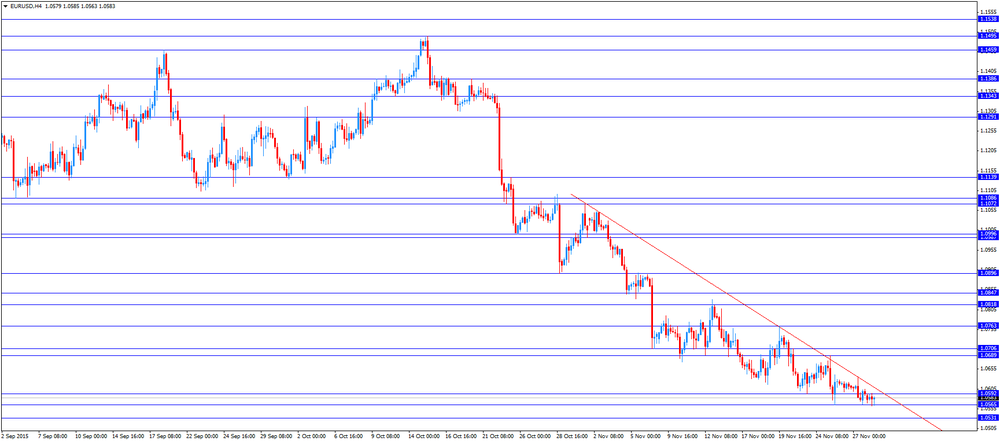

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on speculation that the European Central Bank will add further stimulus measures

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand ANZ Business Confidence November 10.5 14.6

00:30 Australia Company Gross Profits QoQ Quarter III -0.5% Revised From -1.9% 1.0% 1.3%

00:30 Australia Private Sector Credit, m/m October 0.7% Revised From 0.8% 0.6% 0.7%

05:00 Japan Construction Orders, y/y October 6.7% -25.2%

05:00 Japan Housing Starts, y/y October 2.6% 2.9% -2.5%

07:00 Germany Retail sales, real adjusted October 0.0% 0.4% -0.4%

07:00 Germany Retail sales, real unadjusted, y/y October 3.5% Revised From 3.4% 2.9% 2.1%

08:00 Switzerland KOF Leading Indicator November 100.4 Revised From 99.8 100.2 97.9

09:30 United Kingdom Consumer credit, mln October 1303 Revised From 1261 1300 1178

09:30 United Kingdom Mortgage Approvals October 69.01 Revised From 68.87 70 69.63

09:30 United Kingdom Net Lending to Individuals, bln October 4.85 4.8

13:00 Germany CPI, m/m (Preliminary) November 0.0% 0.1% 0.1%

13:00 Germany CPI, y/y (Preliminary) November 0.3% 0.4% 0.4%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The Chicago purchasing managers' index is expected to decline to 54.0 in November from 56.2 in October.

Pending home sales in the U.S. expected to climbs 1.5% in October, after a 2.3% drop in September.

The euro traded lower against the U.S. dollar on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB President Mario Draghi said at a press conference after the ECB meeting in October that the central bank will review its stimulus measures at its next meeting in December.

Meanwhile, the economic data from Germany was mixed. Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index increased 0.1% in November, in line with expectations, after a flat reading in October.

On a yearly basis, German preliminary consumer price index increased to 0.4% in November from 0.3% in October, in line with expectations.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in November.

Goods prices dropped 0.6% year-on-year in November, driven by a decline in energy prices. Energy prices slid 7.5% year-on-year in November.

German adjusted retail sales fell 0.4% in October, missing forecasts of a 0.4% gain, after a flat reading in September.

On a yearly basis, German retail sales jumped 2.1% in October, missing expectations for a 2.9% gain, after a 3.5% rise in September. September's figure was revised up from a 3.4% increase.

Sales of non-food products increased at an annual rate of 1.8% in October, while sales of food, beverages and tobacco products climbed by 2.3%.

