Noticias del mercado

-

22:07

The main US stock indexes finished trading mostly in positive territory

Stock indexes Nasdaq and S & P finished the session near the zero mark, while Dow for the first time in history overcame the level of 22,000 against the backdrop of Apple's good results.

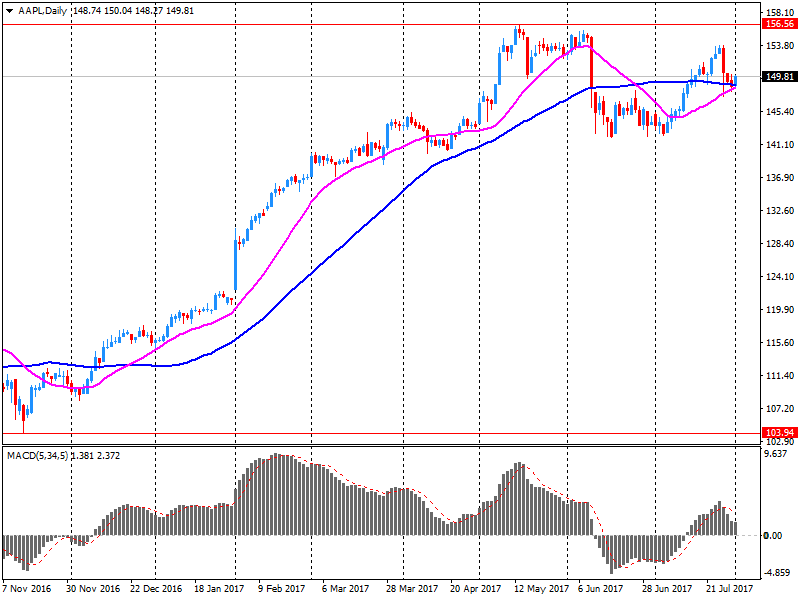

The profit of Apple (AAPL) for the third quarter of 2017 fiscal year (FY) reached $ 1.67 per share (versus $ 1.42 in the third quarter of 2016 FY), which was above the average forecast of analysts at $ 1.57. Quarterly revenue of the company was $ 45.408 billion (+ 7.2% y / y), while the average forecast of analysts was $ 44.939 billion. The company said that in the fourth quarter they expect to receive revenues of $ 49-52 billion against the average forecast of analysts $ 49.23 billion. And the gross margin at 37.5-38.0% against the average forecast of analysts 38.2% and 38% recorded a year earlier.

A certain influence on the dynamics of trading was provided by statistics on the United States. The business activity in New York improved noticeably last month, surpassing analysts' forecasts, and reaching its highest level since December 2016. The index, which measures the economic conditions in the manufacturing and services sectors for companies registered in New York, rose in July to 62.8 points from 55.5 points in May. Economists predicted that the index will drop to 53.1 points.

Oil has risen by about 1%, supported by data on oil stocks in the US and the widespread weakening of the US currency. The US Energy Ministry reported that crude oil stocks fell again, but less than expected. However, the data also indicated another drop in gasoline and distillate stocks. According to the report, in the week of July 22-28, oil reserves fell by 1.527 million barrels to 481.888 million barrels. The reduction was expected at 2.8 million barrels.

Most components of the DOW index recorded a decline (18 out of 30). Outsider were shares of The Walt Disney Company (DIS, -1.89%). Leader of growth were shares of Apple Inc. (AAPL, + 5.21%).

Most sectors of the S & P index finished trading in the red. The greatest decline was shown by the sector of conglomerates (-1.2%). The consumer goods sector grew most (+ 0.7%).

At closing:

DJIA + 0.23% 22,015.46 +51.54

Nasdaq -0.00% 6,362.65 -0.29

S & P + 0.05% 2.477.54 +1.19

-

21:00

DJIA +0.20% 22,008.91 +44.99 Nasdaq +0.04% 6,365.24 +2.30 S&P -0.01% 2,476.05 -0.30

-

18:01

European stocks closed: FTSE 100 -12.23 7411.43 -0.16% DAX -69.81 12181.48 -0.57% CAC 40 -19.78 5107.25 -0.39%

-

16:44

US crude oil inventories fall less than expected

The U.S. Energy Information Administration (EIA) reported that crude inventories fell by 1.527 million barrels to 481.9 million barrels in the week ended July 28. Economists had forecast a decline of 2.8 million barrels. At the same time, gasoline stocks decreased by 2.517 million barrels to 227.7 million barrels, while analysts had expected a drop of 636,000 barrels. Distillate stocks reduced by 150,000 barrels to 149.4 million barrels last week, while analysts had forecast a fall of 525,000 barrels. Meanwhile, oil production in the U.S. rose to 9.430 million barrels per day versus 9.410 million barrels per day in the previous week. U.S. crude oil imports averaged about 8.3 million barrels per day last week, up by 209,000 barrels per day from the previous week.

