Noticias del mercado

-

21:00

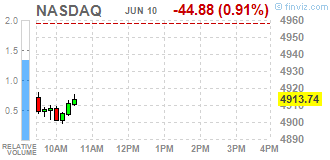

Dow -0.87% 17,828.26 -156.93 Nasdq -1.46% 4,886.10 -72.52 S&P -1.11% 2,091.97 -23.91

-

20:18

American focus: The US dollar strengthened against most major currencies

The US dollar rose modestly against the euro, continuing yesterday's trend. Increased demand for the US currency due to the fall in bond yields in Europe and Japan. Additional support for the dollar was data on consumer sentiment. Preliminary results of studies presented Thomson-Reuters and Institute of Michigan, showed in June, American consumers feel almost as optimistic about the economy, as in the previous month. According to reports, in June consumer sentiment index fell to 94.3 points compared with a final reading of 94.7 points in May. According to average estimates, the index was 94.0 points to make. In addition, the report stated that the index 5-year inflation expectations in June was + 2.3% and the 12-month inflation expectations were at 2.4%.

Investors are also waiting for the Fed meeting, which will take place next week. Despite the fact that the probability of a rate hike in June has fallen to almost zero, the accompanying statement may contain hints of the timing of the next increase. Recently, Federal Reserve Chairman Yellen said the US central bank does not intend to raise interest rates, while keeping the uncertain economic outlook in the United States. Yellen also expects the US recovery will continue, but did not specify the possible timing of the next rate hike. Today

futures on interest rates Fed indicate that the probability of a rate hike of 2% in June. The chances of an increase in rates are estimated at 23% in July.

The British pound dropped significantly against the dollar, reaching the lowest level since April 14, which was conditioned by the increased concern about the possibility of the UK from the EU structure. Sharp fluctuations in the pound are also associated with low liquidity, which is partly caused by the uncertainty in the run-up to the referendum.

The results of the latest public opinion poll conducted by the newspaper The Independent, revealed that the share of the UK release of adherents from the EU was 55%, while the number of speakers for the preservation of the country in the EU has been at the level of 45%.

Earlier today, investors pay attention to the results of research by the Bank of England and to TNS, which showed that the average expectations of inflation over the next year amounted to 2.0 percent compared to 1.8 percent in February. Five-year inflation expectations rose to 3.4 percent from 2.9 percent. The respondents said that the current inflation rate of 2.2 percent compared to 2.0 percent in February. Recent data from the ONS showed that annual inflation slowed to 0.3 percent in April compared with 0.5 percent in March. The latest report on inflation the Bank of England said that inflation is projected to grow steadily over the next months and will reach 0.9 percent in September. The survey also showed that 41 percent of respondents expect that interest rates will rise over the next 12 months compared to 38 percent in February.

The Canadian dollar rose sharply against the US dollar, supported by strong data on the labor market, but then lost all the positions on the background of falling oil prices. The Statistical Office of Canada reported that employment changed little in May (14,000 or 0.1%). Given the fact that fewer people were looking for work, the unemployment rate fell by 0.2 percentage points to 6.9%, the lowest since July 2015. Full employment increased by 61,000 in May. This increase was largely offset by a decrease of 47 000 for part-time work. During the 12 months to May, employment increased by 109,000, or 0.6%, the result of growth in full-time. During the same period, the number of hours worked increased by 0.8%. In May, employment increased for both men and women aged 55 years and older, while it has fallen for young people aged 15 to 24. The number of public sector employees has increased in May, while there was little change among private sector employees and the self-employed.

-

20:02

U.S.: Federal budget , May -52.5 (forecast -60)

-

18:09

European stocks close: stocks closed lower on falling oil prices

Stock closed lower as oil prices continued to decline. Oil prices fell on a stronger U.S. dollar.

No major economic reports were released in the Eurozone.

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK rose to 2.0% in June from 1.8% in March.

Inflation expectations for coming two years in the U.K. increased to 2.2% in June from 2.1% in March.

The annual consumer price inflation in the U.K. was 0.3% in April, below the central bank's 2% target.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 2.5% in April, after a 3.6% drop in March.

The increase was mainly driven by rises in all new work and all repair and maintenance. All new work gained 2.9% in April, while all repair and maintenance rose 1.9%.

On a yearly basis, construction output decreased 3.7% in April, after a 4.5% fall in March.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,115.76 -116.13 -1.86 %

DAX 9,834.62 -254.25 -2.52 %

CAC 40 4,306.72 -98.89 -2.24 %

-

18:00

European stocks closed: FTSE 100 6,115.76 -116.13 -1.86% CAC 40 4,306.72 -98.89 -2.24% DAX 9,834.62 -254.25 -2.52%

-

17:46

Central Bank of Russia lowers its interest rate to 10.5% in June

The Central Bank of Russia (CBR) on Friday cut its interest rate to 10.5% from 11.0%. This decision was not expected by analysts.

The central bank noted that inflation was more stable.

"The Board of Directors notes the positive trends of more stable inflation, decreased inflation expectations and inflation risks against the backdrop of imminent growth recovery in the economy," the CBR said.

The central bank pointed out that it could lower its interest rate further.

"The Bank of Russia will consider the possibility of a further rate cut based on estimates for inflation risks and alignment of inflation decline with the forecast trajectory," the CBR noted.

The CBR expects inflation to be 5%-6% by the end of 2016, less than 5% in May 2017 and 4% in late 2017, while the quarterly GDP was expected to be positive in the second half of the year.

The next meeting of the CBR is scheduled to be July 29, 2016.

