Noticias del mercado

-

22:09

Major US stock indexes finished trading with an increase

Major US stock indexes rose slightly on Monday, amid continued growth in the health sector and the second straight session after the publication of positive macroeconomic news. Thus, according to the US Commerce Department, new orders for US manufactured goods marked their biggest increase in eight months in March, against a background of increasing demand for transport equipment, but the underlying trend remains weak against the background of a strong dollar. New orders for manufactured goods increased by 2.1%, noting the biggest gain since July 2014, after a revised fall of 0.1% in February.

In addition, oil prices decline moderately after today peaked this year. Market participants continue to analyze data on the manufacturing sector in China, which increased expectations for additional measures to support the economy. Earlier today it was reported that of the HSBC manufacturing PMI for China fell to 48.9 in April from 49.6 in March. It was expected that the figure will be 49.4. Manufacturing activity declined at the fastest pace in a year due to lower levels of new orders, fueling fears over a slowdown in the second largest economy in the world.

Most components of the index DOW closed in positive territory (23 of 30). Outsider were shares McDonald's Corp. (MCD, -1.68%). Most remaining shares rose JPMorgan Chase & Co. (JPM, + 1.68%).

Almost all sectors of the S & P closed in the positive zone. Most utilities sector grew (+ 0.9%). The decrease recorded only sector conglomerates (-0.2%).

At the close:

Dow + 0.26% 18,070.40 +46.34

Nasdaq + 0.23% 5,016.93 +11.54

S & P + 0.29% 2,114.47 +6.18

-

21:00

Dow +0.40% 18,095.42 +71.36 Nasdaq +0.39% 5,025.14 +19.75 S&P +0.40% 2,116.82 +8.53

-

20:20

American focus: the dollar rose against the euro

The dollar played the part of the previously lost ground against the euro, supported by data on US factory orders. The Commerce Department reported that new orders for manufactured goods increased by 2.1 percent, saying the biggest gain since last July, after falling a revised 0.1 percent in February. Economists had forecast an increase in orders of 2.0 percent in March after a previously reported 0.2 percent gain in February. Orders excluding transportation were unchanged in March after a 0.1 percent gain in February. Production was influenced by the strong dollar and lower oil prices that have held back profits flow of transnational corporations and oil companies. Department of Commerce also reported that orders for non-defense capital goods excluding aircraft - which are regarded as a measure of trust and business expenses - increased by 0.1 percent instead of the 0.5 percent drop last month. Supplies of non-defense capital goods excluding aircraft fell 0.4 percent.

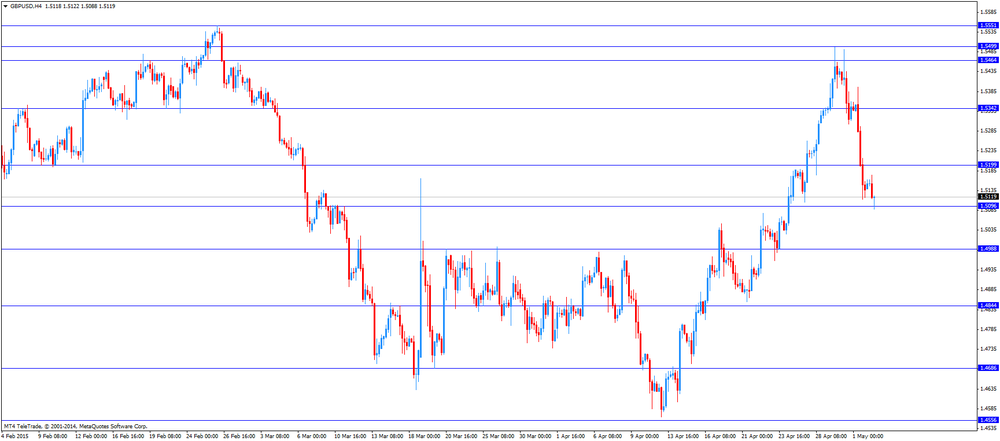

The pound fell slightly against the dollar, updating the at least Friday. Investors continue to be cautious in anticipation of elections in the UK, which will take place this Thursday. "The markets are still generally ignored the uncertainty surrounding the elections, despite the fact that the results are very difficult to predict," - said James Pomeroy, an economist at HSBC. The final voting results are unlikely to be known before Friday morning. The results of the poll of Britons say the probability that none of the parties does not receive a majority of seats in parliament, and this will mean that the final rearrangement of the government will depend on the discussions that will take place after the elections, and can take several days.