-

16:30

U.S.: Crude Oil Inventories, July -1.527 (forecast -2.8)

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1600 (EUR 480m) 1.1750 (380m)

USDJPY: None of note

GBPUSD: 1.2900 (GBP 435m)

AUDUSD: 0.8000 (AUD 940m)

NZDUSD: 0.7400 (NZD 200m) 0.7500 (340m)

AUDNZD: 1.1000 (AUD 1.1bn)

-

15:32

U.S. Stocks open: Dow +0.20%, Nasdaq +0.47%, S&P +0.07%

-

15:21

Before the bell: S&P futures +0.10%, NASDAQ futures +0.75%

U.S. stock-index futures rose as investors cheered Apple's (AAPL) latest earnings report.

Global Stocks:

Nikkei 20,080.04 +94.25 +0.47%

Hang Seng 27,607.38 +67.15 +0.24%

Shanghai 3,286.02 -6.62 -0.20%

S&P/ASX 5,744.20 -28.17 -0.49%

FTSE 7,398.33 -25.33 -0.34%

CAC 5,121.44 -5.59 -0.11%

DAX 12,233.67 -17.62 -0.14%

Crude $49.13 (-0.06%)

Gold $1,272.70 (-0.52%)

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

65.78

0.28(0.43%)

1260

Amazon.com Inc., NASDAQ

AMZN

1,000.20

4.01(0.40%)

20207

Apple Inc.

AAPL

159.15

9.10(6.06%)

2156480

AT&T Inc

T

39

0.12(0.31%)

6807

Barrick Gold Corporation, NYSE

ABX

17.15

-0.09(-0.52%)

28715

Boeing Co

BA

240.5

1.06(0.44%)

722

Caterpillar Inc

CAT

113.3

0.20(0.18%)

1201

Cisco Systems Inc

CSCO

31.6

-0.05(-0.16%)

6380

Citigroup Inc., NYSE

C

69.74

0.14(0.20%)

7628

Facebook, Inc.

FB

170.52

0.66(0.39%)

54327

FedEx Corporation, NYSE

FDX

207

0.29(0.14%)

475

Ford Motor Co.

F

10.96

0.01(0.09%)

46569

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.31

-0.18(-1.24%)

23450

General Electric Co

GE

25.49

0.05(0.20%)

9493

General Motors Company, NYSE

GM

34.88

0.12(0.35%)

100

Goldman Sachs

GS

226.4

-0.60(-0.26%)

2604

Google Inc.

GOOG

932

1.17(0.13%)

3493

Intel Corp

INTC

36.28

-0.07(-0.19%)

13681

International Business Machines Co...

IBM

145.27

-0.03(-0.02%)

2405

Johnson & Johnson

JNJ

133

0.49(0.37%)

100

JPMorgan Chase and Co

JPM

93.25

0.22(0.24%)

8018

Microsoft Corp

MSFT

72.7

0.12(0.17%)

36608

Pfizer Inc

PFE

33

0.24(0.73%)

9943

Starbucks Corporation, NASDAQ

SBUX

54.7

-0.03(-0.05%)

6936

Tesla Motors, Inc., NASDAQ

TSLA

320.2

0.63(0.20%)

45736

Twitter, Inc., NYSE

TWTR

16.33

0.12(0.74%)

23762

Verizon Communications Inc

VZ

49.05

0.16(0.33%)

4504

Visa

V

101.11

0.24(0.24%)

941

Walt Disney Co

DIS

110.15

-0.46(-0.42%)

815

-

14:43

Analyst coverage initiations before the market open

Wal-Mart (WMT) initiated with Outperform at Oppenheimer; target $90

-

14:42

Target price changes before the market open

Apple (AAPL) target raised to $146 from $123 at Barclays

Apple (AAPL) target raised to $176 from $165 at JPMorgan

Apple (AAPL) target raised to $175 from $165 at Needham

Apple (AAPL) target raised to $190 from $180 at Guggenheim

Apple (AAPL) target raised to $170 from $160 at Citigroup

-

14:41

Upgrades before the market open

Pfizer (PFE) upgraded to Outperform at BMO Capital Markets

-

14:27

US private sector employment increases less than expected in July

The employment report prepared by Automatic Data Processing Inc. (ADP) and Moody's Analytics showed the U.S. private employers added 178,000 jobs in July. Economists had expected a gain of 185,000. The increase for June was revised up to 191,000 from 158,000.

