Noticias del mercado

-

20:00

Dow -1.24% 17,672.60 -222.62 Nasdaq -0.82% 4,853.07 -40.22 S&P -1.02% 2,044.97 -20.98

-

18:07

European stocks close: most stocks closed higher as oil and gas shares declined

Most stock indices closed higher as oil and gas shares declined.

The Greek Finance Ministry released tax revenue figures on Friday. Tax receipts accounted 121 million euros below target in February, after a 1.048 billion shortfall in January.

Overall, tax revenues came in at 7.298 billion euros in the first two months of 2015, 13.8% below a target of 8.467 billion euros, according to the Greek Finance Ministry.

The central government surplus came in at 1.243 billion euros in the first two months of 2015, below a target of 1.411 billion euros, the ministry said.

The Greek statistics service ELSTAT released GDP estimate for 2014 on Friday. Greece's economy grew by 0.8% in 2014.

GDP in real terms was 186.5 billion euros in 2014, up from 185.1 billion euros in 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,740.58 -20.49 -0.30 %

DAX 11,901.61 +102.22 +0.87 %

CAC 40 5,010.46 +23.13 +0.46 %

-

18:00

European stocks closed: FTSE 100 6,740.58 -20.49 -0.30% CAC 40 5,010.46 +23.13 +0.46% DAX 11,901.61 +102.22 +0.87%

-

17:42

Oil: a review of the market situation

Oil prices have fallen dramatically today (WTI fell by about 4 percent, and Brent - 3 percent) were under pressure to strengthen the US dollar and concerns about global oversupply.

Today, the International Energy Agency (MEA) reported that the recovery in oil prices remains uncertain, as production in the United States began to grow again, as well as stocks in storage tanks. This contradicts the view that the decline in oil prices boom constrains production in US shale deposits. The monthly report MEA said that "despite the apparent stability, rebalancing the market, which began with the fall in prices will continue, and this process is going to be quite difficult." The report MEA, published last month, it was noted that the recovery in oil prices is inevitable, as is expected to complete production boom in the United States.

"In the second half of this year, the market will be more balanced, but excess oil still remain in the first half. We still expect that oil prices will fall in the next few weeks due to growth stocks," - said Commerzbank analyst Barbara Lambrecht.

The course of trade also affected the US data. One report showed that producer price index fell to a seasonally adjusted 0.5% last month from January. Excluding volatile food prices and energy index fell 0.5%. Economists had expected prices to rise by 0.2%, while the so-called core prices fell by 0.1%. Meanwhile, preliminary findings presented Thomson-Reuters and the Institute of Michigan, showed that in March US consumers feel more pessimistic about the economy than last month. According to published data, in March, preliminary index of consumer sentiment fell to 91.2 points compared with the final reading for February at around 95.4 points. It is worth noting that, according to the average expert estimates, the index was slightly increase to 95.6 points.

Recall the price of oil falls in the summer of 2014. Experts point out that this is due to an excess of fuel in the oil market. The solution is not to reduce the OPEC quota on oil production increased price collapse. Minister of Energy of Saudi Arabia, explaining the decision, said that the oil market may well resolve itself.

April futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 45.07 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea Brent crude oil mix fell $ 1.71 to 55.53 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:41

Foreign exchange market. American session: the Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian labour market data

The U.S. dollar traded mixed against the most major currencies despite the weaker-than-expected U.S. economic data. The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 91.2 in March from a final reading of 95.4 in February, missing expectations for an increase to 95.6.

The U.S. producer price index fell 0.5% in February, missing forecasts of a 0.2% increase, after a 0.8% drop in January.

The decline was driven by a drop in trade services.

The producer price index excluding food and energy declined 0.5% in February, missing forecasts of a 0.1% decrease, after a 0.1% fall in January.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index will be released at 14:00 GMT0, and is expected to rise to 95.6 in March from a final reading of 95.4 in February.