-

17:41

Oil prices fell nearly two percent

Prices of oil futures fell nearly $ 1, has come under pressure due to the strengthening US dollar and expectations of the publication of statistics on the number in the US rig. The decline of oil prices has also been associated with negative dynamics of the global stock market.

Oil prices jumped nearly doubled since January, when it reached the lowest level since the end of 2003, which was mainly due to the unplanned interruptions in oil production in countries such as Canada, Venezuela, Libya and Nigeria. However, as prices have reached a level where drilling activity is profitable for some companies, the number of rigs may begin to grow and the reduction of production volumes in the United States may slow down. Today at 17:00 GMT Baker Hughes oilfield services company reported as changing the number of drilling rigs in the United States for the past week. Recall, according to the results ended June 3 working weeks, the number of drilling rigs in the US increased by 4 points, or 0.9%, to 408 units. In annual terms, a decline of 460 units or 52.9%. Number of oil rigs for the week increased by 9 units to 325 units. It was only the second increase this year. Prior to this, the number of oil rigs was reduced by an average of 10 units per week. Recall that last year the number of plants was reduced by an average of 18 units per week on concerns about oversupply.

Important market participants also switched to the Fed meeting, which will take place on 15 June. It Open Market Committee will decide on interest rates. Raising rates will promote appreciation of the dollar, which will reduce the price of oil. Despite the fact that most analysts do not expect such a move, investors prefer to take profits. Today futures on interest rates Fed indicate that the probability of a rate hike of 2% in June. The chances of an increase in rates are estimated at 23% in July.

WTI for delivery in July fell to $49.53 a barrel. Brent for July fell to $50.87 a barrel.

-

17:40

WSE: Session Results

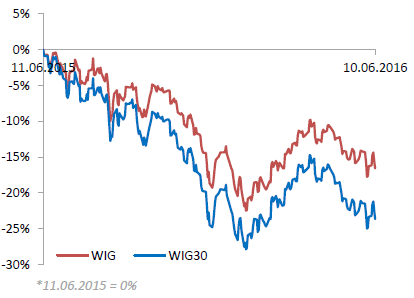

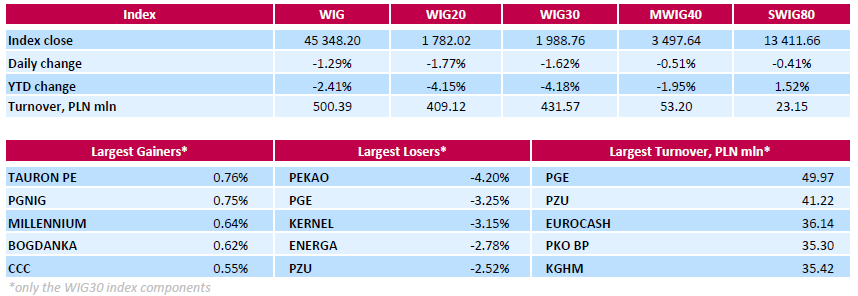

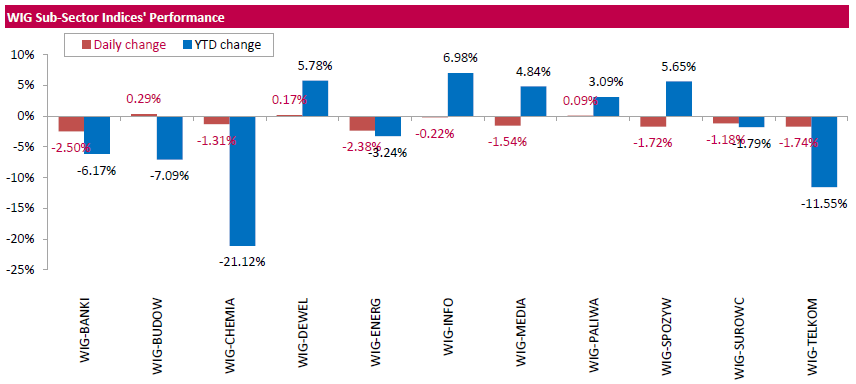

Polish equity market plunged on Friday. The broad market measure, the WIG Index, declined by 1.29%. From a sector perspective, banking sector (-2.50%) fared the worst, while construction (+0.29%) was the best-performing group.

The large-cap companies' measure, the WIG30 Index, lost 1.62%. Only eight index constituents managed to generate positive returns with genco TAURON PE (WSE: TPE) outperforming with a 0.76% gain. It was followed by oil and gas producer PGNIG (WSE: PGN), which rose by 0.75%. The company announced that its distribution and regasification rates will remain unchanged, as Poland's energy market regulator decided yesterday to extend current tariffs for gas distribution and LNG regasification until the end of 2016. At the same time, the session's biggest loser was bank PEKAO (WSE: PEO), which tumbled by 4.2%. Other major decliners were genco PGE (WSE: PGE) and agricultural producer KERNEL (WSE: KER), which slumped by 3.25% and 3.15% respectively.

-

17:20

Gold prices continued to rise today,

Gold prices rose moderately, reaching a new three-week high, helped by the strengthening of demand for safe-haven assets due to concerns about the negative yield of government bonds on the international markets, the Fed meeting, as well as a referendum in Britain.