"Job gains continued to be strong in the month of July," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "However, as the labor market tightens employers may find it more difficult to recruit qualified workers," he added.

Meanwhile, Mark Zandi, chief economist of Moody's Analytics, said, "The American job machine continues to operate in high gear. Job gains are broad-based across industries and company sizes, with only manufacturers reducing their payrolls. At this pace of job growth, unemployment will continue to quickly decline."

-

14:15

U.S.: ADP Employment Report, July 178 (forecast 185)

-

13:38

Company News: Apple (AAPL) quarterly results beat analysts’ expectations

Apple (AAPL) reported Q3 FY 2017 earnings of $1.67 per share (versus $1.42 in Q3 FY 2016), beating analysts' consensus estimate of $1.57.

The company's quarterly revenues amounted to $45.408 bln (+7.2% y/y), beating analysts' consensus estimate of $44.939 bln.

The company also issued guidance for Q4 FY 2017, projecting revenues of $49-52 bln versus analysts' consensus estimate of $49.23 bln, and gross margins of 37.5-38.0% versus analysts' consensus estimate of 38.2% and 38% last year.

AAPL rose to $158.31 (+5.50%) in pre-market trading.

-

12:07

Eurozone producer price inflation slows in June

Eurostat, the statistical office of the European Union (EU) reported that industrial producer prices in the Eurozone fell by 0.1 percent m-o-m in June, following a revised 0.3 decrease m-o-m in May (originally a 0.4 percent m-o-m drop).

In y-o-y terms, industrial producer prices rose by 2.5 percent, following a revised 3.4 percent increase in May (originally a 3.3 percent gain). The figure was the lowest this year.

Economists had forecast the Eurozone's industrial producer prices in June would fall 0.1 percent m-o-m but raise 2.4 percent y-o-y.

According to the report, the June decrease in industrial producer prices was due to falls in prices in the energy sector (-0.3 percent m-o-m) and for intermediate goods (-0.2 percent m-o-m). These declines were partially offset by higher prices for capital goods (+0.1 percent m-o-m) and non-durable consumer goods (+0.2 percent m-o-m). Elsewhere, prices for durable consumer goods were stable.

The annual growth in industrial producer prices was underpinned by increases in prices in all groups. The prices for intermediate goods (+2.9 percent y-o-y) and in the energy sector (+2.9 percent y-o-y) recorded the biggest gains, followed by prices for non-durable consumer goods (+2.5 percent y-o-y), for capital goods (+0.9 percent y-o-y) and for durable consumer goods (+0.6 percent y-o-y).

-

11:33

Swiss manufacturing PMI rises more than estimated in July

The Schweizerischer Verband für Materialwirtschaft und Einkauf (SVME) reported its Purchasing Manager's Index (PMI) for Swiss manufacturing sector rose to 60.9 in July from 60.1 in June. That was the highest reading since February of 2011 and exceeded economists' forecast of 58.9. A reading above 50 indicates expansion in the sector, while a reading below 50 shows contraction.

According to the report, the July improvement was primarily attributable to a boost in order books. The corresponding subcomponent - "the order backlog" - climbed from 59.9 points in June to 65.2 points in July. A similar score was seen in 2010. Such sub-components as production (+0.4 to 63.8), purchasing volume (+3.4 to 63.1), stocks purchased (+2.2 to 50.3) and purchasing prices (+0.7 to 55) also rose last month, while delivery times (-2.3 to 63) employment (-3.5 to 54.6) declined.

-

11:07

UK construction PMI falls more than expected in July

The report from IHS Markit and Chartered Institute of Procurement & Supply (CIPS) showed that activity in the construction sector of the UK's economy eases to an 11-month low in July.

According to the report, the Markit/CIPS Purchasing Managers' Index (PMI) for the UK's construction sector fell to 51.9 in July from an unrevised 54.8 in June. That marked the weakest construction performance since August 2016. Economists had forecast the indicator to slide down to 54.5. The 50 mark divides contraction and expansion.

According to the report, July's growth slowdown in construction sector reflected lower volumes of commercial building and a softer expansion of housing activity. The survey also revealed a reduction in new business volumes for the first time since August 2016, leading to softer job creation in the period. At the same time, intense supply chain pressures continued last month and prices for construction materials boosted at one of the sharpest rates since the first half of 2011.