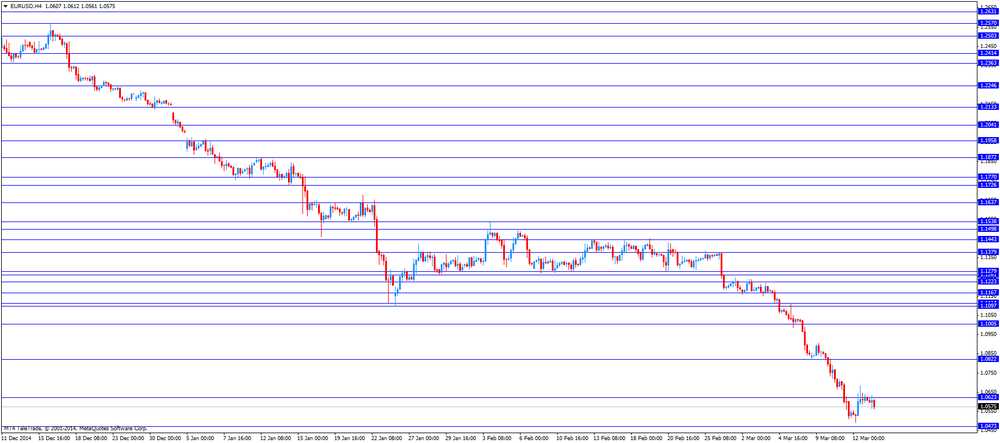

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro.

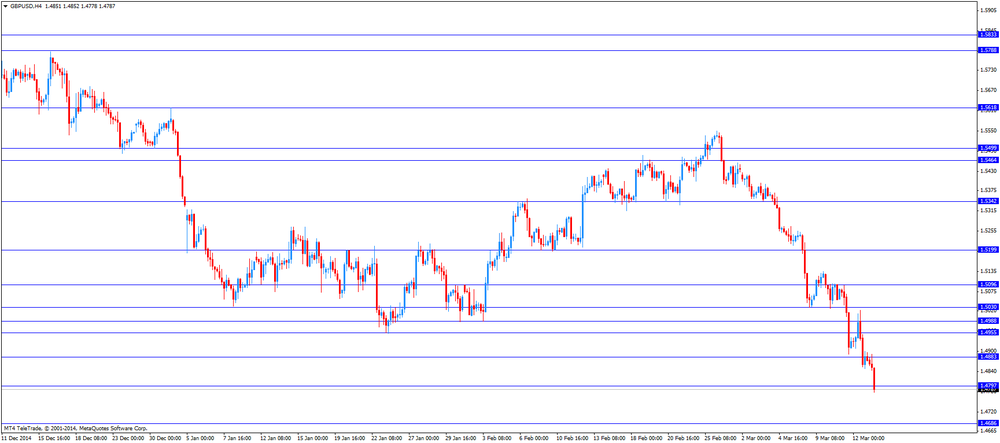

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K. Comments by the Bank of England (BoE) Governor Mark Carney still weighed on the pound. He said in a speech in Sheffield on Thursday that a stronger pound and low global inflation could weigh on inflation in the U.K. for some time. Carney added that a persistent period of low global inflation is possible, driven by lower oil prices and a slowdown in global demand.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian labour market data. Canada's unemployment rate climbed to 6.8% in February from 6.6% in January. That was the highest level since September 2014.

Analysts had expected the unemployment rate to decline to 6.5%.

The number of employed people decreased by 1,000 in February, missing expectations for a gain of 21,300, after a 35,400 rise in January.

The decline was driven by job losses in the manufacturing and natural resources sector.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback despite the solid Business NZ manufacturing purchasing managers' index from New Zealand. The index increased to 55.9 in February from 50.7 in January. January's figure was revised down from 50.9.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after the weaker-than-expected final industrial production from Japan. Japan's final industrial production rose 3.7% in January, down from the 4.0% increase estimated earlier.

-

17:20

Gold: а review of the market situation

Gold has fallen in price, while returning to a session low, due to the renewed strengthening of the US dollar. It is worth emphasizing the price of the precious metal has been declining for the 10th consecutive session, which is the longest running series in more than 40 years.

"Gold is supported at the level of $ 1,150, although in the short and medium term, there is a tendency to decrease," - said a trader at MKS Group James Gardiner. Meanwhile, an analyst at Phillip Futures Howie Lee said that prices could still rise, but met resistance near $ 1,166, said

Little support have expectations of the Fed meeting. Experts point out that the results of the Fed's FOMC meeting, which will take place next week, will be the determining factor for gold prices. Most likely, the Fed will remove only the wording, indicating a cautious approach in determining the timing of interest rate increases

"To achieve the new targets for improving the economic situation in the United States may take more than a year. In short, the Fed can only change the wording of the statement, "- said Nur al-Hammour of ADS Securities.

The course of trade also affected the US data. The Labor Department said that the producer price index fell to a seasonally adjusted 0.5% last month from January. Excluding volatile food prices and energy index fell 0.5%. Economists had expected prices to rise by 0.2%, while the so-called core prices fell by 0.1%. Most of the reduction in overall prices was associated with a fall of 1.5% in volatile trade services category, which measures changes in the margin, resulting in the wholesale and retail trade. Excluding food, energy, and trade in services, the index remained unchanged in February from January.