Precious metal, which is often seen as insurance against economic and financial problems, increased by almost 2 percent this week after a weaker-than-expected data on the US labor market have sharply reduced the chances of an early increase in interest rates the US Fed. Meanwhile, recent comments by Fed chief also confirmed the intention of the Central Bank to postpone the rate hike as long as the uncertainty about the economic outlook does not shatter. Today futures on interest rates Fed indicate that the probability of a rate hike of 2% in June. The chances of an increase in rates are estimated at 23% in July. Recall, the higher interest rates in the US have a negative impact on the price of gold, since lead to a stronger dollar, which trades precious metals. This makes the purchase of gold more expensive for holders of other currencies.

"The market is no longer worried that the Fed will raise rates next week. Investors are more wary of the approaching referendum in the UK, which is likely to help increase the demand for gold, "- said Jens Pedersen, an analyst at Danske Bank.

"If the Fed refuses to raising rates in June and July and has not specified a specific time frame for further policy tightening, gold will get some support, and the US dollar will fall in price", - said Commerzbank analyst Daniel Briesemann.

Gold reserves in the largest gold ETF-fund SPDR Gold Trust rose by the end of Thursday's 0.7 percent, to 887.38 tonnes, the highest level since October of 2013.

The cost of the August gold futures on the COMEX rose to $ 1277.3 per ounce.

-

16:42

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell as global growth worries and a sharp drop in oil prices sent jitters through Wall Street. Despite higher demand, oil eased as traders booked profits after a three-day winning streak that started Monday and pushed prices to 2016 highs, and as the dollar moved higher. Financial stocks came under pressure again as global issues, including uncertainty over interest rate hikes and the impending vote on Britain's membership in the European Union, sent investors scurrying to safe haven assets.

Most all of Dow stocks in negative area (25 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -1,87%). Top gainer - Verizon Communications Inc. (VZ, +0,59%).

All S&P sectors in negative area. Top looser - Conglomerates (-1,9%).

At the moment:

Dow 17790.00 -92.00 -0.51%

S&P 500 2091.50 -13.75 -0.65%

Nasdaq 100 4467.00 -37.50 -0.83%

Oil 49.92 -0.64 -1.27%

Gold 1277.50 +4.80 +0.38%

U.S. 10yr 1.63 -0.05

-

16:33

Germany’s economy ministry: the economic growth is likely to slow in the second quarter

The German economy ministry said on Friday that the economic growth was likely to slow in the second quarter, despite a decent start to the second quarter. The ministry noted that the country's economy was on a solid growth path, adding that private consumption remained the main driver.

-

16:09

Thomson Reuters/University of Michigan preliminary consumer sentiment index declines to 94.3 in June

The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 94.3 in June from a final reading of 94.7 in May. Analysts had expected the index to fall to 94.0.

"Consumers were a bit less optimistic in early June due to increased concerns about future economic prospects," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"The strength recorded in early June was in personal finances, and the weaknesses were in expectations for continued growth in the national economy," he added.

The index of current economic conditions climbed to 111.7 in June from 109.9 in May, while the index of consumer expectations decreased to 83.2 from 84.9.

The one-year inflation expectations remained unchanged at 2.4% in June.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, June 94.3 (forecast 94)

-

15:59

Producer prices in Japan rise 0.2% in May

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Thursday evening. Producer prices in Japan rose 0.2% in May, after a 0.4% fall in April. April's figure was revised down from a 0.3% decline.

Export prices were flat in May, while import prices increased 0.3%.

On a yearly basis, producer prices slid 4.2% in May, after a 4.2% drop in April.

Export prices dropped 4.5% year-on-year in May, while import prices plunged 13.1%.

-

15:51

WSE: After start on Wall Street

Wall Street started the day from declines. In Germany, the scale of decline of the DAX is impressive, and such situation was hardly expected to anyone. By contrast, the WIG20 index appeared a modest reflection. It is a response of the market to a small correction of the zloty and once again confirmed the sensitivity of the behavior of the currency market. Still the positive fact is the low turnover, which barely approached PLN 300 million. This low market activity sends a signal that the price declines is a simple transfer of mood from the environment, and not attack of supply.

-

15:33

U.S. Stocks open: Dow -0.52%, Nasdaq -0.85%, S&P -0.63%

-

15:30

European Central Bank Governing Council member Jens Weidmann: the ECB’s low-interest-rate policy for a longer period could lead to a sudden hike in risk premiums

The European Central Bank (ECB) Governing Council member Jens Weidmann said on Friday that the central bank's low-interest-rate policy for a longer period could lead to a sudden hike in risk premiums.

"Monetary policymakers have to take this into account in order to avoid unintended consequences," he added.

Weidmann pointed out that the ECB should consider financial imbalances.

"Monetary policy would be wise to take the implications of financial imbalances for price stability into account," he noted.

-

15:18

European Central Bank Vice President Vitor Constancio: negative interest rates are positive for banks

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that negative interest rates were positive for banks, but added that there were some negative side effects. He also said that the central bank's monetary easing could pose risks to the financial stability.

-

15:17

Before the bell: S&P futures -0.74%, NASDAQ futures -0.84%

U.S. stock-index futures slid.

Global Stocks:

Nikkei 16,601.36 -67.05 -0.40%

Hang Seng 21,042.64 -255.24 -1.20%

Shanghai Composite Closed.

FTSE 6,108.81 -123.08 -1.98%

CAC 4,316.68 -88.93 -2.02%

DAX 9,844.97 -243.90 -2.42%

Crude $49.80 (-1.50%)

Gold $1272.80 (+0.01%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.7

-0.14(-1.4228%)

14744

Amazon.com Inc., NASDAQ

AMZN

723.75

-3.90(-0.536%)

20639

American Express Co

AXP

65.19

-0.52(-0.7914%)

2339

AMERICAN INTERNATIONAL GROUP

AIG

55.45

-0.65(-1.1586%)

2299

Apple Inc.

