Noticias del mercado

-

23:59

Schedule for today, Tuesday, Dec 06’2016 (GMT0)

00:00 Japan Labor Cash Earnings, YoY October 0.2% 0.2%

00:30 Australia Current Account, bln Quarter III -15.5 -13.7

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

07:00 Germany Factory Orders s.a. (MoM) October -0.6% 0.6%

08:15 Switzerland Consumer Price Index (MoM) November 0.1%

08:15 Switzerland Consumer Price Index (YoY) November -0.2% -0.1%

10:00 Eurozone GDP (QoQ) (Finally) Quarter III 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Finally) Quarter III 1.6% 1.6%

13:30 Canada Trade balance, billions October -4.08 -2.0

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III -0.6% 3.3%

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter III 4.3% 0.3%

15:00 Canada Ivey Purchasing Managers Index November 59.7 59.9

15:00 U.S. Factory Orders October 0.3% 2.5%

22:30 Australia AiG Performance of Construction Index November 45.9

-

22:07

Major US stock indices closed in the green zone

Major stock indexes in Wall Street rose on Monday amid a rise in price of shares of conglomerates sector and technology segment. Dow newly updated records, which was largely due to the growth of the banking and industrial sectors, which are expected to benefit from increased spending on infrastructure and simpler rules for the administration of Donald Trump.

As it became known today, suppliers of services in the US have experienced robust expansion of business activity in November, helped by the fastest growth of new orders in the period of one year. Large workloads and strong business confidence led to a further rise in the rate of job creation to three and a half year low, noted in September. At the same time, input price inflation fell slightly in November, which contributed to slow growth in average prices charged by the services sector, since April. The seasonally adjusted final index of business activity in the US services sector from Markit was 54.6 in November, and remained above the neutral 50.0 value of the ninth month in a row.

At the same time, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), improved significantly in November, reaching a level of 57.2 compared with 54.8 in the previous month. According to the forecast, the rate had to rise only to 55.4. Recall, the indicator is the result of a survey of about 400 companies from 60 sectors across the United States. ISM index value greater than 50 is usually considered as an indicator of the growth of industrial activity, but less than 50, respectively, falls.

DOW index closed mixed components (15 black, 15 red). Most remaining shares rose NIKE, Inc. (NKE, + 2.98%). Outsider were shares of UnitedHealth Group Incorporated (UNH, -2.13%).

All business sectors S & P index recorded an increase. The leader turned conglomerates sector (+ 1.3%).

At the close:

Dow + 0.24% 19,216.48 +46.06

Nasdaq + 1.01% 5,308.89 +53.24

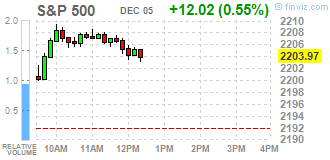

S & P + 0.58% 2,204.70 +12.75

-

21:00

DJIA +0.18% 19,205.06 +34.64 Nasdaq +0.89% 5,302.65 +47.00 S&P +0.50% 2,202.85 +10.90

-

18:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday, with financials and technology stocks powering Dow to a new intraday high and boosting the S&P and the Nasdaq. The Dow has been enjoying a record-setting rally, largely driven by bank and industrial stocks, which are expected to benefit the most from higher spending on infrastructure and simpler regulations under a Donald Trump administration.

Most of Dow stocks in positive area (18 of 30). Top gainer - NIKE, Inc. (NKE, +3.27%). Top loser - UnitedHealth Group Incorporated (UNH, -1.86%).

Most S&P sectors also in positive area. Top gainer - Basic Materials (+1.0%). Top loser - Utilities (-0.7%).

At the moment:

Dow 19230.00 +72.00 +0.38%

S&P 500 2203.75 +11.75 +0.54%

Nasdaq 100 4777.25 +38.75 +0.82%

Oil 51.95 +0.27 +0.52%

Gold 1168.40 -9.40 -0.80%

U.S. 10yr 2.40 +0.01

-

18:00

European stocks closed: FTSE 100 +16.11 6746.83 +0.24% DAX +171.48 10684.83 +1.63% CAC 40 +45.50 4574.32 +1.00%

