Noticias del mercado

-

22:12

Major US stock indexes finished trading with an increase

Major stock indices closed above zero, supported by data on the US labor market. Thus, the number of Americans applying for first time unemployment benefits rose slightly last week after touching a 15-year low, but the rate remains at the level of the economy, consistently adding jobs. Primary applications for unemployment benefits, the gauge of layoffs throughout the US economy increased by 3000 and reached a seasonally adjusted 265,000 in the week ended May 2nd. Economists expected 280,000 initial claims last week.

The market's attention is directed to Takeo April data on unemployment in the US, which will be released on Friday. According to experts, the number of jobs in the US economy in the past month increased by 224 ths., And the unemployment rate fell to 5.4% from 5.5%.

"The signals that market participants have seen in the past few days have been different directions, - said the chief investment officer at Philadelphia Trust Co. Richard Sishel. - Recent statistical data proved to be rather disappointing, so the performance of the labor market, which will be released on Friday, are worthy of attention more than usual. "

Oil prices fell moderately, while dropping below $ 66 (Brent) and $ 59 (WTI), which is due to profit-taking after the recent increase to the maximum this year, and the strengthening of the US dollar. In the course of yesterday's trading continues to affect data on oil reserves in the United States. Recall the week April 25 - May 1 volume of commercial oil stocks in the United States fell by 3.9 million barrels to 487 million barrels per day. Analysts had expected growth of reserves by 1.1 million barrels per day.

Most components of the index DOW closed in positive territory (24 of 30). Outsider shares were Caterpillar Inc. (CAT, -0.82%). More rest up shares The Home Depot, Inc. (HD, + 1.71%).

Almost all sectors of the S & P finished trading above zero. Most of the services sector grew (+ 0.8%). Outsiders were the basic materials sector (-1.2%).

At the close:

Dow + 0.46% 17,924.06 +82.08

Nasdaq + 0.53% 4,945.55 +25.91

S & P + 0.38% 2,088.00 +7.85

-

21:00

U.S.: Consumer Credit , March 20.52 (forecast 16)

-

20:20

American focus: the euro fell against the US dollar

The euro depreciated significantly against the dollar, falling below $ 1.1300, which was associated with the publication of a report on the number of initial applications for unemployment insurance in the United States. Ministry of Labor announced initial applications for unemployment benefits rose by 3,000 and reached a seasonally adjusted 265,000 in the week ended May 2nd. Economists expected 280,000 initial claims. The level of applications in the previous week has not been revised and remained at around 262,000 - the lowest since 2000. The moving average for the four weeks of initial claims fell by 4,250 last week to 279 500. The Labor Department said that no special factors did not affect the latest data. A report on Thursday showed that the number of repeat applications for unemployment benefits fell by 28,000 to 2.23 million in the week ended April 25 was the lowest level since November 2000.

Meanwhile, reports that next Monday Greece is unlikely to enter into an agreement with the EU, also pressured the single currency. EU Head Deysselblum said today that next Monday, Greece will likely not be agreed, adding that in the case of liquidity problems the country may face difficulties in complying with the deadlines. "From a political point of view, the only deadline is the end of June, when the end of the second term of the assistance program. However, there may be other deadlines - in case if Athens will mature liquidity problems, "- he said.

The pound traded in a narrow range against the US dollar on a background of ongoing general elections in the UK. They are considered the most unpredictable for many years. The first exit poll data will be available 21.00 GMT. During the last two elections, the results of such polls accurately predicted the results of the elections, so we should expect the pound fluctuations in response to any unexpected information obtained on the basis of surveys of voters. According to forecasts, the Conservatives need to get around 281 seats in parliament, Labour - 266 Liberal Democrats - 27, the Scottish National Party - 51, and the United Kingdom Independence Party - 1 seat. Higher rates Conservatives or the Liberal Democrats, who will bring them to obtain an absolute majority, probably led to a sharp increase in the pound. Increasing the number of votes cast in the Labour Party seems to have a negative impact on the pound, if it does not happen at the expense of the votes cast of the Scottish National Party, as in this case, the impact on the pound will not.