Also, market participants are waiting for the publication of data on business activity in the services sector, which will be released on Wednesday. Economists expect that the results of business surveys, show that activity in the service sector grew strong pace in April (according to the forecast, the index fell to 58.6 from 58.9 in March), despite recent evidence of loss of revolutions of the economy in 2015.

The Swiss franc was little changed against the US dollar. Small influenced Swiss data. As previously reported, an indicator of industrial production stabilized in Switzerland in April, suggesting that companies are coping with the strong franc and the country can avoid recession. Index Swiss purchasing managers was unchanged in April from March and seasonally adjusted was 47.9 points. Reading in April was slightly higher than economists' average forecast of 47.7. Swiss index is still holding close to the lowest level since October 2012 and is still below 50 points, which indicates a reduction in industrial production. Production fell sharply immediately after the decision of the Swiss National banka- January 15, to give up his 3.5-year-old policy of limiting the franc of 1.20 per euro - the currency of Switzerland's largest export market. Since his fall in January, the index stabilized around 48 points, and "although such values indicate a decrease in PMI industrial activity, general economic downturn is unlikely," analysts said Credit Suisse Group AG.

-

18:10

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday as healthcare stocks rose for a second straight session and new orders for U.S. factory goods recorded their biggest increase in eight months. New orders for U.S.-made goods rose a higher-than-expected 2.1 percent in March.

Most of the Dow stocks are trading in positive area (27 of 30). Top looser - Chevron Corporation (CVX, -0.50%). Top gainer - Merck & Co. Inc. (MRK, +1.30%).

All S&P index sectors in positive area. Top gainer - Utilities (+1,1%).

At the moment:

Dow 18020.00 +86.00 +0.48%

S&P 500 2110.75 +9.25 +0.44%

Nasdaq 100 4487.75 +20.00 +0.45%

10-year yield 2.13% +0.02

Oil 58.83 -0.32 -0.54%

Gold 1189.90 +15.40 +1.31%

-

18:00

European stocks closed: FTSE 100 Closed CAC 40 5,081.97 +35.48 +0.70% DAX 11,619.85 +165.47 +1.44%

-

18:00

European stocks close: stocks closed higher on manufacturing PMIs from the Eurozone

Stock indices closed higher on manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in April from 52.2 in March, up from a preliminary reading of 51.9.

Ireland and Spain were the top performers in April, while France's and Greece's manufacturing activity contracted due to falling production and job cuts.

Germany's final manufacturing PMI decreased to 52.1 in April from 52.8 in March, up from a preliminary reading of 51.9.

France's final manufacturing PMI dropped to 48.0 in April from 48.8 in March, down a preliminary reading of 48.4.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 19.6 in May from 20.0 in April, missing expectations for a decline to 19.8.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis.

Stock market in the U.K. is closed for a public holiday.

Indexes on the close:

Name Price Change Change %

FTSE 100 closed

DAX 11,619.85 +165.47 +1.44 %

CAC 40 5,081.97 +35.48 +0.70 %

-

17:38

Oil prices fell due to the weak Chinese manufacturing PMI

Oil prices fell due to the weak Chinese manufacturing PMI. The final Chinese HSBC manicuring PMI was 48.9 in April, down from a preliminary reading of 49.6.

WTI crude oil for June delivery decreased to $58.99 a barrel on the New York Mercantile Exchange. Brent crude oil for June fell to $66.44 a barrel on ICE Futures Europe.