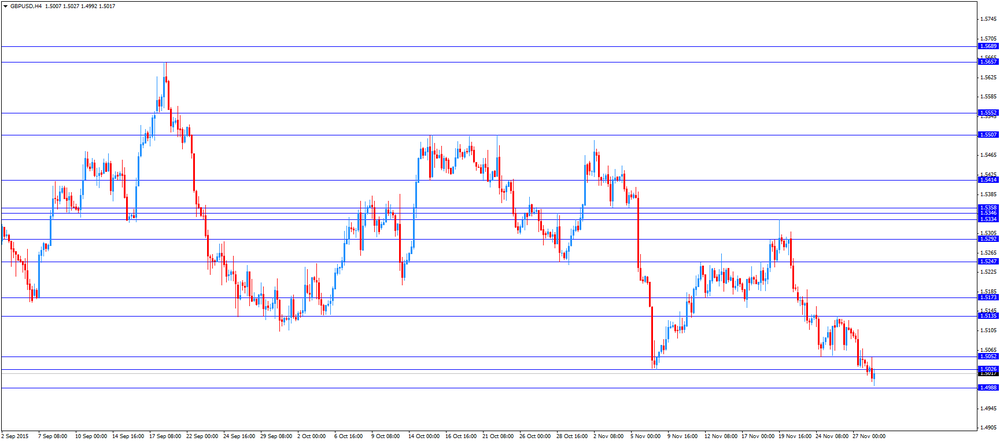

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected economic data from the U.K. The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 69,630 in October from 69,012 in September, missing expectations for an increase to 70,000. September's figure was revised up from 68,874.

Consumer credit in the U.K. rose by £1.178 billion in October, missing expectations for a £1.300 billion increase, after a £1.303 billion gain in September. September's figure was revised down from £1.261 billion.

Net lending to individuals in the U.K. increased by £4.8 billion in October, after a £4.85 billion gain in September.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of Canadian current account data. The Canadian current account deficit is expected to narrow to C$15.15 billion in the third quarter from a deficit of C$17.4 billion in the second quarter.

EUR/USD: the currency pair declined to $1.0562

GBP/USD: the currency pair fell to $1.4992

USD/JPY: the currency pair increased to Y123.13

The most important news that are expected (GMT0):

13:30 Canada Current Account, bln Quarter III -17.4 -15.15

14:45 U.S. Chicago Purchasing Managers' Index November 56.2 54

15:00 U.S. Pending Home Sales (MoM) October -2.3% 1.5%

-

14:12

German consumer price inflation increases 0.1% in November

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index increased 0.1% in November, in line with expectations, after a flat reading in October.

On a yearly basis, German preliminary consumer price index increased to 0.4% in November from 0.3% in October, in line with expectations.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in November.

Goods prices dropped 0.6% year-on-year in November, driven by a decline in energy prices. Energy prices slid 7.5% year-on-year in November.

-

14:00

Germany: CPI, m/m, November 0.1% (forecast 0.1%)

-

14:00

Germany: CPI, y/y , November 0.4% (forecast 0.4%)

-

11:52

Building permits in New Zealand jump 5.1% in October

Statistics New Zealand released its building permits data on late Sunday evening. Building permits in New Zealand jumped 5.1% in October, after a 5.8% drop in September. September's figure was revised down from a 5.7% decline.

Residential work rose 2.4% year-on-year in October, while non-residential work climbed 4.9%.

"Dwelling consents are well above the historical average in both Auckland and Canterbury. Auckland dwelling consents have continued to increase, while Canterbury has come down from the peak we saw last year," business indicators senior manager Neil Kelly said.

-

11:37

Greek retail sales slides 8.5% in September

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Monday. Greek retail sales slid 8.5% in September.

On a yearly basis, Greek retail sales fell by 3.2% in September, after a 2.1% drop in August. August's figure was revised up from a 2.2% decline.

Sales of food products decreased by 2.8% in September, sales of non-food products climbed by 1.5%, while sales of automotive fuel dropped by 6.4%.

-

11:31

Preliminary consumer prices in Italy decrease 0.4% in November

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy declined 0.4% in November, after a 0.2% rise in October.

The decrease was mainly driven by a drop in prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care plunged 1.8% in November.

On a yearly basis, consumer prices climbed 0.1% in November, after a 0.3% increase in October.

The slower increase was mainly driven by lower prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care rose 0.4% year-on-year, after a 1.4% gain in October.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.6% year-on-year in November from 0.8% in October.