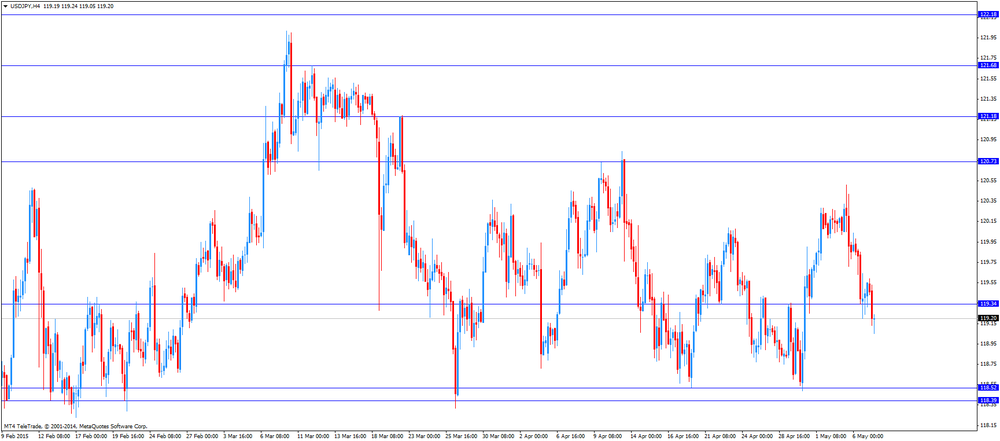

The dollar rose against the yen significantly, restoring all the lost positions yesterday. The US currency was supported by a report on applications for unemployment benefits. In addition, market participants are waiting for Friday's release of data on the US labor market. Economists forecast that employment will increase by 224,000 and the unemployment rate fell to 5.4% from 5.5%. If job growth does not accelerate, it could be a problem for Fed policy. Recall the recent series of disappointing US economic data undermined optimism about the economic recovery, prompting investors to reconsider the initial expectations of the Fed raising interest rates at the end of the year instead of the middle. Meanwhile, today the head of the Federal Reserve Bank of Chicago Charles Evans said the Fed could raise rates at any meeting of the Fed, but added that the start of tightening in 2016 will be better coordinated with the picture of inflation. The politician also added that he expects a rebound after the economic slowdown in the 1st quarter. In the 2nd quarter, it expects to see economic growth of 3%.

-

18:21

Wall Street. Major U.S. stock-indexes growth

Major U.S. stock-indexes growth on Thursday as better-than-expected U.S. jobs data led to U.S. Number of Americans filing new claims for unemployment benefits rose marginally last week, staying near a 15-year low in a sign that the labor market continues to strengthen despite moderate economic growth.

Most of the Dow stocks are trading in positive area (22 of 30). Top looser - Exxon Mobil Corporation (XOM, -0.69%). Top gainer - The Home Depot, Inc. (HD, +1.59%).

Almost all S&P index sectors in positive area. Top giner - Services (+0,7%). Top looser - Basic materials (-1.3%).

At the moment:

Dow 17865.00 +87.00 +0.49%

S&P 500 2082.75 +8.50 +0.41%

Nasdaq 100 4395.00 +22.00 +0.50%

10-year yield 2.21% -0.03

Oil 59.70 -1.23 -2.02%

Gold 1183.00 -7.30 -0.61%

-

18:07

European stocks close: stocks closed mixed on a weaker euro and as a selloff of government bonds eased

Stock indices closed mixed on a weaker euro and as a selloff of government bonds eased. The euro fell against the greenback after the number of initial jobless claims. The number of initial jobless claims in the week ending May 02 in the U.S. climbed by 3,000 to 265,000 from 262,000 in the previous week, beating expectations for a rise by 18,000.

The uncertainty around today's parliamentary elections in the U.K. also weighed on markets. The win of the Conservatives is expected to have a negative impact on the pound as the Conservatives want to carry out a referendum on Britain's membership in the European Union (EU). The Labour Party said that the Britain's exit from the EU will be a catastrophe for the U.K. The Labour Party has promised to reduce the budget deficit.