-

17:24

Gold price traded higher after a significant drop on Friday

Gold price traded higher after a significant drop on Friday. Gold price declined on Friday as investors speculate when the Fed will start to hike its interest rate. The Fed kept its monetary policy unchanged last Wednesday, but it did not rule out the interest rate hike in June. The central bank said that the U.S. economy slowed down during the winter months, but the slowdown was driven by "transitory factors".

Investors are also awaiting the release of the labour market data on Friday.

June futures for gold on the COMEX today increased to 1189.70 dollars per ounce.

-

16:54

U.S. factory orders rises 2.1% in March

The U.S. Commerce Department released factory orders data on Monday. Factory orders in the U.S. rose 2.1% in March, exceeding expectations for a 2.0% increase, after a 0.1% decline in February. It was the largest increase since August 2014.

February's figure was revised down from a 0.2% rise.

The increase was driven by higher orders for durable goods. Durable goods orders jumped by 4.4% in March

Non-durable goods orders fell 0.3% in March.

-

16:23

Italy's manufacturing PMI increases to 53.8 in April

Markit Economics released its manufacturing purchasing managers' index for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) increased to 53.8 in April from 53.3 in March.

A reading above 50 indicates expansion in activity.

The increase was driven by higher output and new orders.

-

16:01

Spain's manufacturing PMI falls to 54.2 in April

Markit Economics released its manufacturing purchasing managers' index for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) was down to 54.2 in April from 54.3 in March.

A reading above 50 indicates expansion in activity.

The index was driven by stronger client demand, which led to an expansion in output and new orders.

-

16:00

U.S.: Factory Orders , March 2.1% (forecast 2.0%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E528mn), $1.1225, $1.1400(E439mn)

USD/JPY: Y119.80, Y120.00($597mn), Y120.25($680mn), Y120.50

GBP/USD: $1.4900(Gbp779mn)

AUD/USD: $0.7600(A$2.1bn), $0.7830(A$432mn)

USD/CAD: C$1.2100, C$1.2165($200mn)

-

15:37

Eurozone's final manufacturing PMI is down to 52.0 in April

Markit Economics released its final manufacturing purchasing managers' index for Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in April from 52.2 in March, up from a preliminary reading of 51.9.

A reading above 50 indicates expansion in activity.

"The Eurozone manufacturing sector continued to grow in April, but the dip in the rate of expansion will serve to check recent optimism that the ECB's quantitative easing programme has bought a guaranteed ticket to recovery for the region," the Chief Economist at Markit Economics Chris Williamson said.

Ireland and Spain were the top performers in April, while France's and Greece's manufacturing activity contracted due to falling production and job cuts.

-

15:36

U.S. Stocks open: Dow +0.24%, Nasdaq +0.42%, S&P +0.34%

-

15:28

Before the bell: S&P futures +0.25%, NASDAQ futures +0.24%

U.S. index futures advanced before data on factory orders.

Global markets:

Hang Seng 28,123.82 -9.18 -0.03%

Shanghai Composite 4,481.59 +39.93 +0.90%

CAC 5,099.95 +53.46 +1.06%

DAX 11,617.61 +163.23 +1.43%

Stock markets in Japan and UK are closed today.

Crude oil $59.56 (+0.69%)

Gold $1182.70 (+0.69%)

-

15:18

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

33.43

+0.03%

9.9K

The Coca-Cola Co

KO

40.95

+0.10%

1.6K

American Express Co

AXP

77.77

+0.12%

0.3K

Deere & Company, NYSE

DE

91.50

+0.12%

3.2K

Merck & Co Inc

MRK

59.94

+0.13%

1.4K

Ford Motor Co.