-

11:20

Retail sales in Spain rise at a seasonally adjusted rate of 0.4% in October

The Spanish statistical office INE released its retail sales data on Monday. Retail sales in Spain rose at a seasonally adjusted rate of 0.4% in October, after a 0.8% gain in September.

Food sales were up 0.6% in October, while non-food sales climbed by 0.6%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 5.8% in October, after a 4.7% rise in September.

Sales of non-food products jumped 7.6% in September from a year ago, while food sales rose 2.0%.

-

11:14

Number of mortgages approvals in the U.K. rises to 69,630 in October

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 69,630 in October from 69,012 in September, missing expectations for an increase to 70,000. September's figure was revised up from 68,874.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. rose by £1.178 billion in October, missing expectations for a £1.300 billion increase, after a £1.303 billion gain in September. September's figure was revised down from £1.261 billion.

Net lending to individuals in the U.K. increased by £4.8 billion in October, after a £4.85 billion gain in September.

-

11:04

KOF leading indicator for Switzerland declines to 97.9 in November

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator declined to 97.9 in November from 100.4 in October, missing expectations for a fall to 100.2. October's figure was revised up from 99.8.

"The decrease of the Barometer in November is predominantly driven by a marked deterioration of sentiment reflected by the indicators on Swiss manufacturing activity. Another negative, but considerably less pronounced, contribution stems from the indicators related to exports," the KOF said.

-

10:42

German adjusted retail sales fall 0.4% in October

Destatis released its retail sales for Germany on Monday. German adjusted retail sales fell 0.4% in October, missing forecasts of a 0.4% gain, after a flat reading in September.

On a yearly basis, German retail sales jumped 2.1% in October, missing expectations for a 2.9% gain, after a 3.5% rise in September. September's figure was revised up from a 3.4% increase.

Sales of non-food products increased at an annual rate of 1.8% in October, while sales of food, beverages and tobacco products climbed by 2.3%.

-

10:31

United Kingdom: Net Lending to Individuals, bln, October 4.8

-

10:30

United Kingdom: Mortgage Approvals, October 69.63 (forecast 70)

-

10:30

United Kingdom: Consumer credit, mln, October 1178 (forecast 1300)

-

10:21

The International Monetary Fund is likely to add the yuan to its basket of reserve currencies

The International Monetary Fund (IMF) is likely to add the yuan to its basket of reserve currencies this Monday. The IMF's basket of reserve currencies (Special Drawing Rights SDR)) includes the yen, euro, pound and U.S. dollar.

The IMF Managing Director Christine Lagarde have already endorsed the idea.

The SDR totals $280 billion. It was modified was in 2000, when the euro replaced the German Deutsche Mark and the French franc.

-

10:11

Preliminary industrial production in Japan climbs 1.4% in October

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Sunday evening. Preliminary industrial production in Japan climbed 1.4% in October, missing expectations for a 1.9% rise, after a 1.1% gain in September.

The increase was mainly driven by rises in business oriented machinery, transport equipment and electronic parts and devices industry.

According to a survey by the ministry, industrial production is expected to rise 0.2% in November, and to decline 0.9% in December.

On a yearly basis, Japan's industrial production was down 1.4% in October, after a 0.8% decline in September.

-

09:23

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 1.25bln)

EUR/USD 1.0500 (EUR 909m) 1.0600 (1bln)

GBP/USD 1.5175 (GBP 428m)

EUR/GBP 0.6950 (EUR 690m) 0.7050 (600m)

EUR/JPY 132.30 (EUR 1.1bln)

NZD/USD 0.6300 (NZD 834m)

AUD/NZD 1.0840 (AUD 373m) 1.1000 (225m)

AUD/JPY 87.00 (AUD 774m)

-

09:00

Switzerland: KOF Leading Indicator, November 97.9 (forecast 100.2)

-

08:02

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence November 10.5 14.6

00:30 Australia Company Gross Profits QoQ Quarter III -0.5% Revised From -1.9% 1.0% 1.3%

00:30 Australia Private Sector Credit, m/m October 0.7% Revised From 0.8% 0.6% 0.7%

05:00 Japan Construction Orders, y/y October 6.7% -25.2%

05:00 Japan Housing Starts, y/y October 2.6% 2.9% -2.5%

07:00 Germany Retail sales, real adjusted October 0.0% 0.4% -0.4%

07:00 Germany Retail sales, real unadjusted, y/y October 3.4% 2.9% 2.1%

The euro declined against the U.S. dollar ahead of an ECB meeting scheduled for Thursday. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

The yen climbed against the greenback amid the latest data. Japan retail sales rose by 1.1% in October exceeding the 0.8% gain reported previously.