German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

France's merchandise trade deficit widened to €4.575 billion in March from €3.623 billion in February. February's figure was revised down from a deficit of €3.4 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,886.95 -46.79 -0.67 %

DAX 11,407.97 +57.82 +0.51 %

CAC 40 4,967.22 -14.37 -0.29 %

-

18:00

European stocks closed: FTSE 100 6,886.95 -46.79 -0.67% CAC 40 4,967.22 -14.37 -0.29% DAX 11,407.97 +57.82 +0.51%

-

17:42

Oil prices declined on profit taking and a stronger U.S. dollar

Oil prices declined on profit taking and a stronger U.S. dollar. The U.S. dollar traded mixed against the most major currencies after the number of initial jobless claims. The number of initial jobless claims in the week ending May 02 in the U.S. climbed by 3,000 to 265,000 from 262,000 in the previous week, beating expectations for a rise by 18,000.

Initial jobless claims remained below 300,000 the ninth straight week. That could be interpreted as the strengthening of the labour market.

Comments by Iranian Oil Minister Bijan Zangeneh also weighed on oil prices. He said at a news conference in Tehran today that Iran could increase its oil production to four million barrels a day in less than a year.

Investors are awaiting the release of the number of oil rigs in the U.S.

WTI crude oil for June delivery fell to $59.48 a barrel on the New York Mercantile Exchange. Brent crude oil for June declined to $66.38 a barrel on ICE Futures Europe.

-

17:23

Gold price traded lower traded lower on a stronger greenback, higher government bonds yields and the uncertainty around the first interest rate hike by the Fed

Gold price traded lower on a stronger greenback, higher government bonds yields and the uncertainty around the first interest rate hike by the Fed.

Today's number of initial jobless claims also weighed on gold price. The number of initial jobless claims in the week ending May 02 in the U.S. climbed by 3,000 to 265,000 from 262,000 in the previous week, beating expectations for a rise by 18,000.

Initial jobless claims remained below 300,000 the ninth straight week. That could be interpreted as the strengthening of the labour market.

Investors are awaiting the release of the labour market data on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 5.4% in April from 5.5% in March. The U.S. economy is expected to add 224,000 jobs in April, after adding 126,000 jobs in March.

June futures for gold on the COMEX today decreased to 1182.20 dollars per ounce.

-

16:17

SECO consumer climate index for Switzerland remains unchanged at -6 in the first quarter

The State Secretariat for Economic Affairs (SECO) released its consumer climate index for Switzerland on Thursday. The SECO consumer climate index remained unchanged at -6 in the first quarter.

The future economic expectations subindex rose to -8 in the first quarter from -12 in the fourth quarter.

The unemployment trends subindex declined to 51 in the first quarter from 52 in the fourth quarter.

The assessment of previous economic trends subindex dropped to -22 in the first quarter from +1 in the fourth quarter.

The price trends over the last twelve months plunged to -3 in the first quarter from +32 in the fourth quarter, while the future price trends subindex declined to +6 from +29.

-

16:02

Atlanta Federal Reserve bank President Dennis Lockhart: the interest rate hike in the middle of the year will be appropriate

The Atlanta Federal Reserve bank President Dennis Lockhart said on Wednesday that he thinks the interest rate hike in the middle of the year will be appropriate. But interest rates could be hiked at each monetary policy meeting, he added.

Lockhart wants to be sure that the weak economic growth in the first quarter was temporary before raising interest rates. He noted that higher consumer spending is needed for the solid economic growth.

The Atlanta Federal Reserve bank president pointed out that the April labour market data will be very important to gauge economic momentum in the second quarter.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1250(E200mn), $1.1325, $1.1350, $1.1370, $1.1400(E507mn)

USD/JPY: Y119.00($1.5bn), Y119.75($$750mn), Y120.00(1.8bn)

GBP/USD: $1.5000(Gbp226mn), $1.5150(Gbp150mn)

EUR/GBP: Gbp0.7250-65(E210mn)

AUD/USD: $0.7890(A$349mn), $0.7900(A$440mn).

NZD/USD: $0.7525(NZ$473mn)

USD/CAD: C$1.1950($512mn)

-

15:34

U.S. Stocks open: Dow -0.08%, Nasdaq +0.13%, S&P +0.03%

-

15:31

Building permits in Canada jump 11.6% in March, the biggest increase since September 2014

Statistics Canada released housing market data on Thursday. Building permits in Canada soared 11.6% in March, exceeding expectations for a 2.5% gain, after a 0.3% decline in February. It was the biggest increase since September 2014.

February's figure was revised up from a 0.9% fall.