Meanwhile, it became known that the stocks of the world's largest gold ETF-secured fund SPDR Gold Trust on Thursday declined by 0.28 percent to its lowest level since late January 750.95 tons.

April futures price of gold on the COMEX today fell to 1152.70 dollars per ounce.

-

17:01

Greek tax revenues decline slightly in February

The Greek Finance Ministry released tax revenue figures on Friday. Tax receipts accounted 121 million euros below target in February, after a 1.048 billion shortfall in January.

Overall, tax revenues came in at 7.298 billion euros in the first two months of 2015, 13.8% below a target of 8.467 billion euros, according to the Greek Finance Ministry.

The central government surplus came in at 1.243 billion euros in the first two months of 2015, below a target of 1.411 billion euros, the ministry said.

-

16:50

Greece's economy grew by 0.8% in 2014

The Greek statistics service ELSTAT released GDP estimate for 2014 on Friday. Greece's economy grew by 0.8% in 2014.

GDP in real terms was 186.5 billion euros in 2014, up from 185.1 billion euros in 2013.

A second estimate of GDP is scheduled to be released on October 9, according to ELSTAT.

Household spending rose 1.3%, while general government spending declined 0.9%. Investment decreased 2.2%.

Exports grew by 9%, while imports climbed by 7.4%.

Import prices dropped to an annual rate of 13.2% in January, after a 12.3 decline in December.

-

16:42

EU Commission chief Jean-Claude Juncker excludes a failure in talks between the Eurogroup of euro zone finance ministers and Greece

The EU Commission chief Jean-Claude Juncker said on Friday that he was not satisfied by results of talks between the Eurogroup of euro zone finance ministers and Greece.

He excludes a failure, and doesn't want that Greece leave the Eurozone.

-

16:21

Former Federal Reserve Chairman Alan Greenspan is unsure whether the strong U.S. dollar reflects the strong U.S. or weak global economy

Former Federal Reserve Chairman Alan Greenspan said in an interview with Bloomberg Television that the oil price hasn't reached a bottom yet as the production output still rises. He added that the storage capacity is going to run out.

Mr Greenspan is unsure whether the strong U.S. dollar reflects the strong U.S. or weak global economy.

-

16:07

Central Bank of Russia lowered the key rate by 1% to 14%

Russia's central cut its interest rate on Friday. The Central Bank of Russia (CBR) lowered the key rate by 1% to 14%. It was the second rate cut as the central bank lowered its interest rate to 15% from 17% at the end of January. This measure should boost the Russian economy.

The country's economy is hit by sanctions and the sharp drop in oil prices.

The Russian ruble strengthened against the U.S. dollar following the decision.

Russia's economy faces high inflation on the one side and a slowdown of growth on the other side.

-

15:40

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 91.2 in March

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 91.2 in March from a final reading of 95.4 in February, missing expectations for an increase to 95.6.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that the decline was a result of lower optimism among lower and middle income households, while confidence rose among households with incomes in the top third.

Mr Curtin added that "despite the small temporary setbacks, the overall level of consumer confidence remains favorable enough to support 3.3 percent growth rate in personal consumption expenditures during 2015".

A gauge of consumers' current economic conditions dropped to 103.0 in March from 106.9 in February.

The index of consumer expectations declined to 83.7 from 88.0.

The one-year inflation expectations in March climbed to 3.0% from 2.8% in February.

-

15:09

European Central Bank Executive Board member Benoit Coeure: the ECB has already purchased 9.8 billion euros worth of assets in three days

The European Central Bank Executive Board member Benoit Coeure said in Paris on Thursday that quantitative easing is having impact on the economy. He noted that the ECB has already purchased 9.8 billion euros worth of assets in three days, adding that there is no problem in finding bonds to buy.

Mr Coeure warned that "the recovery is cyclical and led by low oil prices". He pointed out that it is a chance for governments to implement reforms.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, March 91.2 (forecast 95.6)

-

14:55

U.S. producer price index plunges by 0.5% in February

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index fell 0.5% in February, missing forecasts of a 0.2% increase, after a 0.8% drop in January. It was the fourth straight monthly decrease.

On a yearly basis, the producer price index decreased 0.6% in February, after a flat reading in January. It was the first decline since 2009.

The decline was driven by a drop in trade services which fell 1.5% in February.

The producer price index excluding food and energy declined 0.5% in February, missing forecasts of a 0.1% decrease, after a 0.1% fall in January.

On a yearly basis, the producer price index excluding food and energy climbed 1.0% in February, after a 1.6% rise in January.