AAPL

99.02

-0.63(-0.6322%)

106526

AT&T Inc

T

39.87

-0.22(-0.5488%)

13832

Barrick Gold Corporation, NYSE

ABX

19.75

0.17(0.8682%)

97124

Boeing Co

BA

131.36

-1.74(-1.3073%)

310

Caterpillar Inc

CAT

76.36

-0.80(-1.0368%)

5990

Chevron Corp

CVX

101.94

-0.87(-0.8462%)

10935

Cisco Systems Inc

CSCO

28.85

-0.29(-0.9952%)

8069

Citigroup Inc., NYSE

C

44.21

-0.80(-1.7774%)

25710

Deere & Company, NYSE

DE

86.21

-0.74(-0.8511%)

229

E. I. du Pont de Nemours and Co

DD

67.96

0.06(0.0884%)

995

Exxon Mobil Corp

XOM

89.95

-0.72(-0.7941%)

12277

Facebook, Inc.

FB

117.79

-0.77(-0.6495%)

82523

Ford Motor Co.

F

13.15

-0.11(-0.8296%)

15754

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.58

-0.32(-2.9358%)

283293

General Electric Co

GE

30.02

-0.22(-0.7275%)

33427

General Motors Company, NYSE

GM

29.12

-0.24(-0.8174%)

16136

Goldman Sachs

GS

150.96

-2.21(-1.4428%)

15274

Google Inc.

GOOG

723.01

-5.57(-0.7645%)

3920

Home Depot Inc

HD

128.43

-0.87(-0.6729%)

5245

Intel Corp

INTC

31.71

-0.23(-0.7201%)

29659

International Business Machines Co...

IBM

152.5

-0.92(-0.5997%)

1309

Johnson & Johnson

JNJ

116.15

-0.85(-0.7265%)

1606

JPMorgan Chase and Co

JPM

63.85

-0.90(-1.39%)

36682

McDonald's Corp

MCD

121.71

-1.08(-0.8796%)

866

Merck & Co Inc

MRK

56.89

-0.29(-0.5072%)

910

Microsoft Corp

MSFT

51.19

-0.43(-0.833%)

17486

Nike

NKE

54.4

-0.54(-0.9829%)

1936

Pfizer Inc

PFE

35.1

-0.21(-0.5947%)

2647

Procter & Gamble Co

PG

82.7

-0.47(-0.5651%)

1289

Starbucks Corporation, NASDAQ

SBUX

55

-0.58(-1.0435%)

606

Tesla Motors, Inc., NASDAQ

TSLA

227.63

-1.73(-0.7543%)

85470

The Coca-Cola Co

KO

45.56

-0.20(-0.4371%)

1284

Twitter, Inc., NYSE

TWTR

14.4

-0.20(-1.3699%)

130957

Verizon Communications Inc

VZ

51.78

-0.17(-0.3272%)

2301

Visa

V

80.81

-0.45(-0.5538%)

1421

Wal-Mart Stores Inc

WMT

70.77

-0.32(-0.4501%)

1107

Walt Disney Co

DIS

97.2

-0.64(-0.6541%)

6883

Yahoo! Inc., NASDAQ

YHOO

36.98

-0.37(-0.9906%)

23649

Yandex N.V., NASDAQ

YNDX

22.57

-0.51(-2.2097%)

600

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) initiated with an Outperform at William Blair

General Motors (GM) initiated with an Overweight at Piper Jaffray

Ford Motor (F) initiated with an Overweight at Piper Jaffray

Tesla Motors (TSLA) initiated with a Neutral at Piper Jaffray

-

14:43

Canada’s unemployment rate declined to 6.9% in May

Statistics Canada released the labour market data on Friday. Canada's unemployment rate declined to 6.9% in May from 7.1% in April. Analysts had expected the unemployment rate to remain unchanged at 7.1%.

The labour participation rate declined to 65.7% in May from 65.8% in April.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people rose by 13,800 jobs in May, exceeding expectations for a gain of 3,800 jobs, after a 2,100 drop in April.

The decrease was mainly driven by a fall in full-time work. Full-time employment climbed by 60,500 in May, while part-time employment slid by 46,800 jobs.

Employment rose in the "other services" industry, public administration, construction, business, building and other support services, educational services, and manufacturing.

-

14:30

Canada: Unemployment rate, May 6.9% (forecast 7.1%)

-

14:30

Canada: Employment , May 13.8 (forecast 3.8)

-

14:14

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the positive economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Tertiary Industry Index April -0.5% Revised From -0.7% 0.7% 1.4%

06:00 Germany CPI, m/m (Finally) May -0.4% 0.3% 0.3%

06:00 Germany CPI, y/y (Finally) May -0.1% 0.1% 0.1%

06:45 France Industrial Production, m/m April -0.4% Revised From -0.3% 0.4% 1.2%

08:30 United Kingdom Consumer Inflation Expectations 1.8% 2%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to decrease to 94.0 in June from 94.7 in May.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were up 0.3% in May, in line with the preliminary estimate, after a 0.4% fall in April.

On a yearly basis, German final consumer price index increased to 0.1% in May from -0.1% in April, in line with the preliminary estimate.

Energy prices dropped 7.9% year-on-year in May, while food prices were flat.

Consumer prices excluding energy increased 1.2% year-on-year in May.

The British pound traded lower against the U.S. dollar despite the positive economic data from the U.K. The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK rose to 2.0% in June from 1.8% in March.