The increase was partly driven by a rise in construction permits for multifamily homes in Ontario and British Columbia.

Building permits for non-residential construction jumped 22.1% in March, while permits in the residential sector rose 6.6%.

-

15:26

Before the bell: S&P futures -0.20%, NASDAQ futures -0.24%

U.S. stock-index futures fell after the chair of the Federal Reserve, Janet Yellen, said yesterday that valuations in the stock market were "quite high."

Global markets:

Nikkei 19,291.99 -239.64 -1.23%

Hang Seng 27,289.97 -350.94 -1.27%

Shanghai Composite 4,112.86 -116.40 -2.75%

FTSE 6,879.09 -54.65 -0.79%

CAC 4,944.76 -36.83 -0.74%

DAX 11,346.34 -3.81 -0.03%

Crude oil $60.88 (-0.11%)

Gold $1180.70 (-0.81%)

-

15:17

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

77.66

+0.01%

10.4K

Chevron Corp

CVX

108.00

+0.05%

0.5K

Pfizer Inc

PFE

33.48

+0.06%

944.4K

Facebook, Inc.

FB

78.25

+0.19%

135.6K

Twitter, Inc., NYSE

TWTR

37.36

+0.27%

374.6K

3M Co

MMM

158.51

+0.55%

0.5K

American Express Co

AXP

78.40

+0.71%

0.3K

Amazon.com Inc., NASDAQ

AMZN

423.12

+0.96%

23.3K

Yahoo! Inc., NASDAQ

YHOO

44.85

+7.66%

920.0K

Starbucks Corporation, NASDAQ

SBUX

48.93

0.00%

7.9K

Yandex N.V., NASDAQ

YNDX

19.60

0.00%

0.2K

International Business Machines Co...

IBM

170.00

-0.03%

1.2K

Travelers Companies Inc

TRV

101.74

-0.03%

0.8K

Apple Inc.

AAPL

124.45

-0.03%

343.9K

Ford Motor Co.

F

15.47

-0.06%

22.4K

The Coca-Cola Co

KO

40.62

-0.10%

2.1K

Exxon Mobil Corp

XOM

88.08

-0.12%

4.9K

Merck & Co Inc

MRK

60.19

-0.12%

0.3K

Cisco Systems Inc

CSCO

28.93

-0.14%

129.3K

Procter & Gamble Co

PG

80.29

-0.14%

1.9K

ALCOA INC.

AA

13.65

-0.15%

54.2K

ALTRIA GROUP INC.

MO

50.60

-0.16%

1.1K

Johnson & Johnson

JNJ

98.99

-0.18%

334.5K

Boeing Co

BA

140.75

-0.21%

6.9K

Nike

NKE

100.00

-0.22%

0.3K

E. I. du Pont de Nemours and Co

DD

72.55

-0.23%

0.5K

Citigroup Inc., NYSE

C

52.65

-0.23%

20.1K

AT&T Inc

T

33.30

-0.24%

7.4K

Walt Disney Co

DIS

109.45

-0.25%

13.5K

General Electric Co

GE

26.74

-0.26%

625.4K

JPMorgan Chase and Co

JPM

63.75

-0.27%

5.7K

Verizon Communications Inc

VZ

49.50

-0.28%

5.5K

Hewlett-Packard Co.

HPQ

32.41

-0.28%

6.6K

General Motors Company, NYSE

GM

34.67

-0.29%

15.4K

Home Depot Inc

HD

107.98

-0.30%

20.7K

McDonald's Corp

MCD

96.09

-0.31%

74.3K

Intel Corp

INTC

32.10

-0.37%

412.8K

Goldman Sachs

GS

195.50

-0.38%

0.6K

Visa

V

65.40

-0.41%

5.2K

Microsoft Corp

MSFT

46.03

-0.54%

1.5M

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

23.12

-0.60%

2.5K

HONEYWELL INTERNATIONAL INC.