-

17:50

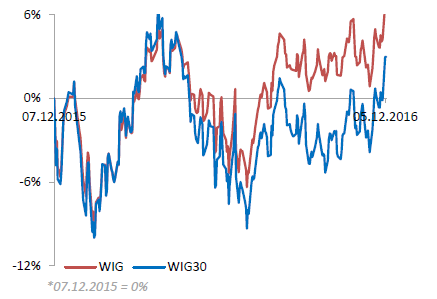

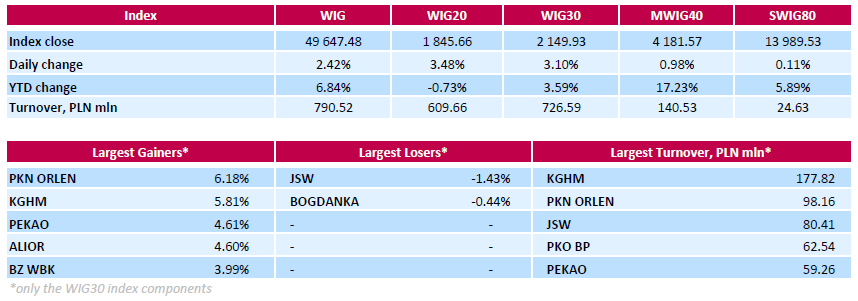

WSE: Session Results

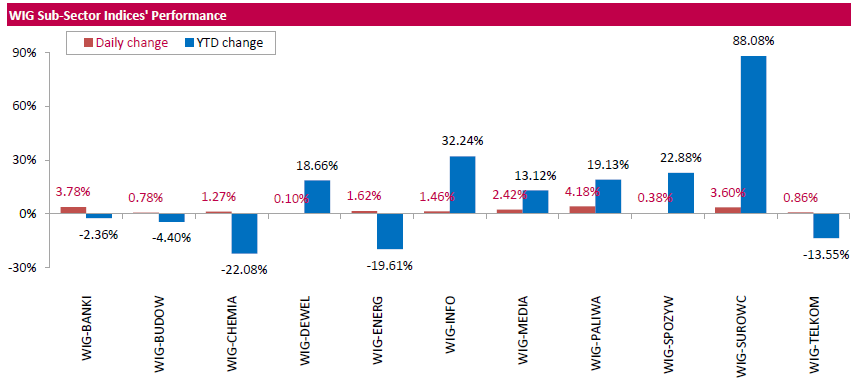

Polish equity closed higher on Monday. The broad market measure, the WIG Index, surged by 2.42%. All sectors in the WIG generated positive returns, with oil and gas (+4.18%), banking sector (+3.78%) and materials (+3.6%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, grew by 3.1%. There were only two decliners among the index components. Coking coal producer JSW (WSE: JSW) posted the sharpest decline, sliding down 1.43%. It was followed by thermal coal miner BOGDANKA (WSE: LWB), falling by 0.44%. On the plus side, oil refiner PKN ORLEN (WSE: PKN) and copper producer KGHM (WSE: KGH) topped the list of outperformers, climbing by 6.18% and 5.81% respectively, supported by growing prices for oil and copper. Among other major gainers were six constituents, belonging to the banking sector, namely PEKAO (WSE: PEO), ALIOR (WSE: ALR), BZ WBK (WSE: BZW), PKO BP (WSE: PKO), ING BSK (WSE: ING) and MBANK (WSE: MBK), which added between 3.22% and 4.61% percent.

-

16:52

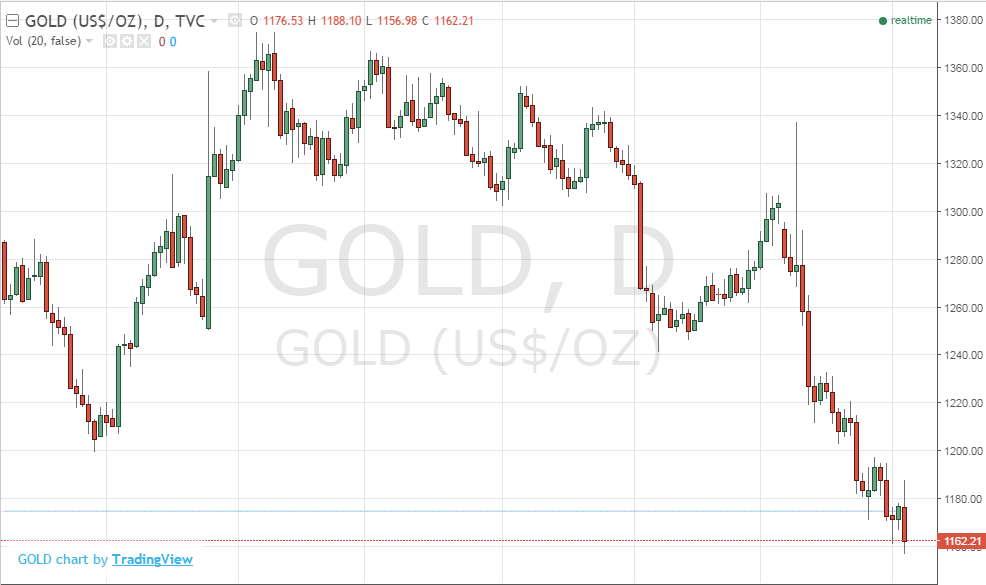

Gold price fell overshadowed by upcoming US rate hike

Gold prices fell on Monday as expectations for an upcoming interest rate increase in the U.S overshadowed the fallout from Italians' rejection of constitutional reform.

Gold for February delivery, the most-active contract, was recently down 0.9% at $1,167.40 a troy ounce on the Comex division of the New York Mercantile Exchange, on track for its lowest close since Feb. 5.

That decline was despite the Italian "no" vote, which some analysts predicted would spur initial safe-haven buying for gold on fears that it could signal further political uncertainty and threaten the stability of the eurozone, says Dow Jones.

-

16:42

-

16:16

U.S.: Labor Market Conditions Index, November 1.5

-

16:15

Fed's Evans Expects U.S. Economic Strength to Continue - Down Jones

Federal Reserve Bank of Chicago President Charles Evans described in a speech Monday a strong U.S. economy that he has "every reason to believe" will continue, especially with the economic policies the new administration has proposed.