Inflation expectations for coming two years in the U.K. increased to 2.2% in June from 2.1% in March.

The annual consumer price inflation in the U.K. was 0.3% in April, below the central bank's 2% target.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 2.5% in April, after a 3.6% drop in March.

The increase was mainly driven by rises in all new work and all repair and maintenance. All new work gained 2.9% in April, while all repair and maintenance rose 1.9%.

On a yearly basis, construction output decreased 3.7% in April, after a 4.5% fall in March.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian labour market data. Canada's new housing price index is expected to rise 0.2% in April, after a 0.2% gain in March. The unemployment rate in Canada is expected to remain unchanged at 7.1% in May.

Canada's economy is expected to add 3,800 jobs in May.

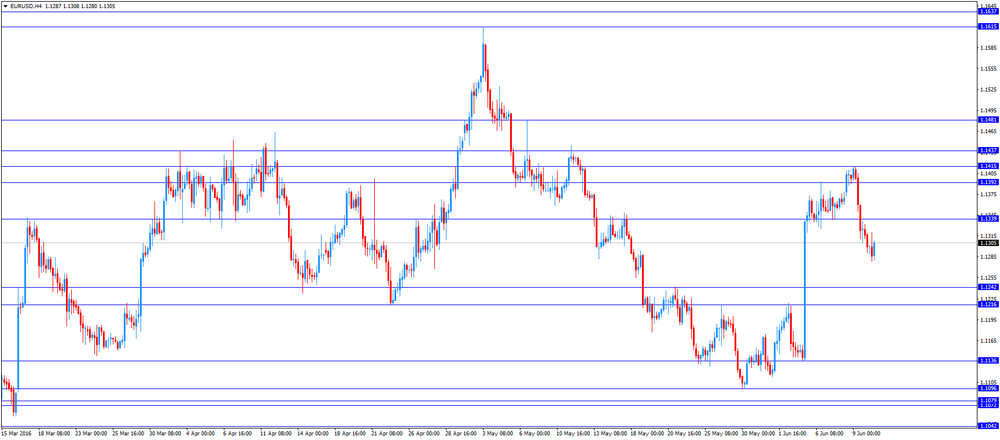

EUR/USD: the currency pair traded mixed

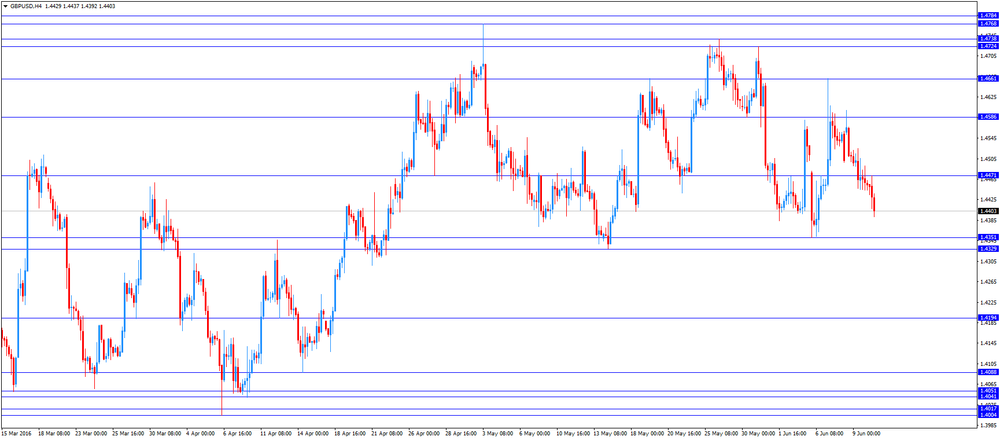

GBP/USD: the currency pair declined to $1.4392

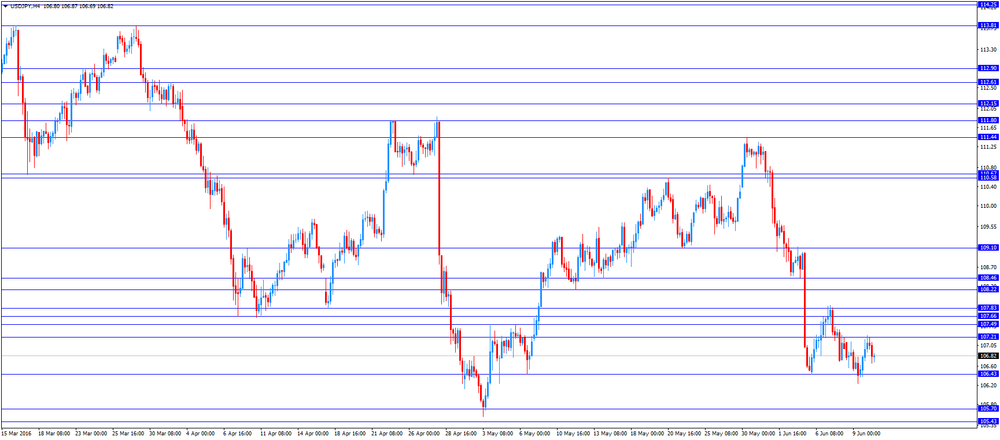

USD/JPY: the currency pair fell to Y106.67

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate May 7.1% 7.1%

12:30 Canada Employment May -2.1 3.8

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) June 94.7 94

18:00 U.S. Federal budget May 106 -60

-

13:08

WSE: Mid session comment

The morning session phase brought a decline of the WIG20 below the level of 1,800 points. The market did not respond with increased turnover - the activity was comparable with the first hour - but the movement is clear and indicates doubt of the investors, who were counting on a shallow correction of the previous growth. The market has no other idea than the correlation with the environment and the zloty, which pairs, USDPLN and EURPLN are traded already at levels higher than during important to strengthen the Warsaw Stock Exchange Wednesday. From the point of view of the balance of power, the breach of 1,800 points, must call a speculation that the market is intend to return to the region of 1,750 points. Today's session looks much weaker than yesterday. Not only that the decline at the same time is larger, the additional problem is the regularity both on the WSE as well as on major markets. Such a course could lead to a further weakening in the subsequent parts of the trade, but on the other hand it gives a chance for faster solstice market. For now, however, no signs of improvement can be seen.