F

15.83

+0.13%

27.9K

Johnson & Johnson

JNJ

100.30

+0.17%

0.1K

Pfizer Inc

PFE

34.14

+0.18%

0.5K

Verizon Communications Inc

VZ

50.50

+0.18%

0.2K

JPMorgan Chase and Co

JPM

63.75

+0.22%

0.4K

Starbucks Corporation, NASDAQ

SBUX

50.40

+0.22%

3.6K

Home Depot Inc

HD

109.80

+0.23%

0.7K

Yahoo! Inc., NASDAQ

YHOO

42.62

+0.26%

30.0K

UnitedHealth Group Inc

UNH

113.52

+0.28%

1.5K

Citigroup Inc., NYSE

C

53.91

+0.28%

0.7K

Google Inc.

GOOG

539.50

+0.30%

2.4K

General Electric Co

GE

27.40

+0.33%

3.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

23.75

+0.38%

0.5K

Wal-Mart Stores Inc

WMT

78.92

+0.41%

2.0K

General Motors Company, NYSE

GM

35.58

+0.45%

1.5K

3M Co

MMM

158.45

+0.49%

0.8K

Exxon Mobil Corp

XOM

89.30

+0.51%

3.0K

International Business Machines Co...

IBM

174.61

+0.54%

3.5K

Facebook, Inc.

FB

79.44

+0.57%

73.5K

Chevron Corp

CVX

109.70

+0.61%

2.4K

Visa

V

66.19

+0.64%

3.2K

Walt Disney Co

DIS

111.23

+0.64%

10.1K

Apple Inc.

AAPL

129.82

+0.67%

407.1K

Amazon.com Inc., NASDAQ

AMZN

426.46

+0.85%

22.0K

Tesla Motors, Inc., NASDAQ

TSLA

228.10

+0.92%

21.5K

Barrick Gold Corporation, NYSE

ABX

13.20

+0.99%

3.2K

Twitter, Inc., NYSE

TWTR

38.30

+1.22%

170.1K

AT&T Inc

T

34.42

0.00%

2.0K

Procter & Gamble Co

PG

80.29

0.00%

2.0K

ALCOA INC.

AA

14.15

0.00%

36.4K

AMERICAN INTERNATIONAL GROUP

AIG

57.74

0.00%

0.1K

E. I. du Pont de Nemours and Co

DD

74.00

-0.05%

0.1K

Yandex N.V., NASDAQ

YNDX

19.54

-0.15%

0.9K

Microsoft Corp

MSFT

48.54

-0.24%

49.2K

International Paper Company

IP

53.90

-0.24%

3.9K

Cisco Systems Inc

CSCO

29.00

-0.45%

18.7K

United Technologies Corp

UTX

114.73

-0.62%

0.1K

Boeing Co

BA

143.60

-0.74%

44.1K

McDonald's Corp

MCD

96.50

-1.33%

4.5K

-

15:13

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded from Sell to Hold at Stifel

Downgrades:

Other:

Amazon (AMZN) reiterated at Outperform at Oppenheimer, target raised from $415 to $525

Walt Disney (DIS) reiterated at Outperform at RBC Capital Mkts, target raised from $110 to $120

-

15:08

Swiss manufacturing PMI remains unchanged at 47.9 in April

The Swiss manufacturing purchasing managers' index (PMI), which is compiled by the Swiss SVME purchasing managers' association and Credit Suisse, remained unchanged at 47.9 in April.

The index declined since the Swiss National Bank (SNB) removed the 1.20 per euro exchange rate floor on January 15th.

A reading below 50.0 indicates contraction of industrial output, a reading above 50.0 indicates expansion of industrial output.

The subindex tracking orders decreased to 46.7 in April.

The employment subindex declined to 42.1. It was lowest level since the 2009.

"An overall economic recession is unlikely," the report said.

-

14:54

Greek manufacturing PMI falls to 46.5 in April

Markit Economics released its manufacturing purchasing managers' index for Greece on Monday. The Greek manufacturing PMI dropped to 46.5 in April from 48.9 in March. It was the lowest level since June 2013.

It was the eight consecutive decline.