HON

100.27

-0.71%

0.3K

Barrick Gold Corporation, NYSE

ABX

12.50

-1.03%

14.5K

Caterpillar Inc

CAT

86.06

-1.07%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

57.21

-1.62%

94.1K

Tesla Motors, Inc., NASDAQ

TSLA

221.35

-3.94%

365.5K

-

15:12

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Goldman Sachs (GS) initiated with a Overweight at Atlantic Equities

Walt Disney (DIS) reiterated at Buy at Argus, target raised from $115 to $123

Amazon (AMZN) reiterated at Outperform at Bernstein, target raised from $450 to $600

-

15:03

Initial jobless claims rise by 3,000 to 265,000 in the week ending May 02

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 02 in the U.S. climbed by 3,000 to 265,000 from 262,000 in the previous week, beating expectations for a rise by 18,000.

The previous week's reading was the lowest reading since April 2000.

Initial jobless claims remained below 300,000 the ninth straight week. That could be interpreted as the strengthening of the labour market.

-

14:49

IMF expects the Asia-Pacific region to expand at 5.6% year-over-year in 2015 and 5.5% in 2016

The International Monetary Fund (IMF) expects the Asia-Pacific region to expand at 5.6% year-over-year in 2015 and 5.5% in 2016. But the region faces risks like rising debts, a stronger dollar and weaker-than-expected performances from China and Japan, the IMF noted.

On the other side, low commodity prices, strong labour markets and recoveries in the U.S. and Europe will support the region, the IMF added.

-

14:38

France's trade deficit widens to €4.575 billion in March

According to the French Customs, France's trade deficit widened to €4.575 billion in March from €3.623 billion in February.

February's figure was revised down from a deficit of €3.4 billion.

The increase of a deficit was driven by energy imports and lower aerospace exports.

Imports rose due to strong recovery in energy and due to strong demand for automobiles, capital goods and intermediate goods, while exports increased due to higher sales of automotive, pharmaceuticals, metals and electrical and electronic equipment.

-

14:30

Canada: Building Permits (MoM) , March 11.6% (forecast 2.5%)

-

14:30

U.S.: Initial Jobless Claims, May 265 (forecast 280)

-

14:30

U.S.: Continuing Jobless Claims, April 2228 (forecast 2280)

-

14:19

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed April 48.1 Revised From 37.7 5.0 -2.9

01:30 Australia Unemployment rate April 6.1% 6.2% 6.2%

05:45 Switzerland SECO Consumer Climate Quarter I -6 -6

06:00 United Kingdom Parliamentary Elections

06:00 Germany Factory Orders s.a. (MoM) March -0.9% 1.5% 0.9%

06:00 Germany Factory Orders n.s.a. (YoY) March -1.3% 1.9%

06:45 France Industrial Production, m/m March 0.5% Revised From 0.0% 0.0% -0.3%

06:45 France Industrial Production, y/y March 1.2% Revised From 0.3% 1.3%

06:45 France Trade Balance, bln March -3.60 Revised From -3.44 -3.6 -4.58

07:00 Switzerland Foreign Currency Reserves April 522.4 Revised From 522.3 521.9

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to increase by 18,000 to 280,000.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

France's merchandise trade deficit widened to €4.575 billion in March from €3.623 billion in February. February's figure was revised down from a deficit of €3.4 billion.

The Greek debt crisis still weighs on the euro.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The uncertainty around UK's parliamentary elections weighed on the pound. The win of the Conservatives is expected to have a negative impact on the pound as the Conservatives want to carry out a referendum on Britain's membership in the European Union (EU). The Labour Party said that the Britain's exit from the EU will be a catastrophe for the U.K. The Labour Party has promised to reduce the budget deficit.

The United Kingdom Independence Party (UKIP), a Eurosceptic and right-wing populist political party in the U.K., may win seats in the parliament. It will not will contribute to political stability in the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian building permits data. Building permits in Canada are expected to climb 2.5% in March, after a 0.9% drop in February.

The Swiss dollar traded mixed against the U.S. dollar after the economic data from Switzerland. The Swiss National Bank's foreign exchange reserves decreased to 521.888 billion Swiss francs in April from 522.399 billion francs in March. It was the first monthly decline in 2015.

March's figure was revised up from 522.323 billion francs.

The SECO consumer climate index for Switzerland remained unchanged at -6 in the first quarter.