In the mid-session, the WIG20 index was at the level of 1790 points (-1.37%) traded at PLN 185 million.

-

12:00

European stock markets mid session: stocks traded lower on falling prices

Stock indices traded lower as oil prices continued to decline. Oil prices fell on a stronger U.S. dollar.

No major economic reports were released in the Eurozone.

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK rose to 2.0% in June from 1.8% in March.

Inflation expectations for coming two years in the U.K. increased to 2.2% in June from 2.1% in March.

The annual consumer price inflation in the U.K. was 0.3% in April, below the central bank's 2% target.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 2.5% in April, after a 3.6% drop in March.

The increase was mainly driven by rises in all new work and all repair and maintenance. All new work gained 2.9% in April, while all repair and maintenance rose 1.9%.

On a yearly basis, construction output decreased 3.7% in April, after a 4.5% fall in March.

Current figures:

Name Price Change Change %

FTSE 100 6,141.39 -90.50 -1.45 %

DAX 9,899.85 -189.02 -1.87 %

CAC 40 4,338.87 -66.74 -1.51 %

-

11:56

Industrial production in Italy rises 0.5% in April

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy rose 0.5% in April, after a flat reading in March.

On a yearly basis, industrial production in Italy climbed at a seasonally-adjusted rate of 1.8% in April, after a 0.5% increase in March.

-

11:52

UK’s construction output climbs 2.5% in April

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 2.5% in April, after a 3.6% drop in March.

The increase was mainly driven by rises in all new work and all repair and maintenance. All new work gained 2.9% in April, while all repair and maintenance rose 1.9%.

On a yearly basis, construction output decreased 3.7% in April, after a 4.5% fall in March.

-

11:48

Consumer inflation expectations for the coming year in the UK rise to 2.0% in June

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK rose to 2.0% in June from 1.8% in March.

Inflation expectations for coming two years in the U.K. increased to 2.2% in June from 2.1% in March.

The annual consumer price inflation in the U.K. was 0.3% in April, below the central bank's 2% target.

-

11:44

French industrial production climbs 1.2% in April

The French statistical office Insee its industrial production figures on Friday. Industrial production in France climbed 1.2% in April, exceeding expectations for a 0.4% increase, after a 0.4% drop in March. March's figure was revised down from a 0.3% fall.

Manufacturing output rose 1.3% in April, while construction output jumped 0.7%.

Output in mining and quarrying, energy, water supply and waste management climbed 0.5% in April.

On a yearly basis, the French industrial production climbed 0.5% in April.

-

11:39

German wholesale prices rise 0.9% in May

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices rose 0.9% in May, after a 0.3% increase in April.

On a yearly basis, wholesale prices in Germany dropped 2.3% in May, after a 2.7% decline in April. Wholesale prices have been declining since July 2013.

The annual fall was mainly driven by a 16.4% drop in solid fuels and related products.

-

11:35

German final consumer price inflation rises 0.3% in May

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were up 0.3% in May, in line with the preliminary estimate, after a 0.4% fall in April.

On a yearly basis, German final consumer price index increased to 0.1% in May from -0.1% in April, in line with the preliminary estimate.

Energy prices dropped 7.9% year-on-year in May, while food prices were flat.

Consumer prices excluding energy increased 1.2% year-on-year in May.

-

11:23

Japan's tertiary industry activity index increases 1.4% in April

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index increased 1.4% in April, exceeding expectations for a 0.7% rise, after a 0.5% fall in March. March's figure was revised up from a 0.7% drop.

The increase was driven by rises in wholesale Trade, business-related services, finance and insurance, information and communications, real estate, transport and postal Activities.

On a yearly basis, the tertiary industry activity index rose 0.1% in April.

-

10:56

The Wall Street Journal survey: only 6% of economists expect the Fed to raise its interest rate in June

According to The Wall Street Journal survey, only 6% of economists expect the Fed to raise its interest rate in June, down from 31% last month. 51% expect that the Fed would hike its interest rate in July, up from 21% last month.

About 30% of economists expect the Fed to wait until September.

8% economists surveyed this month said that the Fed will raise its interest rates in December.

-

10:39

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy increase to 43.5 in in the week ended June 05

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.5 in in the week ended June 05 from 43.2 the prior week.

The increase was driven by rises in all sub-indexes. The measure of views of the economy was up to 32.9 from 32.2, the buying climate index climbed to 40.3 from 40.1, while the personal finances index rose to 57.4 from 57.3.

-

10:31

United Kingdom: Consumer Inflation Expectations, 2%

-

10:25

Unemployment rate in the OECD area remains unchanged at 6.4% in April

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Thursday. The OECD unemployment rate remained unchanged at 6.4% in April.

The unemployment rate in Eurozone remained unchanged at 10.2% in April.

The U.S. unemployment rate remained unchanged at 5.0% in April.

39.4 million people were unemployed in the OECD area in April.