-

11:01

Eurozone: Producer Price Index, MoM , June -0.1% (forecast -0.1%)

-

11:01

Eurozone: Producer Price Index (YoY), June 2.5% (forecast 2.4%)

-

10:54

Swiss retail sales rise in June

The Swiss Federal Statistical Office reported that real retail sector rose by 0.8 percent in seasonally adjusted terms in June following a revised 0.5 percent m-o-m gain in May (originally a 0.3 percent m-o-m increase).

In y-o-y terms, real turnover in the retail sector grew by 1.5 percent in June compared to a revised drop of 0.8 percent in the prior month (originally a 0.3 percent decline). That was the first rise in three months and exceeded economists forecast for 1.3 percent y-o-y surge.

According to the report, the real, seasonally adjusted retail sector excluding service stations rose 1.4 percent y-o-y in June. The real, seasonally adjusted retail sales of food, drinks and tobacco recorded an increase of 3.1 percent y-o-y, while non-food sector registered only a 0.1 percent uptick in retail sales turnover.

-

10:30

United Kingdom: PMI Construction, July 51.9 (forecast 54.5)

-

09:30

Switzerland: Manufacturing PMI, July 60.9 (forecast 58.9)

-

09:17

Swiss consumer confidence improves in July

The State Secretariat for Economic Affairs (SECO) reported that consumer sentiment in Switzerland improved again in July.

According to SECO report, the consumer sentiment index came in at -3 points in the third quarter, up from -8 in the prior quarter and well above the long-term average of -9 points. The reading matched economists forecast.

The report confirmed the recovery in sentiment from the lows following the sharp rise in the Swiss franc, the SECO said.

According to the report, consumers' expectations for economic growth and for the job market in July became considerably more optimistic compared to April. The sub-index that measures optimistic regarding the general economic prospects over the coming twelve months climbed from +5 points in April to +16 points in July, while sub-index that tracks unemployment outlook dropped from +48 points to +41 points.

In contrast, consumers' expectations for their own financial situation and their ability to save money showed no improvement. At -4 points, the sub-index on the anticipated financial situation remained virtually unchanged in July compared to April (-3 points), considerably below its long-term average of +2 points. At the same time, the sub-index on consumers' anticipated opportunities to save came in at +17 compared to +15 in the previous survey and slightly below the average of +21 points. The SECO noted, however, that the situation with these two questions could change if the job market does recover as consumers expect.

-

09:17

Switzerland: Retail Sales (MoM), June 0.8%

-

09:15

Switzerland: Retail Sales Y/Y, June 1.5% (forecast 1.3%)

-

08:51

Options levels on wednesday, August 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1917 (4166)

$1.1884 (3733)

$1.1861 (4871)

Price at time of writing this review: $1.1826

Support levels (open interest**, contracts):

$1.1770 (1665)

$1.1735 (1757)

$1.1693 (2769)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 102359 contracts (according to data from August, 1) with the maximum number of contracts with strike price $1,1800 (4871);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3292 (1735)

$1.3268 (2601)

$1.3244 (3054)

Price at time of writing this review: $1.3210

Support levels (open interest**, contracts):

$1.3163 (138)

$1.3128 (1025)

$1.3087 (1031)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 32128 contracts, with the maximum number of contracts with strike price $1,3100 (3054);

- Overall open interest on the PUT options with the expiration date August, 4 is 31665 contracts, with the maximum number of contracts with strike price $1,2800 (3023);

- The ratio of PUT/CALL was 0.99 versus 0.97 from the previous trading day according to data from August, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:04

Japan consumer confidence strengthens in July

The Cabinet Office reported that consumer confidence in Japan improved slightly last month. The seasonally adjusted consumer confidence index rose to 43.8 in July from 43.3 in June. The reading exceeded the economists' forecast of 43.6 and hit the highest level since March. A score above 50 indicates optimism, while a score below 50 shows the lack of confidence.

According to the report, perception improved for most components, including overall livelihood (up 1.2 points m-o-m to 42.3), income growth (up 0.1 points m-o-m to 41.7) and willingness to buy durable goods (up 1.0 points m-o-m to 43.2), while was unchanged for employment (at 48.10).