-

16:09

Growth in the US non-manufacturing sector at a faster rate

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management (ISM) Non-Manufacturing Business Survey Committee. "The NMI registered 57.2 percent in November, 2.4 percentage points higher than the October reading of 54.8 percent. This represents continued growth in the non-manufacturing sector at a faster rate. This is the 12-month high, and the highest reading since the 58.3 registered in October of 2015".

The New Orders Index registered 57 percent, 0.7 percentage point lower than the reading of 57.7 percent in October. The Employment Index increased 5.1 percentage points in November to 58.2 percent from the October reading of 53.1 percent. The Prices Index decreased 0.3 percentage point from the October reading of 56.6 percent to 56.3 percent, indicating prices increased in November for the eighth consecutive month at a slightly slower rate

-

16:00

U.S.: ISM Non-Manufacturing, November 57.2 (forecast 55.4)

-

15:51

WSE: After start on Wall Street

European markets almost did not notice an increase in uncertainty. Slightly cheaper are mainly Italian banks but other sectors are gaining in value and the best presents sector of the automotive companies. As a result, the German market today gained greater vigor, although in the southern phase of trade gains slightly less than it was before. Increases of 2% on the WSE put us in first place among the most important parquets. The common currency also made up for earlier losses. This is somewhat surprising change, because after today's events, the ECB may be less inclined to reduce their support.

Wall Street opens with an increase of 0.4%, which may not be a significant change, but ranks the index over the broken last week support. This situation indirectly led to another wave of optimism on the Warsaw Stock Exchange.

An hour before the close of trading the WIG20 index was at the level of 1,831 points (+2,67%).

-

15:50

U.S. service providers experienced a robust expansion of business activity in November - Markit

U.S. service providers experienced a robust expansion of business activity in November, helped by the fastest rise in new work for one year. Greater workloads and resilient business confidence led to a further upturn in the pace of job creation from the three-and-a-half year low recorded in September. Meanwhile, input cost inflation eased slightly during November, which contributed to the slowest rise in average prices charged by service sector companies since April.

The seasonally adjusted final Markit U.S. Services Business Activity Index registered 54.6 in November, to remain above the 50.0 no-change value for the ninth consecutive month. Although the latest reading was fractionally lower than in October (54.8), the rate of growth remained stronger than at any time in the first half of 2016. Survey respondents noted that improved client confidence and a favourable domestic economic backdrop had helped to boost business activity in November.

-

15:45

U.S.: Services PMI, November 54.6 (forecast 54.9)

-

15:31

U.S. Stocks open: Dow +0.44%, Nasdaq +0.52%, S&P +0.45%

-

15:30

Data unlikely to drive GBP this week says Credit Agricole

"It will be more active in terms of data with October trade and production data as well as Services PMI scheduled to be released. However, none of these releases should have any bigger an impact on the BoE's monetary policy stance, which is stable in an environment in which intact Brexit uncertainty is coupled to increased upside risks to inflation.

As such it will be political developments that drive the currency still. Mainly on the back of Eurogroup President Dijsselbloem stressing that the EU may find a way for the UK to access the internal market, hard-Brexit fears fell anew to the benefit of the currency.

With short positioning still elevated some additional position squaring related GBP upside risks cannot be excluded towards the end of the year, especially against the USD.

When it comes to EUR/GBP we believe that the longer-term outlook is more constructive. Hence, we stay long the cross via options".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

15:17

Before the bell: S&P futures +0.30%, NASDAQ futures +0.37%

U.S. stock-index futures advanced amid rising oil prices and as investors shrug off the Italian referendum defeat and Italy's prime-minister Matteo Renzi's resignation.

Global Stocks:

Nikkei 18,274.99 -151.09 -0.82%

Hang Seng 22,505.55 -59.27 -0.26%

Shanghai 3,204.95 -38.90 -1.20%

FTSE 6,738.88 +8.16 +0.12%

CAC 4,559.10 +30.28 +0.67%

DAX 10,643.98 +130.63 +1.24%

Crude $52.16 (+0.93%)

Gold $1,169.90 (-0.67%)

-

15:13

Reuters: EU cannot ask Italy for more budget measures now - Eurogroup chief

-

14:56

Fed's Dudley Says He Favors Rate Rises If Economy Meets Expectations

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

28.86

-0.18(-0.6198%)

8375

Amazon.com Inc., NASDAQ

AMZN

745.25

4.91(0.6632%)