The youth unemployment fell to 13.0% in April from 13.1 in March. The highest youth unemployment was in Spain with 45.0%, followed by Italy with 36.9% and Portugal with 29.9%.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1375 (EUR 271m) 1.1390 (219m) 1.1400 (756m)

USD/JPY 106.25 (USD 300m) 106.50 (280m) 107.00 (257m) 107.50 (293m)

GBP/USD 1.3930 (GBP 666m) 1.4000 (1.12bln) 1.4185 (303m)

AUD/USD 0.7300 (AUD 498m) 0.7350 (252m) 0.7500 (253m)

USD/CAD 1.2655 (USD 380m) 1.2835-40 (630m)

NZD/USD 0.7000 (NZD 326m) 0.7030 (672m)

AUD/JPY 80.75 (AUD 307m)

-

10:14

European Central Bank Governing Council member Ignazio Visco: the central bank’s stimulus measures are appropriate

The European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that the central bank's stimulus measures were appropriate.

"The current low level of policy rates is the appropriate reaction to current conditions," he said.

Visco added that the ECB's monetary easing helped to combat deflationary risks.

-

09:20

WSE: After opening

The WIG20 futures started in a similar to yesterday's style, which means close to the reference price, but straight with a tendency to descend down. Yesterday we finished the session at minima, so today's descent at the start session means to drop below the lows of yesterday and the day before yesterday sessions.

WIG20 index opened at 1815.50 points (+0.07%)*

WIG 46002.11 0.13%

WIG30 2022.84 0.07%

mWIG40 3525.49 0.28%

*/ - change to previous close

The first transactions did not bring fireworks, and the market is trying to repeat yesterday's scenario of stabilizing the index after opening. Yesterday it ended up in a fall, forced by the environment and the weakness of the zloty. Each of these elements is also present today. Abrupt weakening of the zloty in the last hour amounted pairs EURPLN and USDPLN above yesterday's highs and that is the reason to expect some attempts to continue the sell-off in the WIG20. Also European markets - the DAX and the CAC - depreciating, so the actual environment continues yesterday's sell-off.

-

08:45

France: Industrial Production, m/m, April 1.2% (forecast 0.4%)

-

08:27

WSE: Before opening

Thursday's session on Wall Street ended in solidarity declines of major indices. In this devaluation, however, was more of the consolidation than the withdrawal. Following a weak start, which to the greatest extent was the transfer of the atmosphere from the raw materials market, indexes found their stabilization, and in the final reduced earlier losses. In the case of the S&P500 decline was barely 0.17 percent.

The contract on the DAX indicates that morning in Europe looks for stability.

The macro calendar is relatively empty today, and investors' attention has already shifted to the next week and waiting for Wednesday's message from the Federal Open Market Committee.

In this environment, Europe seems to be now doomed to look out towards the United States and seek there the signals that allow estimating the mood ahead of the FOMC.

In the case of the Warsaw Stock Exchange, equally important is the behavior of emerging markets, which - as we can see from yesterday's weakening of the zloty - were the correction of optimism reinforced the week before by weak data from the US labor market.

It seems that the correction rather gain momentum. Emerging markets are simply conducive to further weakening of the zloty, which combined with the WIG20 correlation with the zloty does not benefit the bulls in Warsaw. Taking into account the neutral setting of European markets, opening of the WIG20 should fall to levels that will sustain the suspension of the index between 1,850 and 1,800 pts., and in the following hours will be important variables such as the condition of the zloty and other indexes.

-

08:19

Options levels on friday, June 10, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1464 (1981)

$1.1449 (1779)

$1.1425 (362)

Price at time of writing this review: $1.1301

Support levels (open interest**, contracts):

$1.1218 (1666)

$1.1188 (1911)

$1.1155 (2344)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 35607 contracts, with the maximum number of contracts with strike price $1,1500 (5442);

- Overall open interest on the PUT options with the expiration date July, 8 is 65096 contracts, with the maximum number of contracts with strike price $1,0900 (12713);

- The ratio of PUT/CALL was 1.83 versus 1.81 from the previous trading day according to data from June, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.4823 (1727)

$1.4728 (728)

$1.4634 (674)

Price at time of writing this review: $1.4458

Support levels (open interest**, contracts):

$1.4363 (676)

$1.4267 (455)

$1.4170 (504)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 15516 contracts, with the maximum number of contracts with strike price $1,5000 (1876);

- Overall open interest on the PUT options with the expiration date July, 8 is 32504 contracts, with the maximum number of contracts with strike price $1,4100 (3259);

- The ratio of PUT/CALL was 2.09 versus 2.04 from the previous trading day according to data from June, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:07

Asian session: The dollar strengthened

The dollar index was on track for a modest weekly gain on Friday, having bounced off this week's one-month lows as the euro took a heavy spill while sterling stayed under a cloud on jitters over the upcoming Brexit vote.

A Reuters report on Commerzbank looking to put billions of euros in vaults rather than pay a penalty charge for parking them with the European Central Bank appeared to have unsettled an already nervous market.

"It seems the news made waves early in the European session Thursday, our London team reporting that this was credited for the euro being sold across the board," analysts at National Australia Bank wrote in a note to clients.

The common currency also plumbed a fresh three-year low of 120.315 yen on Thursday before paring losses. It was last down 0.2 percent at 120.95, down 0.1 percent for the week.

The dollar was down 0.1 percent against the yen at 107.02 yen but was still up 0.4 percent in a choppy week that saw it touch 106.26 yen on Thursday, its lowest since May 4.