The Australian dollar fell on inflation data at the beginning of the session; however it partly recovered later. TD Securities reported that consumer prices rose by 0.1% in November compared to the 0% change in October. The Reserve Bank of Australia's target inflation range is 2%-3%. This means the consumer price index is still way below the desired level.

The New Zealand dollar climbed on business confidence data from ANZ. The corresponding index rose to a six-month high of 14.6 in November from 10.5 reported previously.

EUR/USD: the pair declined to $1.0570 in Asian trade

USD/JPY: the pair fell to Y122.60

GBP/USD: the pair fell to $1.5015

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland KOF Leading Indicator November 99.8 100.2

09:30 United Kingdom Consumer credit, mln October 1261 1300

09:30 United Kingdom Mortgage Approvals October 68.87 70

09:30 United Kingdom Net Lending to Individuals, bln October 4.85

13:00 Germany CPI, m/m (Preliminary) November 0.0% 0.1%

13:00 Germany CPI, y/y (Preliminary) November 0.3% 0.4%

13:30 Canada Current Account, bln Quarter III -17.4 -15.15

14:45 U.S. Chicago Purchasing Managers' Index November 56.2 54

15:00 U.S. Pending Home Sales (MoM) October -2.3% 1.5%

22:30 Australia AIG Manufacturing Index November 50.2

23:50 Japan Capital Spending Quarter III 5.6%

-

08:00

Germany: Retail sales, real adjusted , October -0.4% (forecast 0.4%)

-

08:00

Germany: Retail sales, real unadjusted, y/y, October 2.1% (forecast 2.9%)

-

07:06

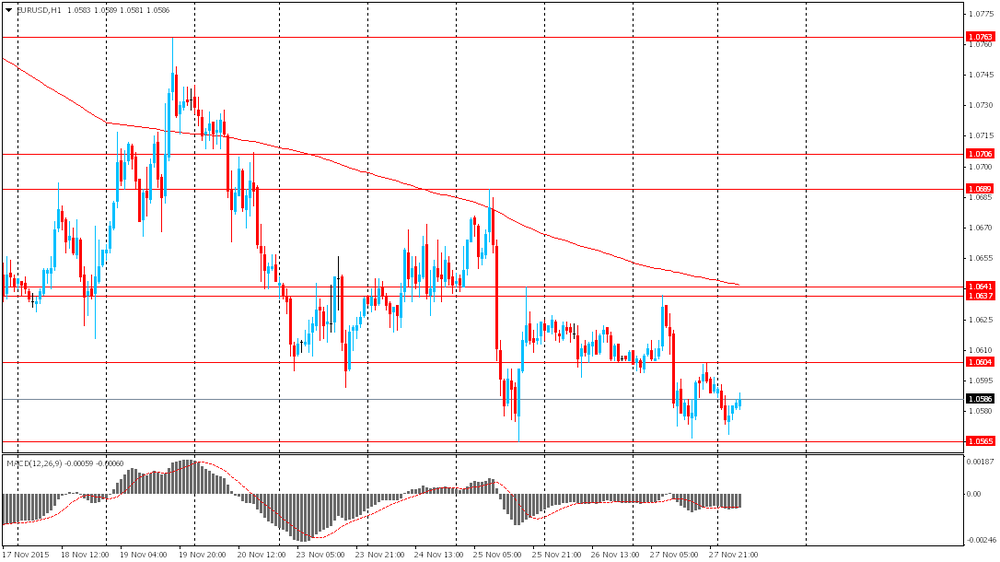

Options levels on monday, November 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0759 (3357)

$1.0700 (1741)