The low inflation could mean that the Fed will delay its interest rate hike, despite a strengthening labour market.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0600(E321mn), $1.0650(E409mn)

USD/JPY: Y120.00($567mn), Y120.50($530mn), Y121.00($1.53bn), Y122.00($1.02bn)

GBP/USD: $1.4980(Gbp317mn), $1.5000(Gbp223mn)

AUD/USD: $0.7600(A$1.04bn), $0.7650(A$456mn), $0.7700(A$822mn), $0.7795-7800(A$600mn)

NZD/USD: $0.7200(NZ$344mn), $0.7325(NZ$353mn), $0.7520(NZ$292mn)

USD/CAD: C$1.2660($890mn)

-

14:37

Canada’s economy lost 1,000 jobs in February, driven by job losses in the manufacturing and natural resources sector

Statistics Canada released the labour market data on Friday. Canada's unemployment rate climbed to 6.8% in February from 6.6% in January. That was the highest level since September 2014.

Analysts had expected the unemployment rate to decline to 6.5%.

The number of employed people decreased by 1,000 in February, missing expectations for a gain of 21,300, after a 35,400 rise in January.

The decline was driven by job losses in the manufacturing and natural resources sector. The manufacturing sector cut 19,900 jobs in February, while natural resources lost 16,900 jobs due to lower oil prices.

The construction sector added 15,500 jobs.

Full-time employment in February rose by 34,000 jobs, while part-time work dropped by 34,900.

Self-employment grew by 3,600.

The labour participation rate rose to 65.8% in February from 65.7 in January.

The Bank of Canada monitors closely the labour participation rate.

-

14:32

U.S. Stocks open: Dow -0.15%, Nasdaq -0.14%, S&P -0.27%

-

14:26

Before the bell: S&P futures -0.17%, NASDAQ futures -0.06%

U.S. stock-index futures fluctuated as oil prices fell and a report showed wholesale prices unexpectedly declined last month.

Global markets:

Nikkei 19,254.25 +263.14 +1.39%

Hang Seng 23,823.21 +25.25 +0.11%

Shanghai Composite 3,373.79 +24.46 +0.73%

FTSE 6,742.22 -18.85 -0.28%

CAC 4,976.36 -10.97 -0.22%

DAX 11,772.43 -26.96 -0.23%

Crude oil $46.05 (-2.17%)

Gold $1155.80 (+0.34%)

-

14:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

107.59

+0.39%

28.0K

United Technologies Corp

UTX

122.49

+1.03%

10.5K

FedEx Corporation, NYSE

FDX

173.40

-0.10%

0.1K

General Motors Company, NYSE

GM

38.39

-0.10%

0.1K

Ford Motor Co.

F

16.15

-0.12%

18.3K

Google Inc.

GOOG

554.84

-0.12%

0.1K

Visa

V

269.19

-0.14%

1.4K

Deere & Company, NYSE

DE

90.05

-0.14%

0.2K

Procter & Gamble Co

PG

81.97

-0.15%

0.3K

The Coca-Cola Co

KO

40.50

-0.17%

2.8K

Apple Inc.

AAPL

124.20

-0.20%

206.1K

Amazon.com Inc., NASDAQ

AMZN

373.50

-0.20%

1.2K

Cisco Systems Inc

CSCO

28.18

-0.21%

14.4K

Home Depot Inc

HD

115.84

-0.22%

6.0K

Intel Corp

INTC

30.73

-0.23%

25.3K

AT&T Inc

T

33.05

-0.24%

2.1K

Boeing Co

BA

151.64

-0.26%

0.1K

JPMorgan Chase and Co

JPM

61.21

-0.26%

2.1K

Johnson & Johnson

JNJ

99.55

-0.28%

0.8K

Yandex N.V., NASDAQ

YNDX

14.49

-0.28%

7.2K

Pfizer Inc

PFE

33.90

-0.29%

1.6K

Merck & Co Inc

MRK

56.00

-0.30%

3.2K

General Electric Co

GE

25.32

-0.31%

1.4K

International Business Machines Co...

IBM

157.49

-0.31%

0.8K

Twitter, Inc., NYSE

TWTR

46.91

-0.34%

23.5K

Citigroup Inc., NYSE

C

53.89

-0.35%

3.8K

American Express Co

AXP

81.27

-0.36%

4.3K

Nike

NKE

96.69

-0.36%

0.1K

Travelers Companies Inc

TRV

107.42

-0.38%

1.7K

Facebook, Inc.

FB

78.62

-0.39%

23.4K

ALCOA INC.