The fall was driven by weak demand from domestic and foreign markets.

The new orders and employment index decreased both in April due to the uncertainty over the Greek debt crisis.

Input price inflation climbed in April as raw material prices increased.

-

14:25

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of manufacturing PMIs for the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia MI Inflation Gauge, m/m March 0.4% 0.3%

01:30 Australia ANZ Job Advertisements (MoM) April -1.4% 2.3%

01:30 Australia Building Permits, m/m March -1.6% Revised From -3.2% -2.0% 2.8%

01:45 China HSBC Manufacturing PMI (Finally) April 49.6 48.9

06:00 United Kingdom Bank holiday

07:30 Switzerland Manufacturing PMI April 47.9 47.9

07:50 France Manufacturing PMI (Finally) April 48.8 48.4 48.0

07:55 Germany Manufacturing PMI (Finally) April 52.8 51.9 52.1

08:00 Eurozone Manufacturing PMI (Finally) April 52.2 51.9 52.0

08:30 Eurozone Sentix Investor Confidence May 20 19.8 19.6

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. factory orders data. Factory orders in the U.S. are expected to rise 2.0% in March, after a 0.2% gain in February.

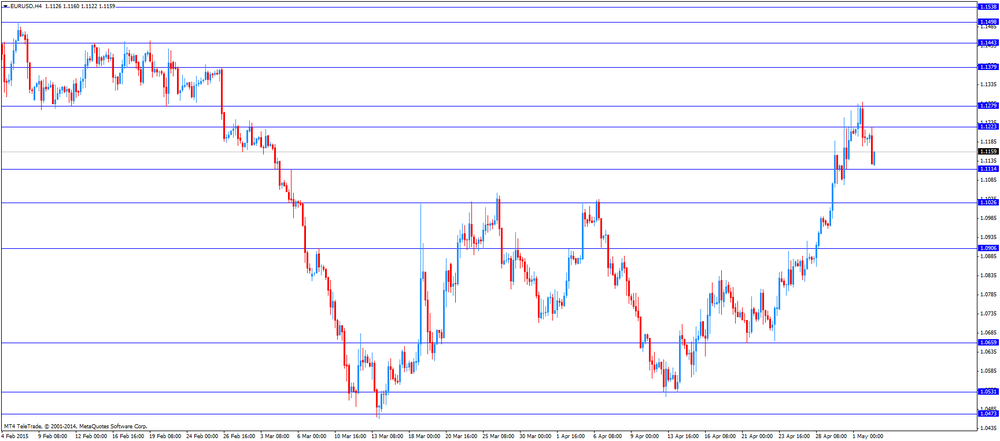

The euro traded lower against the U.S. dollar after the release of manufacturing PMIs for the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in April from 52.2 in March, up from a preliminary reading of 51.9.

Germany's final manufacturing PMI decreased to 52.1 in April from 52.8 in March, up from a preliminary reading of 51.9.

France's final manufacturing PMI dropped to 48.0 in April from 48.8 in March, down a preliminary reading of 48.4.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 19.6 in May from 20.0 in April, missing expectations for a decline to 19.8.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K. Markets in the U.K. are closed for a public holiday.

The Swiss franc traded lower against the U.S. after the manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland remained unchanged at 47.9 in April.