$1.0656 (824)

Price at time of writing this review: $1.0583

Support levels (open interest**, contracts):

$1.0543 (7410)

$1.0502 (6142)

$1.0446 (10702)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 98110 contracts, with the maximum number of contracts with strike price $1,1100 (6166);

- Overall open interest on the PUT options with the expiration date December, 4 is 122124 contracts, with the maximum number of contracts with strike price $1,0500 (10702);

- The ratio of PUT/CALL was 1.24 versus 1.26 from the previous trading day according to data from November, 27

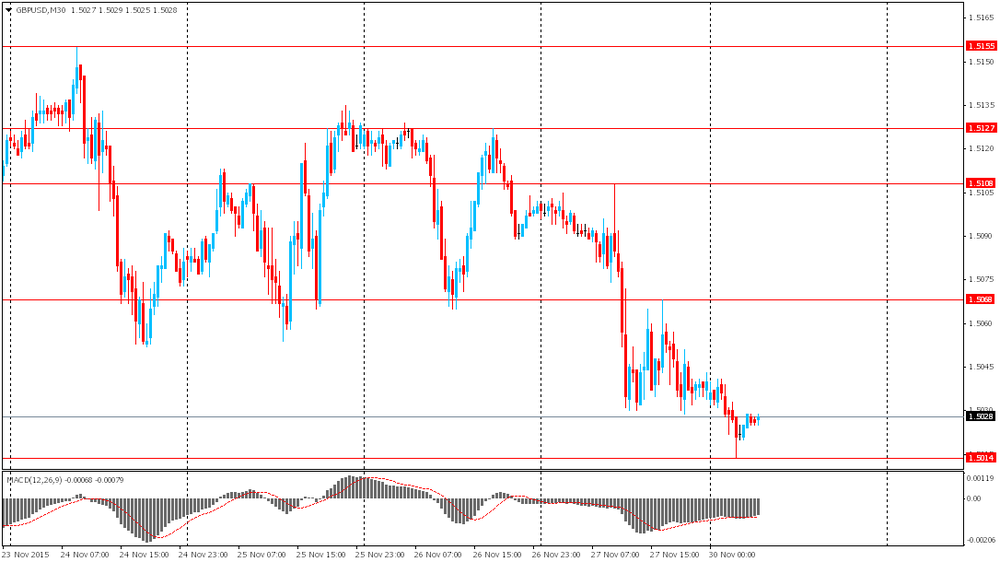

GBP/USD

Resistance levels (open interest**, contracts)

$1.5301 (2532)

$1.5202 (1173)

$1.5104 (1283)

Price at time of writing this review: $1.5024

Support levels (open interest**, contracts):

$1.4996 (2689)

$1.4898 (2676)

$1.4799 (650)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28334 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 32850 contracts, with the maximum number of contracts with strike price $1,5050 (4947);

- The ratio of PUT/CALL was 1.16 versus 1.14 from the previous trading day according to data from November, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:16

Japan: Construction Orders, y/y, October -25.2%

-

06:02

Japan: Housing Starts, y/y, October -2.5% (forecast 2.9%)

-

02:03

Currencies. Daily history for Nov 27’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0593 -0,15%

GBP/USD $1,5040 -0,40%

USD/CHF Chf1,0292 +0,54%

USD/JPY Y122,84 +0,24%

EUR/JPY Y130,12 +0,05%

GBP/JPY Y184,84 -0,12%

AUD/USD $0,7190 -0,47%

NZD/USD $0,6532 -0,57%

USD/CAD C$1,3369 +0,57%

-

01:31

Australia: Company Gross Profits QoQ, Quarter III 1.3% (forecast 1.0%)

-

01:31

Australia: Private Sector Credit, m/m, October 0.7% (forecast 0.6%)

-

01:00

New Zealand: ANZ Business Confidence, November 14.6

-

00:51

Japan: Industrial Production (YoY), October -1.4%

-

00:50

Japan: Retail sales, y/y, October 1.8% (forecast 0.8%)

-

00:50

Japan: Industrial Production (MoM) , October 1.4% (forecast 1.9%)

-

00:30

Australia: MI Inflation Gauge, m/m, November 0.1%

-