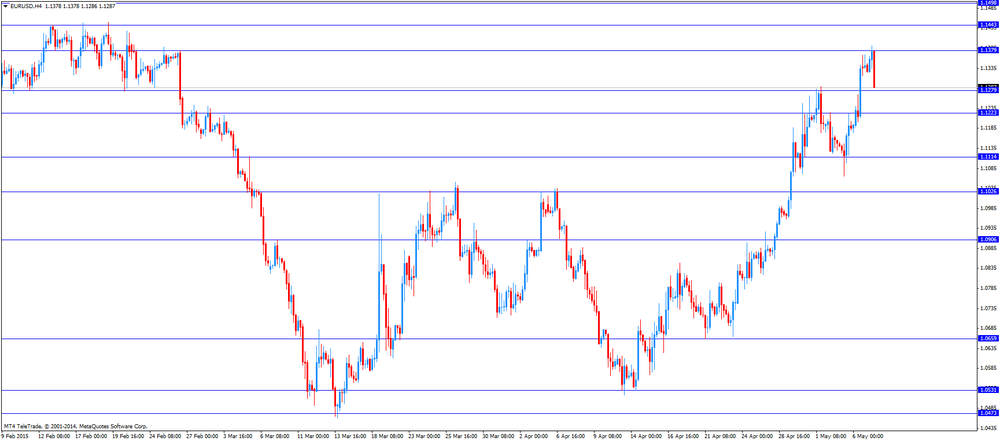

EUR/USD: the currency pair fell to $1.1286

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y119.05

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) March -0.9% 2.5%

12:30 U.S. Initial Jobless Claims May 262 280

23:50 Japan Monetary Policy Meeting Minutes

-

13:50

Orders

EUR/USD

Offers 1.1385 1.1400 1.1425 1.1445 1.1470 1.1485 1.1500

Bids 1.1330 1.1300 1.1285 1.1255-60 1.1220 1.1200 1.1180 1.1160 1.1140 1.1120

GBP/USD

Offers 1.5240-50 1.5265 1.5280 1.5300 1.5325-30 1.5350

Bids 1.5180-85 1.5160 1.5125 1.5100 1.5085 1.5065 1.5050 1.5030 1.5000

EUR/GBP

Offers 0.7485 0.7500 0.7525 0.7555-60 0.7585 0.7600

Bids 0.7450 0.7425-30 0.7400 0.7385 0.7365 0.7350 0.7330 0.7300-10

EUR/JPY

Offers 135.85 136.00 136.50 136.80 137.00

Bids 135.00 134 80 134.40 134.00 133.70 133.50

USD/JPY

Offers 119.65 119.85 120.00 120.25-30 120.50 120.80 121.00

Bids 119.25-30 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7980 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7920-25 0.7900 0.7880 0.7850-55 0.7820-25 0.7800

-

12:01

European stock markets mid session: stocks traded lower, following U.S. and Asian stock indexes

Stock indices traded lower, following U.S. and Asian stock indexes. U.S. and Asian stock indexes declined on comments by the Fed Chair Janet Yellen. Yellen said on Wednesday that valuations in the stock market are high and there is a potential risk there.

The uncertainty around today's parliamentary elections in the U.K. also weighed on markets. The win of the Conservatives is expected to have a negative impact on the pound as the Conservatives want to carry out a referendum on Britain's membership in the European Union (EU). The Labour Party said that the Britain's exit from the EU will be a catastrophe for the U.K. The Labour Party has promised to reduce the budget deficit.

German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

France's merchandise trade deficit widened to €4.575 billion in March from €3.623 billion in February. February's figure was revised down from a deficit of €3.4 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,813.21 -120.53 -1.74%

DAX 11,192.22 -157.93 -1.39%

CAC 40 4,884.28 -97.31 -1.95%

-

11:43

German seasonal adjusted factory orders jumps 0.9% in March

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders jumped 0.9% in March, missing expectations for a 1.5% increase, after a 0.9% drop in February.

Domestic orders climbed by 4.3% in March, while foreign orders dropped by 1.65.

New orders from the Eurozone rose 2.5% in March, while orders from other countries decreased 4%.

The intermediate- and capital goods orders were up 0.9% and 1.3% in March. Consumer goods orders fell 2.2%.

-

11:27

French industrial production is down 0.3% in March

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France fell 0.3% in March, missing expectations for a flat reading, after a 0.5% rise in February. February's figure was revised up from a flat reading.

The decline was driven by declines in the production of energy and water.