EUR/USD: the currency pair decreased to $1.1122

GBP/USD: the currency pair fell to $1.5088

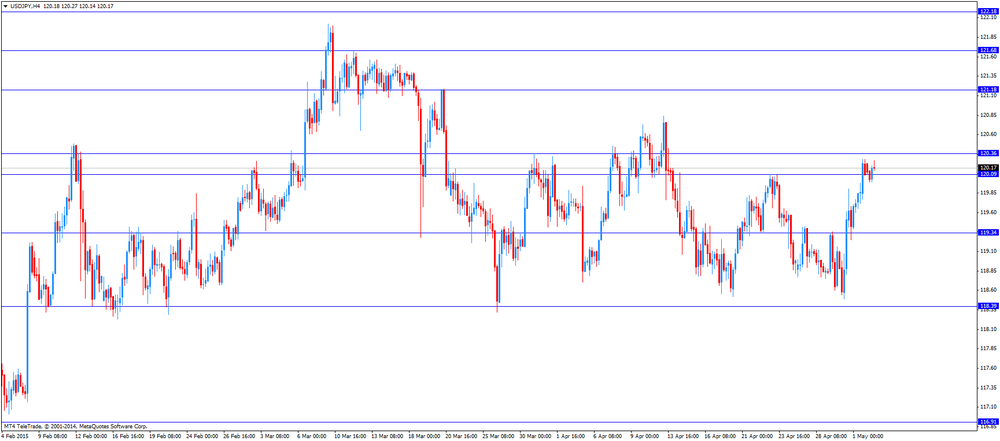

USD/JPY: the currency pair rose to Y120.27

The most important news that are expected (GMT0):

14:00 U.S. Factory Orders March 0.2% 2.0%

16:25 U.S. FOMC Member Charles Evans Speaks

-

14:02

Cleveland Fed President Loretta Mester: that the Fed could hike its interest rate in every monetary policy meeting

Cleveland Fed President Loretta Mester said on Friday that the Fed could hike its interest rate in every monetary policy meeting. The employment reports will be indicative of a lot to her, she said.

"We're getting close to the point where it will be time to lift off," she noted.

Mester is not a voting member of the Federal Open Market Committee this year.

-

13:50

Orders

EUR/USD

Offers 1.1165 1.1180 1.1200 1.1220 1.1235 1.1250

Bids 1.1120 1.1100 1.11050 1.1050-60

GBP/USD

Offers 1.5380 1.5400 1.5420-30 1.5450 1.5480 1.5500 1.5525 1.5560

Bids 1.5320 1.5300 1.5280 1.5250 1.5225-30 1.5200

EUR/GBP

Offers 0.7380-85 0.7400 0.0.7420-25 0.7445-50

Bids 0.7350 0.7330 0.7300-10 0.7280 0.7260 0.7240

EUR/JPY

Offers 134.30 134.60 134.80 135.00 135.50

Bids 133.70 133.50 133.00 132.80 132.50

USD/JPY

Offers 120.25-30 120.50 120.80 121.00

Bids 120.00 119.80-85 119.65 119.40 119.00

AUD/USD

Offers 0.7860 0.7880 0.7900 0.7920-25 0.7940

Bids 0.7820-25 0.7800 0.7780 0.7750-60 0.7720 0.7700

-

12:00

European stock markets mid session: stocks traded higher on final manufacturing PMIs from the Eurozone

Stock indices traded higher on final manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.0 in April from 52.2 in March, up from a preliminary reading of 51.9.

Germany's final manufacturing PMI decreased to 52.1 in April from 52.8 in March, up from a preliminary reading of 51.9.

France's final manufacturing PMI dropped to 48.0 in April from 48.8 in March, down a preliminary reading of 48.4.

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 19.6 in May from 20.0 in April, missing expectations for a decline to 19.8.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis.

Stock market in the U.K. is closed for a public holiday.

Current figures:

Name Price Change Change %

FTSE 100 closed

DAX 11,603.34 +148.96 +1.30 %

CAC 40 5,081.53 +35.04 +0.69 %

-

11:35

Sentix investor confidence index for the Eurozone is down to 19.6 in May

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 19.6 in May from 20.0 in April, missing expectations for a decline to 19.8.

A reading above 0.0 indicates optimism, below indicates pessimism.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis.

The current conditions index climbed to 13 in May from 9 in April. It was the highest level since February 2006.

The expectations index remained declined to 26.5 in May from 31.5 in April.