18941

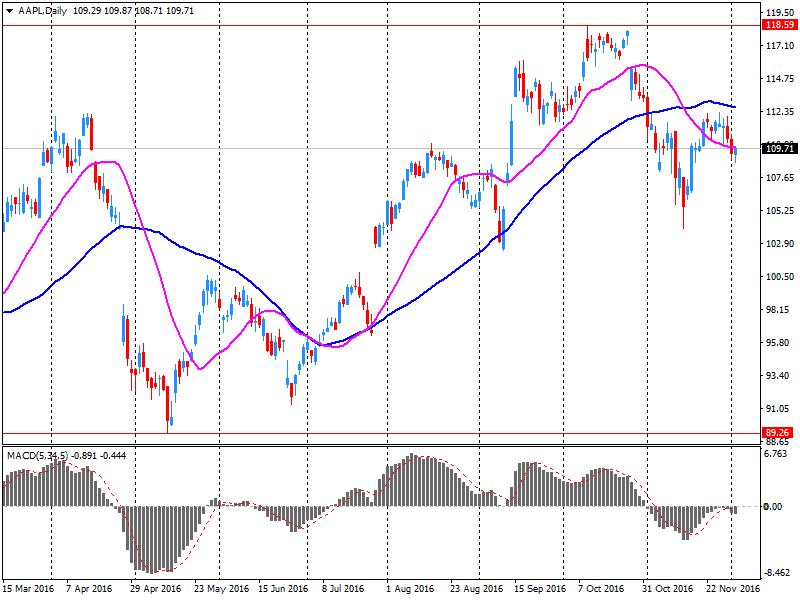

Apple Inc.

AAPL

110.16

0.26(0.2366%)

44739

AT&T Inc

T

38.62

0.01(0.0259%)

3899

Barrick Gold Corporation, NYSE

ABX

15.32

-0.34(-2.1711%)

33450

Boeing Co

BA

152

-0.25(-0.1642%)

421

Caterpillar Inc

CAT

95.41

0.27(0.2838%)

2881

Chevron Corp

CVX

113.78

0.78(0.6903%)

391

Cisco Systems Inc

CSCO

29.36

0.11(0.3761%)

2672

Citigroup Inc., NYSE

C

56.35

0.33(0.5891%)

21494

Exxon Mobil Corp

XOM

87.58

0.54(0.6204%)

2471

Facebook, Inc.

FB

115.95

0.55(0.4766%)

53906

Ford Motor Co.

F

12.35

0.11(0.8987%)

25832

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.7

0.28(1.8158%)

195468

General Electric Co

GE

31.42

0.08(0.2553%)

7294

General Motors Company, NYSE

GM

35.21

0.18(0.5138%)

8560

Goldman Sachs

GS

225

1.64(0.7342%)

2640

Google Inc.

GOOG

754.06

3.56(0.4744%)

2436

Home Depot Inc

HD

130

0.13(0.1001%)

1189

Intel Corp

INTC

34.3

0.14(0.4098%)

2069

International Business Machines Co...

IBM

159.99

-0.03(-0.0187%)

500

International Paper Company

IP

50.5

0.04(0.0793%)

500

Johnson & Johnson

JNJ

112.5

0.54(0.4823%)

728

JPMorgan Chase and Co

JPM

81.91

0.31(0.3799%)

8926

McDonald's Corp

MCD

119.61

1.37(1.1587%)

3382

Merck & Co Inc

MRK

61.5

0.37(0.6053%)

350

Microsoft Corp

MSFT

59.36

0.11(0.1857%)

1934

Nike

NKE

51.01

0.55(1.09%)

7111

Pfizer Inc

PFE

31.7

0.07(0.2213%)

1951

Procter & Gamble Co

PG

82.47

0.07(0.085%)

2792

Starbucks Corporation, NASDAQ

SBUX

56.81

-0.40(-0.6992%)

10311

Tesla Motors, Inc., NASDAQ

TSLA

182.8

1.33(0.7329%)

6922

The Coca-Cola Co

KO

40.4

0.04(0.0991%)

3118

Twitter, Inc., NYSE

TWTR

18.02

0.09(0.502%)

23564

United Technologies Corp

UTX

108.68

0.46(0.4251%)

200

Verizon Communications Inc

VZ

49.85

0.04(0.0803%)

5622

Visa

V

76.53

0.81(1.0697%)

7435

Wal-Mart Stores Inc

WMT

70.98

0.10(0.1411%)

4365

Walt Disney Co

DIS

99.2

0.70(0.7107%)

401

Yahoo! Inc., NASDAQ

YHOO

40.28

0.21(0.5241%)

100

Yandex N.V., NASDAQ

YNDX

18.7

0.28(1.5201%)

8980

-

14:44

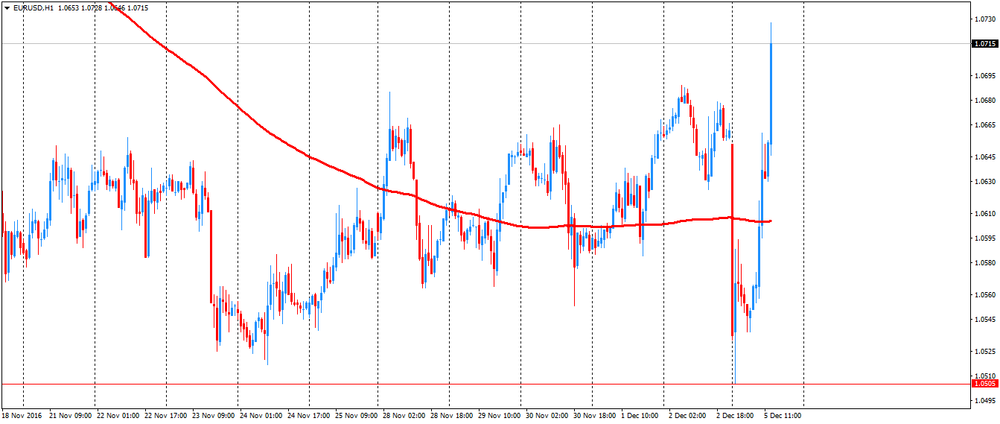

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0445-50 (EUR 520m) 1.0500 (1.82bln) 1.0510 (487m) 1.0700 (1.62bln) 1.0750 (1.68bln)