On a yearly basis, the French industrial production rose 1.3% in March, after a 1.2% gain in February. February's figure was revised down up a 0.3% rise.

In the first quarter of 2015, industrial production grew 1.4%.

On a monthly basis, manufacturing output in France rose 0.3% in March, after a 0.5% gain in February.

Construction output climbed 0.9% in March from the previous year, after a 2.2% decrease in February.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1250(E200mn), $1.1325, $1.1350, $1.1370, $1.1400(E507mn)

USD/JPY: Y119.00($1.5bn), Y119.75($$750mn), Y120.00(1.8bn)

GBP/USD: $1.5000(Gbp226mn), $1.5150(Gbp150mn)

EUR/GBP: Gbp0.7250-65(E210mn)

AUD/USD: $0.7890(A$349mn), $0.7900(A$440mn).

NZD/USD: $0.7525(NZ$473mn)

USD/CAD: C$1.1950($512mn)

-

11:03

OECD said the annual rate of inflation in its 34 members remained unchanged at 0.6% in March

The Organization for Economic Cooperation and Development (OECD) said on Wednesday that the annual rate of inflation in its 34 members remained unchanged at 0.6% in March. The inflation target of most central banks in developed economies is 2%.

The inflation was driven by lower energy prices. Food prices increased.

The inflation excluding energy and food for the OECD area remained unchanged at 1.7%.

-

10:54

Swiss National Bank's foreign exchange reserves fall to 521.888 billion Swiss francs in April

The Swiss National Bank's foreign exchange reserves decreased to 521.888 billion Swiss francs in April from 522.399 billion francs in March. It was the first monthly decline in 2015.

March's figure was revised up from 522.323 billion francs.

The decrease was likely driven by a weaker U.S. dollar.

-

10:39

European Union Economic and Monetary Affairs Commissioner Pierre Moscovici: Eurozone have to find a way to deal with the high public debt accumulated in 2008-2012

The European Union (EU) Economic and Monetary Affairs Commissioner Pierre Moscovici said on Wednesday that Eurozone have to find a way to deal with the high public debt accumulated in 2008-2012. But he didn't say how to do it.

-

10:24

Australia's unemployment rate rises to 6.2% in April

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.2% in April from 6.1% in March, in line with expectations.

The number of employed people in Australia fell by 2,900 in April, missing expectations for an increase by 5,000, after a gain by 48,100 in March.

March's figure was revised up from a rise by 37,700.

The decline in employment was driven by declines in full-time employment for males, which fell by 47,900, and part-time employment for females, which decreased by 10,700.

Full-time employment fell by 21,900, while part-time employment rose by 19,000.

The participation rate was 64.8%.

These figures might add pressure on the Reserve Bank of Australia to lower its interest rate again.

-

09:01

France: Industrial Production, y/y, March 1.3%

-

09:00

Switzerland: Foreign Currency Reserves, April 521.9

-

08:45

France: Trade Balance, bln, March -4.60 (forecast -3.6)

-

08:45

France: Industrial Production, m/m, March -0.3% (forecast 0.0%)

-

08:23

Options levels on thursday, May 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1523 (1878)

$1.1453 (1694)

$1.1405 (3164)

Price at time of writing this review: $1.1361

Support levels (open interest**, contracts):

$1.1281 (471)

$1.1217 (833)

$1.1178 (2870)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 63642 contracts, with the maximum number of contracts with strike price $1,1200 (6477);

- Overall open interest on the PUT options with the expiration date May, 8 is 92693 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.46 versus 1.42 from the previous trading day according to data from May, 6