German investor confidence index dropped to 28.2 in May from 31.4 in April due to a stronger euro and mixed signals from the US economy.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E528mn), $1.1225, $1.1400(E439mn)

USD/JPY: Y119.80, Y120.00($597mn), Y120.25($680mn), Y120.50

GBP/USD: $1.4900(Gbp779mn)

AUD/USD: $0.7600(A$2.1bn), $0.7830(A$432mn)

USD/CAD: C$1.2100, C$1.2165($200mn)

-

11:04

Thomson Reuters/University of Michigan final consumer sentiment index is 95.9 in April

The Thomson Reuters/University of Michigan's final consumer sentiment index was 95.9 in April, missing expectations for a rise to 96.0, up from the preliminary estimate of 93.0.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said the U.S. consumer sentiment index in April reached its second highest level since 2007.

"Consumer optimism has become increasingly dependent on the persistence of low inflation and low interest rates as well as slowly improving prospects for jobs and incomes," he added.

-

11:01

Asia Pasific Stocks closed:

Chinese shares climbed as a bigger-than-estimated drop in a private manufacturing gauge spurred stimulus speculation. The Shanghai Composite Index climbed 0.9 percent as the final April Purchasing Managers' Index from HSBC Holdings Plc and Markit Economics fell to 48.9, the lowest in a year. Gold climbed 0.4 percent. U.S. oil was little changed.

HANG SENG 28,154.46 +21.46 +0.08%

S&P/ASX 200 5,827.5 +13.10 +0.23%

TOPIX Closed

SHANGHAI COMP 4,473.99 +32.33 +0.73%

-

10:44

ISM manufacturing purchasing managers’ index remains unchanged at 51.5 in April

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Friday. The index remained unchanged at 51.5 in April, missing expectations for a rise to 52.0.

March's figure was revised up from 51.3.

A reading above 50 indicates expansion, below indicates contraction.

The new orders index increased to 53.5 in April from 51.8 in March.

The production index increased to 56.0 in April from 53.8 in March.

The employment index decreased to 48.3 in April from 50.0 in March.

-

10:30

Eurozone: Sentix Investor Confidence, May 19.6 (forecast 19.8)

-

10:23

Construction spending in the U.S. declines 0.6% in March

The U.S. Commerce Department released construction spending data on Friday. Construction spending in the U.S. declined 0.6% in March, missing expectations for a 0.5% gain, after a flat reading in February.

February's figure was revised up from a 0.1% decrease.

A 0.3% decline in spending on private construction weighed on construction spending.

Spending on residential construction dropped 1.6% in March, while spending on non-residential construction rose 1.0%.

Spending on federal government projects plunged 4.9%in March.

-

10:00

Eurozone: Manufacturing PMI, April 52.0 (forecast 51.9)

-

09:55

Germany: Manufacturing PMI, April 52.1 (forecast 51.9)

-

09:50

France: Manufacturing PMI, April 48.0 (forecast 48.4)

-

09:30

Switzerland: Manufacturing PMI, April 47.9

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia MI Inflation Gauge, m/m March 0.4% 0.3%

01:30 Australia ANZ Job Advertisements (MoM) April -1.4% 2.3%

01:30 Australia Building Permits, m/m March -1.6% Revised From -3.2% -2.0% 2.8%

01:45 China HSBC Manufacturing PMI (Finally) April 49.6 48.9

The euro held its biggest monthly gain in 4 1/2 years amid signs of life for the world's second-largest economy, while the dollar rebounded against peers on prospects U.S. growth will pick up after a sluggish first quarter.

The single currency was little changed Friday after touching a two-month high of $1.1266 a day earlier when data showed Europe's consumer prices ended four months of declines.

Australia's dollar dropped with copper futures, while Chinese shares climbed as a bigger-than-estimated drop in a private manufacturing gauge spurred stimulus speculation. Gold advanced. Copper futures slid 0.8 percent on the Comex by 1:06 p.m. in Hong Kong, while the Aussie lost 0.4 percent as the final April Purchasing Managers' Index from HSBC Holdings Plc and Markit Economics fell to 48.9, the lowest in a year. The Shanghai Composite Index swung to a gain of 0.9 percent.