AA

13.74

-0.43%

7.3K

Goldman Sachs

GS

189.10

-0.45%

0.2K

Microsoft Corp

MSFT

40.83

-0.46%

31.1K

Yahoo! Inc., NASDAQ

YHOO

42.75

-0.47%

30.8K

Caterpillar Inc

CAT

79.80

-0.49%

1.9K

McDonald's Corp

MCD

95.78

-0.49%

0.1K

Exxon Mobil Corp

XOM

83.73

-0.58%

30.7K

Hewlett-Packard Co.

HPQ

32.50

-0.67%

0.1K

Chevron Corp

CVX

101.70

-0.70%

9.0K

E. I. du Pont de Nemours and Co

DD

79.82

-0.72%

0.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.70

-1.01%

14.7K

Tesla Motors, Inc., NASDAQ

TSLA

188.20

-1.50%

38.5K

-

14:10

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies despite the weaker-than-expected U.S. producer price index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (MoM) (Finally) January +4.0% +4.0% +3.7%

04:30 Japan Industrial Production (YoY) (Finally) January -2.6% -2.6% -2.8%

12:30 Canada Employment February 35.4 21.3 -1

12:30 Canada Unemployment rate February 6.6% 6.5% 6.8%

12:30 U.S. PPI, m/m February -0.8% +0.2% -0.5%

12:30 U.S. PPI, y/y February 0.0% -0.6%

12:30 U.S. PPI excluding food and energy, m/m February -0.1% -0.1% -0.5%

12:30 U.S. PPI excluding food and energy, Y/Y February +1.6% +1.0%

The U.S. dollar traded mixed to higher against the most major currencies despite the weaker-than-expected U.S. producer price index (PPI). The U.S. producer price index fell 0.5% in February, missing forecasts of a 0.2% increase, after a 0.8% drop in January.

The decline was driven by a drop in trade services.

The producer price index excluding food and energy declined 0.5% in February, missing forecasts of a 0.1% decrease, after a 0.1% fall in January.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index will be released at 14:00 GMT0, and is expected to rise to 95.6 in March from a final reading of 95.4 in February.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K. Comments by the Bank of England (BoE) Governor Mark Carney still weighed on the pound. He said in a speech in Sheffield on Thursday that a stronger pound and low global inflation could weigh on inflation in the U.K. for some time. Carney added that a persistent period of low global inflation is possible, driven by lower oil prices and a slowdown in global demand.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian labour market data. Canada's unemployment rate climbed to 6.8% in February from 6.6% in January. That was the highest level since September 2014.

Analysts had expected the unemployment rate to decline to 6.5%.

The number of employed people decreased by 1,000 in February, missing expectations for a gain of 21,300, after a 35,400 rise in January.

The decline was driven by job losses in the manufacturing and natural resources sector.

EUR/USD: the currency pair fell to $1.0561

GBP/USD: the currency pair decreased to $1.4778

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 95.4 95.6

-

14:04

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Underperform from Sell at Credit Agricole

eBay (EBAY) upgraded from Neutral to Positive at Susquehanna, target raised from $59 to $75

Downgrades:

Other:

Google (GOOG) target raised to $681 from $640 at Cowen; Outperform

Apple (AAPL) target raised to $85 from $60 at Berenberg; Sell

Intel (INTC) reiterated at Outperform at FBR Capital, target lowered from $42 to $40

Intel (INTC) reiterated at Buy at Jefferies, target lowered from $50 to $48

-

14:01

Orders

EUR/USD

Offers 1.0625 1.0640 1.0665 1.0680 1.0700 1.0720 1.0735 1.0750

Bids 1.0580 1.0560 1.0540 1.0520 1.0500 1.0485 1.0460

GBP/USD

Offers 1.4900 1.4925 1.4940-50 1.4985 1.5000 1.5030-35 1.5060 1.5080 1.5100

Bids 1.4845-50 1.4820-25 1.4800 1.4785 1.4765 1.4750

EUR/JPY

Offers 129.20 129.60 129.80 130.00 130.20

Bids 128.40 128.00 127.80 127.50 127.00

USD/JPY

Offers 121.60 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 121.20 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7145-50 0.7185 0.7200 0.7220-25 0.7245-50

Bids 0.7110-15 0.7095-00 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7700-10 0.7725 0.7740 0.7760

Bids 0.7670 0.7640 0.7620 0.7600 0.7585 0.7565 0.7550

-

13:31

U.S.: PPI, y/y, February -0.6%

-

13:31

U.S.: PPI excluding food and energy, Y/Y, February +1.0%

-

13:30

Canada: Employment , February -1 (forecast 21.3)

-

13:30

Canada: Unemployment rate, February 6.8% (forecast 6.5%)

-

13:30

U.S.: PPI, m/m, February -0.5% (forecast +0.2%)

-

13:30

U.S.: PPI excluding food and energy, m/m, February -0.5% (forecast -0.1%)

-

12:20

Oil: Prices further decline on IEA report

Oil further declined today with Brent Crude losing -0.30%, currently trading at USD56.91 a barrel - closing in on one-month lows set two days ago. West Texas Intermediate declined by -0.51% currently quoted at USD46.81.