USD/JPY 110.50 (USD 1.77bln) 110.75 (600m) 112.45 (405m) 113.50 (380m)

GBP/USD 1.2240-45 (GBP 612m) 1.2350 (455m) 1.2490-1.2500 (630m) 1.2800 (520m)

USD/CHF 1.0200 (USD 300m) 1.0400 (630m)

AUD/USD 0.7400 (AUD 453m)

USD/CAD 1.3300 (USD 591m) 1.3400 (346m)

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Visa (V) upgraded to Buy from Neutral at Guggenheim

McDonald's (MCD) upgraded to Buy from Neutral at Nomura

NIKE (NKE) upgraded to Buy from Hold at HSBC Securities

Downgrades:

Alcoa (AA) downgraded to Neutral from Buy at Citigroup

Other:

Caterpillar (CAT) target raised to $89 from $78 at JP Morgan; Neutral

Hewlett Packard Enterprise (HPE) target raised to $25 from $22 at Maxim Group

-

14:34

1 year+ low and 3 weeks high for EUR/USD in the same day. 225 pips the trading range so far

-

14:15

Apple (AAPL) have hinted about working on unmanned vehicles

According to WSJ, Apple actually admitted that is working on unmanned vehicles, writing a letter to the public transport US regulator, requesting comments and suggestions on the new technology.

In the letter to the National Highway Traffic Safety Administration, Director of Product Development Steve Kenner, said the company "will invest heavily in machine learning and automation, and full of enthusiasm for the automated systems capacities in many areas, including transport. " In this case, as the newspaper notes, the letter did not disclose any details about the project.

Recall, for several years now there are rumors that Apple is working on a project code-named Project Titan for electric vehicle production. However, the company never publicly acknowledged it.

Apple also encourages the regulator to quickly adopt new safety rules, which, however, need to be flexible. As noted by Mr. Kenner, "improving the regulatory flexibility", the controller will "contribute to the implementation of innovation and promote" the development of life-saving technologies. "

AAPL shares rose in premarket trading to $ 110.44 (+ 0.49%).

-

13:59

Orders

EUR/USD

Offers : 1.0665 1.0685 1.0700 1.0730 1.0745-50 1.0780 1.0800 1.0820 1.0850

Bids: 1.0620 1.0600 1.0580 1.0550 1.0520 1.0500

GBP/USD

Offers : 1.2750 1.2770 1.2785 1.2800 1.2830 1.2850 1.2875 1.2900

Bids: 1.2700 1.2680 1.2660 1.2630 1.2600 1.2585 1.2560 1.2520-25 1.2500

EUR/GBP

Offers : 0.8375-80 0.8400 0.8420 0.8450 0.8465 0.8480-85 0.8500

Bids: 0.8350 0.8335 0.8320 0.8300 0.8280-85 0.8250 0.8200

EUR/JPY

Offers : 121.85 122.00 122.30 122.65-70 123.00 123.50 124.00

Bids: 121.00 120.80-85 120.50 102.20 120.00 119.60 119.30 119.00 118.50 118.00

USD/JPY

Offers : 114.20 114.35 114.50 114.80-85 115.00 115.25 115.45-50

Bids: 113.80 113.40-45 113.20 113.00 112.85 112.50 112.20 112.00 111.80 111.50

AUD/USD

Offers : 0.7465 0.7485 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids: 0.7420 0.7400 0.7380 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

13:06

-

13:05

WSE: Mid session comment

The forenoon readings of PMIs from services sector in Europe proved to be very good. It did not cause a greater reaction in the market, as investors traditionally are more focused on reports from the industry.

Today's market behavior is another, surprising reaction to a political event which was the referendum in Italy last weekend. The German DAX rising 1.5%, while the French CAC40 booster exceeds 1.2%. Our market is further supported by the good behavior of raw materials, where drops of oil have been completed and WIG20 in the first hour of trading was elevated above the level of 1,800 points. In the middle of trading the turnover among the largest companies exceeded the level of PLN 250 million, which is not bad for a Monday, although one-third of it is KGHM.

At the halfway point of today's session the WIG20 index was at the level of 1,819 points (+ 2.01%).

-

12:21

ECB, François Villeroy: Italy referendum can not be compared to Brexit

During his speech today in Tokyo, the European Central Bank official, and head of the Bank of France, François Villeroy said that the consequences of the Italian referendum can not be compared to the exit of Great Britain from the EU. The official believes that the results of the referendum will be another source of uncertainty, but certainly not a disaster. "We will closely monitor the effects of the referendum in Italy. However, the economic reforms in Europe have developed resistance. Economic growth in the euro area is now stable and reliable. They are supported by domestic demand and loose monetary policy "- said Villeroy.