-

07:45

Switzerland: SECO Consumer Climate, Quarter III -3 (forecast -3)

-

07:36

Australia building permits increase more than expected

The Australian Bureau of Statistics (ABS) announced the total number of building permits issued in the country surged 10.3 percent m-o-m in seasonally adjusted terms in June. That exceeded economists' forecast for a 1.5 percent increase, following a 5.4 percent m-o-m decrease in May (revised from a 5.6 percent m-o-m drop).

According to the report, approvals for private sector dwellings excluding houses boosted by 20.0 percent m-o-m in June, while private sector houses approvals grew by 3.4 percent m-o-m. In y-o-y terms, total approvals fell 2.3 percent.

-

07:29

Global Stocks

Asian equities continued to rise Wednesday, helped by strong results from Apple, though Sydney shares eased as commodities prices pulled back. The stock market in Taiwan, home to a number of Apple's suppliers, was the strongest performer in the region. That market's strength in the past year has been in large part Apple-driven, thanks to the company's results as well as expectations about how its coming iPhone will fare.

Stocks in Europe gained ground Tuesday, as trading in August kicked off with shares of BP PLC climbing after the oil major's earnings report, and as data showed rising economic growth in the eurozone. The Stoxx Europe 600 SXXP, +0.64% tacked on 0.6% to close at 380.26. Energy and industrial stocks led advancers, and the health care sector was the only laggard. The pan-European index on Monday slipped 0.1% to close at its lowest since April.

The U.S. stock market finished higher Tuesday, with the Dow logging its second straight record and a sixth straight session in positive territory on the back of upbeat earnings, shaking off less-than-stellar reports on manufacturing and inflation. The Dow Jones Industrial Average DJIA, +0.33% added 72.80 points, or 0.3%, to finish at an all-time closing high at 21,963.92, marking its 31st record in 2017 and putting the blue-chip gauge within 40 points of a milestone at 22,000. The Dow had touched an intraday all-time high at 21,990.96 before retreating somewhat.

-

07:19

New Zealand unemployment rate falls to almost eight-year low

Statistics New Zealand announced the unemployment rate in the country fell to 4.8 percent in the second quarter of 2017 from an unrevised 4.9 percent in the first quarter. That was the lowest unemployment rate since the last quarter of 2008 and in-line with economists' forecast.

The data also showed that the number of employed people fell 0.2 percent q-o-q in the second quarter (compared to a 1.2 percent q-o-q increase in the first quarter), while the number of unemployed decreased by 2.2 percent q-o-q (compared to a 4.4 percent q-o-q drop in the previous quarter). The employment rate fell to 66.7 percent in the second quarter, down from 67.1 percent in the first quarter. The labour force participation rate declined by 0.6 percentage point to 70, retreating from an all-time high of 70.6 percent seen in the prior quarter. Average hourly earnings increased 0.8 percent q-o-q to $30.09.

-

07:02

Japan: Consumer Confidence, July 43.8 (forecast 43.6)

-

03:30

Australia: Building Permits, m/m, June 10.9% (forecast 1.5%)

-

00:45

New Zealand: Employment Change, q/q, Quarter II -0.2% (forecast 0.7%)

-

00:45

New Zealand: Unemployment Rate, Quarter II 4.8% (forecast 4.8%)

-

00:18

Commodities. Daily history for Aug 01’2017:

(raw materials / closing price /% change)

Oil 48.79 -0.75%

Gold 1,274.80 -0.36%

-

00:17

Stocks. Daily history for Aug 01’2017:

(index / closing price / change items /% change)

Nikkei +60.61 19985.79 +0.30%

TOPIX +9.89 1628.50 +0.61%

Hang Seng +216.24 27540.23 +0.79%

CSI 300 +32.51 3770.38 +0.87%

Euro Stoxx 50 +28.03 3477.39 +0.81%

FTSE 100 +51.66 7423.66 +0.70%

DAX +133.04 12251.29 +1.10%

CAC 40 +33.26 5127.03 +0.65%

DJIA +72.80 21963.92 +0.33%

S&P 500 +6.05 2476.35 +0.24%

NASDAQ +14.82 6362.94 +0.23%

S&P/TSX +58.23 15202.10 +0.38%

-

00:17

Currencies. Daily history for Aug 01’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1804 -0,25%

GBP/USD $1,3206 +0,00%

USD/CHF Chf0,96508 -0,16%

USD/JPY Y110,36 +0,11%

EUR/JPY Y130,29 -0,15%

GBP/JPY Y145,752 +0,11%

AUD/USD $0,7968 -0,40%

NZD/USD $0,7469 -0,53%

USD/CAD C$1,25375 +0,41%

-