Today the International Energy Agency said that the rebound in prices may be only temporarily and it might be overly optimistic to count on a continuation as the global glut is worsening with no signs of U.S. production to slow down - despite dropping numbers of active rigs. U.S. Crude stocks are at records and spare storage capacity may soon run out. The IEA further stated that it will take at least till the second half of 2015 for U.S. production to slow down.

-

12:00

Gold further rebounds from 3-month low ahead of U.S. data

Gold is trading slightly higher today taking a breather from the recent decline further rebounding from fresh 3-month lows hit two days ago. Gold prices found support in weaker-than-expected U.S. retail sales as weaker data could lead the FED to postpone the planned interest-rate hike. Today all eyes will be on U.S. data on Producer Prices due at 12:30 GMT and the Reuters/Michigan Consumer Sentiment Index.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing. The Fed could start raising rates in the middle of this year (probably in June), and investors are preparing for the Fed next week to get further indications on whether the bank will give up its "patient" approach regarding the timing of a rate hike.

Gold is currently quoted at USD1,155.30, +0,23% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0600(E321mn), $1.0650(E409mn)

USD/JPY: Y120.00($567mn), Y120.50($530mn), Y121.00($1.53bn), Y122.00($1.02bn)

GBP/USD: $1.4980(Gbp317mn), $1.5000(Gbp223mn)

AUD/USD: $0.7600(A$1.04bn), $0.7650(A$456mn), $0.7700(A$822mn), $0.7795-7800(A$600mn)

NZD/USD: $0.7200(NZ$344mn), $0.7325(NZ$353mn), $0.7520(NZ$292mn)

USD/CAD: C$1.2660($890mn)

-

10:20

Press Review: Greece Complains About Schaeuble in Deepening Conflict

BLOOMBERG

Greece Complains About Schaeuble in Deepening Conflict

(Bloomberg) -- Greece's war of words with Germany deepened as Greece renewed demands for war reparations and formally complained about Finance Minister Wolfgang Schaeuble.

Germany and Greece confirmed Thursday that the Greek ambassador in Berlin made an official protest late Tuesday to the German Foreign Ministry over comments made by Schaeuble.

Schaeuble and his Greek counterpart Yanis Varoufakis have traded barbs in recent weeks, with Schaeuble suggesting on Tuesday that Varoufakis needed to look more closely at an agreement Greece signed in February and commenting on his fellow minister's communication strategy. Schaeuble said Thursday that any suggestion he had insulted Varoufakis was "absurd."

REUTERS

Oil helps Asian central banks stray from Fed's shadowReuters) - Asian central banks are running their own race on monetary policy for the first time in decades, cutting interest rates with a breezy confidence that is absent from other big emerging markets, thanks largely to weak oil prices.

As recently as 2013, when the U.S. Federal Reserve hinted that it would start tapering its loose money policy, which would typically suck capital out of emerging markets and into dollar assets, Asian central banks rushed to raise rates to keep hold of that money.

But now, even with a U.S. rate rise looming, central banks in the region, including those in Singapore, China, India and Indonesia, have on eight occasions this year announced unexpected easing measures.

Source: http://www.reuters.com/article/2015/03/13/us-asia-economy-policy-idUSKBN0M90A820150313

BLOOMBERG

Apple Watch Could Make Gold Cool Again

(Bloomberg) -- If anyone could make gold jewelry fashionable to Americans and Europeans, it's Apple Inc.

U.S., U.K. and Italian demand for baubles made from the metal has been cut in half over the past decade, according to data compiled by Bloomberg from the World Gold Council, as shoppers favored white-colored metals such as silver and platinum. Apple's status as the arbiter of cool means its new $10,000 gold watch and yellow iPhones and MacBooks may entice consumers to buy other gold ornaments, said Neil Meader, a precious metals consultant at Metallis Consulting Ltd.

Apple, which called gold "uniquely luxurious" in its advertising, has a history of swaying consumer tastes with its designs for touch-screen phones and portable music players. While the watch won't move the price of gold, the publicity benefits the metal that in the U.S. and Europe suffers from a reputation as old-fashioned, Meader said.