-

11:24

Oil is trading in the red zone

This morning the New York futures for Brent are down 0.19% to $ 51.56 and WTI fell 0.20% to $ 54.35 per barrel. Thus, the black gold is traded lower on the background of drilling rigs growth in the United States, which excited the market because of concerns that the production cuts agreed by OPEC countries and Russia, may not be as significant as previously expected.

As shown by Baker Hughes data on Friday the number of rigs in the US increased by 3. After the low of May 27 manufacturers increased the number of drilling rigs in the United States at 161 (plus 51 percent).

-

11:21

Retail trade rose by 1.1% in the euro area

In October 2016 compared with September 2016, the seasonally adjusted volume of retail trade rose by 1.1% in the euro area (EA19) and by 1.2% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September the retail trade volume decreased by 0.4% in the euro area and by 0.2% in the EU28. In October 2016 compared with October 2015 the calendar adjusted retail sales index increased by 2.4% in the euro area and by 3.5% in the EU28.

Among Member States for which data are available, the highest increases in the total retail trade volume were registered in Slovenia (+3.7%), Luxembourg (+2.9%), Germany (+2.4%) and the United Kingdom (+2.0%), while decreases were observed in Malta (-0.5%), Ireland (-0.4%), Hungary (-0.3%), Slovakia (-0.2%) and Spain (-0.1%).

-

11:00

Eurozone: Retail Sales (MoM), October 1.1% (forecast 0.8%)

-

11:00

Eurozone: Retail Sales (YoY), October 2.4% (forecast 1.7%)

-

10:50

Investors entirely revise their expectations for the US economy and turn euphoric - Sentix

The sentix Economic Indices show as one of the first published leading indicators after the US election a remarkable shift in economic expectations. Investors entirely revise their expectations for the US economy and turn euphoric. Expectations jump by 20.5 points. Another beneficiary of the surprising US election result is Japan. The surge in the US Dollar causes the Japanese Yen to decline which should boost the export-driven economy. While the US, Japan and the sentix Global Aggregate Index benefit, only Europe trails behind. The headline index for the Eurozone slides 3.1 points. The Global Aggregate Index shows a plus of 3.1 points.

-

10:49

Important growth for UK services sector

November PMI survey data from IHS Markit and CIPS signalled that the UK service sector remained on a firm growth path towards the end of 2016. The rate of expansion of total activity accelerated further to the strongest since January. Employment growth picked up to the fastest since April, partly fuelled by the sharpest build-up of outstanding work since July 2015. The strength of long-term business sentiment weakened for the first time since July, however, attributed to ongoing political uncertainty and inflationary pressures.

The Index remained above 50.0 for the fourth consecutive month in November, indicating a continued recovery in growth following a contraction in July linked to the EU referendum. Moreover, the Index rose to 55.2, from 54.5, signalling the fastest expansion since January. The rate of growth was broadly in line with the 20- year long-run survey average.

-

10:30

United Kingdom: Purchasing Manager Index Services, November 55.2 (forecast 54)

-

10:17

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0445-50 (EUR 520m) 1.0500 (1.82bln) 1.0510 (487m) 1.0700 (1.62bln) 1.0750 (1.68bln)

USD/JPY 110.50 (USD 1.77bln) 110.75 (600m) 112.45 (405m) 113.50 (380m)

GBP/USD 1.2240-45 (GBP 612m) 1.2350 (455m) 1.2490-1.2500 (630m) 1.2800 (520m)

USD/CHF 1.0200 (USD 300m) 1.0400 (630m)

AUD/USD 0.7400 (AUD 453m)

USD/CAD 1.3300 (USD 591m) 1.3400 (346m)

Информационно-аналитический отдел TeleTrade

-

10:04

November final composite PMI for Euro Zone slightly below estimate

The rate of eurozone economic expansion accelerated to its highest in the year to date during November. This was highlighted by the final Markit Eurozone PMI Composite Output Index posting 53.9, slightly below the earlier flash estimate of 54.1 but still the best reading since December 2015.

Growth of manufacturing production slowed slightly since October, but nonetheless expanded at a slightly faster pace than service sector business activity. Services output rose at the quickest rate in 11 months.

The strongest rates of increase were registered by Ireland and Spain, both of which saw growth accelerate (to three- and five-month highs respectively). However, simply by the virtue of its size, Germany contributed the greatest to the latest expansion, with the rate of increase little-changed from October, says Markit.

-

10:01

Eurozone: Services PMI, November 53.8 (forecast 54.1)

-

09:59

German service providers enjoyed a further month of solid output growth

German service providers enjoyed a further month of solid output growth, with the latest expansion the most marked in six months. Increased activity was driven by new business wins which continued to expand strongly. With business outstanding rising for the first time since June, companies were encouraged to raise their workforce numbers further during the month. Moreover, sharply rising input costs led to the strongest rate of charge inflation in four-and-a-half years as service providers passed higher input prices on to their clients.