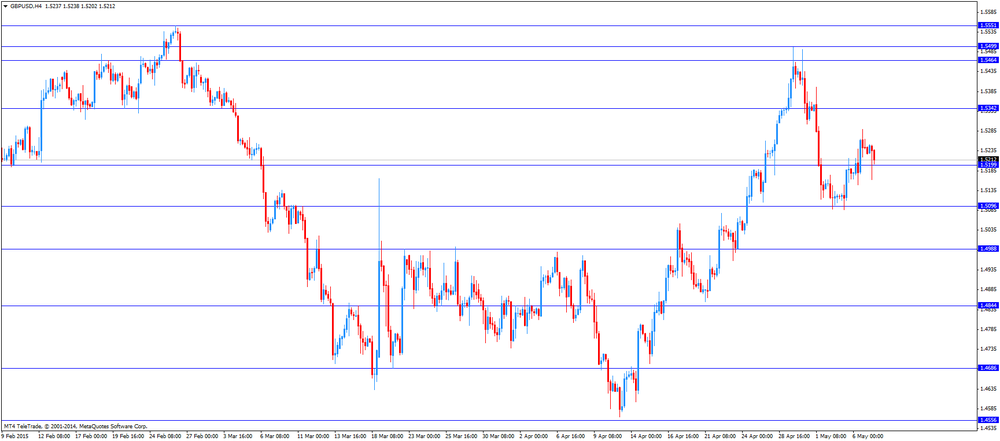

GBP/USD

Resistance levels (open interest**, contracts)

$1.5503 (2373)

$1.5405 (1025)

$1.5308 (1229)

Price at time of writing this review: $1.5227

Support levels (open interest**, contracts):

$1.5192 (1466)

$1.5094 (1539)

$1.4997 (2620)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27423 contracts, with the maximum number of contracts with strike price $1,5000 (2861);

- Overall open interest on the PUT options with the expiration date May, 8 is 37245 contracts, with the maximum number of contracts with strike price $1,4800 (2747);

- The ratio of PUT/CALL was 1.36 versus 1.31 from the previous trading day according to data from May, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed April 48.1 Revised From 37.7 5.0 -2.9

01:30 Australia Unemployment rate April 6.1% 6.2% 6.2%

The pound was little changed before U.K. elections on Thursday and Australia's dollar rose after the nation's unemployment rate remained below its peak.

The dollar was less than 0.4 percent from a three-month low amid concern a U.S. payroll report on Friday will add to signs the world's biggest economy is slowing. A gauge of the greenback is set for a four-week decline, its worst losing streak since 2013, as investors wait for more clues on the U.S. economy's direction and the Fed's ability to raise interest rates this year.

EUR / USD: during the Asian session, the pair was trading around $ 1.1340

GBP / USD: during the Asian session, the pair was trading around $ 1.5240

USD / JPY: during the Asian session the pair rose to Y119.60

-

08:01

Germany: Factory Orders n.s.a. (YoY), March 1.9%

-

08:00

Germany: Factory Orders s.a. (MoM), March 0.9% (forecast 1.5%)

-

07:45

Switzerland: SECO Consumer Climate, Quarter I -6

-

04:02

Nikkei 225 19,325.13 -206.50 -1.06 %, Hang Seng 27,477.32 -163.59 -0.59 %, Shanghai Composite 4,198.5 -30.77 -0.73 %

-

03:31

Australia: Changing the number of employed, April -2.9 (forecast 5.0)

-

03:30

Australia: Unemployment rate, April 6.2% (forecast 6.2%)

-

01:52

Japan: Monetary Base, y/y, April 35.2%

-

01:31

Australia: AiG Performance of Construction Index, April 47

-

00:37

Commodities. Daily history for May 6’2015:

(raw materials / closing price /% change)

Oil 60.93 +0.88%

Gold 1,190.30 -0.24%

-

00:36

Stocks. Daily history for Apr May 6’2015:

(index / closing price / change items /% change)

Hang Seng 27,640.91 -114.63 -0.41%

S&P/ASX 200 5,692.2 -134.36 -2.31%

Shanghai Composite 4,231.33 -67.37 -1.57%

FTSE 100 6,933.74 +6.16 +0.09%

CAC 40 4,981.59 +7.52 +0.15%

Xetra DAX 11,350.15 +22.47 +0.20%

S&P 500 2,080.15 -9.31 -0.45%

NASDAQ Composite 4,919.64 -19.68 -0.40%

Dow Jones 17,841.98 -86.22 -0.48%

-

00:34

Currencies. Daily history for May 6’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1342 +1,38%

GBP/USD $1,5243 +0,43%

USD/CHF Chf0,9159 -1,14%

USD/JPY Y119,44 -0,34%

EUR/JPY Y135,47 +1,04%

GBP/JPY Y182,06 +0,09%

AUD/USD $0,7968 +0,35%

NZD/USD $0,7497 -0,89%

USD/CAD C$1,2041 -0,23%

-