-

10:00

Global Stocks: Wall Street rebounds, Nikkei at fresh 15-year high

U.S. stocks rallied on Wednesday rebounding from a two-day losing streak. The gains brought the two indices back into positive territory for the year. Mixed U.S. data led the greenback lower and tempered the outlook for an interest rate hike. The S&P 500 closed +1.26% with a final quote of 2,065.95 points. The DOW JONES index added +1.47% closing at 17,895.22 points, re-approaching the psychologically important 18,000 points mark.

Chinese stocks continued to go up on Friday. Hong Kong's Hang Seng is trading higher +0.16% at 23,836.73 points. China's Shanghai Composite closed at 3,373.79 points gaining +0.73% at the close. The governor of the People's Bank of China Zhou Xiaochuan said responding to critics on Thursday that credit funds flowing into equity markets are helpful to economic growth and that the bank endorses the flow of fund into equities.

The Nikkei posted gains on Friday and extended its 15-year high posting a fifth consecutive week of gains on upbeat sentiment. The index closed +1.39% with a final quote of 19,254.25 points. Industrial Production in January came in at +3.7%, below estimates of an unchanged reading of +4.0%. Year on year Industrial Production declined by 2.8%, more than the predicted 2.6%.

-

09:00

European stock markets First hour: Indices open steady

European stocks open steady on a light data day. The German DAX is heading for its 9th weekly gain, the longest winning streak in 17 years. The weaker euro is supporting export-heavy sectors.

Worries over Greece continue to weigh but equities remain supported by the ECB's quantitative easing started on Monday. The ECB is buying bonds worth 60 billion euros a month.

The commodity heavy FTSE 100 index is currently trading -0.10% quoted at 6,754.19, down for the week. Germany's DAX 30 added +0.17% trading at 11,818.86, slightly below its all-time high set at 11,845.9. France's CAC 40 is currently trading at 4,987.67 points, +0.17%.

-

08:30

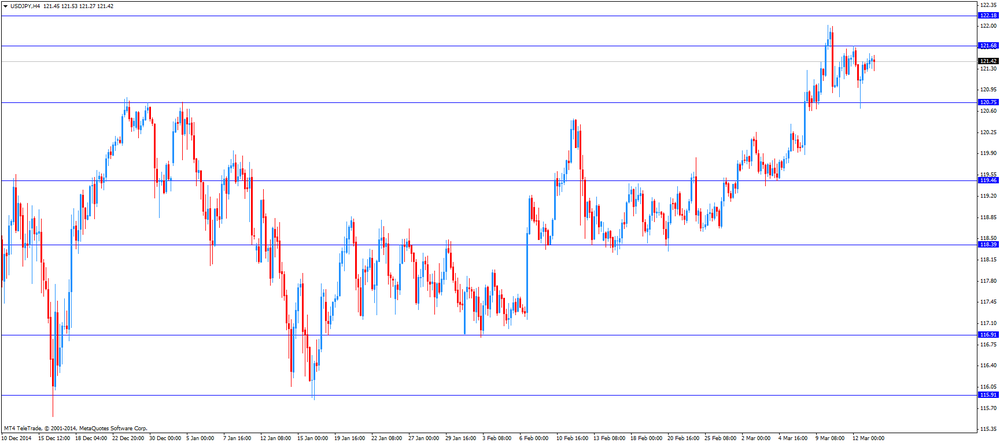

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan Industrial Production (MoM) (Finally) January +4.0% +4.0% +3.7%

04:30 Japan Industrial Production (YoY) (Finally) January -2.6% -2.6% -2.8%

The U.S. dollar traded higher against its major peers on Friday after mixed data reported yesterday. U.S. business inventories were flat in January, below expectations for a 0.2% increase, after a flat reading in December. The U.S. retail sales dropped 0.6% in February, missing expectations for a 0.5% increase, after a 0.8% decline in January. Initial jobless claims in the week ending March 07 in the U.S. fell by 36,000 to 289,000 from 325,000 in the previous week. Business Inventories came in +0.0%. Analysts expected an increase of +0.2%.

Market participants look ahead to the upcoming FOMC meeting next week to see if the "patient" wording will be changed.

The euro is trading slightly lower against the U.S. dollar after taking a breather of its recent plunge yesterday. Quantitative Easing and concerns over Greece continue to weigh on the single currency.