The final seasonally adjusted Markit Germany Services PMI Business Activity rose from October's 54.2 to a six-month high of 55.1 in November and thereby signalled stronger growth of business activity. The index has now posted above the crucial 50.0 no-change mark for three-and-ahalf years and latest survey results signalled that companies in the Transport & Storage sub-sector enjoyed particularly solid growth. Panel members largely attributed increased output to new business wins.

-

09:56

Germany: Services PMI, November 55.1 (forecast 55)

-

09:51

France: Services PMI, November 51.6 (forecast 52.6)

-

09:45

Major stock markets trading in the red zone: FTSE -0.4%, DAX -0.1%, CAC40 -0.4%, FTMIB -1.7%, IBEX -0.9%

-

09:23

Further signs of improvement in the Spanish service sector - Markit

There were further signs of improvement in the Spanish service sector during November, with rates of growth in activity and new business edging higher during the month and optimism improving. A faster rise in employment was also recorded. Meanwhile, companies increased their output prices only marginally, in spite of a further solid increase in input costs.

The headline seasonally adjusted Business Activity Index posted 55.1 in November, up slightly from 54.6 in October and thereby signalling an acceleration in the rate of expansion during the month. The latest increase was the thirty-seventh in as many months and the sharpest since August.

-

09:17

WSE: After opening

WIG20 index opened at 1788.93 points (+0.30%)*

WIG 48732.15 0.53%

WIG30 2098.93 0.65%

mWIG40 4159.57 0.45%

*/ - change to previous close

The futures market began the new week with a surprising and considerable increase of 0.73% to 1,795 points. In the surrounding derivative on DAX lost approx. 0.2%, and the difference in the behavior may result from a positive reception of Friday's S&P statement.

The cash market also began with modest increases with a modest turnover beyond excluding the traditional distinctive behavior of KGHM shares. The copper conglomerate stands out positively, and indeed highly opens. The German DAX also gained at the opening, the same market shows that the Italian referendum does not work unfavorably.

After fifteen minutes of trading in Warsaw, the WIG20 index was at 1,796 points (+ 0.73%)

-

08:56

Today’s events

-

At 07:30 GMT the Bank of Japan Governor Haruhiko Kuroda will deliver a speech

-

At 15:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 16:30 GMT FOMC member William Dudley will make a speech

-

At 17:25 GMT FOMC member Charles Evans will give a speech

-

At 20:00 GMT the Bank of England Governor Mark Carney will deliver a speech

-

At 22:05 GMT FOMC member James Bullard will give a speech

-

-

08:28

Morgan Stanley booked a massive 1570 pips profit on its GBP/JPY long position

Morgan Stanley booked a massive 1570 pips profit on its GBP/JPY long position as the trade hit its target on Thursday.

Here is MS' view on the pair now:

"We hit our target on this trade as GBP/USD made new multimonth highs. We think there is still a bit more upside for GBP in the coming week but don't see a need to re-enter GBPJPY for now. We still think the JPY will weaken and are expressing the view via CHFJPY. One of our top trades for 2017 is to be short EURGBP, but we are awaiting a better entry point".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:28

WSE: Before opening

Over the weekend Italy held a constitutional referendum. According to preliminary data, the Italians are against changes in the constitution, which will probably lead to the resignation of the government.

Markets reacted negatively with the weakening of the euro and pressure on risky assets. This reaction, however, proved to be short-lived. The euro stabilizes after night considerable discounts. On the other hand contracts in the United States opened with the gap, but did not fall further. The Asian markets are dominated by the red color, but the price of copper is gaining in value.

On Friday, Standard & Poor's upgraded the rating outlook for Poland to "stable" from "negative", supporting the assessment of the country at "BBB plus". In explanation they said that concerns about the independence of the central bank were dropped. An overall statement of the S&P was a big surprise and it seems that domestic investors will not pay greater attention to the message considering it to be unreliable. On the other hand, from the point of view of foreign investors, it is a plus, but is offset by the unfavorable outcome of the referendum in Italy.

Hence morning mix of information for the Warsaw market is different. We have positive news, we also have negative ones, although based on the model of similar situation this year we should not expect any disaster. In theory, this should mean a negative initial impulse, which, however, does not necessarily continue until the end of the session. In the meantime, there will be PMI / ISM readings for services sector, where traditionally reports from the US will be the most important.

-

08:24

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.8%, CAC40 -0.5%, FTSE -0.4%

-

08:22

The index of business activity in the services sector of Australia rose in November

The index of business activity in Australia's services sector, published by the Australian Industry Group (AiG), was 51.1 points, which is higher than the previous value of 50.5. AiG explores the results of a survey of 200 manufacturers in the assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian currency.

Three of the five sub-indices of activity were above 50 indicating expansion in November. New orders rose 1.7 points to 54.0, employment expanded at a slower pace, falling 0.6 points to 52.3, deliveries climbed into positive territory, up 3.6 points to 51.8.

-

08:18

Solid increase in Chinese business activity - Markit

Caixin China Composite PMI data (which covers both manufacturing and services) showed a further solid increase in Chinese business activity in November. The Composite Output Index was unchanged from October's 43-month record of 52.9 in November.