"It's very hard to take new positions in dollar/yen now, ahead of next week's central bank meetings, so I think the pair will be rangebound for a while," said Kaneo Ogino, director at foreign exchange research firm Global-info Co in Tokyo.

The U.S. Federal Reserve is scheduled to hold its two-day policy meeting through Wednesday, while the Bank of Japan concludes its own two-day policy meeting on Thursday. China's industrial production and retail sales data due on Monday could also set the tone for Asian trading next week.

The pound has whipsawed in recent session in response to polls and other developments ahead of the UK's June 23 referendum on EU membership.

BlackRock, the world's largest asset manager, said financial markets may be under-pricing the "Brexit" risk of Britain leaving the EU.

With the euro zone and the UK in focus overnight, the dollar enjoyed a small reprieve. Dollar bulls had been hit hard since disappointing payrolls data a week ago convinced investors that the Fed will refrain from hiking interest rates as early as next week's policy review.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1295-1.1320

GBP / USD: during the Asian session, the pair was trading in the $ 1.4440-65

USD / JPY: during the Asian session, the pair is trading in the range of $ 106.90-107.25

Based on Reuters materials

-

08:00

Germany: CPI, y/y , May 0.1% (forecast 0.1%)

-

08:00

Germany: CPI, m/m, May 0.3% (forecast 0.3%)

-

07:05

Global Stocks

European stocks fell Thursday, marking a second straight decline as a pullback in crude-oil futures off multimonth highs weighed on energy shares.

Among oil producers, Neste Corp. NESTE, -1.28% declined 1.3%, France's Total SA FP, -1.21% gave up 1.2%, and Spain's Respsol SA REP, -2.18% fell 2.2%. Oilfield data-services provider TGS-NOPEC Geophysical Co. ASA TGS, -3.72% slumped 3.7%.

Crude prices turned lower in early European trade, with Brent LCOQ6, -0.29% slipping 1.1% to $51.96 a barrel. West Texas Intermediate CLN6, -0.40% futures were off 1.3% at $50.56. But oil prices were still on track for a weekly jump of more than 4%.

U.S. stocks pared earlier losses but ended in negative territory, snapping a three-day win streak as oil futures pulled back from 10-month highs.

The S&P 500 SPX, -0.17% declined 3.64 points, or 0.2%, to close at 2,115.48, coming back from an 11-point deficit earlier in the session, with materials and financial stocks leading the losses. Seven out of the index's 10 sectors finished lower, with consumer staples, telecoms and utilities showing slight gains.

The Dow Jones Industrial Average DJIA, -0.11% slipped 19.86 points, or 0.1%, to close at 17,985.19, after being down by as many as 89 points earlier in the session. Shares of American Express Co. AXP, -0.83% Caterpillar Inc. CAT, -1.22% and Goldman Sachs Group Inc. GS, -0.95% led blue chips lower.

Asian shares pulled back on Friday as investors sought refuge in safe-haven assets amid festering concerns over the June 23 referendum that could see Britain exit the European Union.

Japan's Nikkei declined 0.5 percent, extending losses for the week to 0.3 percent.

Hong Kong's Hang Seng index slipped 0.3 percent, heading for a loss of 1.4 percent for the week.

"There are concerns over 'Brexit' as polls seem to suggest the probability of Britain leaving Europe is rising," said Tatsushi Maeno, managing director at PineBridge Investments.

"You can't buy risk assets under such conditions even if you want to," he said.

-

06:32

Japan: Tertiary Industry Index , April 1.4% (forecast 0.7%)

-

04:09

NNikkei 225 16,586.71 -81.70 -0.49 %, Hang Seng 21,225.92 -71.96 -0.34 %

-

00:38

Commodities. Daily history for Jun 09’2016:

(raw materials / closing price /% change)

Oil 50.48 -0.16%

Gold 1,271.90 -0.06%

-

00:33

Stocks. Daily history for Jun 09’2016:

(index / closing price / change items /% change)

Nikkei 225 16,668.41 -162.51 -0.97 %

S&P/ASX 200 5,361.94 -8.04 -0.15 %

FTSE 100 6,231.89 -69.63 -1.10 %

CAC 40 4,405.61 -43.12 -0.97 %

Xetra DAX 10,088.87 -128.16 -1.25 %

S&P 500 2,115.48 -3.64 -0.17 %

NASDAQ Composite 4,958.62 -16.03 -0.32 %

Dow Jones 17,985.19 -19.86 -0.11 %

-

00:31

Currencies. Daily history for Jun 09’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1316 -0,72%

GBP/USD $1,4458 -0,36%

USD/CHF Chf0,9642 -0,50%

USD/JPY Y106,96 +0,07%

EUR/JPY Y121,05 -0,65%

GBP/JPY Y154,63 -0,30%

AUD/USD $0,7431 -0,70%

NZD/USD $0,7101 +0,21%

USD/CAD C$1,272 +0,24%

-

00:02

Schedule for today, Friday, Jun 10’2016:

(time / country / index / period / previous value / forecast)

04:30 Japan Tertiary Industry Index April -0.7% 0.7%

06:00 Germany CPI, m/m (Finally) May -0.4% 0.3%

06:00 Germany CPI, y/y (Finally) May -0.1% 0.1%

06:45 France Industrial Production, m/m April -0.3% 0.4%

08:30 United Kingdom Consumer Inflation Expectations 1.8%

12:30 Canada Unemployment rate May 7.1% 7.1%

12:30 Canada Employment May -2.1 3.8

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) June 94.7 94

18:00 U.S. Federal budget May 106 -60

-