The Australian dollar declined against the greenback with no major data reported in the region

New Zealand's dollar further lost against the greenback after the RBNZ Interest Rate Decision and the following Rate Statement from yesterday. The official benchmark rate remains unchanged at 3.5% even as the bank cut 90-day bill forecasts. RBZ Governor Wheeler said that rates are entering a period of stability. Future measures, rate cuts or hikes, taken by the bank will depend on economic data. New Zealand's Food Price Index for February came in at -0.7% compared to +1.3% in the previous period.

The Japanese yen traded lower against the greenback on Friday closer to an 8-year low set on Tuesday in a light data day in Asia. Industrial Production in January came in at +3.7%, below estimates of an unchanged reading of +4.0%. Year on year Industrial Production declined by 2.8%, more than the predicted 2.6%.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

12:30 Canada Employment February 35.4 21.3

12:30 Canada Unemployment rate February 6.6% 6.5%

12:30 U.S. PPI, m/m February -0.8% +0.2%

12:30 U.S. PPI, y/y February 0.0%

12:30 U.S. PPI excluding food and energy, m/m February -0.1% -0.1%

12:30 U.S. PPI excluding food and energy, Y/Y February +1.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 95.4 95.6

-

08:09

Options levels on friday, March 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0742 (932)

$1.0702 (372)

$1.0661 (35)

Price at time of writing this review: $1.0578

Support levels (open interest**, contracts):

$1.0516 (2342)

$1.0468 (6285)

$1.0408 (4536)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 55822 contracts, with the maximum number of contracts with strike price $1,1200 (3168);

- Overall open interest on the PUT options with the expiration date April, 2 is 60864 contracts, with the maximum number of contracts with strike price $1,0600 (6285);

- The ratio of PUT/CALL was 1.09 versus 1.14 from the previous trading day according to data from March, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5105 (1697)

$1.5008 (1302)

$1.4912 (802)

Price at time of writing this review: $1.4857

Support levels (open interest**, contracts):

$1.4787 (1311)

$1.4691 (1230)

$1.4594 (1512)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 22409 contracts, with the maximum number of contracts with strike price $1,5100 (1697);

- Overall open interest on the PUT options with the expiration date April, 2 is 25305 contracts, with the maximum number of contracts with strike price $1,5050 (2413);

- The ratio of PUT/CALL was 1.13 versus 1.26 from the previous trading day according to data from March, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:31

Japan: Industrial Production (MoM) , January +3.7% (forecast +4.0%)

-

05:30

Japan: Industrial Production (YoY), January -2.8% (forecast -2.6%)

-

03:01

Nikkei 225 19,265.1 +273.99 +1.44 %, Hang Seng 23,845.02 +47.06 +0.20 %, Shanghai Composite 3,382.86 +33.53 +1.00 %

-

02:31

Commodities. Daily history for Mar 12’2015:

(raw materials / closing price /% change)

Oil 47.05 -2.33%

Gold 1,159.00 +0.62%

-

02:29

Stocks. Daily history for Mar 12’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,850.17 +56.97 +0.98%

TOPIX 1,546.63 +20.96 +1.37%

SHANGHAI COMP 3,349.08 +58.18 +1.77%

HANG SENG 23,805.23 +87.26 +0.37%

FTSE 100 6,761.07 +39.56 +0.59 %

CAC 40 4,987.33 -10.42 -0.21 %

Xetra DAX 11,799.39 -6.60 -0.06 %

S&P 500 2,065.95 +25.71 +1.26 %

NASDAQ Composite 4,893.29 +43.35 +0.89 %

Dow Jones 17,895.22 +259.83 +1.47 %

-

02:26

Currencies. Daily history for Mar 12’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0624 +0,75%

GBP/USD $1,4884 -0,30%

USD/CHF Chf1,0028 -0,60%

USD/JPY Y121,29 -0,16%

EUR/JPY Y128,86 +0,60%

GBP/JPY Y180,52 -0,45%

AUD/USD $0,7701 +1,47%

NZD/USD $0,7385 +1,48%

USD/CAD C$1,2690 -0,40%

-

02:01

Schedule for today, Friday, Mar 13’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan Industrial Production (MoM) (Finally) January +4.0% +4.0%

04:30 Japan Industrial Production (YoY) (Finally) January -2.6% -2.6%

12:30 Canada Employment February 35.4 21.3

12:30 Canada Unemployment rate February 6.6% 6.5%

12:30 U.S. PPI, m/m February -0.8% +0.2%

12:30 U.S. PPI, y/y February 0.0%

12:30 U.S. PPI excluding food and energy, m/m February -0.1% -0.1%

12:30U.S. PPI excluding food and energy, Y/Y February +1.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary)

-