Services companies based in China saw a solid increase in business activity during November, which offset a slight slowdown in the rate of output expansion across the manufacturing sector. Furthermore, the seasonally adjusted Caixin China General Services Business Activity Index rose from 52.4 to reach a 16-month high of 53.1 in November.

-

08:16

Moody's changes Japan Life Insurance industry outlook to negative from stable

-

08:12

New Zeeland Prime Minister Key to stand down; says he will not stand for re-election in 2017

-

08:09

Referendum seen as crucial to the future of Italy’s government and the stability of the euro - Bloomberg

-

08:08

EUR/USD gaps down and falls 150 pips after Italy said “NO” to constitutional reform

-

08:06

Italian Prime Minister Renzi resigns after referendum is rejected

-

07:14

Global Stocks

U.S. stocks struggled for direction Friday with the Dow industrials finishing lower and the S&P 500 and the Nasdaq closing slightly higher as investors digested a weaker-than-expected payroll report, favoring sectors viewed as safe in economically uncertain times.

Asian shares fell on Monday Italian Prime Minister Matteo Renzi after he suffered a humiliating defeat in a referendum over constitutional reforms and investors eyed a growing spat between the incoming U.S. administration China.

-

07:07

Options levels on monday, December 5, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0791 (3058)

$1.0743 (2014)

$1.0688 (127)

Price at time of writing this review: $1.0568

Support levels (open interest**, contracts):

$1.0522 (6610)

$1.0455 (6047)

$1.0417 (5911)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 86889 contracts, with the maximum number of contracts with strike price $1,1400 (6413);

- Overall open interest on the PUT options with the expiration date December, 9 is 75670 contracts, with the maximum number of contracts with strike price $1,0600 (6610);

- The ratio of PUT/CALL was 0.87 versus 0.83 from the previous trading day according to data from December, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.3001 (2463)

$1.2902 (577)

$1.2804 (1501)

Price at time of writing this review: $1.2686

Support levels (open interest**, contracts):

$1.2597 (1243)

$1.2498 (2623)

$1.2399 (1568)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 36131 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 35239 contracts, with the maximum number of contracts with strike price $1,2500 (2623);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:01

Japan: Consumer Confidence, November 40.9 (forecast 43.8)

-

02:45

China: Markit/Caixin Services PMI, November 53.1 (forecast 52.7)

-

01:31

Australia: ANZ Job Advertisements (MoM), November 1.7%

-

01:30

Australia: Company Gross Profits QoQ, Quarter III 1.0% (forecast 3%)

-

00:29

Commodities. Daily history for Dec 02’2016:

(raw materials / closing price /% change)

Oil 51.680. 00%

Gold 1,179.20+ 0.12%

-

00:28

Stocks. Daily history for Dec 02’2016:

(index / closing price / change items /% change)

Nikkei 225 18,426.08 -87.04 -0.47%

Shanghai Composite 3,244.48 -28.83

S&P/ASX 200 5,439.50 -4.52 -0.08%

FTSE 100 6,730.72 -22.21 -0.33%

CAC 40 4,528.82 -31.79 -0.70%

Xetra DAX 10,513.35 -20.70 -0.20%

S&P 500 2,191.95 +0.87 +0.04%

Dow Jones Industrial Average 19,170.42 -21.51 -0.11%

S&P/TSX Composite 15,052.52 +24.99 +0.17%

-

00:28

Currencies. Daily history for Dec 02’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0661 +0,01%

GBP/USD $1,2724 +1,05%

USD/CHF Chf1,0106 +0,03%

USD/JPY Y113,56 -0,46%

EUR/JPY Y121,08 -0,44%

GBP/JPY Y144,5 +0,62%

AUD/USD $0,7448 +0,48%

NZD/USD $0,7134 +0,66%

USD/CAD C$1,328 -0,27%

-

00:14

Schedule for today, Monday, Dec 05’2016 (GMT0)

00:30 Australia MI Inflation Gauge, m/m November 0.2%

00:30 Australia Company Gross Profits QoQ Quarter III 6.9% 3%

00:30 Australia ANZ Job Advertisements (MoM) November 1.0%

01:45 China Markit/Caixin Services PMI November 52.4

05:00 Japan Consumer Confidence November 42.3

08:50 France Services PMI (Finally) November 51.4 52.6

08:55 Germany Services PMI (Finally) November 54.2 55

09:00 Eurozone Services PMI (Finally) November 52.8 54.1

09:30 Eurozone Sentix Investor Confidence December 13.1

09:30 United Kingdom Purchasing Manager Index Services November 54.5 54

10:00 Eurozone Retail Sales (MoM) October -0.2% 0.8%

10:00 Eurozone Retail Sales (YoY) October 1.1% 1.7%

12:30 U.S. FOMC Member Dudley Speak

14:45 U.S. Services PMI (Finally) November 54.8 54.7

15:00 U.S. Labor Market Conditions Index November 0.7

15:00 U.S. ISM Non-Manufacturing November 54.8 55.3

19:05 U.S. FOMC Member James Bullard Speaks

21:45 New Zealand Building Permits, m/m October 0.2%

-