EUR / USD: during the Asian session, the pair was trading around $ 1.1190

GBP / USD: during the Asian session, the pair was trading around $ 1.5150

USD / JPY: during the Asian session the pair fell to Y120.00

-

08:18

Options levels on monday, May 4, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1355 (3408)

$1.1297 (6577)

$1.1257 (2452)

Price at time of writing this review: $1.1209

Support levels (open interest**, contracts):

$1.1143 (937)

$1.1101 (2602)

$1.1041 (3234)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 63671 contracts, with the maximum number of contracts with strike price $1,1200 (6577);

- Overall open interest on the PUT options with the expiration date May, 8 is 88686 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.39 versus 1.39 from the previous trading day according to data from May, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5404 (1050)

$1.5306 (1259)

$1.5210 (1636)

Price at time of writing this review: $1.5162

Support levels (open interest**, contracts):

$1.5088 (1119)

$1.4992 (2304)

$1.4894 (2186)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27813 contracts, with the maximum number of contracts with strike price $1,5500 (2829);

- Overall open interest on the PUT options with the expiration date May, 8 is 37970 contracts, with the maximum number of contracts with strike price $1,4700 (2818);

- The ratio of PUT/CALL was 1.37 versus 1.38 from the previous trading day according to data from May, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:45

China: HSBC Manufacturing PMI, April 48.9

-

03:31

Australia: Building Permits, m/m, March 2.8% (forecast -2.0%)

-

03:31

Australia: ANZ Job Advertisements (MoM), April 2.3%

-

02:31

Australia: MI Inflation Gauge, m/m, March 0.3%

-

00:34

Commodities. Daily history for May 1’2015:

(raw materials / closing price /% change)

Oil 59.15 -0.92%

Gold 1,177.40 +0.25%

-

00:33

Stocks. Daily history for Apr May 1’2015:

(index / closing price / change items /% change)

Nikkei 225 19,531.63 +11.62 +0.06 %

S&P/ASX 200 5,814.4 +24.42 +0.42 %

Topix 1,585.61 -7.18 -0.45 %

FTSE 100 6,985.95 +25.32 +0.36 %

CAC 40 5,046.49 +7.10 +0.14 %

Xetra DAX 11,454.38 +21.66 +0.19 %

S&P 500 2,108.29 +22.78 +1.09 %

NASDAQ Composite 5,005.39 +63.97 +1.29 %

Dow Jones 18,024.06 +183.54 +1.03 %

-

00:32

Currencies. Daily history for May 1’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1197 -0,14%

GBP/USD $1,5137 -1,38%

USD/CHF Chf0,9327 -0,02%

USD/JPY Y120,08 +0,56%

EUR/JPY Y134,56 +0,48%

GBP/JPY Y181,95 -0,70%

AUD/USD $0,7850 -0,64%

NZD/USD $0,7539 -0,84%

USD/CAD C$1,2157 +0,73%

-

00:00

Schedule for today, Monday, May 4’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

00:30 Australia MI Inflation Gauge, m/m March 0.4%

01:30 Australia ANZ Job Advertisements (MoM) April -1.4%

01:30 Australia Building Permits, m/m March -3.2% -2.0%

01:45 China HSBC Manufacturing PMI (Finally) April 49.6

06:00 United Kingdom Bank holiday

07:30 Switzerland Manufacturing PMI April 47.9

07:50 France Manufacturing PMI (Finally) April 48.8 48.4

07:55 Germany Manufacturing PMI (Finally) April 52.8 51.9

08:00 Eurozone Manufacturing PMI (Finally) April 52.2 51.9

08:30 Eurozone Sentix Investor Confidence May 20 19.8

14:00 U.S. Factory Orders March 0.2% 2.0%

16:25 U.S. FOMC Member Charles Evans Speaks

23:30 Australia AIG Services Index April 50.2

-